4 minutes reading time

Global markets

Global stocks pulled back last week after several weeks of strong gains. Some impatience is emerging around the timing of US trade deals.

US-UK trade deal

Global markets opened last week on a nervous note. Reports suggested that US President Trump will personally set tariff levels. This means negotiations with trade partners may not be as important.

By mid-week, the US and UK unveiled a bare-bones trade deal that may hint at what future agreements will look like:

-

Both sides slightly eased restrictions on beef exports, but the UK upheld its ban on hormone-treated meat.

-

UK car exports will face a 10% tariff on the first 100,000 vehicles – matching current export volumes – instead of the higher 27.5% rate.

-

Steel and aluminium exports will avoid the 25% tariff, although the exact product coverage remains unclear.

-

Rolls-Royce engines and aircraft parts will be exempt from tariffs.

-

Talks on pharmaceuticals and digital services made no progress. The UK will continue applying its 2% digital services tax on revenue earned from UK users by US tech firms like Meta, Alphabet and Apple.

-

Most other UK exports will now incur the 10% tariff Trump introduced in early April.

All up, the deal is very limited in nature and the US will still impose the minimum 10% tariff on most UK exports.

It also suggests that the likely outcome of all these trade deals may be a minimum 10% tariff on most imports into the US, although there may be country and sector-specific special deals. If so, the US would still see a major rise in tariffs and a more complex trade landscape.

Other global news of note

Media reports highlighted progress in US-China trade talks. This has, understandably, got markets excited this morning.

As many analysts expected, the Fed kept rates firmly on hold. It also downplayed the prospects of a rate cut anytime soon. Markets have lowered their assessment of a possible June rate cut from 30% to 12%. The probability of a July rate cut has also fallen from 60% to just under 50%.

In Europe, incoming German chancellor Friedrich Merz had a tougher time getting voted in by the new parliament than expected. This suggests that his ability to push through major economic reforms and fiscal stimulus could be more limited than hoped.

Global week ahead

The key global event this week will likely be the outcome of any announced US-China trade deal. Just how far tariffs are reduced on both sides remains to be seen. While declines are expected, markets may well end up being disappointed should tariff levels remain significant.

The US consumer price index (CPI) is also released this week, with core annual inflation expected to stay at a modest 2.4%. However, this data is now outdated, as markets are preparing for possible sharp price increases in the coming months due to higher tariffs. But since these increases are expected, markets may dismiss them as temporary or ‘one-off’ events.

We will also get updates on US retail spending, industrial production and consumer sentiment. While consumer spending and industrial activity is expected to hold up, markets may react negatively if we get a further decline in already depressed consumer sentiment.

