4 minutes reading time

Global markets

Global stocks rebounded last week, driven by hopes that President Trump may reduce the 145% tariff imposed on China.

Over the last fortnight, financial markets have been driven by shifts in President Trump’s economic policies. Threats like tariff hikes and intentional meddling with the Federal Reserve dampen optimism – only for partial policy reversals to restore some of it.

Markets were buoyed last week by suggestions that Trump might not increase Chinese tariffs by as much as first thought. For its part, China maintains that trade talks are not underway. Having also complained about Fed policy, namely that Chair Jerome Powell is too slow in cutting interest rates, Trump admitted he had no plans to sack Powell before his term ends next year.

As it stands, markets remain in a state of flux. After all, the key question remains: is Trump as ‘crazy’ as he seems or will he ultimately relent before his tariff plans push the economy into recession?

My view is that if current plans are pursued, a recession will occur and likely lead to more downside in the equity market near-term. That is unless Trump relents in time.

Given recent reversals, my base case is that policies will be softened quickly enough to avoid a worst-case scenario. For instance, US Treasury Secretary Scott Bessent has said “there is a path” to an agreement over reduced tariffs with China.

The ‘hard’ data on the US economy, such as unemployment and consumer spending, have yet to buckle in a serious way. However, some recent spending could reflect a rush to purchase goods ahead of planned tariff increases.

Meanwhile, ‘soft’ data, such as consumer and business sentiment measures, have already weakened. It may take further equity market weakness, a weakening in the hard data and/or a material lift in inflation before Trump backs down further.

Finally, and it must be said, there is a very real risk Trump does not relent (or at least, not fast enough).

Global week ahead

There is a plethora of key US data this week, alongside important earnings results from Microsoft and Amazon. Markets will be extremely sensitive to any signs of weakness.

This week, we get:

- Q1 US GDP

- The ISM manufacturing survey

- Job openings (JOLTS)

- Payrolls (the unemployment report) and

- Core PCED inflation (the Fed’s preferred measure of price increases).

The US economy is expected to have barely grown last quarter, with 0.4% annualised growth being forecast by economists. If we see a downside surprise (e.g. 0.3% or less), it may jangle the market’s nerves.

A potential slump in the ISM manufacturing index is also of concern, even if economists only expect a small drop from 49 to 48.

Job openings are expected to fall further but remain reasonably high. We also get weekly jobless claims but these haven’t risen yet in a meaningful way.

Job growth is expected to have grown by a reasonable 130k in April, keeping the unemployment rate steady at 4.2%.

The core private consumption price deflator (PCED) is expected to lift by a benign 0.1%. This would lower annual core inflation from 2.8% to 2.5%. Were it not for tariff concerns, markets would likely be celebrating this continued downtrend in US inflation and the rate cuts that would have followed.

