8 minutes reading time

In this special edition of Charts of the Month, we put a spotlight on a few of our ETFs that have recently celebrated their ‘birthdays’ (their launch anniversaries).

With over 90 ETFs, Betashares offers the widest range of ETFs on the market to help Australian investors build low-cost, diversified portfolios.

It’s important to remember that past performance is not indicative of future performance of any index or ETF.

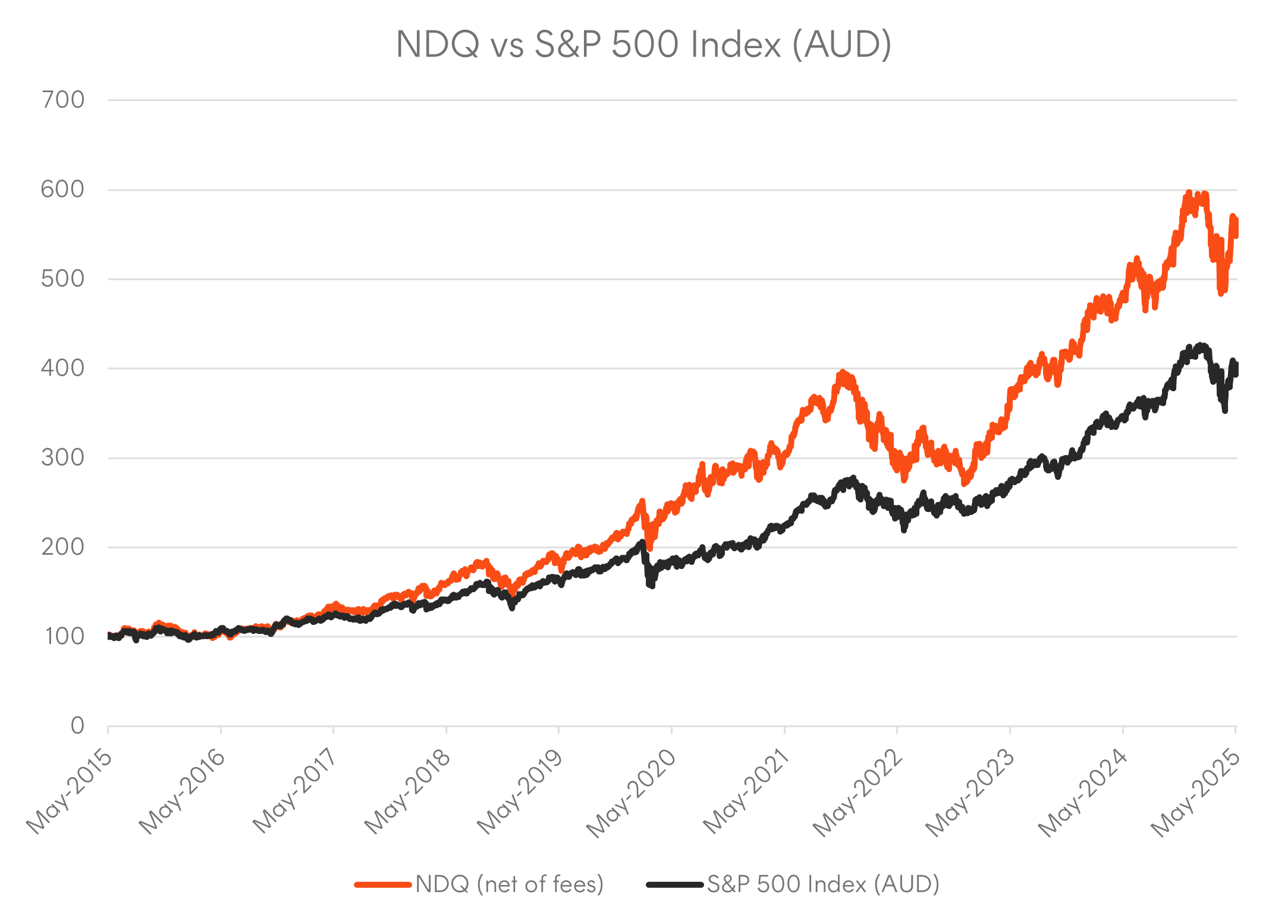

1 – NDQ Nasdaq 100 ETF

Launched on 26 May 2015, NDQ reached its 10-year anniversary last week and has become a popular exposure for many Australian investors.

Home to some of the most innovative companies in the world, NDQ provides the potential for high growth and diversification benefits within a portfolio.

