4 minutes reading time

Global markets

Global stocks rebounded last week, helped by a bounce in US consumer confidence as well as US President Trump’s decision to delay a 50% tariff on European imports.

Trump’s on-again, off-again tariff saga continues

Markets were whipsawed again last week after US President Trump threatened to impose a 50% tariff on European imports. The threat, due to apparently stalled trade talks, was quickly delayed until early July.

The same factors that caused markets to end the previous week on a negative footing helped fuel an early rebound last week. It’s also consistent with the “TACO” (“Trump Always Chickens Out”) theory now circulating in markets. Accordingly, markets are again taking Trump’s latest announcement of higher steel tariffs with a grain of salt.

A rebound in US consumer confidence also helped boost sentiment. This likely reflects easing fears of a US recession after Trump scaled back tariff threats in recent weeks.

Last but not least was the US Court of International Trade’s decision to rule against Trump’s ability to impose tariffs based on ‘economic emergency’ grounds. This optimism was quickly tempered, however, as the administration said it would appeal the decision all the way to the Supreme Court and/or use any number of alternative flimsy legislative excuses to impose tariffs.

The Fed: Comfortably on hold for now

In other news, minutes from the May US Fed meeting suggested the central bank still sees economic growth holding up well despite tariff-related inflation risks.

As a result, the Fed remains comfortably on hold for now. Indeed, resilient US economic activity has been helping to support the V-shaped equity market rebound since early April.

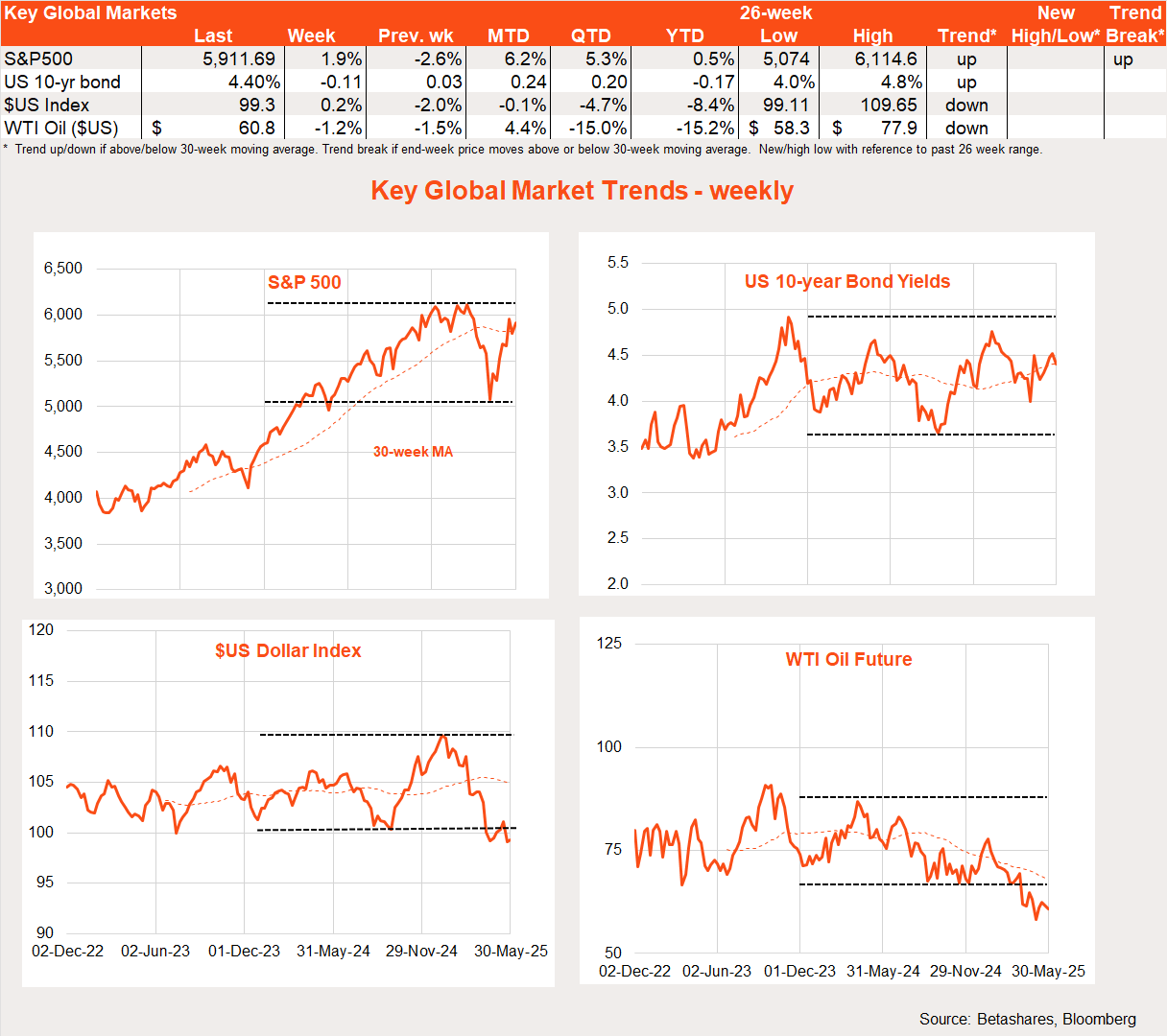

Despite the previous week’s concerns over the US budget outlook, US 10-year bond yields eased last week by 0.11% to 4.40%.

Further US economic tests ahead

We’ll get more tests of US economic resilience this week. Both the ISM manufacturing and service sector surveys will be released, in addition to job openings and the all-important May payrolls report on Friday. Markets expect both ISM reports to hold well above recession territory and for employment to grow by 130k.