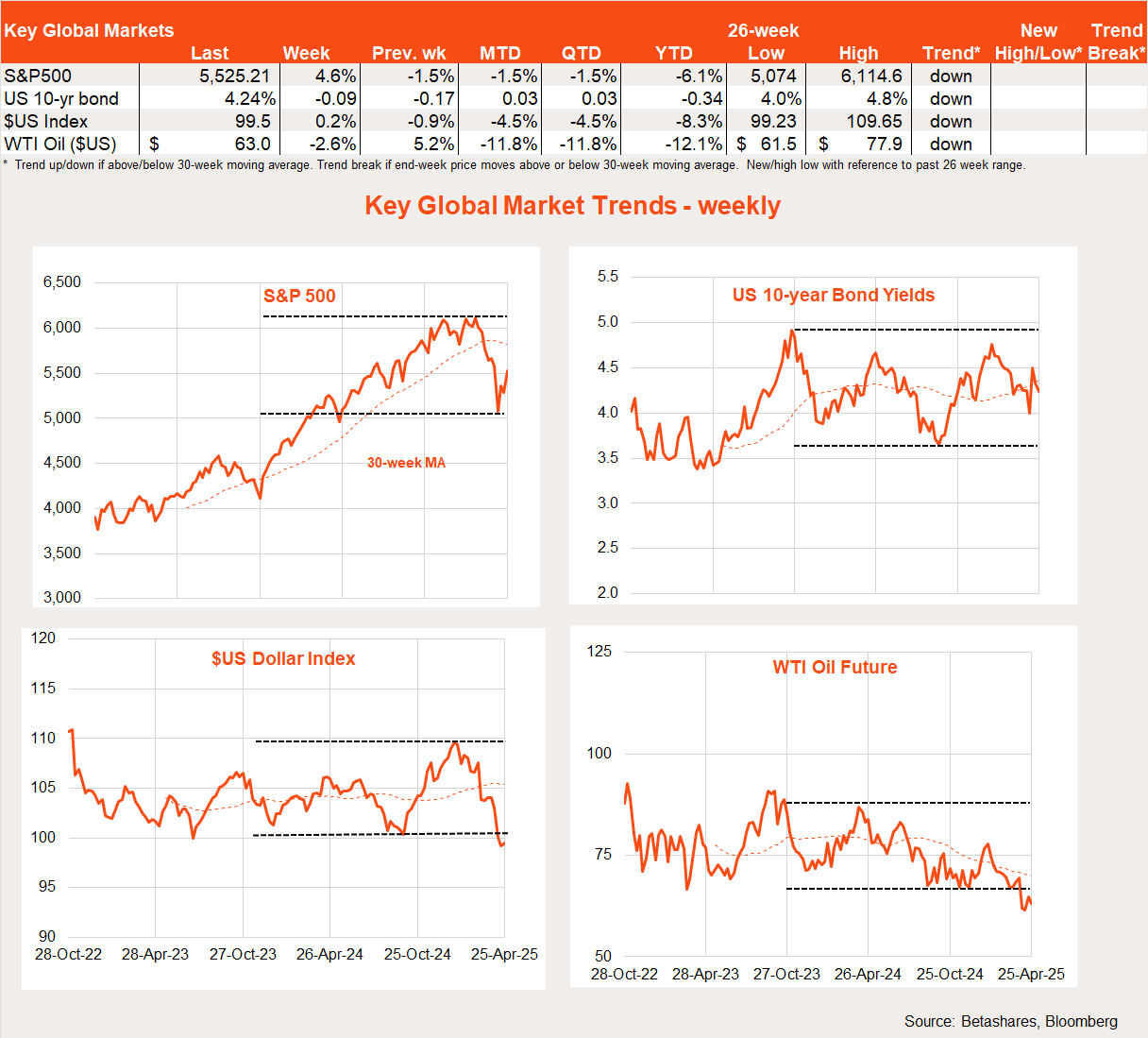

Global market trends

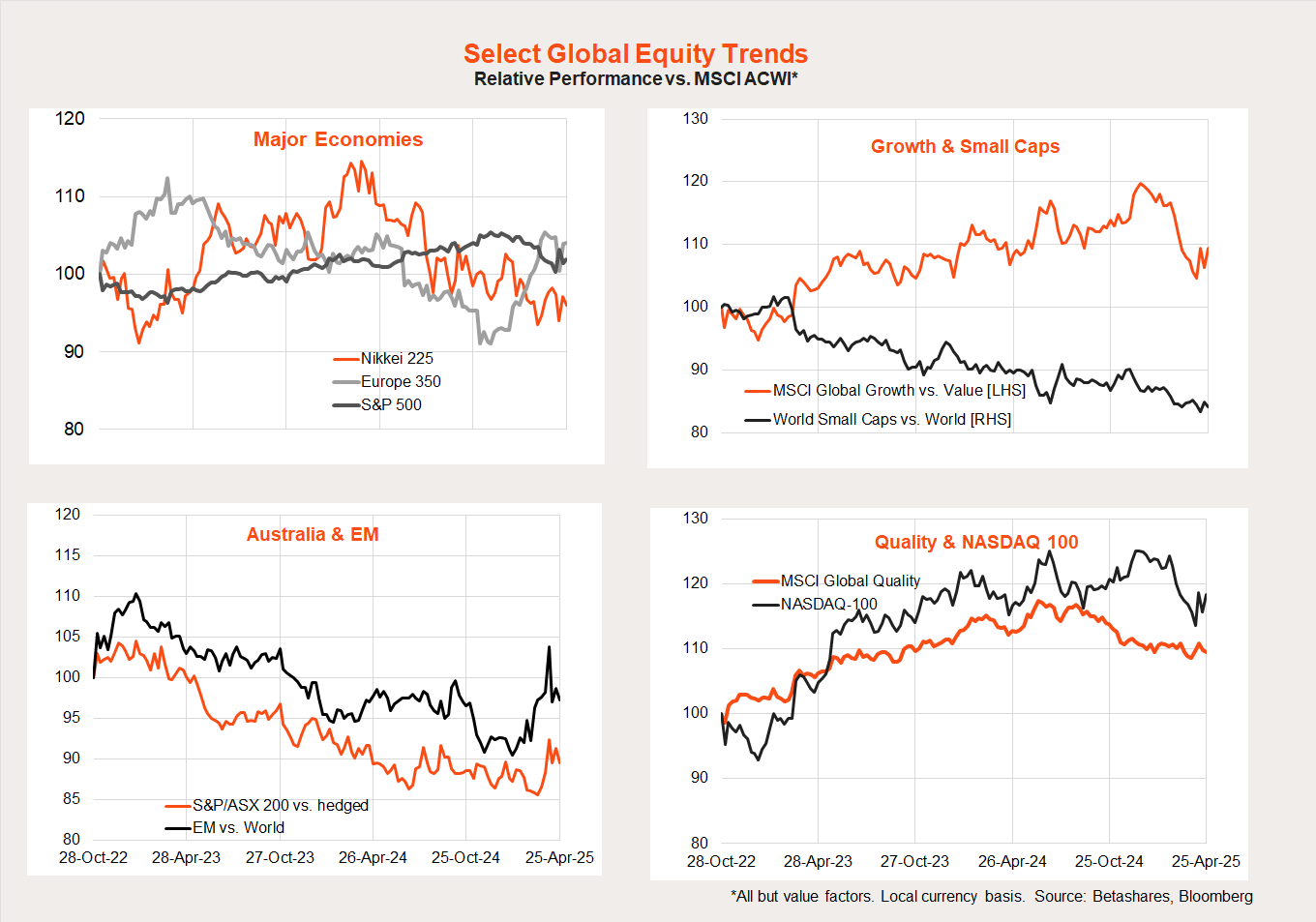

The recent bounce in global equities has also led to a rebound in the relative performance of growth over value, developed over emerging markets as well as the US relative to non-US markets.

These trends seem tied to equity market direction. If stocks fall further, I expect growth and US equity markets to be hit hardest.

