7 minutes reading time

If you’ve ever wondered why certain shares seem to keep climbing while others lag behind, you’re not alone. The momentum factor is one of the most intriguing strategies used by investors to capture market returns. At its core, momentum investing is about riding the wave – buying assets that have performed well recently and selling those that have underperformed.

Momentum’s success isn’t just about numbers and charts – it’s deeply rooted in human psychology. Investors, both professional and amateur, are prone to a range of behavioural biases. These include the tendency to extrapolate recent trends, herd mentality, and the slow reaction to new information. Instead of instantly reflecting all news, markets often adjust in waves as investors gradually update their views. This collective behaviour creates persistent price trends that momentum strategies seek to exploit.

Why does momentum outperform?

Historically, the momentum factor has delivered returns that have outpaced the broader markets. This outperformance is largely due to those same human behaviours: people tend to chase past “winners” and are slow to let go of “losers”. As a result, assets that have performed well continue to attract buyers, pushing prices even higher. Conversely, underperformers often struggle as sellers flee. Academic research and empirical results consistently show that, over long periods of time and across multiple markets, momentum strategies have led to superior returns when compared to traditional benchmarks.

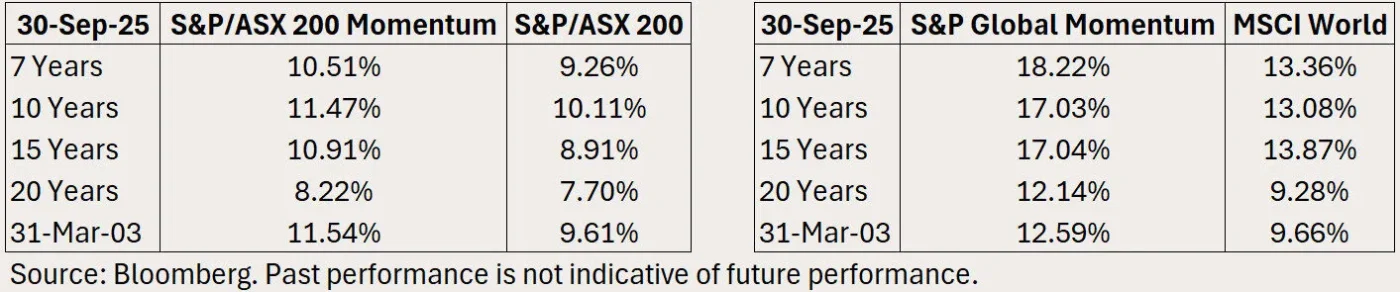

As at 30 September 2025, over the long run, both the S&P/ASX 200 Momentum Index and the S&P Momentum Global Large Mid Cap Index have outperformed their respective broad market cap benchmarks.

Source: Bloomberg. Past performance is not indicative of future performance.

While momentum investing isn’t foolproof – sharp market reversals can catch investors off guard – it remains a powerful tool for diversifying an investor’s investment strategy. By understanding the human drivers behind market trends, investors can better appreciate why momentum has worked and how it might help achieve their investment goals.

Why a momentum strategy can keep your portfolio relevant

Given the powerful sway of behavioural biases, investors can often be better off allowing momentum strategies, like those employed by MTUM, to systematically rotate into out-performing market segments rather than relying on their own instincts. Human tendencies such as fear, greed, and recency bias can cloud judgement, leading individuals to hold onto “losers” for too long or chase “winners” too late. By contrast, systematic momentum approaches rely on objective data and predefined rules, removing emotion from the decision-making process.

For example, the MTUM Australian Momentum ETF doesn’t stick rigidly to one sector or group of shares. Instead, it methodically shifts its exposure based on companies that have recently performed strongly relative to the broader market. As momentum continues to build, MTUM increases its weight to those winning positions as investor confidence builds around the underlying investment thesis.

Recently, this has meant moving away from financials and large caps in favour of Industrials and smaller cap segments of the market. This disciplined rebalancing helps investors avoid the pitfalls of emotional trading and ensures portfolio exposure is aligned with prevailing market trends. Ultimately, trusting a systematic momentum strategy can help capture returns where they’re strongest, while sidestepping common behavioural traps that can often lead to poor investment outcomes.

To learn more about momentum investing and how it could fit an investor’s portfolio, read our whitepaper here.