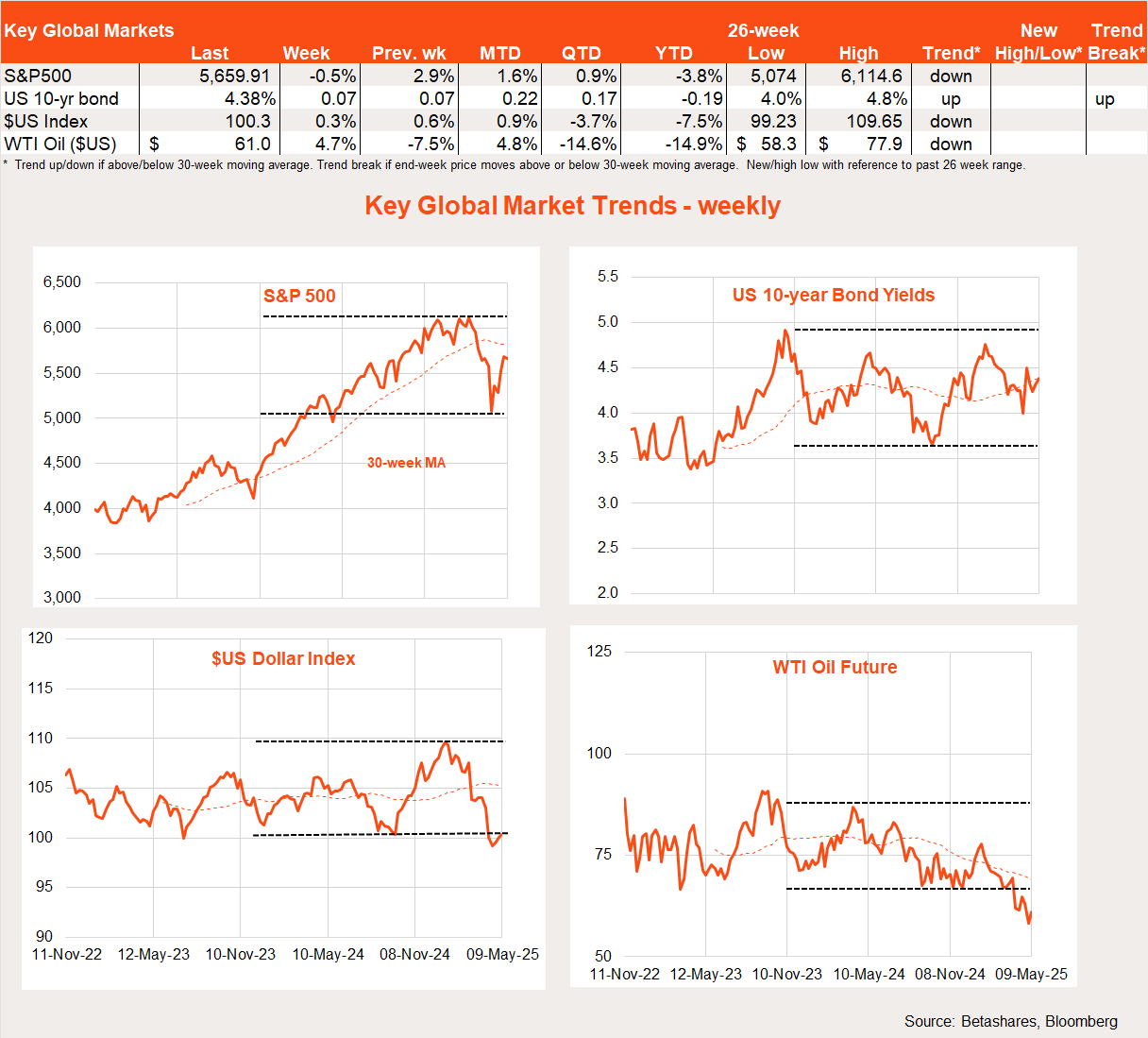

Global market trends

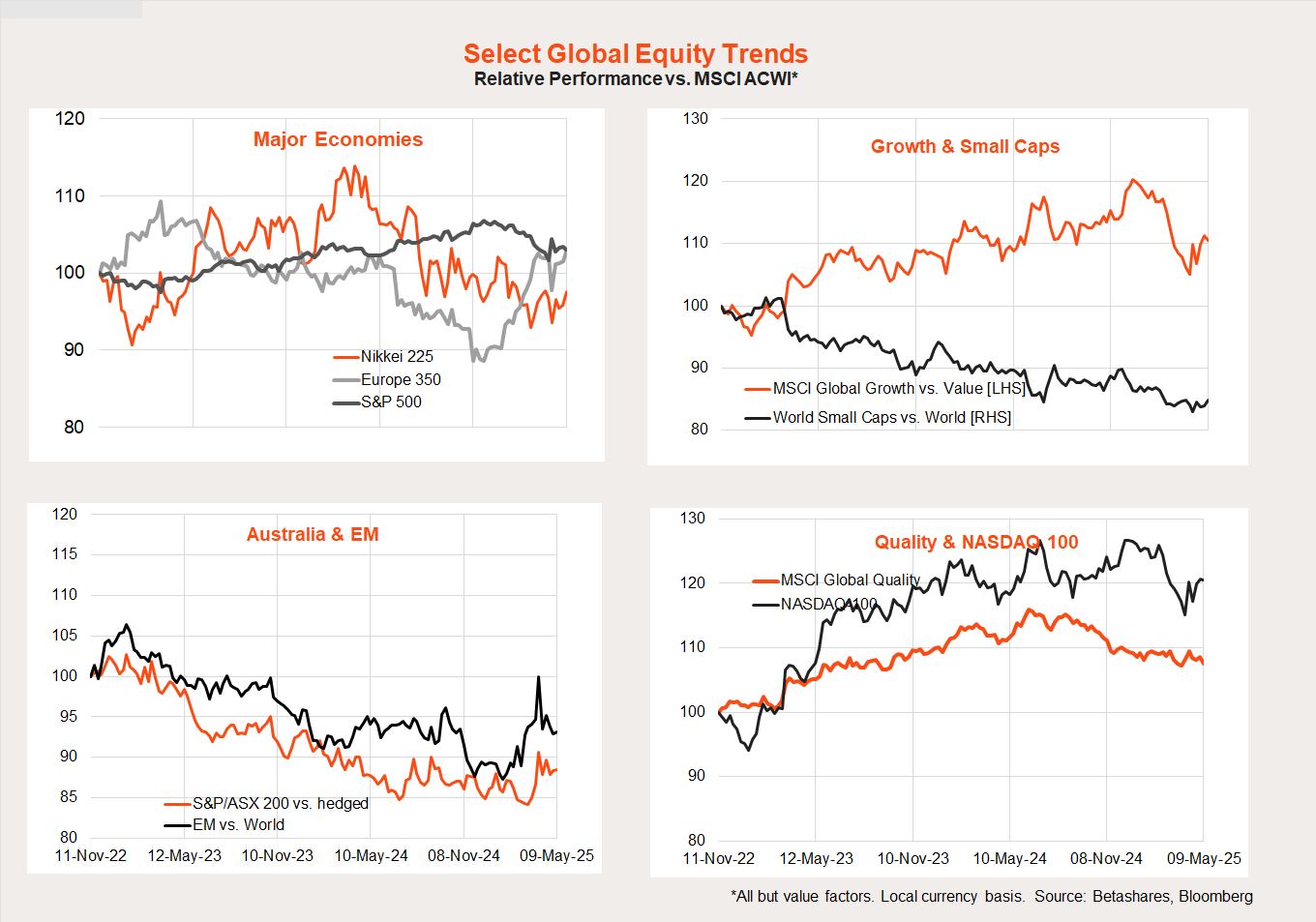

The recent bounce in global equities has also led to a rebound in the relative performance of growth over value, developed over emerging markets as well as the US relative to non-US markets.

These trends seem tied to equity market direction. If stocks fall further, I expect growth and US equity markets to be hit hardest.

