7 minutes reading time

- Fixed income, cash & hybrids

Higher income, capital stability and liquidity throughout the economic cycle are the key attributes that many investors seek when they invest in fixed income.

Prior to the current rate hiking cycle many investors found it challenging to meet their income needs from a traditional asset allocation. The yields on offer in the public investment grade credit and bond markets were underwhelming. So some turned to private credit funds, seeking higher income and apparent capital stability, albeit in benign economic conditions.

Private credit funds typically lend to borrowers that are unable to access bank financing or capital markets, with very little investor reporting of who these borrowers are. While private credit funds in the US can provide exposure to quite a diverse range of borrowers, in Australia private credit exposure is almost entirely real estate related.1

The questions private credit investors should ask themselves are:

- Do you know what the counterparty risk is?

- How will these borrowers perform in a higher rate environment and/or a prolonged property downturn?

- Do you still need to take this counterparty risk to meet your income needs, now that you can now earn significantly more from traditional fixed income securities?

There is no doubt that, on the whole, private credit delivered on the promise of higher income in what was a low-rate environment. But the veneer of capital stability may be in part because independent valuers appointed by the fund manager help determine a fund’s Net Asset Value (NAV). There is no observable market pricing for private credit loans with bespoke terms.

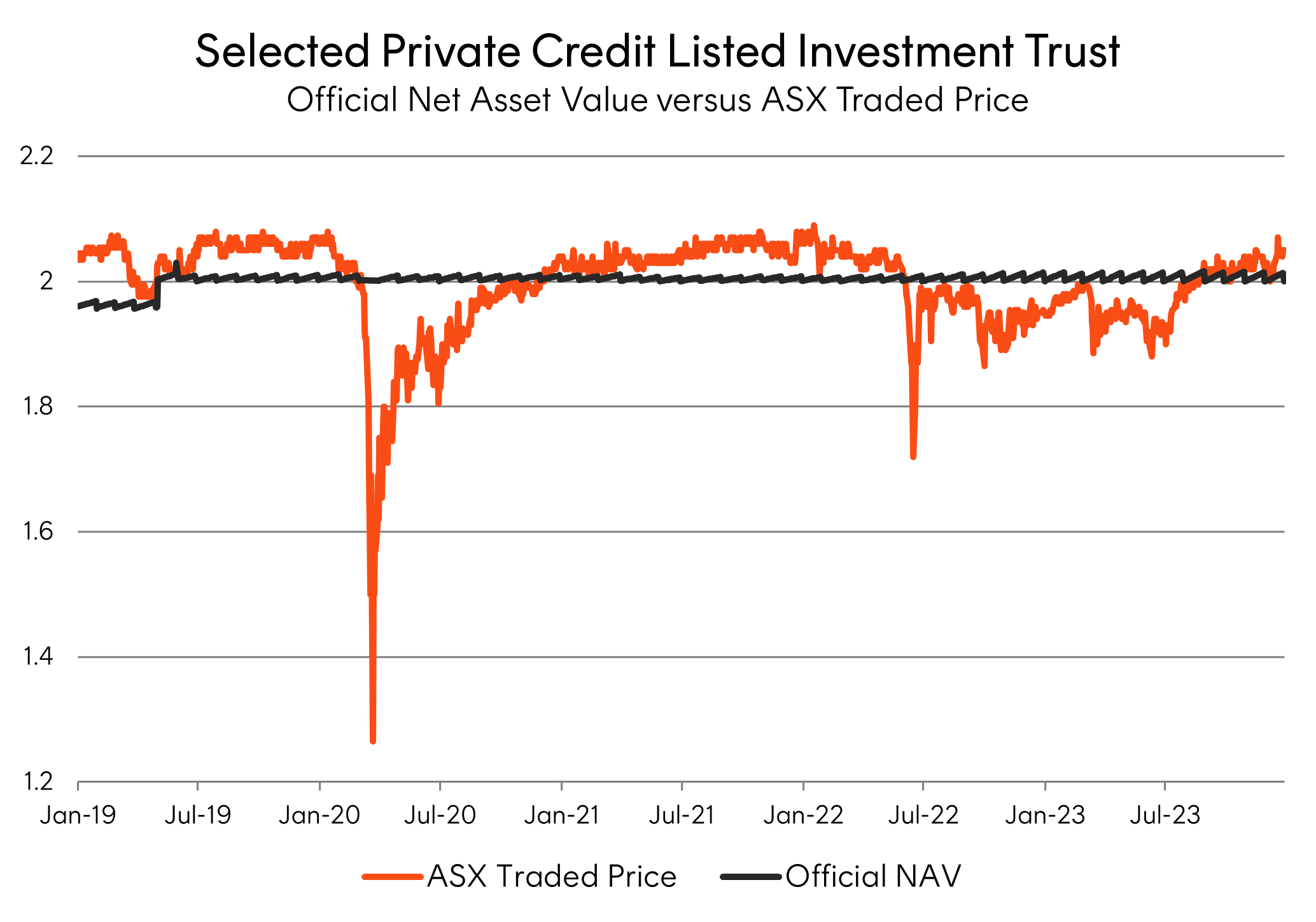

