6 minutes reading time

If you’d prefer to listen to this week’s Bassanese Bites podcast, click below or subscribe on Apple, Amazon or Spotify:

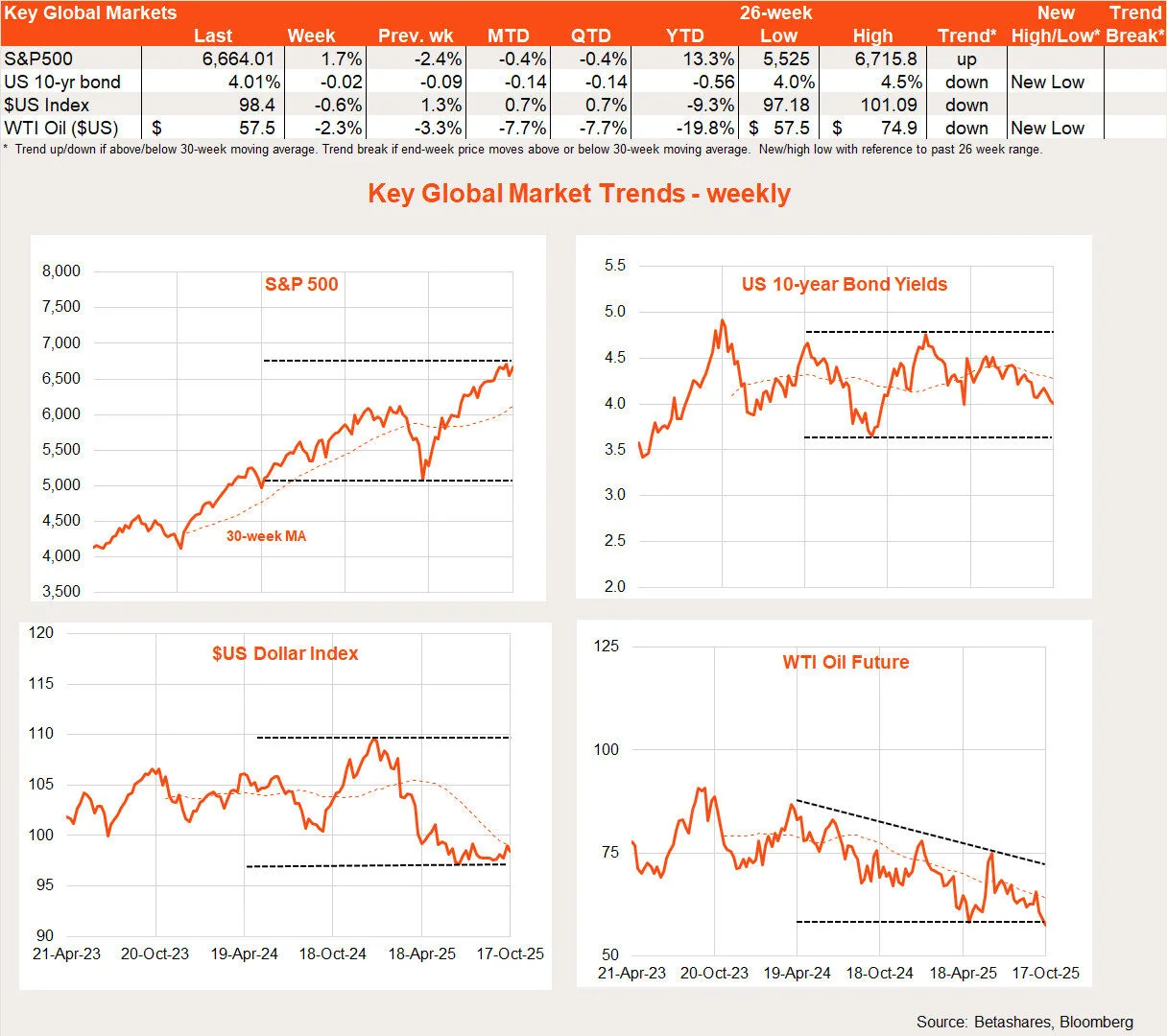

Equities recovered some of the previous week’s losses reflecting easing US-China trade tensions and reaffirmation of the Fed’s policy easing bias.