Market dynamics within MTUM

MTUM was launched on 22 July 2024, Australia’s first ETF of its kind. Since inception to 30 September 2025, it has returned 19.03% p.a. outperforming the S&P/ASX200 Index by 5.200% p.a. While the index MTUM tracks has returned 11.93% p.a. outperforming the S&P/ASX200 Index by 2.99% p.a. since inception in May 2011.

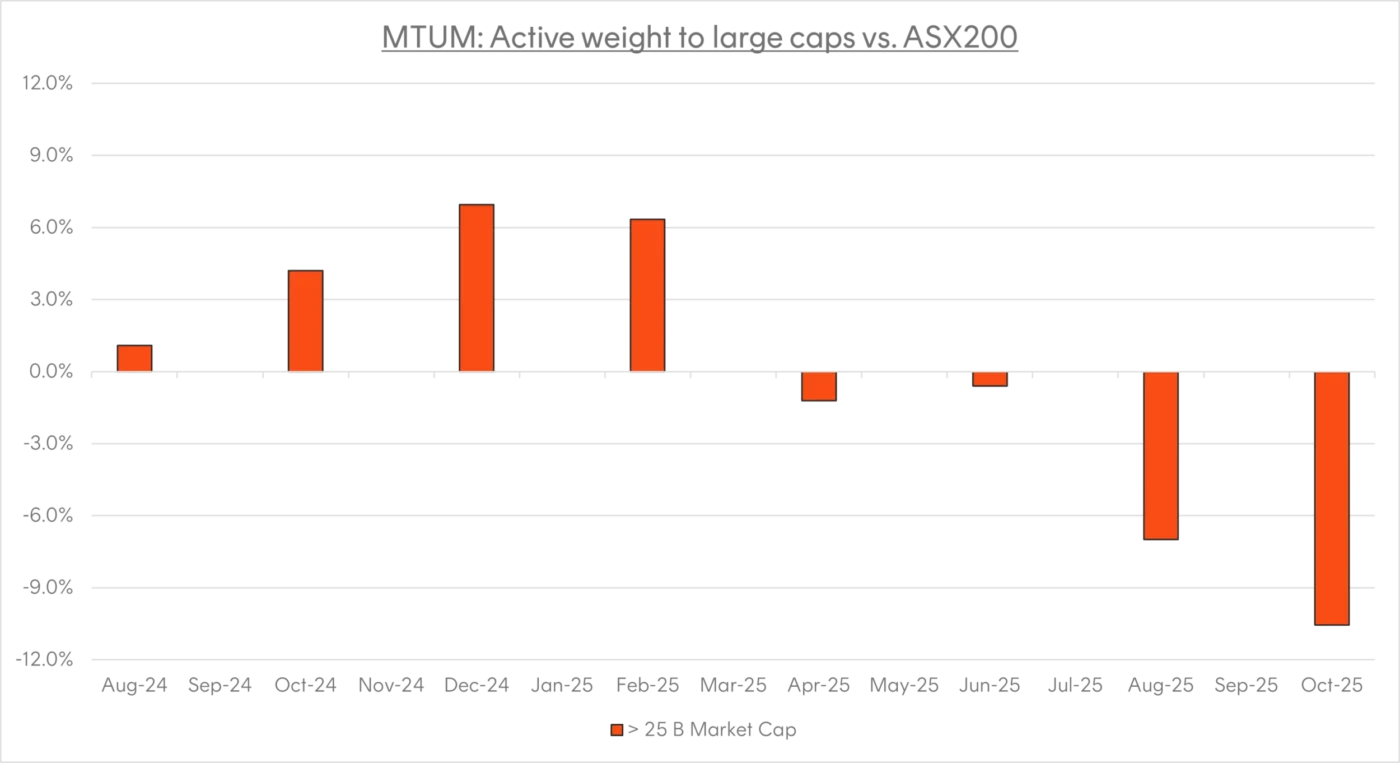

At launch, MTUM adopted a strategic overweight position to stocks in Australia’s top 20 companies (large caps, generally with market capitalisations exceeding $25 billion), growing this position through the latter half of 2024 as large-cap companies performed strongly.

However, 2025 has seen a notable shift in MTUM’s portfolio. The fund has gradually reduced its exposure to large caps, increasing its allocation to mid-caps in response to evolving market dynamics. As at the end of September 2025, MTUM holds a significant underweight in the top 20 names of approximately 10% below the S&P/ASX 200 weights in favour of mid-cap stocks.