The 5-year chart below shows an example a private credit fund where valuers saw no reason to mark down the loan assets during this period, even during Covid (as evidenced by the official NAV). What makes this particular private credit fund interesting, is that it is also an ASX listed investment trust. The ASX traded prices for this listed investment trust imply that it has at times been far riskier than the official NAV would suggest (trading at a discount to NAV of nearly 40% in the depths of Covid).

Again, in 2023, we witnessed discounts open up between the official NAVs and the ASX traded prices of private credit ASX listed investment trusts. In our view, such a disconnect arises where the liquidity profile of an investment fund does not match the liquidity profile of the underlying assets which the fund holds. If you invest in unlisted private credit funds, there may be a risk of large realized losses and periods of illiquidity in a prolonged credit downturn (depending on the level of counterparty and liquidity risk arising from the private credit loans held by the fund). Also investors should be mindful of complicated and multi-level fee structures associated with some of these types of funds.

HCRD Interest Rate Hedged Australian Investment Grade Corporate Bond ETF offers investors an alternative, with exposure to investment grade corporate bonds that are issued by companies which are the lifeblood of the Australian economy. Bonds issuers include infrastructure providers, such as Australian Pacific Airports, the NBN Co, Transgrid, AusNet and WestConnex, and leading Australian and global corporates, such as Coles, Woolworths, Wesfarmers, McDonalds and Verizon.2

HCRD provides investors with:

- Ready liquidity on a T+2 basis

- Daily transparency of the investment portfolio; and

- Greater certainty of valuations and entry and exit prices, with the underlying portfolio marked-to-market daily.

