5 minutes reading time

Global markets

Global stocks rebounded sharply last week after the US and China agreed to temporarily lower tariffs for 90 days while trade negotiations continue.

US-China trade deal

Investors breathed a sigh of relief after it became clear that the outcome of the weekend US-China trade talks exceeded expectations. Rather than merely agreeing to ‘keep talking’, both sides committed to reducing their respective tariffs by a combined 115 percentage points for 90 days.

Chinese exports to the US will still face a 30% US tariff, while US exports to China will be subject to a 10% tariff.

It is important to note that this remains an onerous tariff on Chinese imports. As a result, it continues to put upward pressure on US inflation and downward pressure on real US incomes. Moreover, uncertainty over future trade policy has not gone away.

Even if the US economy faces short term hurdles, markets may well try to ‘look across the chasm’ – as they did in mid-2020. The key development of late is that the US has de-escalated its tariff threats. Treasury Secretary Scott Bessent has emerged as the lead voice in trade negotiations, as opposed to his counterparts Peter Navarro and Howard Lutnick.

The art of the deal?

This may be spun as the ‘Art of the Deal’ – suggesting that the initial tariff hikes were merely a negotiating tactic. Navarro and Lutnick’s aggressive rhetoric could have been a ‘bad cop’ routine, with Bessent now stepping in as the ‘good cop’.

That said, it’s also possible the Trump administration simply misjudged the backlash to its tariff proposals and underestimated the unwillingness of other governments to capitulate.

To markets, the strategy itself is largely irrelevant. What matters is the prospect of de-escalation and, potentially, a uniform 10% US tariff in exchange for token trade concessions from partners. Should this happen, it would allow Trump to claim a political win.

If this is the ultimate outcome, the worst case may be a temporary period of weak growth/higher inflation in the US. This may result in either no recession or a very mild one. If borne out, it may well mean that the bottom in equity markets is already in place. In addition, it would mean that investors escaped with only a correction rather than an ongoing bear market. For now, this is my base case assumption.

US economy yet to feel the tariff heat

The US economy has yet to feel much heat from the tariff mayhem. Retail spending was softer than expected last week and consumer sentiment dropped further. However, producer prices remained benign and weekly jobless claims stayed impressively low.

As long as trade negotiations remain on the table, markets may be willing to look past a deteriorating economic outlook for a while. The situation would be far more concerning if the economy was weakening while Trump remained firmly stuck to his guns.

Global week ahead

China releases its monthly ‘data dump’ covering retail sales, investment and industrial production. These could well show the economy softening but not buckling in light of recent tariff pressures.

