6 minutes reading time

Bitcoin has soared back above US$104K on positive macro sentiment as at May 11th. An apparent ceasefire between India and Pakistan, progress in US-China trade talks and movement towards a Ukraine-Russia deal sent Bitcoin to its highest traded price since late January. The rest of the broad crypto market has followed.

Bitcoin and Ethereum rose by 7.85% and 34.41% respectively over the seven days to 11 May 2025. Bitcoin’s market capitalisation is back above US$2 trillion while the global crypto market cap is up to US$3.3 trillion. Bitcoin’s market dominance has fallen to 62.3%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $103,417 | $104,869 | $93,633 | 7.85% |

| ETH (in US$) | $2,474 | $2,592 | $1,755 | 34.41% |

Source: CoinMarketCap. As at 11 May 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Ripple bids for stablecoin issuer

Circle has rejected a takeover bid from Blockchain-based digital payment provider Ripple, rumoured to have been worth between US$4 and 5 billion.

According to sources cited by Bloomberg, Circle thought the initial offer was too low. The same reports suggest Ripple is still interested in acquiring Circle, but has not decided whether to put forward a new offer.

Circle remains focused on a planned IPO that it filed for earlier this month1.

Corporate treasuries adding Bitcoin

Asset manager Bernstein’s research team estimates that corporate entities could invest up to US$330 billion in Bitcoin over the next five years. This projection suggests Bitcoin may be shifting from a speculative asset to a legitimate option for corporate treasuries.

Bernstein expects companies with over US$100 million in cash reserves to contribute as much as US$190 billion to Bitcoin holdings. Smaller, high-growth firms could add another US$11 billion by 2026. However, these assumptions are based on the corporate treasury model popularised by Michael Saylor through Strategy (formerly MicroStrategy).2

CRYP company spotlight

Galaxy Digital Holdings (TSE: GLXY) eyes Nasdaq listing

After announcing its intent to list on the Nasdaq on 30 April, digital asset manager Galaxy Digital Holdings (TSE: GLXY) has moved one step closer to securing a listing. The US Securities and Exchange Commission has approved the company’s plan to redomicile in the United States.3

The listing still depends on meeting legal and listing requirements, gaining shareholder approval for the reorganisation and redomiciling, and receiving final approvals from both the Toronto Stock Exchange and Nasdaq. If it clears all hurdles, the company expects to list in May.4

Galaxy is currently held in the Betashares Crypto Innovators ETF (ASX: CRYP)5. CRYP provides exposure to global companies at the forefront of the crypto economy.6

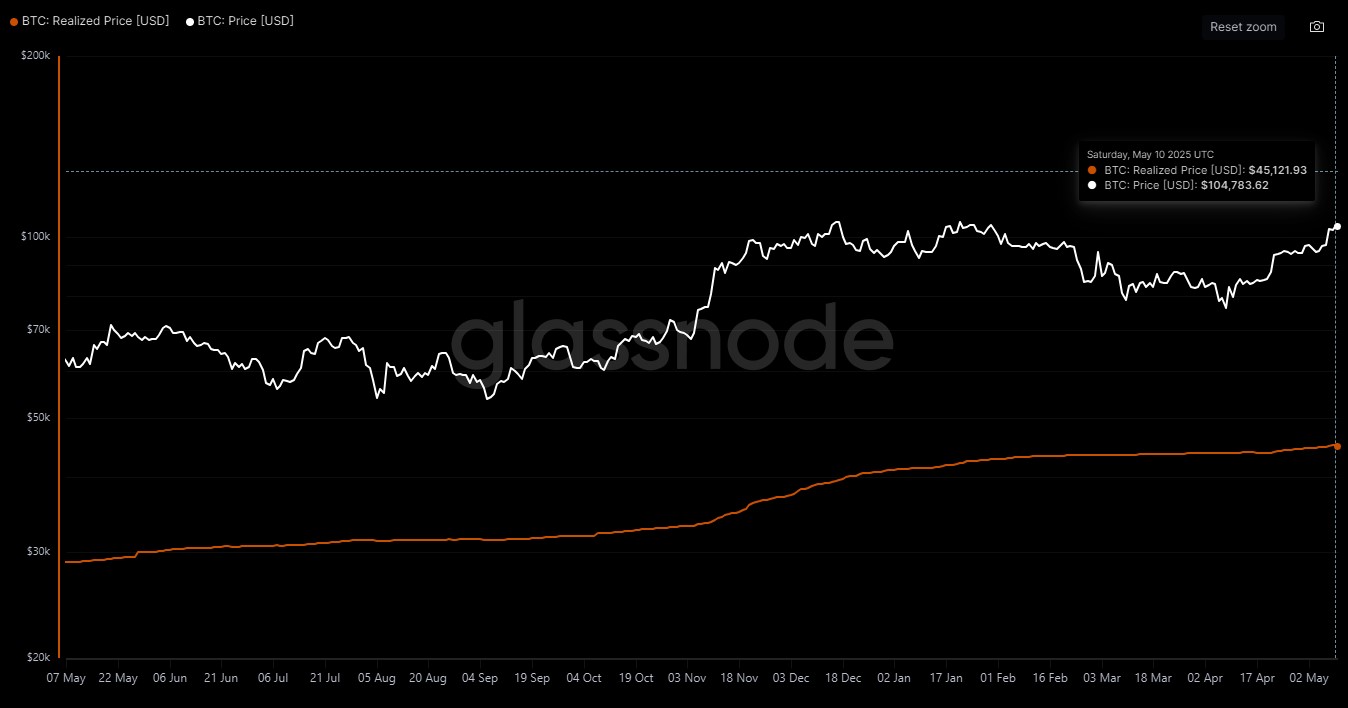

Bitcoin (BTC): Realised Price

This metric shows the realised price, which is the realised capitalisation divided by the current supply.

According to Glassnode data, as at 10 May 2025, the realised price of Bitcoin is $45,121. That is up by $10,000 since November 19 2024. It indicates that there has been significant purchasing at much higher prices since late last year, which is helping to drive the realised price up.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Percent Supply in Profit

The percent supply in profit shows the percentage of circulating supply in profit. That is, the percentage of existing coins whose last price was lower than the current price.

According to data from Glassnode as of 10 May 2025, the circulating supply in profit is now at 98.8% as the market has rebounded from price lows in March 2025. At current price levels, the market dynamics appear very healthy.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Most top 20 altcoins gained over the seven days to 11 May 2025. However, after trailing Bitcoin for much of the year, Ethereum finally broke out and strongly outperformed the top 20 coins, rising by over 34% over the same period.

Alongside positive macro news, a recent upgrade may have helped drive ETH higher. Ethereum has led in smart contracts but has faced growing competition from faster and cheaper smart contract blockchains.

The latest upgrade, called Pectra, doubled the network’s data capacity. This has made Layer-2 transactions much cheaper and increased the number of transactions the network can process at once. It also improved security through better validation.6

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://www.bloomberg.com/news/articles/2025-04-30/ripple-is-said-to-have-offered-to-buy-stablecoin-rival-circle?embedded-checkout=true

2. https://cryptopotato.com/corporations-could-add-330b-to-bitcoin-treasuries-in-next-5-years-bernstein/

3. https://www.galaxy.com/newsroom/galaxy-intent-to-list-on-nasdaq-may-16/

4. https://cointelegraph.com/news/galaxy-digital-approved-us-domicile-nasdaq-listing

5. As at 9 May 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

6. CRYP does not invest in crypto assets directly, and does not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.

7. https://www.forbes.com/sites/greatspeculations/2025/05/09/up-65-why-is-eth-price-on-fire/

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.