Global week in review: Still flying blind

With US government operations still shut down (I note politicians still get paid!), markets remain bereft of official economic data on the health of the economy. In this vacuum, focus last week remained on simmering US-China trade tensions and a speech from Fed Chair Jerome Powell.

The US is trying hard to play tough guy against China but the latter is simply calling its bluff. That said, markets were encouraged by further comments from President Trump conceding high tariffs are not sustainable and all will eventually “be fine” with China. With regards to Powell, he still seemed more concerned with downside risks to employment than upside risks to inflation, arguing tariffs should likely only have a one-off effect on prices.

In other news, there were a few more wobbles in US private credit markets with two US regional banks – Zions Bancorp and Western Alliance Bancorp – indicating that some loans to credit funds that invest in distressed debt had been based on fraudulent information. This follows credit losses from the collapse earlier this month of two firms: car parts supplier First Brands and the car financier Tricolor.

At this stage, it’s way too early to suggest these wobbles reflect systemic problems in the US economy or private credit. After all, firms go broke every day and some losses on some loans go with the territory. Some of the issues with Tricolor – which lent mainly to undocumented lower-income immigrant workers – may reflect the US immigration crackdown.

So far at least, credit spreads on US high yield debt (see chart below) have widened so far this month but remain at relatively low historic levels, and are still well below the spikes seen in the early-April tariff concerns.

Source: Bloomberg. As at 20 October 2025.

Source: Bloomberg. As at 20 October 2025.

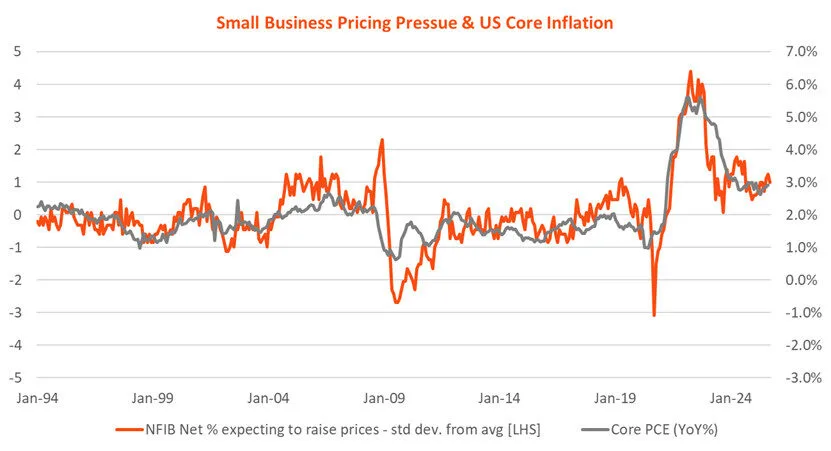

We did get further private sector data with the NFIB small business survey noting a dip in optimism, although overall small business confidence remained around long-run average levels. Pricing pressure also remained above average, consistent with sticky core annual consumer inflation around current levels of 3%.

Source: NFIB

Global week ahead: CPI, PPI and retail sales (maybe!)

This week was again supposed to be one in which we’d receive a smattering of key US economic data, such as consumer prices on Friday. But whether we get it or not depends on whether the US government reopens, and there seems little sign of that anytime soon.

Either way, market expectations had pencilled in a 0.3% gain in core consumer prices for September – which would have been the third rise in a row – keeping annual core inflation steady at 3.1%.

The US earnings season also ramps up with week, with key reports due from Netflix and Tesla.