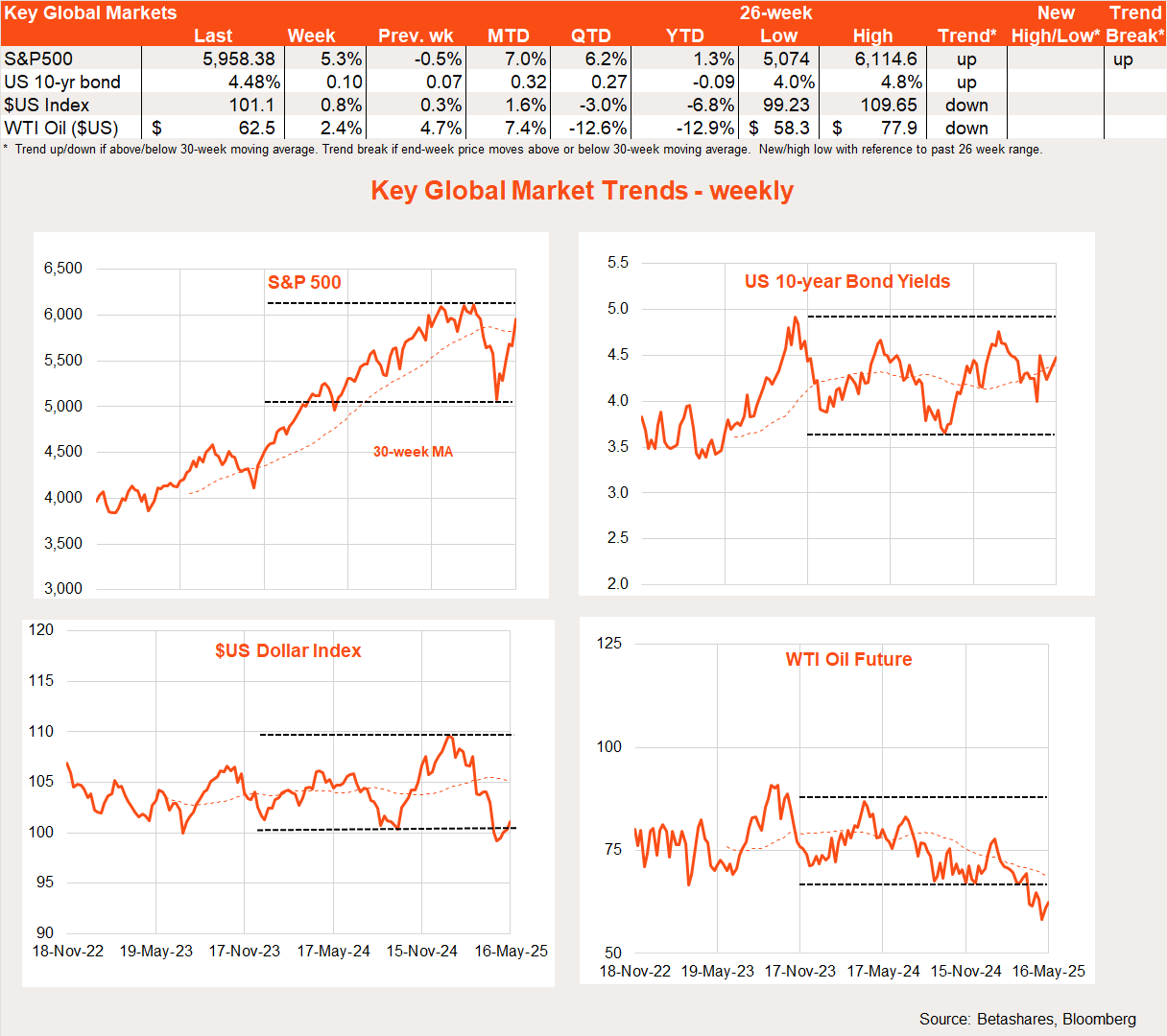

Global market trends

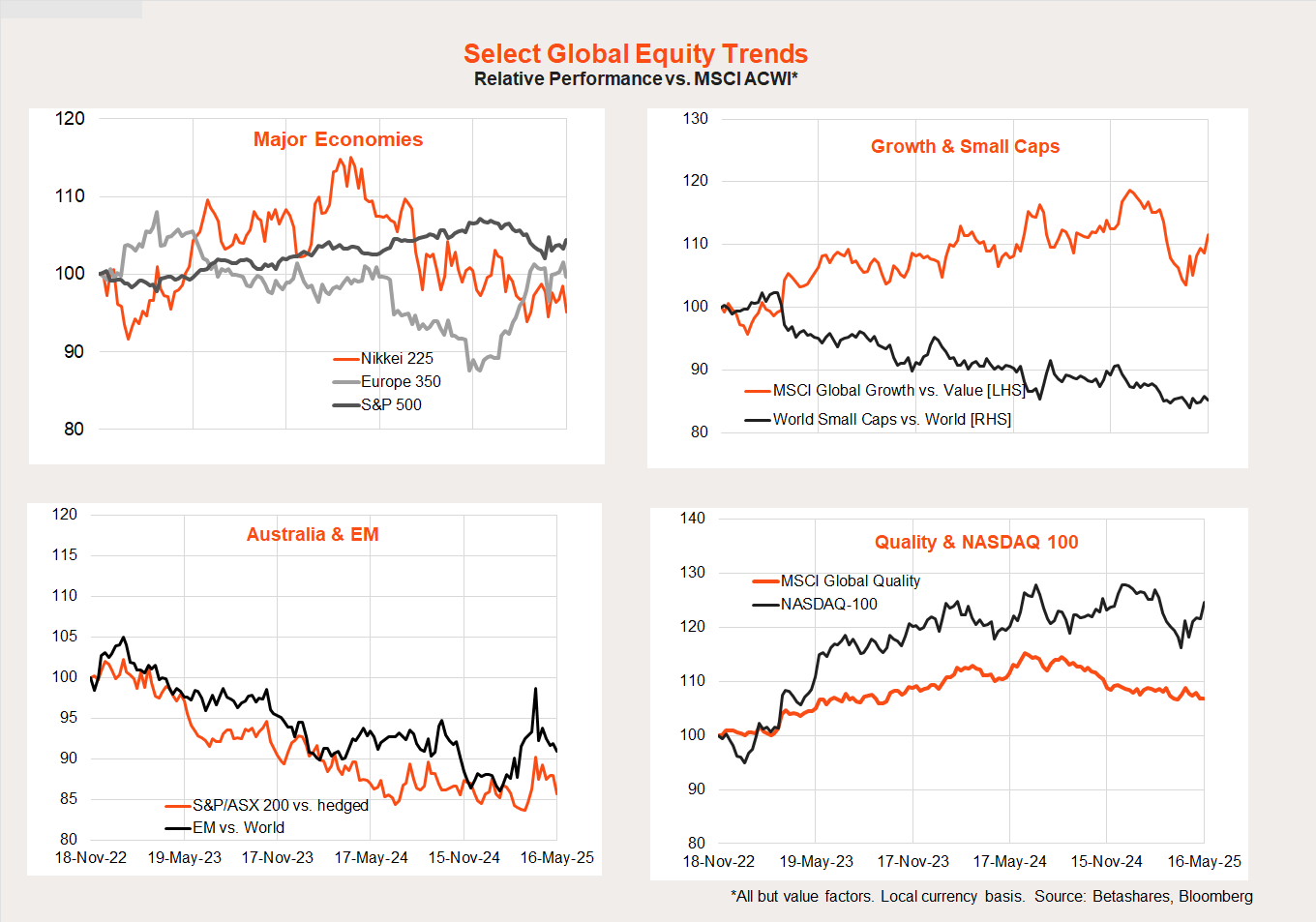

The recent bounce in global equities has also led to a rebound in the relative performance of growth over value, developed over emerging markets as well as the US relative to non-US markets.

These trends seem tied to equity market direction. If stocks resume their downtrend, I expect growth and US equity markets to be hit hardest. If, however, the equity uptrend has returned, reports of the death of US tech exceptionalism could be premature once again.