Since its inception, NDQ returned 19.4% p.a., outperforming the S&P 500 Index (AUD) by 4.5% p.a. (as at 30 May 2025) and cementing itself as one of the best performing Australian domiciled global equity funds over these periods. Over the 5 years to 30 May 2025, NDQ returned 18.4% p.a.

Chart 1: NDQ vs S&P 500 Index (AUD) Total Return Performance Series (26 May 2015 to 30 May 2025)

Source: Bloomberg. As at 30 May 2025. Normalised to 100 as at 26 May 2015 (being the inception date for NDQ). NDQ returns are shown net of management fee and costs, being 0.48% p.a. for NDQ, assuming reinvestment of distributions Does not take into account brokerage or bid ask spreads that investors incur when buying and selling units on the ASX, or any tax paid by investors. You cannot invest directly in an index. Past performance is not an indicator of future performance of any index or ETF.

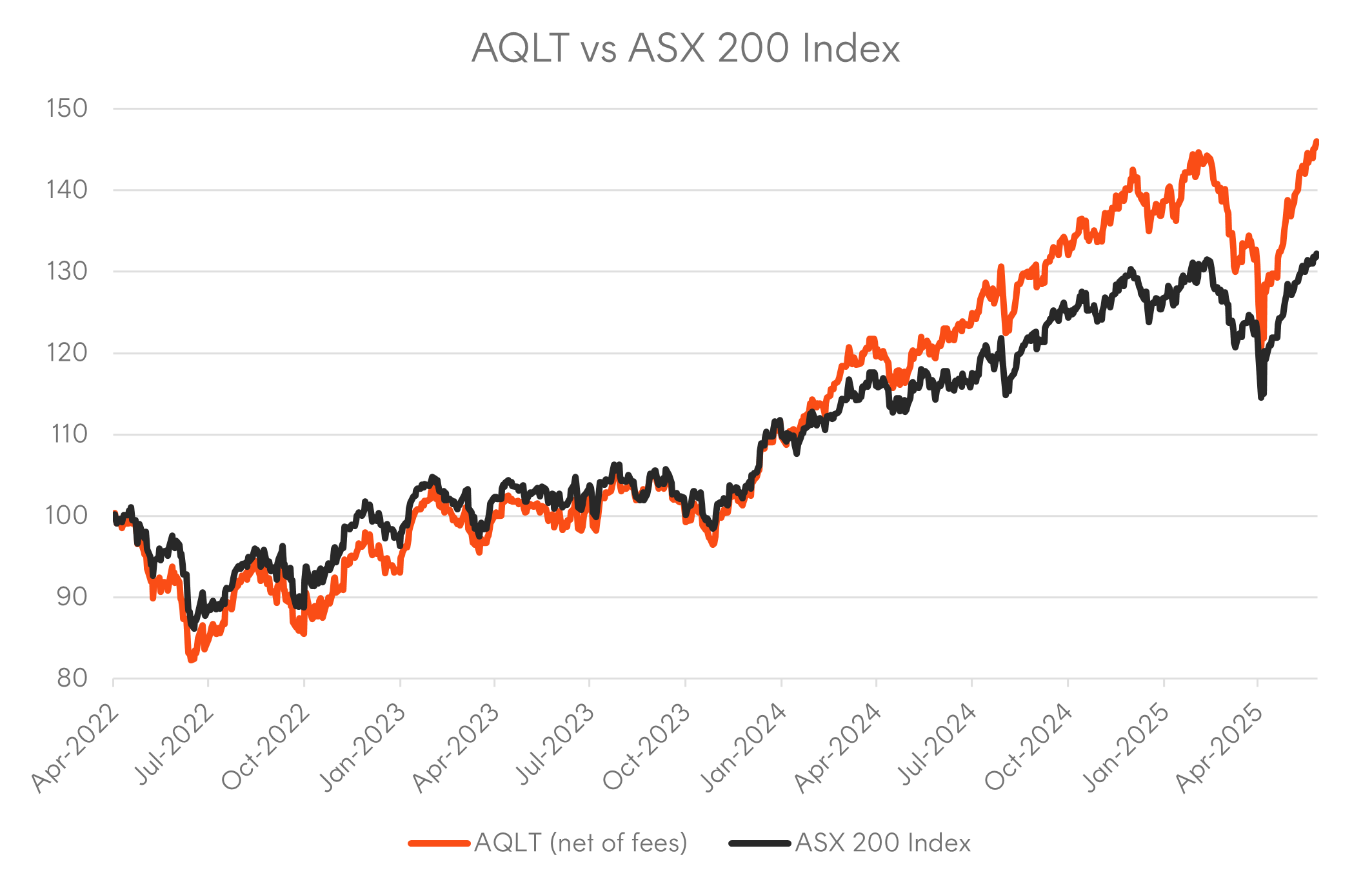

2 – AQLT Australian Quality ETF

In a market dominated by cyclical exposures through the banks and miners, quality could remain an enduring advantage on the ASX.