Global equity trends

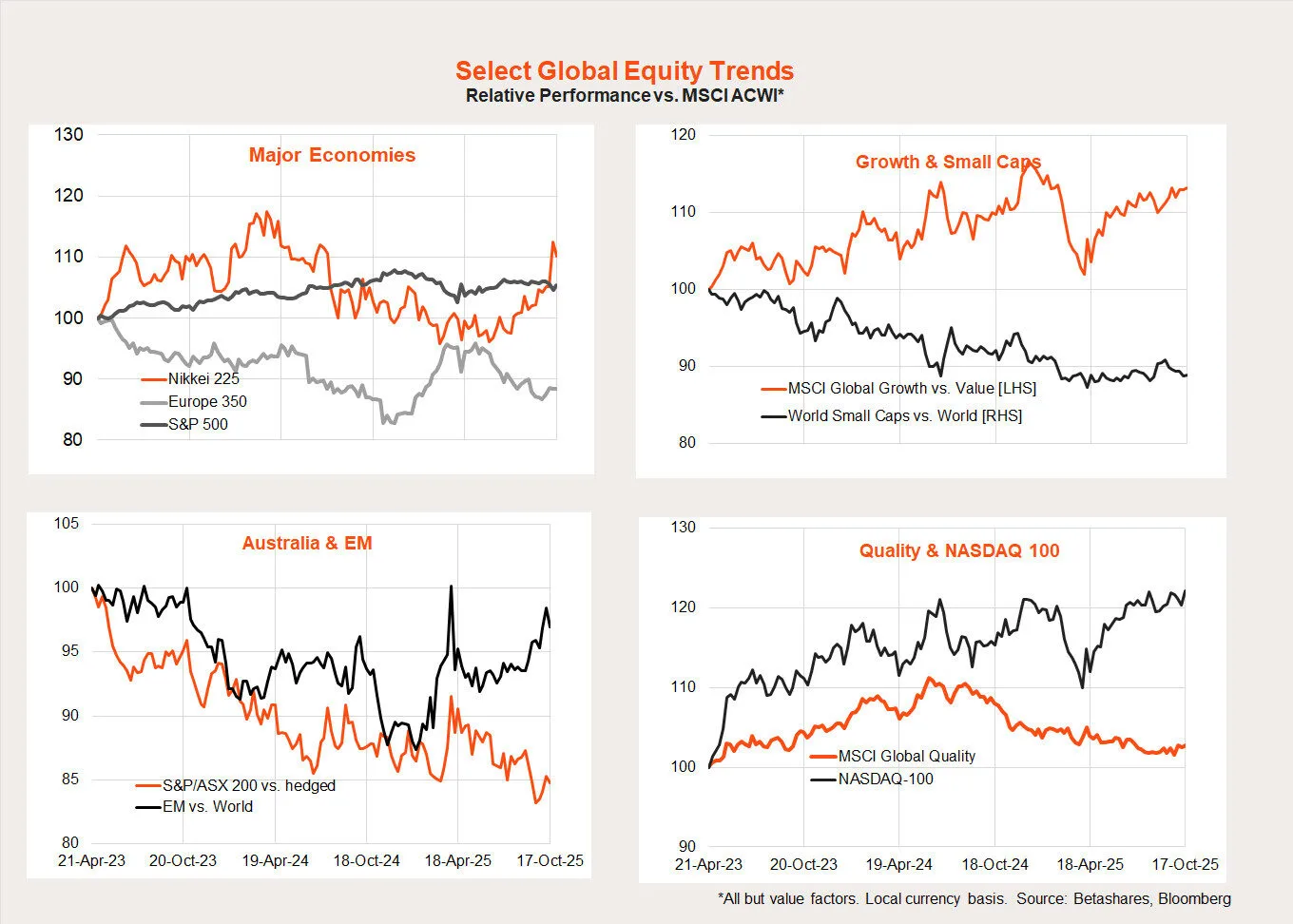

Japanese stocks pulled back a little last week after recent strong gains, while the NASDAQ-100 rebounded.

All up, however, the relative performance of long popular themes – US/NASDAQ-100/growth – has rolled over somewhat and been replaced with strength in emerging markets and Japan in particular. Australia and Europe are still underperforming, while quality and small caps are no longer underperforming.

Australian week in review: Unemployment jump

The key local news last week was a softer-than-expected employment report which has re-raised hopes of an RBA rate cut next month.

Employment rebounded a little less than expected in September, with a gain of 15k (markets were expecting 20k), after a 12k drop in August. But the big news was a surprise jump in the unemployment rate from 4.3% to 4.5%, with still-firm labour supply relative to weakening jobs demand leading to a increase in the number unemployed. Markets quickly raised the odds of a rate cut next month, although it still remains critically dependent on next week’s Q3 CPI report.

To my mind, the lift in unemployment means a steady annual trimmed mean inflation result of 2.7% next week could still be enough to see the RBA cut rates next month. A trimmed mean inflation rate of 2.6% or less would almost guarantee a cut, whereas a rate of 2.8% or higher would likely see the RBA pass on cutting rates. My view is that Q3 trimmed mean inflation will be 2.7% or less, hence providing scope for the RBA to cut rates next month. My base case, at this stage, remains for three RBA rate cuts by mid-2026.