Australian markets

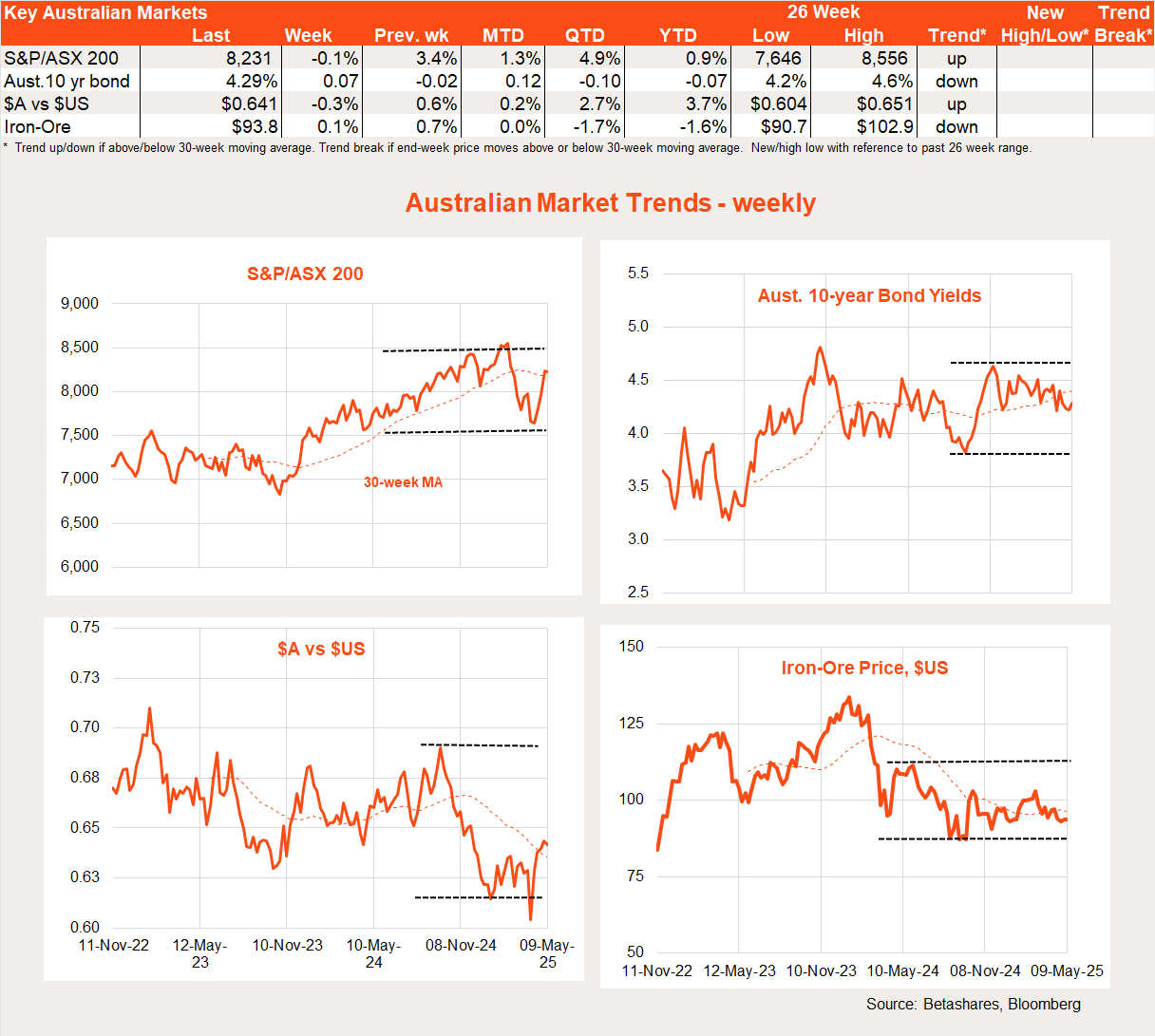

Local stocks also pulled back last week in line with renewed global caution.

A larger-than-expected drop in dwelling approvals dominated last week’s local data. Despite the monthly decline, a gradual recovery in housing activity (thankfully) still appears to be in place.

Key highlights this week include the NAB and Westpac measures of business and consumer sentiment respectively, along with the wage price index and April employment report.

- Given tariff concerns and an absence of RBA rate cuts, business conditions are likely to remain subdued.

- After dropping in April due to US tariff concerns, consumer sentiment could recover (or at least stabilise) in May.

- Analysts expect Q1 wage growth to remain modest, with annual growth just above 3%.

- Economists expect employment growth to remain fairly firm, at around 20,000 jobs. This would keep the unemployment rate steady at 4.1%.

All up, nothing released this week (barring a bumper employment gain) is likely to shake the market’s firm view that an RBA rate cut is coming next week.

Have a great week!