AQLT offers exposure to high-quality Australian companies selected based on high return on equity, low leverage and relative earnings stability. Quality companies have the potential to compound earnings growth into capital gains over time.

AQLT reached its 3-year anniversary last month and has returned 13.1% p.a. since its inception on 4 April 2022, outperforming the ASX 200 by 3.9% p.a. (as at 30 May 2025). The index that AQLT seeks to track returned 13.1% p.a. over the 5 years to 30 May 2025, net of AQLT’s management fee and costs of 0.35% p.a.

Chart 2: AQLT vs ASX 200 Index Total Return Performance Series (4 April 2022 to 30 May 2025)

Source: Bloomberg. 4 April 2022 to 30 May 2025. Normalised to 100 as at 4 April 2022 (AQLT’s inception). Returns shown net of management fee and costs, being 0.35% p.a. for AQLT, assuming reinvestment of distributions. Does not take into account brokerage or bid ask spreads that investors incur when buying and selling units on the ASX, or any tax paid by investors. You cannot invest directly in an index. Past performance is not an indicator of future performance of any index or ETF.

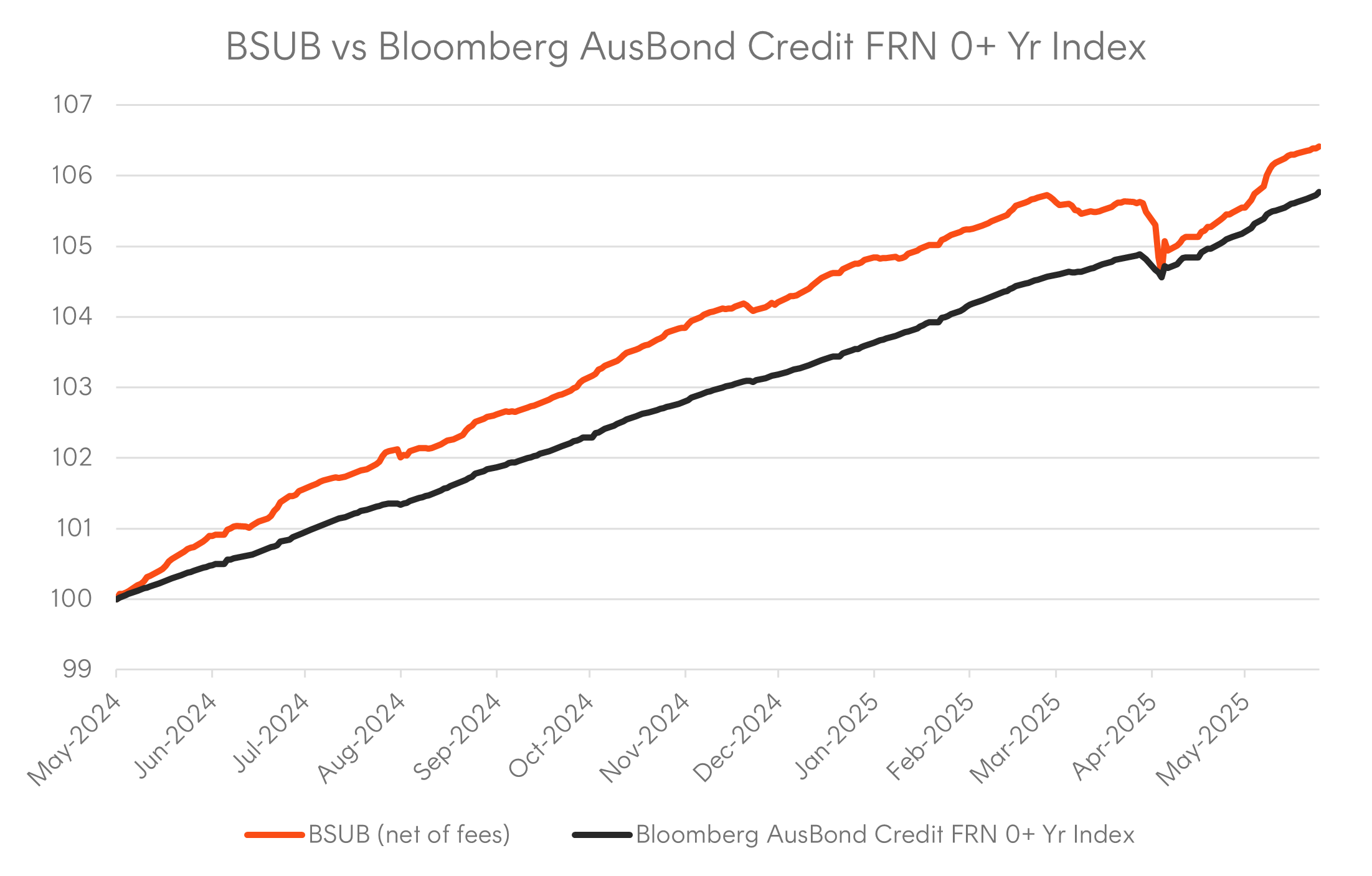

3 – BSUB Australian Major Bank Subordinated Debt ETF

Since its launch on 6 May 2024, BSUB has provided investors seeking reliable income and potential portfolio diversification benefits with exposure to subordinated debt issued by Australia’s four major banks.

Since its inception, BSUB has returned 6.3% (as at 30 May 2025) (with the index that BSUB seeks to track returning 4.5% p.a. over the 5 years to 30 May 2025, net of BSUB’s management fee and costs of 0.29% p.a.) and has grown to over A$270 million in net assets.

With the hybrids market winding down, BSUB provides a stable alternative for those seeking income and capital preservation.

Chart 3: BSUB vs Bloomberg AusBond Credit FRN 0+ Yr Index Total Return Performance Series (6 May 2024 to 30 May 2025)

Source: Bloomberg. From 6 May 2024 to 30 May 2025. Normalised to 100 as at 6 May 2024 (BSUB’s inception). Returns shown net of management fee and costs, being 0.29% p.a. for BSUB, assuming reinvestment of distributions. Does not take into account brokerage or bid ask spreads that investors incur when buying and selling units on the ASX, or any tax paid by investors. You cannot invest directly in an index. Past performance is not an indicator of future performance of any index or ETF.