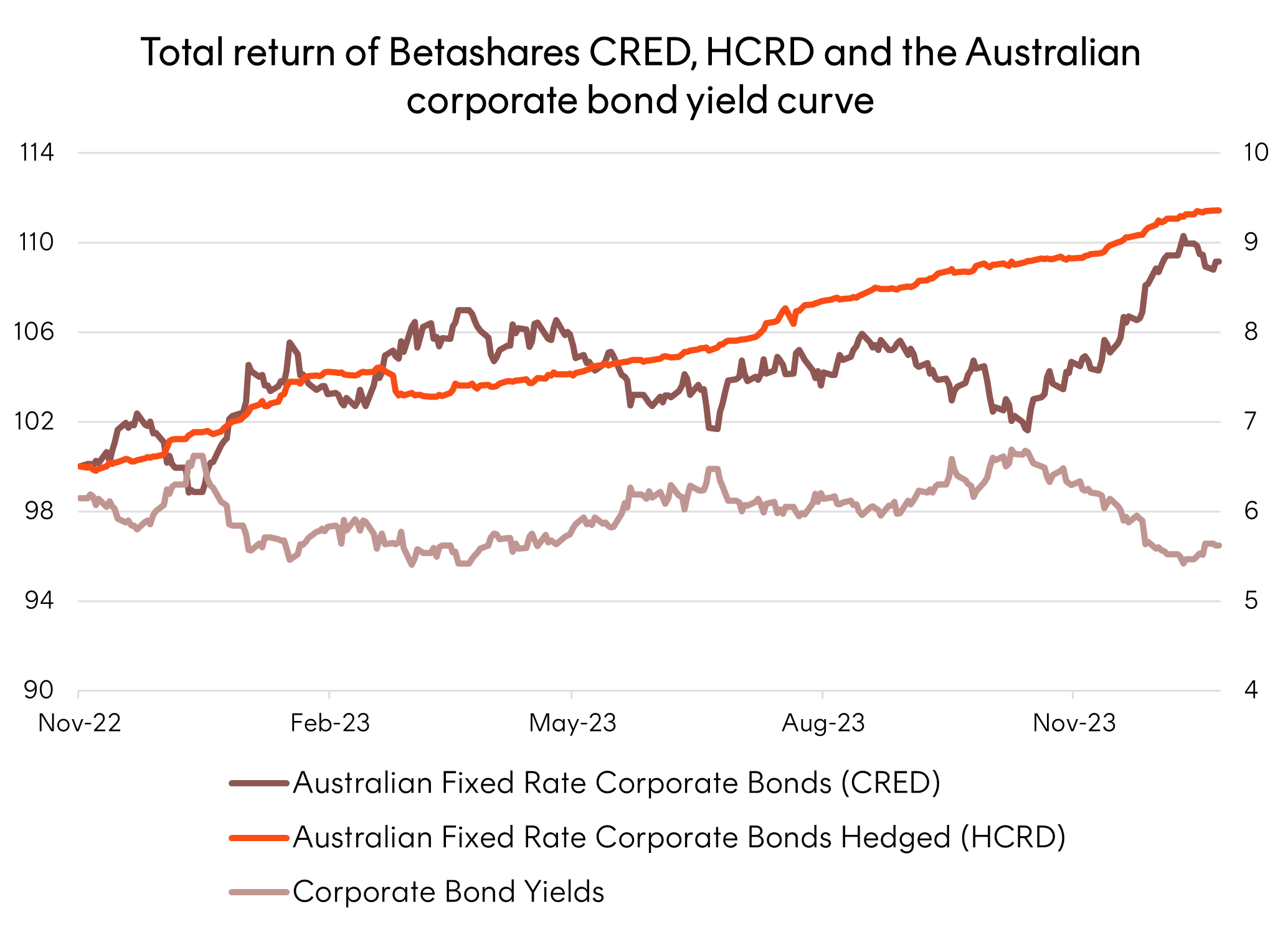

HCRD seeks to provide an attractive yield by harvesting credit premia while maintaining a relatively high degree of capital stability. HCRD does this by investing in our popular Betashares Australian Investment Grade Corporate Bond ETF (ASX Code: CRED) and hedging out the interest rate risk associated with CRED’s fixed rate bond portfolio. The result is HCRD provides a level of yield that might surprise you, with substantially reduced interest rate risk.

HCRD’s underlying investment universe, investment grade Australian corporate bonds with a term to maturity of between 5.25 to 10.25 year, is currently yielding more than the forecast cash yield and even grossed up yield of the Australian equity market.3

By hedging out the interest rate component, HCRD provides investors with exposure to the underlying bond’s credit premia with the potential for substantially reduced interests rate volatility.