Source: Bloomberg

Why has MTUM reduced its allocation to large caps?

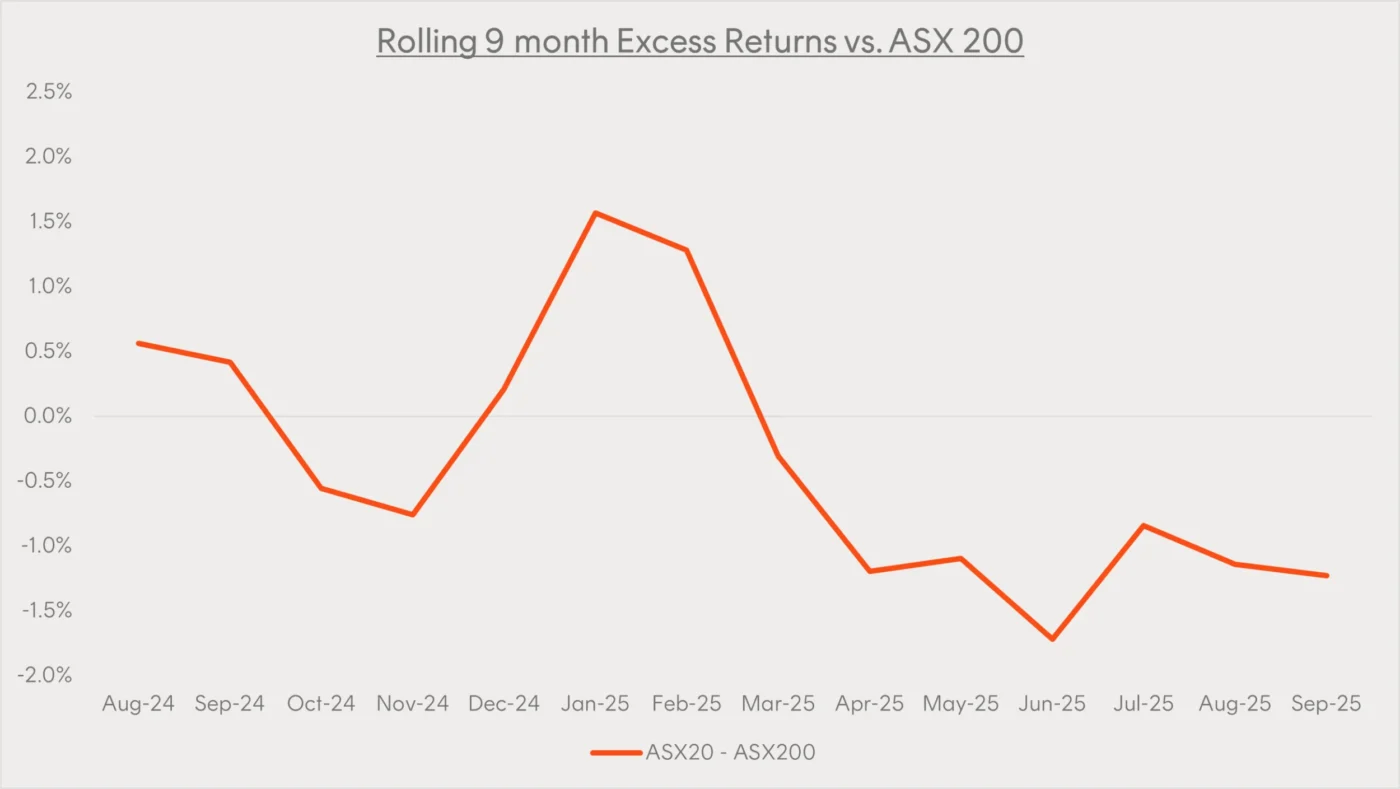

This shift away from large-cap stocks reflects a broader change in market leadership. The chart below illustrates the 9-month rolling excess returns of the S&P/ASX 20 (large caps) vs. the S&P/ASX 200. As shown, the trend in relative performance has started to decline, while year-to-date large caps have underperformed the broader S&P/ASX 200 by -2.92%. Mid-cap stocks (those outside the top 20) have returned 16.43% as measured by the Solactive Australia ex 20 Index outperforming the S&P/ASX 200 by 4.98% over the same time period.