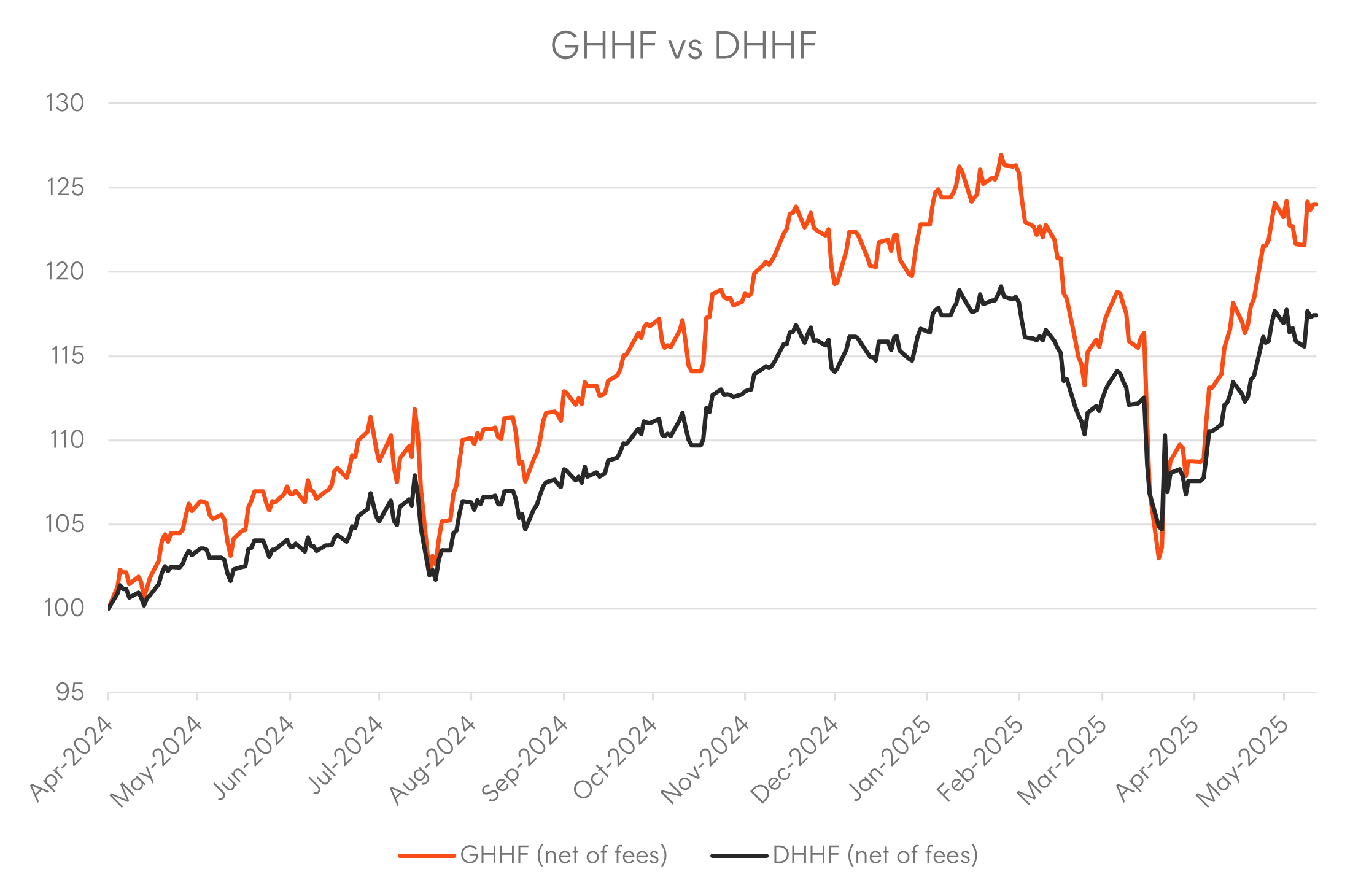

4 – GHHF Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF

The first funds in the Betashares Wealth Builder range were launched last year on 15 April 2024, providing Australian investors access to ‘moderately geared’ ETFs on the ASX. With a target gearing ratio of between 30-40% on a given day, these ETFs provide an effective way by which investors can seek to build long term wealth.

GHHF is one of the Wealth Builder ETFs that was launched last April, providing exposure to a diversified ‘all growth’ portfolio of Australian and global equities.

Since its inception, GHHF has performed strongly relative to the Betashares Diversified All Growth ETF (ASX: DHHF) (a diversified ‘all growth’ equities exposure) despite the significant levels of volatility that global markets experienced over the last year, including the unwinding of the yen carry trade in August 2024 and Trump’s Liberation Day announcement in April 2025.

Chart 4: GHHF vs DHHF Total Return Performance Series (19 April 2024 to 30 May 2025)

Source: Bloomberg. 19 April 2024 to 30 May 2025. Normalised to 100 as at 19 April 2024 (being the inception date for GHHF). Returns shown net of management fee and costs, being 0.35% p.a. of Gross Asset Value for GHHF and 0.19% p.a. for DHHF, net of distributions. Please note that GHHF’s international equities allocation currently includes a 18.9% allocation to currency hedged international equities, while DHHF’s international equities allocation does not include a currency hedged allocation. Both GHHF and DHHF have a 63% allocation to international equities and a 37% allocation to Australian equities. Performance comparison is provided for illustrative purposes only. Past performance is not indicative of future returns.