Australian markets

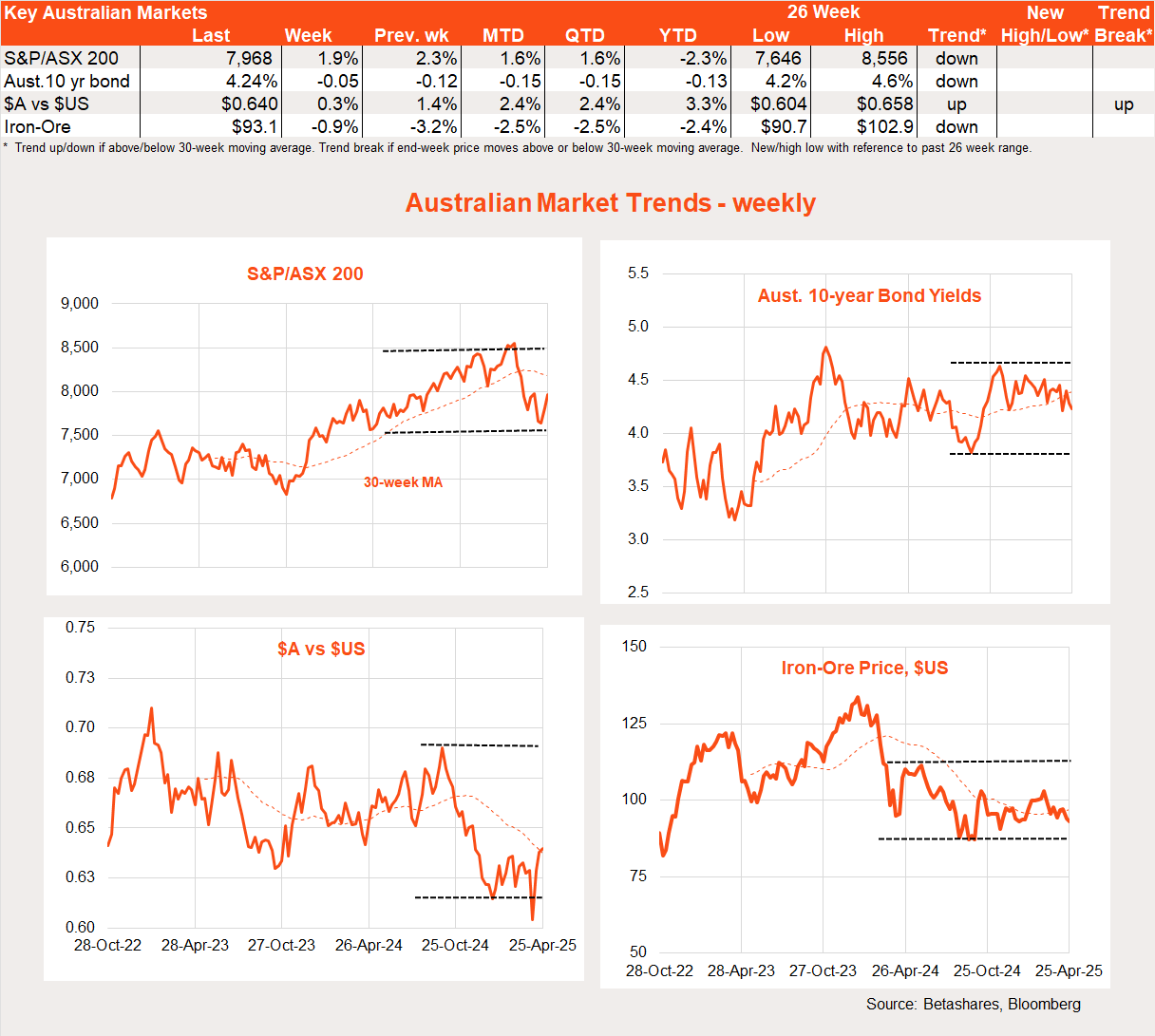

Reflecting global optimism, local stocks staged a second successive weekly rebound. The S&P/ASX 200 rose 1.9%.

There was little major economic data over last week’s holiday shortened period. The federal election campaign rolled on, with polls suggesting that Labor has a reasonable chance of attaining majority government.

The key event this week is Wednesday’s March quarter consumer price index. Markets expect annual trimmed mean inflation to drop from 3.2% to 2.8%. If it occurs, this would support an RBA rate cut next month, even without global trade tensions. While Trump’s tariff issues could create an upside CPI surprise, I still expect a rate cut if inflation is 3.1% or lower.

Have a great week!

2 comments on this

I look forward to this each week. I like the fact you call it as it is, like saying many people think Trump is barking mad. Which he clearly is. We will most likely get an obvious madman elected as Prime Minister in Australia next week as well, Peter “Lord Voldemort” Dutton. As I have said I also like your rude logo.

This would be great as a daily or weekly recording or podcast!