Nearly 9 in 10 Australians are making sacrifices to their financial dreams as the cost-of-living crunch stretches household budgets, our latest survey found1. The survey also showed striking differences between the financial aspirations of different age groups.

The survey revealed the increasingly high cost of living has forced 86% of Aussies to rethink their financial goals with a view to making sacrifices – of this cohort, 35% admitted to making significant sacrifices to their financial aspirations as inflation and interest rate hikes stretch household budgets to breaking point.

Millennials and Gen Xers were most likely to rethink their financial goals, with 40% from both age groups reporting that “everything’s changed” in the face of rising affordability issues. Baby Boomers (27%) were far less likely to report significant changes to their financial aspirations in the current climate.

There were significant differences in the aspirations of Baby Boomers and younger Aussies, with home ownership more likely to be ranked as the number one financial aspiration by 18–55-year-olds (52%), while those aged 55-years and over were more likely to rank a bucket list holiday or experience as their number one aspiration.

Baby Boomers reported wanting a more comfortable retirement than their parents before them, with holidays on top of the agenda. Approximately one-third of those aged 55-years and over stated that they wanted a more comfortable retirement when comparing their financial aspirations to those of their parents, with 20% saying they would like to travel more.

The research also included other notable findings about Australia’s financial aspirations and concerns, such as:

The great Aussie sleep debt

Financial concerns are literally keeping us awake at night with nearly half of adult Australians (49%) admitting that money worries are causing sleepless nights. Aussie women were more likely to be feeling the stress of money worries, with a staggering 57% of women saying finances have left them lying awake at night.

Overall, our survey found that the higher cost-of-living was the number one financial stressor for Aussies (35%), followed by unplanned expenses (22%) and mortgage/debt and rising house prices equal third (14% each).

More specifically for young Australians (18-34 years) yet to break into the property market, rising house prices, mortgage or debt, and higher inflation were equally weighted (25%) – all getting in the way of the great Aussie dream of home ownership.

House with white picket fence still the dream

Ten consecutive interest rate rises have failed to deter Aussies from the dream of owning their own home. In fact, 38% of 18-24-year-olds say home ownership is more important to them than their parents’ generation.

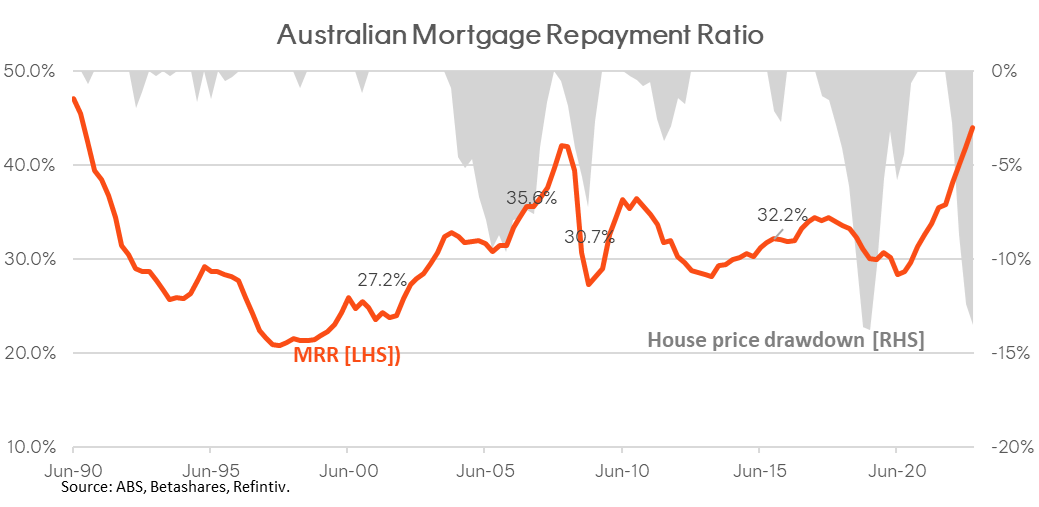

The survey comes as our mortgage affordability index reveals that the repayment burden on households in Sydney is sitting at levels not seen since the 1990s when the Reserve Bank’s (‘RBA’) cash rate was 16% p.a. – which is significantly higher than today’s RBA cash rate of 3.60% p.a. (with another 0.25% p.a. rate rise from the RBA potentially on the cards for early April).

Nearly half think being a millionaire will provide financial security

Financial security means a lot of different things to different people – with nearly half of Aussies (46%) saying they would need over $1 million in the bank to feel financially secure.

However, over a quarter of 18–24-year-olds revealed they would need less than $150,000 in the bank to make them feel financially secure – despite the fact that home ownership ranks as a top three financial aspiration for over two-thirds of the cohort.

Saving is the new black

Another trend to come out of the research was that Aussies are focusing on saving, with 28% admitting that one of the key financial goals to have changed in the last 10 years is a greater emphasis on saving. This is equal to those who admitted home ownership is more important to them now (28%).

The data found that parents were more likely to prioritise saving for the future, home ownership, and their children’s education. Aussie parents stated that since having children their priorities have changed, with saving for the future (39%) more important than home ownership (34%), and saving for children’s education coming in at third (26%).

Despite the cost-of-living crunch, Australians can still pursue their financial aspirations by taking a few simple steps to improve their financial position.

The first step is to prepare a realistic and measurable plan to achieve financial aspirations that includes short, medium, and long-term goals. Your goals may be purchasing a home, income in retirement or a combination of the two.

Secondly, take control of your expenses by creating a sustainable budget, cutting back on wasteful spending and paying down any high interest debt, like credit cards.

Following this, save and invest for the long-term by setting aside a portion of your income for emergency expenses and longer-term financial aspirations. Many experts suggest having three to six months’ worth of your regular expenses set aside in an emergency fund. These funds are there to help you in case life takes a turn for the worse, whether it be losing your job, sickness, or another situation.

Lastly, make investing a habit. Focus on low-cost, diversified investments, like ETFs, that are relevant to your personal risk profile. Aim to contribute to that investment regularly to utilise dollar cost averaging.

Accessing low-cost, diversified ETFs

DHHF Diversified All Growth ETF can be an effective investment solution for someone who is just starting out on their investment journey and has a high tolerance for risk. It provides exposure to approximately 8,000 equity securities listed on over 60 global exchanges for a management fee of 0.19% p.a.2

1. PureProfile conducted the nationally representative research of 1,006 Australians aged 18-65+ years, during March 2023

2. Other costs, such as transactional costs and operational costs may apply. Refer to the Product Disclosure Statement for more information.

3. Other costs, such as transactional costs and operational costs may apply. Refer to the Product Disclosure Statement for more information.

4. Source: Bloomberg, based on expense ratios of Australian shares ETFs based in Australia or on overseas exchanges.

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.