Equity Markets Quarterly Commentary Q1 2025

3 minutes reading time

You might’ve noticed companies such as CrowdStrike, Darktrace, Bitdefender, DTEX, and Arctic Wolf appearing more often throughout your day-to-day. But what are these firms? All five companies are cybersecurity companies, and it’s big business. When valuable assets are stored anywhere, it inevitably attracts the attention of criminals. Cybercrime is no different. In fact, many of the most prevalent cybercrimes, such as fraud, scams, theft, and extortion, are simply old crimes delivered via a new medium – the internet.

Cybersecurity offers huge opportunities

According to estimates from Statista, there are approximately 30 billion devices connected to the internet around the world today1 – more than three for every person alive. That’s 30 billion opportunities for criminals to commit cybercrimes.

Based on recent data from the Australian Cyber Security Centre (ACSC), cybercrime reports increased by nearly 23% in Australia during FY23, with one report made approximately every six minutes2.

These crimes have a real cost, to individuals, corporates, governments, and the economy. The ACSC also reported that medium-sized businesses in Australia lost an average of $97,200 per reported incident in FY23. Looking at a wider scale, global cybercrime is projected to cost US$10.5 trillion per annum by 20253.

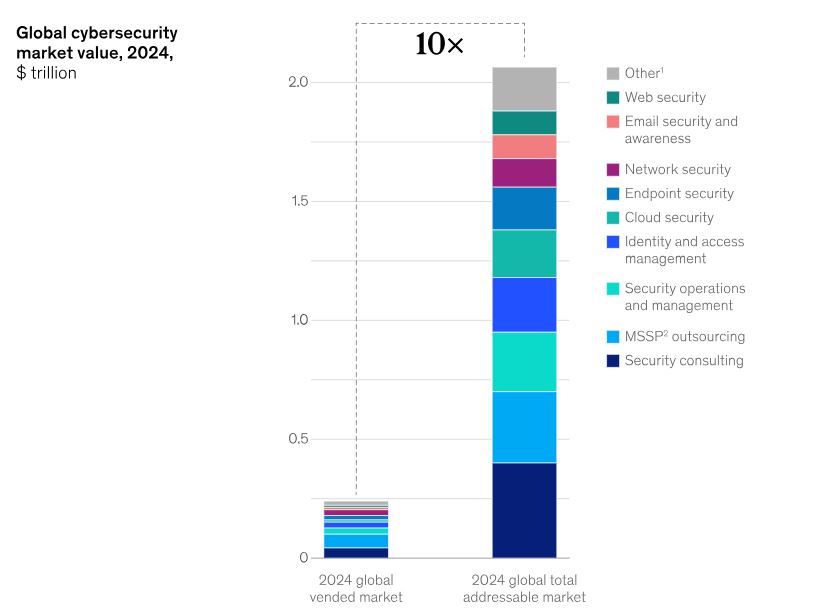

To combat this, organisations are already spending increasing sums on cybersecurity each year – an estimated US$150 billion in 2021. However, large areas of the market remain under-served, with estimates suggesting that segments such as cloud security are reaching just 1 to 5 percent of their total addressable market4. This demonstrates both the size of the risk to organisations, and the opportunity for cybersecurity firms.

Global cybersecurity market size and penetration (US$ trillions)

Source: McKinsey Cyber Market Map 2024

The need to outsource

As cybercrime becomes more prevalent, cybersecurity companies are becoming increasingly important. They provide essential protection for individuals, businesses, and governments, helping to safeguard sensitive data and prevent cyber-attacks. These companies use a variety of techniques to secure their clients’ networks and systems, including threat detection, incident response, and penetration testing. Some even offer more advanced solutions like artificial intelligence and machine learning to stay ahead of evolving threats.

While some would surely like to manage these threats in-house, a shortage of talent means that many organisations are forced to outsource to service providers5.

The digital ‘arms race’

In today’s digital age, cybersecurity is no longer an optional expense, but rather a necessity. As such, companies are investing heavily in cybersecurity measures to protect their business and their customers.

What’s resulted is something of a digital ‘arms race’, as both cybercriminals and cybersecurity experts aim to continuously improve their methods and outsmart each other. Recently this battle has stepped up, with the prevalence of generative AI (such as OpenAI’s ChatGPT) offering new tools to both sides.

With cybercrime showing no signs of slowing down, it appears that the need for cybersecurity will continue to grow.

Investors can seek to benefit from the forecast growth of the cybersecurity industry via the HACK Global Cybersecurity ETF . HACK aims to track the performance of an index (before fees and expenses) that provides exposure to the leading companies in the global cybersecurity sector – a sector that is heavily under-represented on the ASX.

There are risks associated with an investment in HACK, including market risk, cybersecurity companies risk, concentration risk and currency risk.

Sources:

2. ASD Cyber Threat Report 2022-2023 ↑

3. 2023 Cybersecurity Almanac: 100 Facts, Figures, Predictions, And Statistics ↑

4. McKinsey Cyber Market Map 2024. ↑

5. McKinsey ↑

3 comments on this

Agree with your article but very disappointed no distribution for FY 23 has been declared. While growth is the primary objective of HACK , in the past it has delivered a healthy annual distribution .

Hi Paul,

During FY23, HACK realised an overall capital loss. The dividend yield of the portfolio companies held in HACK was also low.

Hope this explains why there was no distribution for FY23.

Regards,

Patrick

How much was spent on cybersecurity globally in 2021, and what does this indicate about the market’s growth potential?

Regard Telkom University Jakarta