Proxy voting and company engagement: Q4 2025

9 minutes reading time

- Responsible investing

In the rapidly evolving world of sustainable finance, green bonds have emerged as a pivotal instrument, bridging the gap between capital markets and environmental sustainability.

As the global economy progresses towards net zero emissions, green bonds are becoming essential tools for mobilising private capital for public and corporate initiatives. These innovative financial products, designed to fund projects with positive environmental impacts, have transformed from niche offerings to mainstream investment vehicles in just over a decade.

This surge reflects the increasing commitment of investors, corporations and governments to address climate change and promote sustainable development. This article delves into the fundamentals of green bonds, classification frameworks, global trends and challenges, while also examining recent trends in Australia.

What are green bonds?

Green bonds are fixed income securities issued to finance or refinance projects with positive environmental outcomes. These projects typically include renewable energy developments, energy efficiency improvements, pollution control measures, biodiversity protection, clean transportation systems and climate change adaptation efforts.

Like conventional bonds, green bonds provide investors with periodic interest payments and return the principal upon maturity. However, their proceeds are strictly allocated to environmentally beneficial projects. The first green bond was issued in 2007 by the European Investment Bank, the EU’s lending arm. This was followed a year later by the World Bank. Since then, the market has expanded significantly, with over 800 governments, development agencies and corporations issuing green bonds globally.1

Green bonds: Eligible categories for use of proceeds (not exhaustive)

Source: Investor and Financial Education Council

Differing shades of green

While both the Climate Bonds Initiative (CBI) Climate Bonds Standard and the International Capital Market Association (ICMA) Green Bond Principles, provide frameworks for classifying green bonds, their approaches differ in scope, methodology and requirements. Below is a comparison of their classification systems:

Scope and structure

- CBI Classification: The CBI uses the Climate Bonds Taxonomy, a science-based framework that identifies assets and projects consistent with decarbonisation pathways aligned with the Paris Agreement’s 2°C warming limit. The taxonomy employs rigorous sector-specific criteria developed by technical working groups to ensure climate integrity.2

- ICMA Classification: The ICMA’s Green Bond Principles (GBP) are voluntary guidelines that emphasise transparency and disclosure. They focus on four core components: use of proceeds, project evaluation and selection, management of proceeds, and reporting.3 Unlike CBI’s taxonomy, ICMA does not prescribe detailed sector-specific standards; instead, it allows issuers to define eligible green projects within broad categories such as renewable energy, clean transportation and biodiversity conservation.4

Certification process

- CBI Certification: Bonds certified under the Climate Bonds Standard must meet sector-specific criteria outlined in the Climate Bonds Taxonomy. Certification involves third-party verification to ensure compliance with eligibility benchmarks for climate mitigation or adaptation.

- ICMA Framework: ICMA does not offer certification but recommends external reviews such as second-party opinions to validate alignment with its principles. These reviews are optional but encouraged to enhance credibility.

Use of proceeds

- CBI: Proceeds must be allocated exclusively to projects or assets meeting stringent decarbonisation criteria as defined by the taxonomy. A minimum of 95% of net proceeds must finance eligible projects; up to 5% may fund activities aligned with ICMA’s GBP or Social Bond Principles.5

- ICMA: The GBP requires issuers to clearly articulate how proceeds will be used for green projects but offers flexibility in defining eligible categories. It recommends quantifying environmental benefits where feasible but does not mandate specific thresholds or allocation percentages.

Reporting requirements

- CBI: Certified bonds require detailed reporting on the allocation of proceeds and environmental impact. Reports must demonstrate compliance with sector-specific criteria and are subject to ongoing verification.

- ICMA: The GBP encourages issuers to report on the allocation of funds and environmental outcomes but does not enforce standardised templates or methodologies for impact measurement. Reporting is voluntary but considered best practice.

Global green shoots – the rise of green bonds

The global green bond market has experienced remarkable growth, driven by increasing commitments to climate change mitigation and sustainable development.

In 2024, green bond issuance reached a record US$447 billion, marking a 17% increase compared to the previous year.6 This momentum is expected to continue, with forecasts for 2025 projecting green bond issuances to approach US$620 billion, contributing significantly to the broader sustainable bond market, which is anticipated to reach US$1 trillion for the fifth consecutive year.7

Europe continues to dominate the global green bond market, accounting for approximately 60 per cent of issuances in 2024. The region’s leadership is underpinned by favourable regulatory frameworks including the EU Taxonomy for Sustainable Activities and the European Green Deal. These initiatives provide clear guidelines for defining ‘green’ activities and incentivise issuers to align their projects with environmental objectives.