Australian week ahead: RBA rhetoric

There’s little on the local data front this week with the main highlight being a talk by RBA Governor Michele Bullock on Friday. She’ll no doubt be quizzed on the recent rise in unemployment and implications for interest rates – although will likely play a fairly straight bat.

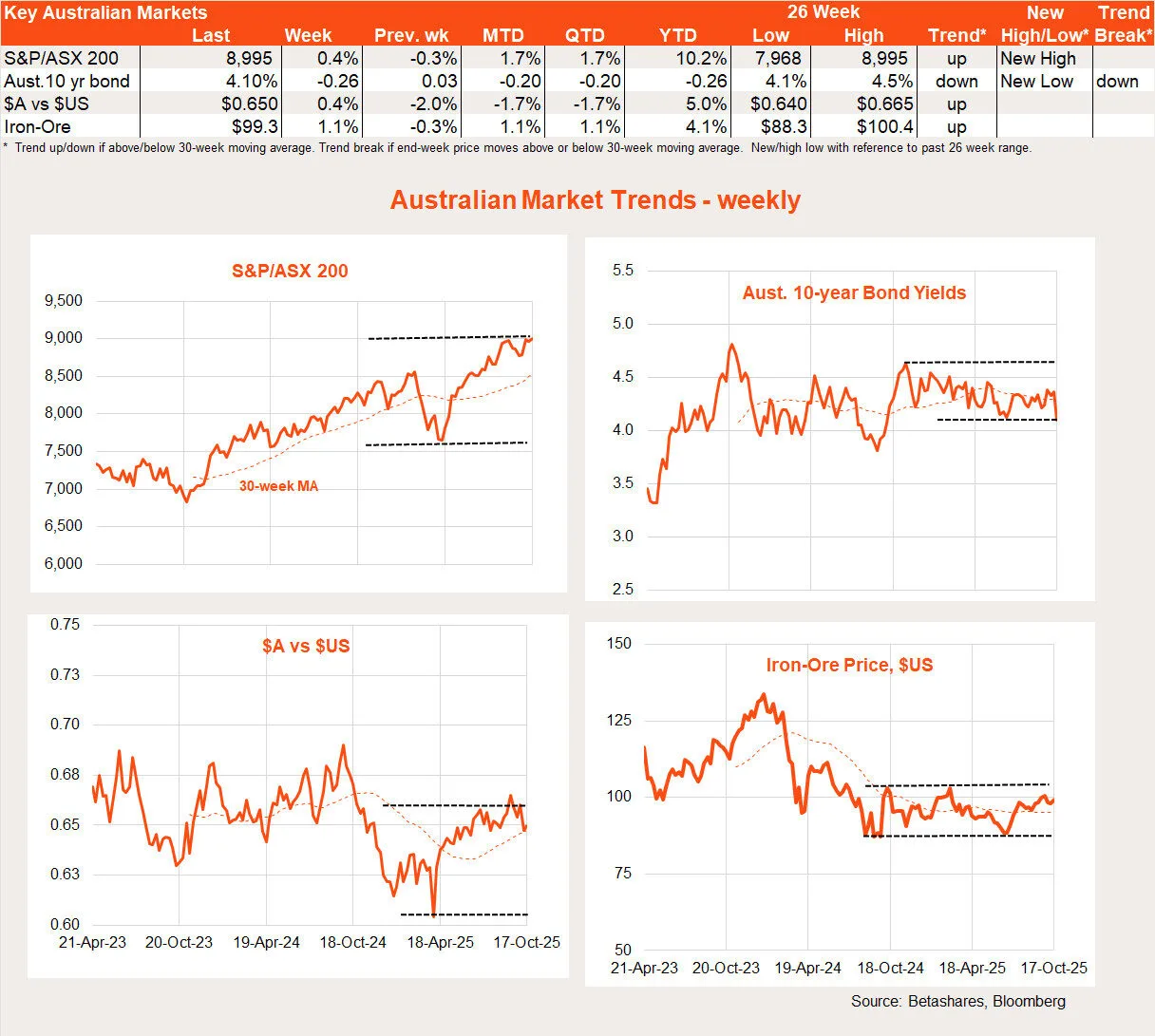