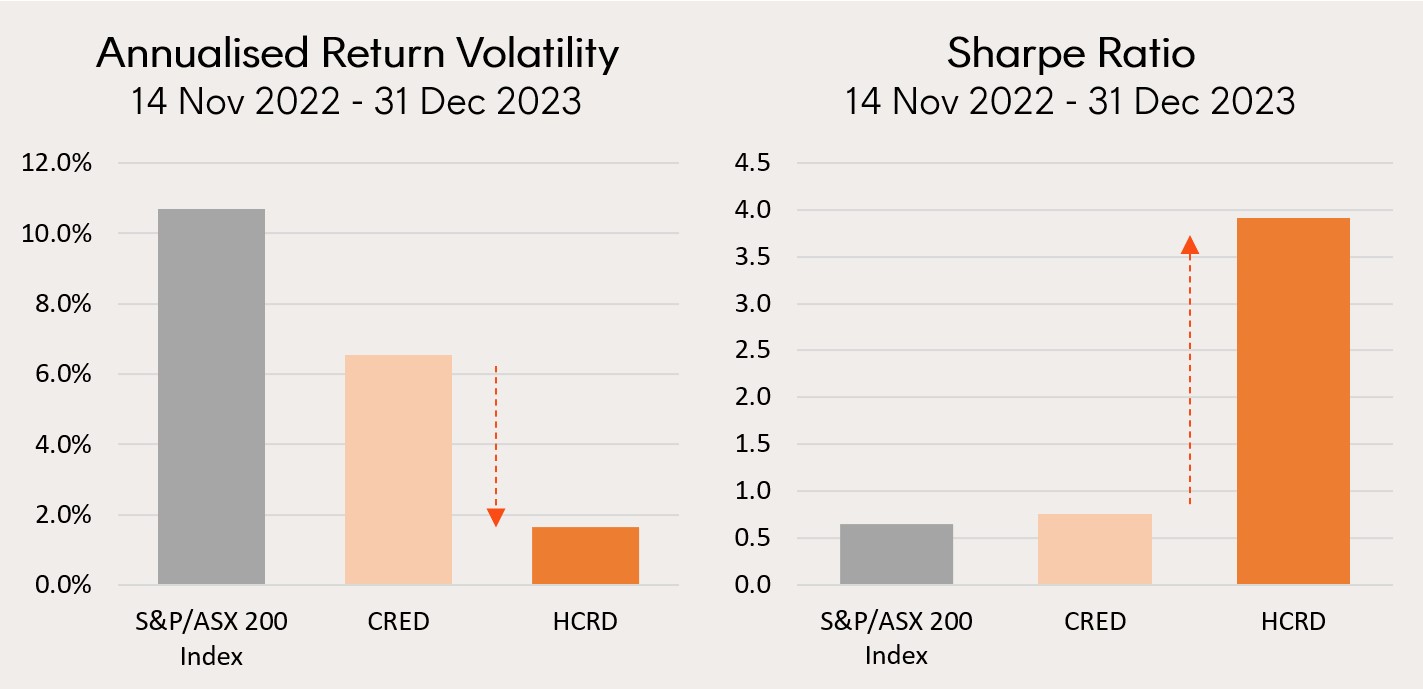

In fact HCRD was the second best performing Australian Fixed Income ETF for the 2023 calendar year, returning 9.91%4 (only bested by CRED, but with far lower volatility). Since inception, HCRD’s volatility has been far lower than that of the S&P/ASX 200 Index and only a quarter of that of CRED. As a function of its strong returns and capital stability to date, HCRD has delivered (as reflected in the Sharpe ratios below) over this period.

HCRD now provides an alternative for investors seeking attractive income, a high degree of capital stability and daily liquidity, which in our view is well placed to weather all seasons.

HCRD is rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.

1 – AFR (https://www.afr.com/companies/financial-services/why-wall-street-s-alternative-asset-managers-are-singing-20231116-p5ekij)

2 – No assurance is given that bonds issued by these entities will remain in the Fund’s underlying portfolio or will be a profitable investment

3 – Source: Bloomberg. Forward 12 month net dividend yield estimate as at 5 February 2024. Gross estimate based off historical franking levels.4 – Yield will vary and may be lower at time of investment. Past performance is not an indicator of future performance.

There are risks associated with an investment in HCRD, including interest rate hedging risk, credit risk, market risk and index tracking risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available here.

The Lonsec Ratings (assigned December 2023) presented in this document is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445. The Rating is limited to “general advice” (as defined in the Corporations Act 2001) and based solely on consideration of the investment merits of the financial product. Past performance information is for illustrative purposes only and is not indicative of future performance. It is not a recommendation to purchase, sell or hold any Betashares fund, and you should seek independent financial advice before investing in this product. The Rating is subject to change without notice and Lonsec assumes no obligation to update the relevant document following publication. Lonsec receives a fee from the Betashares for researching the product using comprehensive and objective criteria. For further information regarding Lonsec’s Ratings methodology, please go to http://www.lonsecresearch.com.au/research-solutions/our-ratings.