Source: Bloomberg

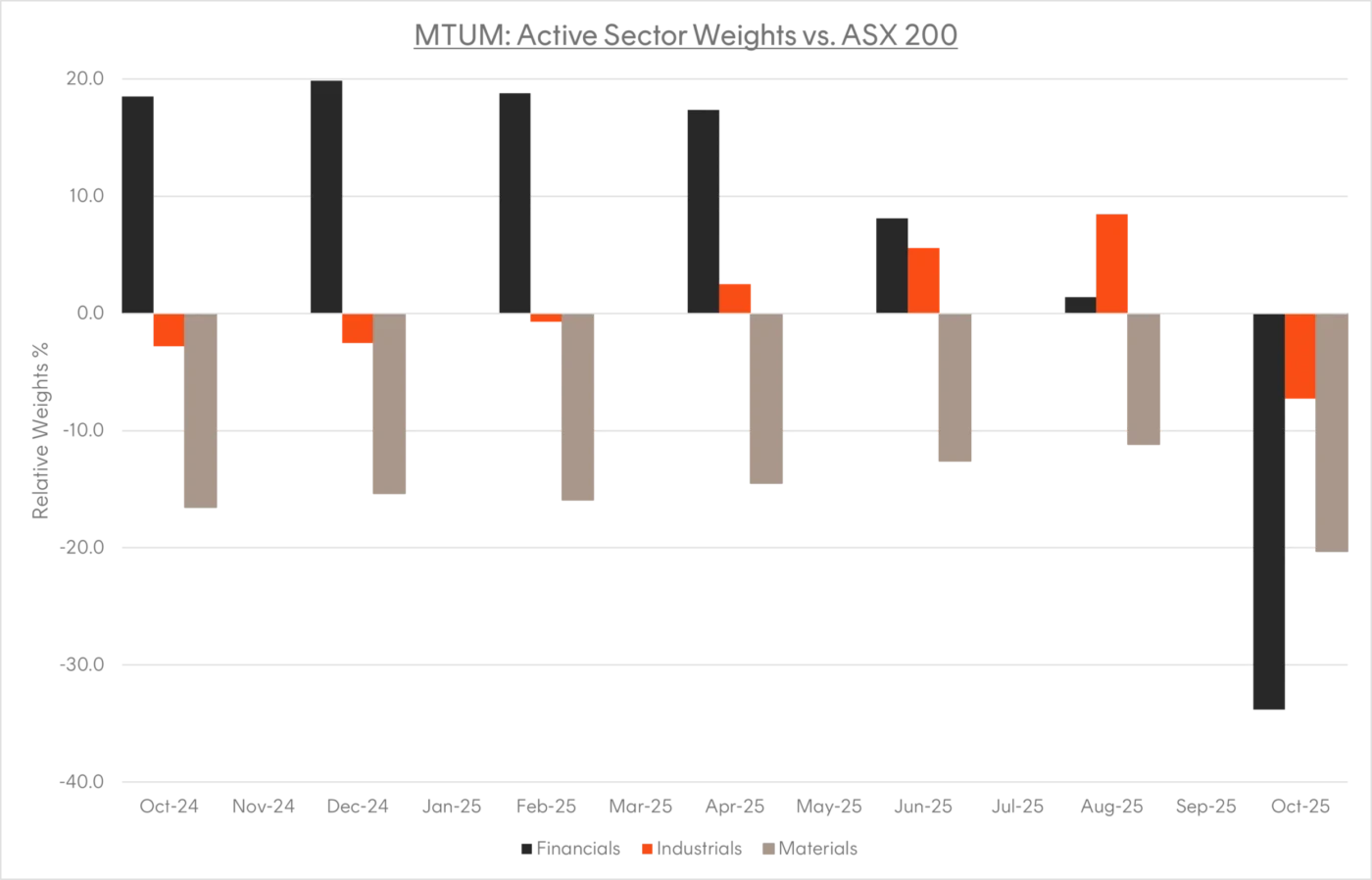

Sector rotation within MTUM: From Financials to Industrials

At inception, MTUM established a significant overweight in Financials, reaching nearly 20% above the sector’s representation in the S&P/ASX 200. This positioning reflected strong performance in major banks and financial stocks throughout 2024. However, since early 2025, the allocation to Financials has steadily declined and now sits below the benchmark weight. In contrast, Materials, initially the most pronounced underweight has seen a steady increase in exposure as momentum in this sector strengthened. Meanwhile, Industrials have undergone a notable shift, once underweight, the sector is now MTUM’s most active overweight position, currently sitting nearly 10% above the broader benchmark.