Australian equity trends

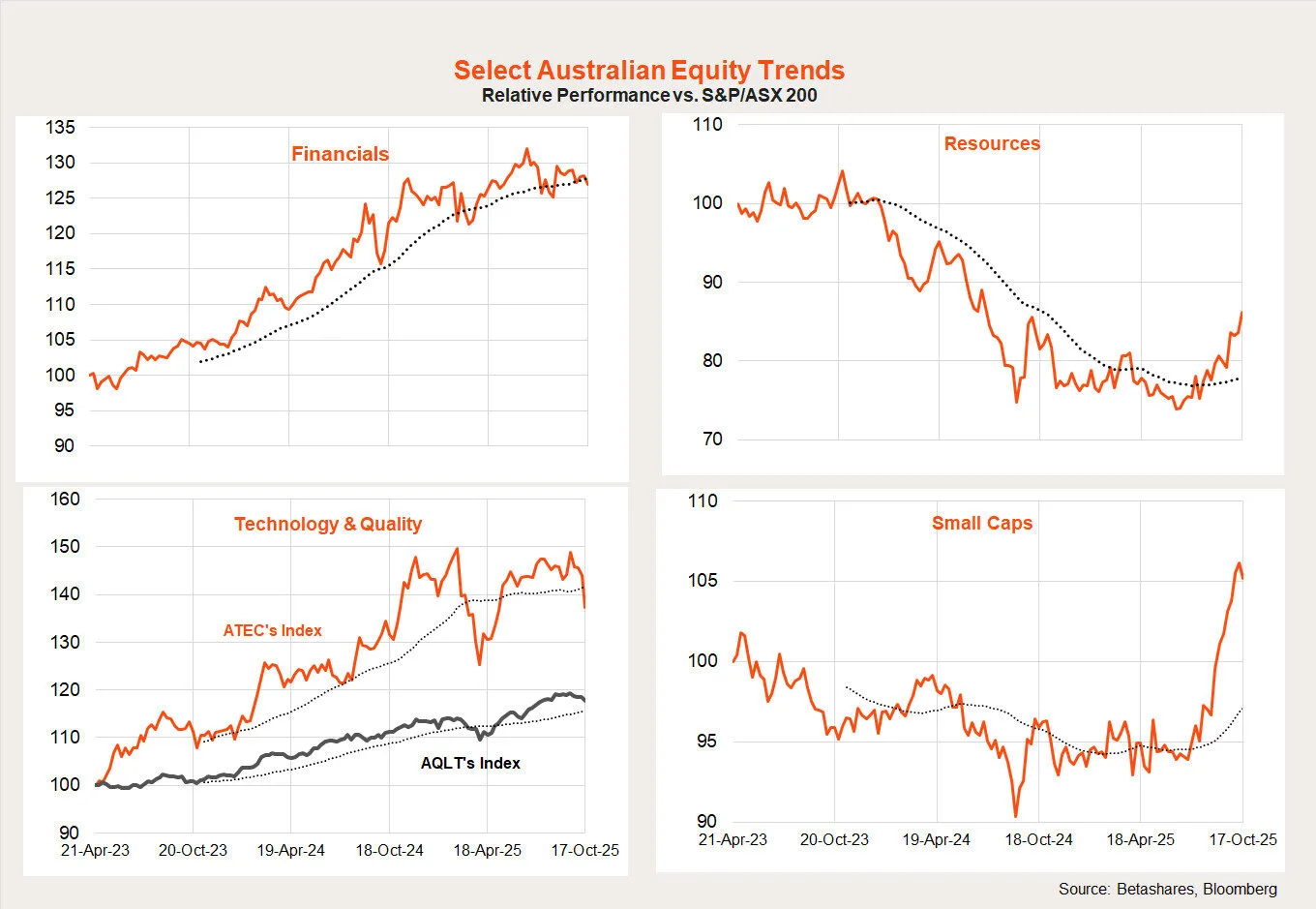

As has been the case globally, notable shifts have been taking place in the Australian equity market. Among large caps, there’s been a rotation from financials to resources, along with a notable rotation from large caps into small caps. That said, local technology stocks also suffered a notable pull back last week.