Emerging markets and Asia Pacific are also poised for growth, with China and Japan having increased their issuance capacities. In contrast, the United States has seen a decline in issuance due to shifting political priorities and reduced participation in global net zero alliances.8

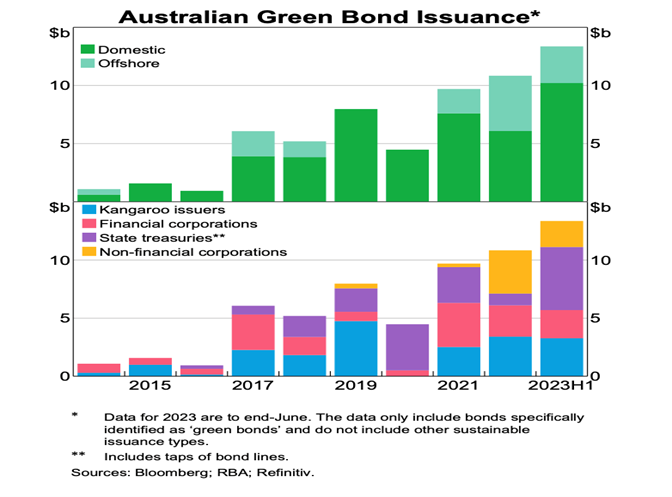

Australia’s green bond market: A snapshot

Australia’s green bond market has grown significantly in recent years, reflecting the increasing focus on sustainable finance to support the nation’s transition to net zero. The issuance of the country’s inaugural sovereign green bond in June 2024 marked a milestone in this development.

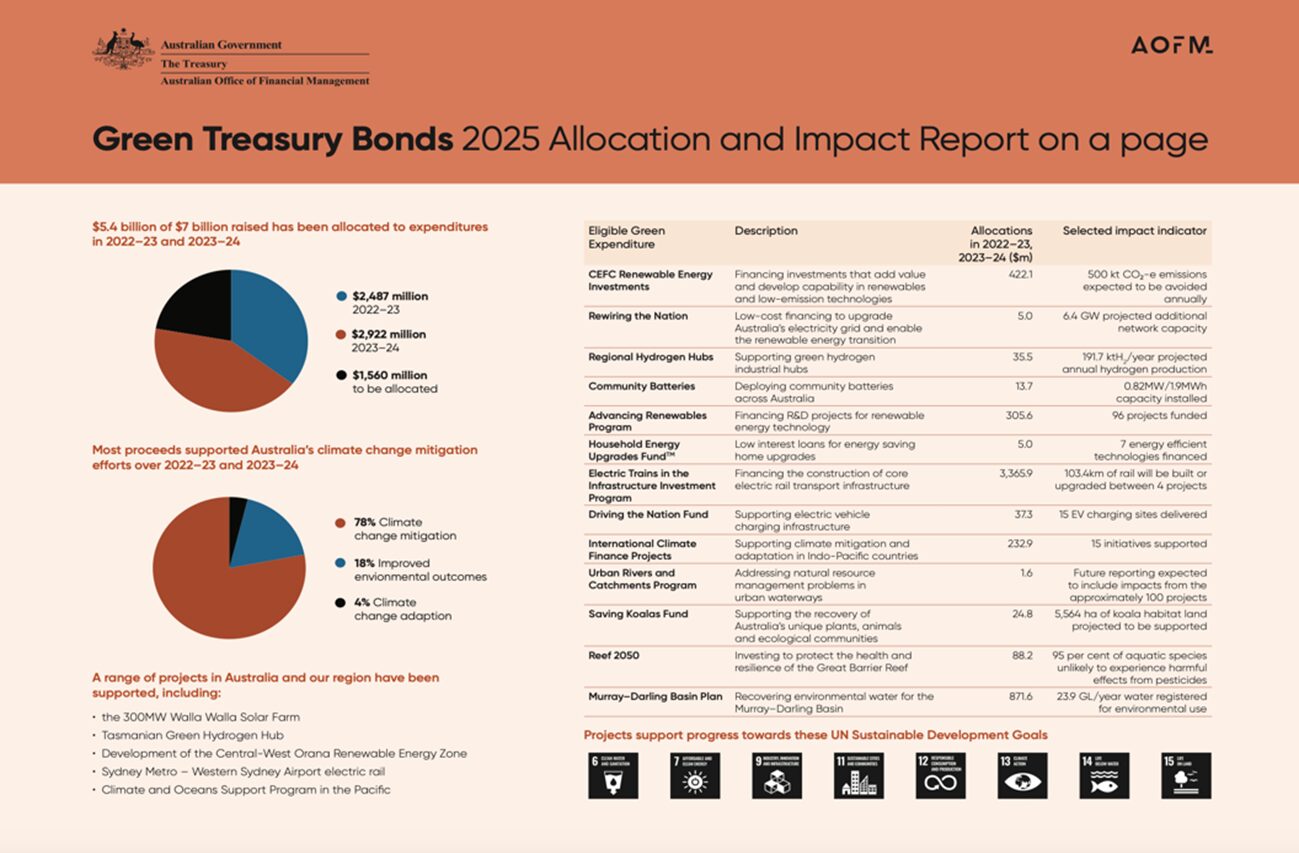

Managed by the Australian Office of Financial Management (AOFM), the A$7 billion bond was heavily oversubscribed, attracting over A$22 billion in bids from 105 institutional investors across Australia, Asia, Europe and North America. This strong demand underscores growing investor confidence in Australia as a destination for green capital, with funds allocated to projects including renewable energy infrastructure, clean transportation and biodiversity conservation.9