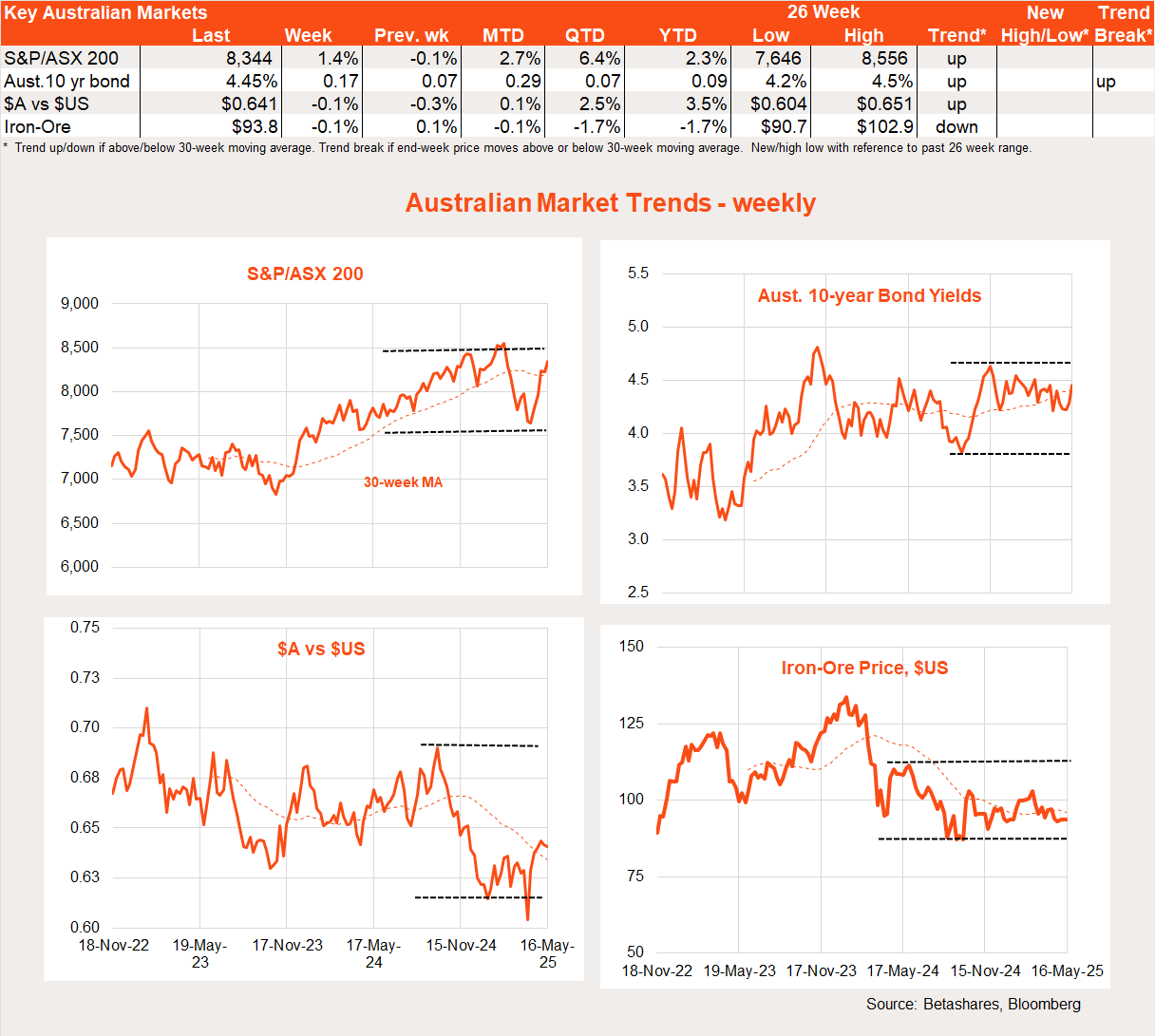

Australian markets

Local stocks also rose last week on the back of improving global optimism. Although local economic data was firm on balance, markets (rightly in my view) are still attaching a near-certain probability to an RBA rate cut tomorrow.

The NAB and Westpac measures of business and consumer sentiment last week suggested a reasonable degree of resilience in the face of concerning global tariff news. Consumer confidence lifted a further 2.2% while business conditions eased back only modestly.

Of greater concern to those expecting a rate cut this week were the wages and employment data. The Wage Price Index rose 0.9% in Q1, lifting the annual rate from 3.2% to 3.4%.

While this was a touch more than the 0.8% quarterly gain expected by the market, it may not really be reflective of a tight labour market. The Fair Work Commission recently agreed to sizeable wage increases for care workers. Overall, underlying wage growth still seems remarkably benign given the low level of unemployment.

Similarly, while the nearly 90,000 gain in employment in April was much larger than expected, the numbers reflect a significantly higher-than-expected supply of labour. That’s why the unemployment rate remained unchanged at 4.1%.

Overall, this firmer-than-expected activity data should not stand in the way of a rate cut tomorrow. The rate cut is still achievable as it’s not being driven by a weak economy. Instead, it reflects well-behaved inflation. This should allow the RBA to continue the process of ‘re-normalising’ interest rates from restrictive levels.

There is little other local data of note this week.

Have a great week!