Government bonds are low-risk debt securities that provide a fixed income. The government repays the bond’s principal to the investor when the bond matures and makes regular interest payments.

Key takeaways:

- Government bonds are loans to the government. In return, the government pays regular interest.

- When a bond matures, the government repays the face value of the bond.

- The government uses the money to repay sovereign debt and to finance spending.

- Government bonds are low-risk investments.

What are government bonds?

Government bonds are the largest single pool of bonds on the Australian market, offering various investment opportunities. Essentially, a government bond involves lending money to the government for a set period, and the government pays interest on this. Then, when the bond matures, the government repays the face value of the bond.

The ability to receive regular interest payments and principal repayment are two advantages of owning government bonds. Bonds can assist in diversifying risk and improving a portfolio’s overall performance.

Because of the low risk and consistent earnings associated with government bonds, most default superannuation plans will invest a portion of their members’ money in them.

Why do governments issue bonds?

Governments raise money in several ways, for example, through taxes or by issuing bonds. To pay down government debt or fund day-to-day government spending, they issue bonds. Because a bond yields a stable, steady income, it can be attractive to investors.

The government might increase bond issuance when planning large projects or in times of financial need.

What are the different types of government bonds?

The Australian government issues different types of bonds. The two main types are Treasury Bonds and Treasury Indexed Bonds, also known as Treasury inflation-protected securities (TIPS).

- Treasury Bond: A treasury bond is a medium to long-term treasury security. It typically has a fixed interest rate paid every six months as a percentage of the bond’s face value. The government repays the face value at maturity.

- Treasury Indexed Bond: With inflation-indexed bonds, the government adjusts the coupon payments for Consumer Price Index (CPI) movements. The government pays interest quarterly. At maturity, it repays the face value of the bond, adjusted for movements in the Consumer Price Index.

How do government bonds work?

Bonds are fixed-income assets, where investors essentially lend money to the government at a fixed interest rate. In exchange, investors will receive regular interest payments. If investors hold on to the bond until it matures, they will receive the face value of the bond.