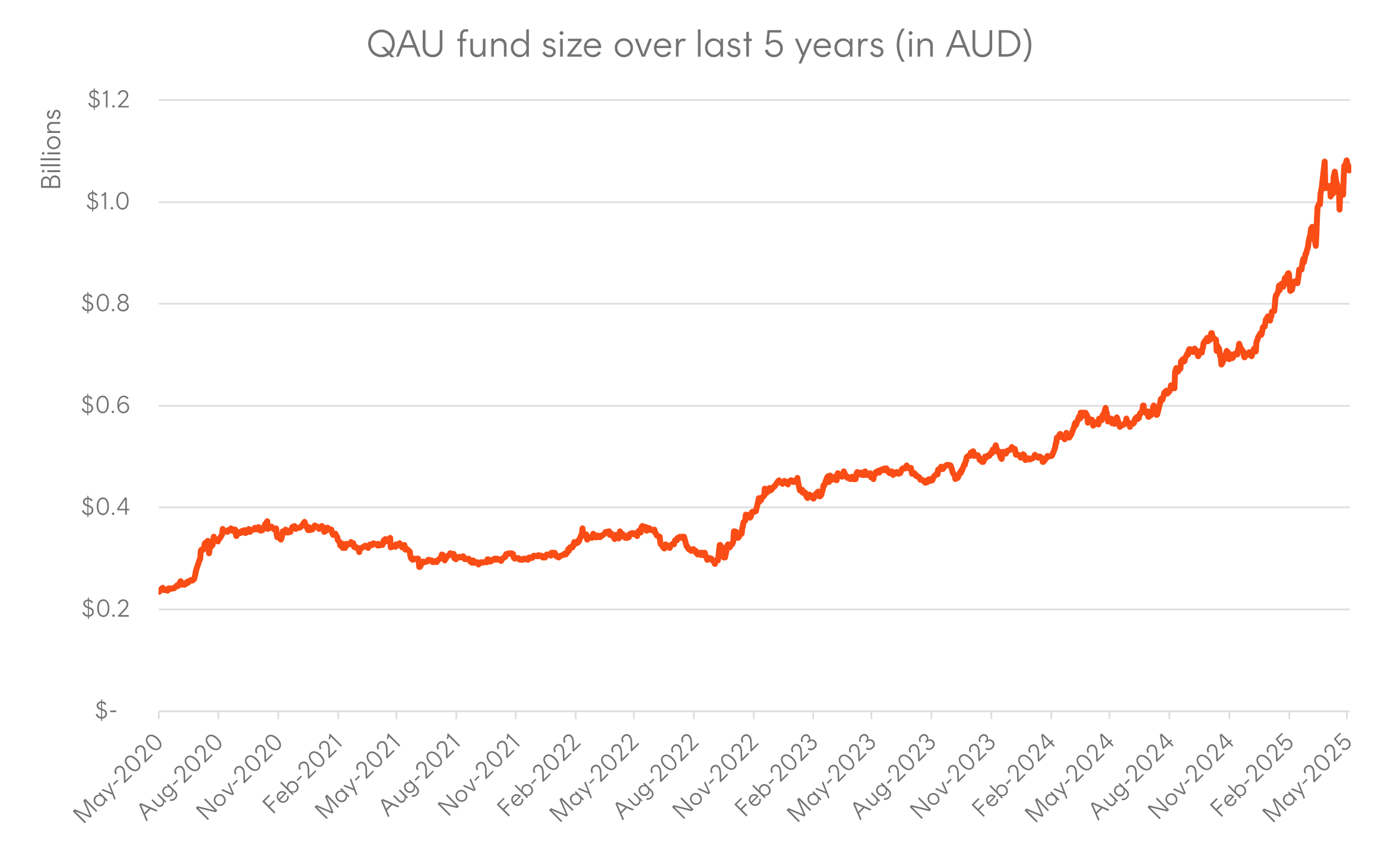

5 – QAU Gold Bullion Currency Hedged ETF

Gold has been a standout performer in 2025 driven by structural central bank demand, and its role as a safe-haven asset during times of uncertainty.

Combined with a weaker US dollar, a currency hedged gold bullion exposure such as QAU has benefited significantly and is now at over A$1 billion in net assets as at 30 May 2025.

Chart 5: QAU fund size (net assets) over last 5 years

Source: Bloomberg. As at 30 May 2025.

That’s all for this edition of Charts of the Month. For more investment and market insights, visit the Betashares Insights page here.

The gearing ratio of between 30% and 40% means that GHHF’s geared exposure is anticipated to vary between ~143% and 167% of the fund’s Net Asset Value on a given day. The fund’s returns will not necessarily be in this range over periods longer than a day, primarily due to the effects of rebalancing to maintain the fund’s daily target geared exposure range and the compounding of investment returns over time, and the impact of fees and costs.

The fund’s returns over periods longer than one day may differ in amount and possibly direction from the daily target geared return range. This effect on returns over time can be expected to be more pronounced the more volatile the relevant sharemarket or portfolio and the longer an investor’s holding period.

Due to the effects of rebalancing and compounding of investment returns over time, investors should not expect the fund’s Net Asset Value to be at a particular level for a given value of the relevant sharemarket or portfolio at any point in time.

Gearing magnifies gains and losses and may not be a suitable strategy for all investors. Geared investments involve significantly higher risk than non-geared investments. An investment in GHHF is extremely high risk in nature.

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in each Betashares fund should only be considered as part of a broader portfolio, taking into account an investor’s particular circumstances, including their tolerance for risk. For more information on the risks and other features of each Betashares fund, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.