In Europe, the ECB is widely expected to cut its three key interest rates by another 0.25%.

Global market trends

The US and growth/tech related exposures such as the Nasdaq 100 outperformed last week, consistent with the directional nature of this trend so far this year.

If stocks resume their downtrend, I expect growth and US equity markets to be hit hardest. If, however, the equity uptrend has returned, reports of the death of US tech exceptionalism could be premature once again.

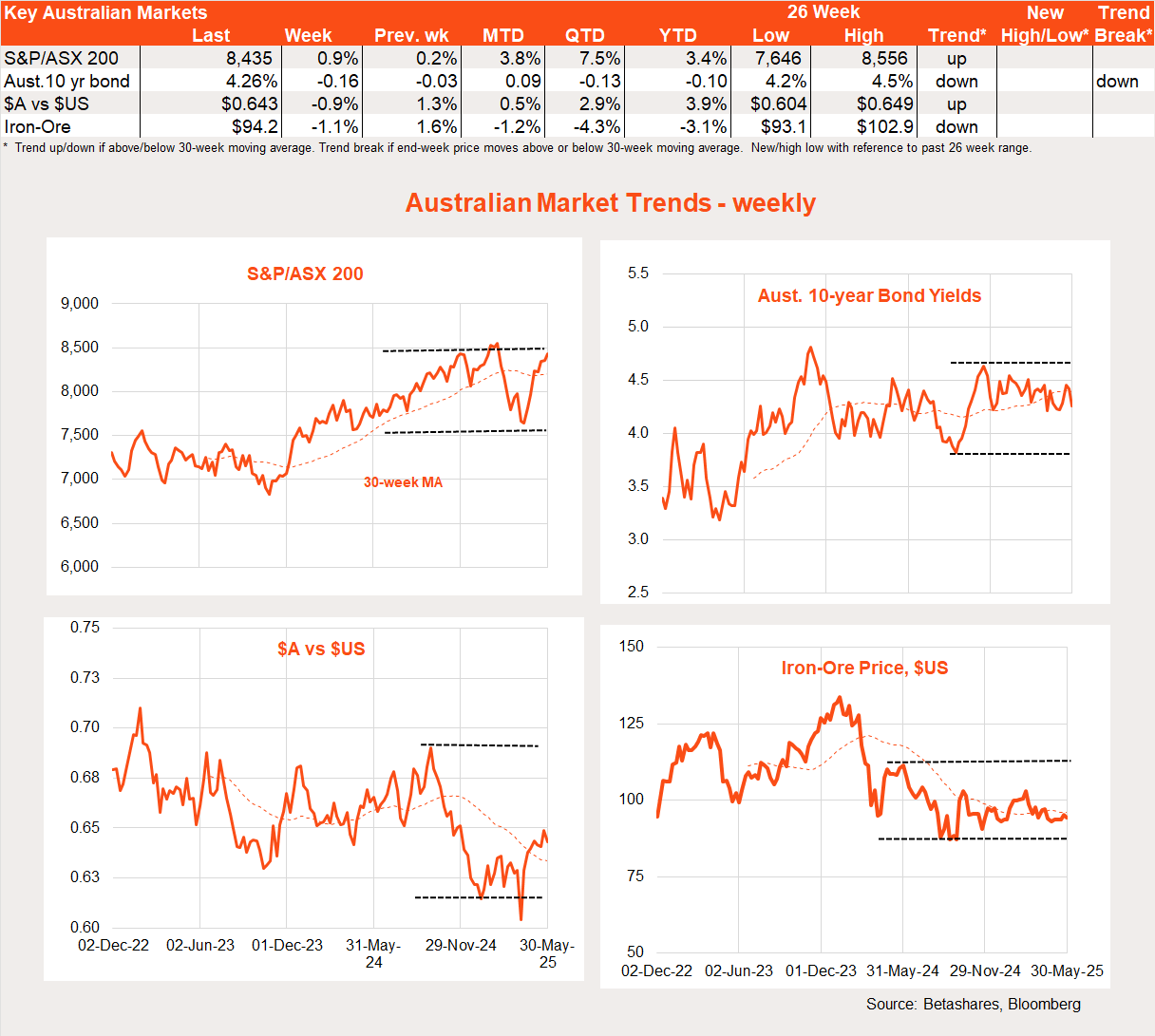

Australian markets

Local stocks enjoyed the global equity rebound last week despite a slightly disappointing April CPI report.

Last week’s key local news was that annual growth in the monthly trimmed mean CPI index edged up to 2.8% from 2.7% in April. This suggests that it will be harder for the RBA to realise its forecast of 2.6% annual underlying inflation in the June quarter CPI report.

While it’s too early to rule out an August RBA rate cut after the Q2 CPI report, last week’s monthly number should dent the chances of a July rate cut. Indeed, I’ve been somewhat surprised that markets have continued to attach such a high probability (70%) to a July cut, given easing global growth fears and the resilient local labour market.

Other local news was more supportive of lower interest rates, with soggy Q1 private capital spending and non-residential construction. Retail spending was also subdued in April although it was likely distorted by weather and holiday effects.

All up, the partial data available so far suggests another lacklustre GDP report on Wednesday. Q1 economic growth of around 0.4% is expected. This would lift annual economic growth from 1.3% to 1.5%.

Minutes from the recent RBA policy meeting are also released tomorrow, which may offer some insight into the chances of a follow-up rate cut as early as next month. Not high in my view!

Have a great week!