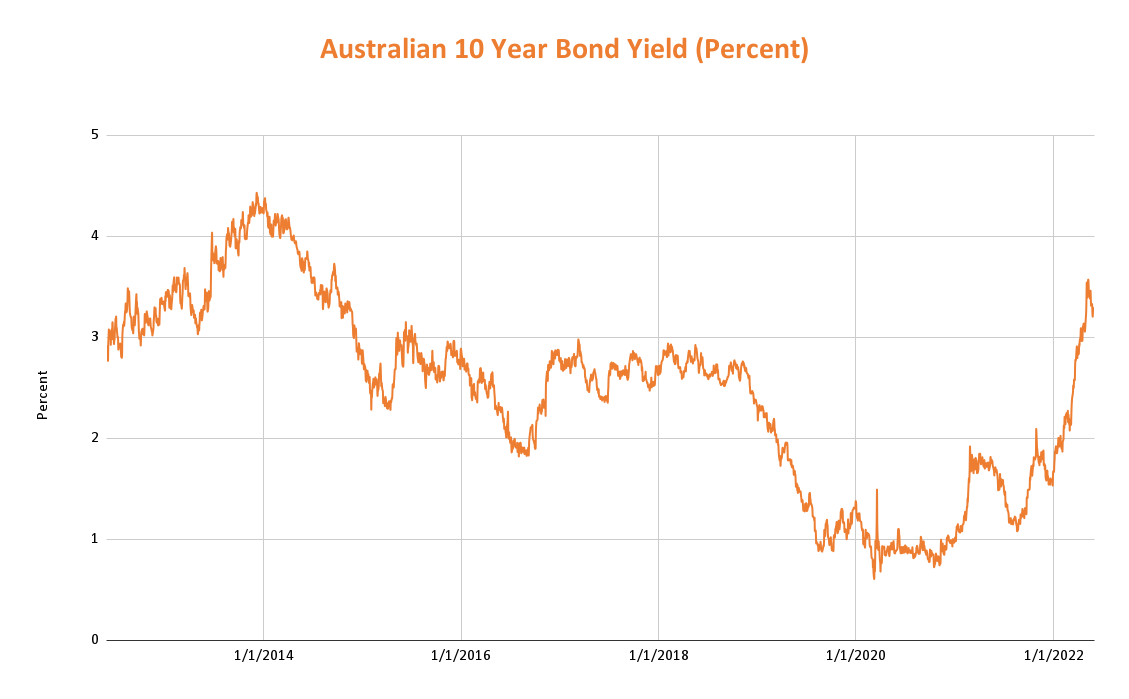

Treasury bonds have a range of maturities. You can see (on the chart below) the yield on the Australian government’s 10-year bonds over the last decade:

Source: Bloomberg

Source: Bloomberg

Government bond example

An investor buys A$10,000 face value worth of ten-year bonds with a 5% coupon. The investor receives 5% of the face value price, or A$500 each year, in two half-yearly payments of A$250 each. After ten years, the investor gets the A$10,000 back. Overall, they earned A$5,000 of coupon interest.

You can sell the bonds before the maturity date, with the amount received depending on how yields have changed since purchase.

Benefits & risks of government bond

Benefits

Risks

Why should you diversify your investments?

Where you choose to invest your money depends on your investment goals and risk tolerance. A diversified portfolio helps to mitigate risk. Diversification involves investing in high, medium, low-risk investments and different asset classes. The most important goal of diversification is to maximise the benefit of having different investments in your portfolio that do not move in lock-step.

Another factor to consider is that interest rates can affect bonds and shares differently. If you want to balance your portfolio, you might consider investing in bonds to balance the risk of your equities.

How to get started?

When the government issues bonds, they typically do so through auctions that large banks and other financial institutions invest in. You can also buy and sell exchange-traded government bonds on the Australian Securities Exchange (ASX) or gain exposure to a portfolio of government bonds through ETFs.

Choose an investment vehicle:

- Exchange-traded Treasury Bonds (eTBs).

- Exchange-traded Treasury Indexed Bonds (eTIBs).

- Government bond exchange-traded funds (ETFs).

BetaShares government bond ETFs

Through Betashares Government Bond ETFs, investors can diversify their portfolios and receive regular monthly income from a portfolio of high-quality government bonds.

AGVT Australian Government Bond ETF : Invests in bonds with a duration of 7-12 years. This ETF provides exposure to a portfolio of high-quality bonds issued by Australian federal and state governments, with a component issued by supranational banks and sovereign agencies.

GGOV U.S. Treasury Bond 20+ Year ETF – Currency Hedged : This ETF provides exposure to high-quality, long-dated, income-producing US Treasury bonds. Currency risks are hedged in this portfolio. This minimises the impact of currency fluctuations on the returns of the portfolio.

| For more information on risks and other features of these funds, please see the Product Disclosure Statement and Target Market Determination available on this website. |

Conclusion

Investing in Australian government bonds secures a steady, low-risk income. Government bond ETFs are low-risk, long-term investments with superior credit quality. To learn more about ETFs and how they could help you achieve your investment goals, visit our Betashares Education Centre.

IMPORTANT INFORMATION

This information has been prepared by Betashares Capital Limited (ABN 78 139 566 868, AFSL 341181) (“Betashares”). This information is general only, is not personal financial advice, and is not a recommendation to buy, hold or sell any investment or adopt any particular investment strategy. It does not take into account any person’s financial objectives, situation or needs. Before making a decision to invest in any Betashares Fund you should obtain and read a copy of the relevant PDS available from www.betashares.com.au or by calling 1300 487 577 and obtain financial advice in light of your individual circumstances. You may also wish to consider the relevant Target Market Determination (TMD) which sets out the class of consumers that comprise the target market for the Betashares Fund and is available at www.betashares.com.au/target-market-determinations. To the extent permitted by law BetaShares accepts no liability for any loss from reliance on this information.

Written by

Benjamin Smith

Video and Content Executive

Ben brings a unique blend of financial acumen and creative storytelling to his role. With a solid background as a portfolio analyst, Ben possesses a deep understanding of the financial markets, investment strategies, and how ETFs work.

Read more from Benjamin.