The Australian green bond market has expanded rapidly since its inception in 2014. By 2023, annual green bond issuance reached A$13 billion, the highest on record, driven by state treasury corporations, major banks and international organisations issuing ‘kangaroo’ bonds denominated in Australian dollars. The introduction of sovereign green bonds has further strengthened this market by providing a benchmark for other issuers and attracting new sources of capital.10

The proceeds from Australia’s inaugural green bond are being used to fund projects aligned with the government’s climate goals under its Green Bond Framework. These include initiatives such as the Sydney Metro and the Rewiring the Nation program, which aims to modernise electricity grids to support renewable energy zones. The framework ensures transparency and accountability by requiring measurable performance indicators for funded projects.11

Use of proceeds summary for Australia’s inaugural sovereign green bond

Source: Australian Office of Financial Management

Global taxonomies – a green spaghetti bowl

The emergence of green taxonomies worldwide has introduced a complex regulatory environment for green bond issuers. While these frameworks aim to standardise sustainable finance and prevent greenwashing, the credibility of standards in different geographies varies, and they can impose significant compliance burdens on issuers, particularly under the current stringent criteria under the EU Taxonomy.12

In Australia, the Australian Sustainable Finance Institute (ASFI) Sustainable Finance Taxonomy (the Taxonomy), designed to classify green and transition activities, faces significant challenges in its application to the green bond market.

While the framework aims to combat greenwashing and align investments with Australia’s net zero goals, several issues risk limiting its effectiveness and adoption. In ASFI’s second taxonomy consultation draft, there is considerable ambiguity around the definition of the terms ‘green’ and ‘transition’. In many places ASFI’s technical screening criteria equate activities ‘consistent with net-zero’ with activities ‘consistent with a pathway to net-zero’, resulting in high emissions activities being classified as ‘green’.

Further, ASFI treat as equivalent activities that genuinely contribute to the decarbonisation of the economy with activities that happen to not produce carbon, such as the acquisition of buildings that are already built. In its submission to ASFI’s second public consultation, the Responsible Investment Association of Australasia (RIAA) noted:

“This particular issue has caused uncertainty around the objectives of the Taxonomy, as well as the possibility that some sectors could be rewarded for activities which do not actually reduce carbon emissions.”13

ASFI’s final draft of the Taxonomy was delivered to Treasury in early 2025 but has not been released to the public. Many investors, including green bond investors, are concerned that, based on the second consultation draft, many of the technical screening criteria are not consistent with any credible definition of the term ‘green’. Furthermore, without complementary policies like subsidies or tax incentives, adoption of the Taxonomy may be limited in driving green bond issuance.14

The way forward

The green bond market has emerged as a vital instrument in global efforts to combat climate change and finance the transition to a sustainable economy.

Its rapid growth reflects the increasing alignment of financial markets with environmental, social and governance (ESG) principles, as well as the urgent need to mobilise capital for renewable energy, sustainable infrastructure and biodiversity conservation projects. However, its expansion is not without challenges. The lack of standardisation, greenwashing risks and political uncertainties underscore the importance of robust regulatory frameworks and transparent reporting to maintain investor confidence and ensure the credibility of green-labelled debt.

In Australia, the recent issuance of a sovereign green bond has set a benchmark for further growth in the domestic market, while globally, Europe and Asia-Pacific continue to lead on innovation and issuance volumes. As governments, corporations and investors increasingly prioritise sustainability, green bonds are expected to remain central to financing climate action. However, addressing existing challenges will be critical to unlocking the market’s full potential.

By fostering collaboration between regulators, issuers and investors, the green bond market can continue to grow while maintaining its integrity, ultimately playing a pivotal role in achieving net zero targets and ensuring long-term economic resilience.

The Betashares Global Green Bond Currency Hedged ETF (ASX: GBND) comprises a portfolio of global green bonds (using the definition applied by the Climate Bonds Initiative), issued specifically to finance environmentally friendly projects, denominated in Euro or US dollars, that have been screened to avoid bond issuers with material exposure to activities deemed inconsistent with responsible investment considerations.

Sources:

1. https://www.weforum.org/stories/2024/11/what-are-green-bonds-climate-chnage/

2. https://www.climatebonds.net/standard/sector-criteria

4. https://www.sustainalytics.com/esg-research/resource/corporate-esg-blog/about-green-bond-principles

5. https://www.climatebonds.net/standard/the-standard

6. https://www.axa-im.com.au/responsible-investing/insights/good-bad-opportunities-green-bonds-2025

9. https://www.uts.edu.au/news/2024/06/australias-first-green-bond-big-hit

10. https://www.rba.gov.au/publications/bulletin/2025/jan/australias-sovereign-green-labelled-debt.html

11. ttps://www.aofm.gov.au/sites/default/files/2023-12-05/Green%20Bond%20Framework_WEB.pdfh