Source: Bloomberg

Sector performance driving MTUM’s rotation

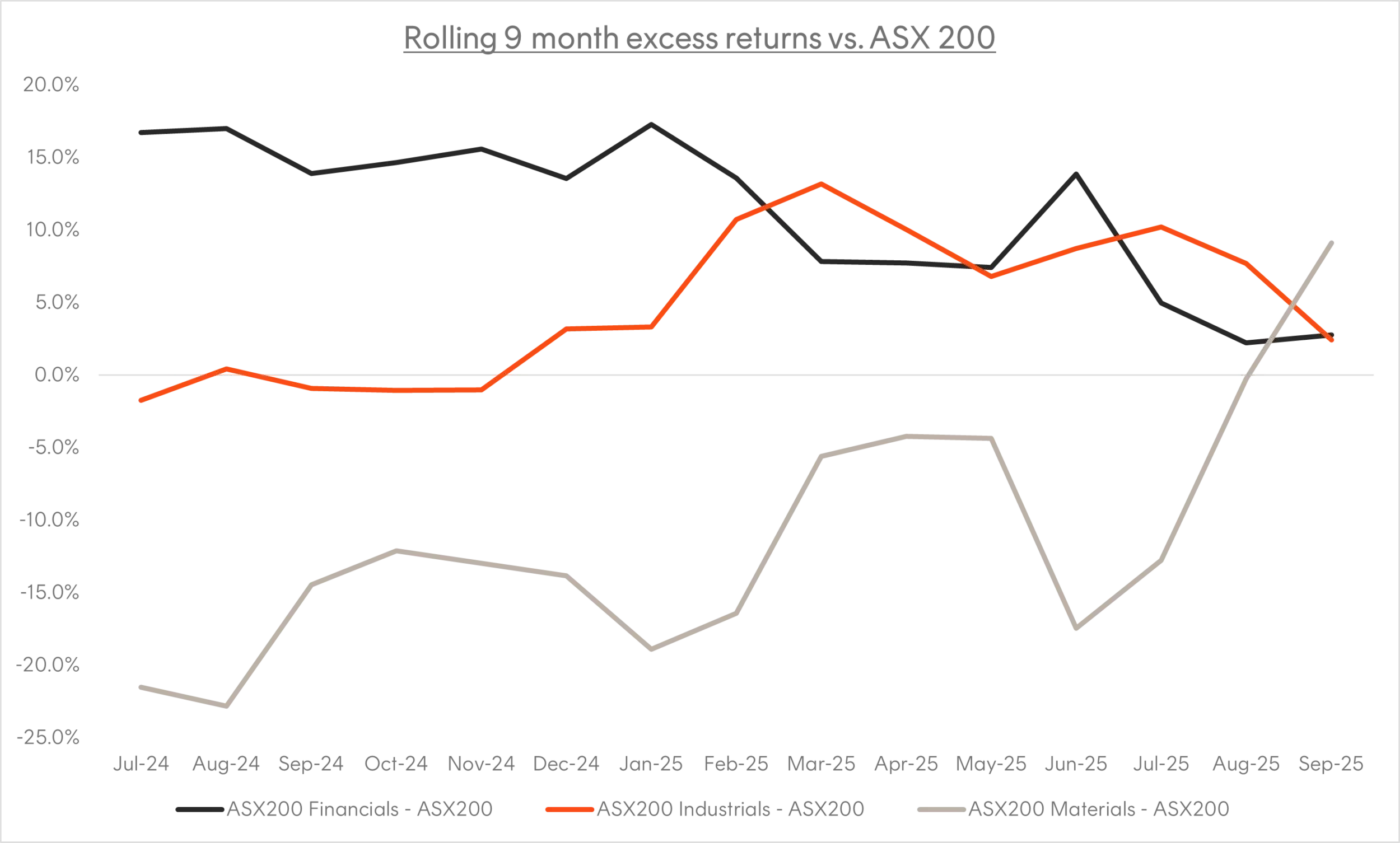

The chart below highlights the 9-month rolling excess returns of key sectors relative to the S&P/ASX 200. As the data demonstrates, Financials have started to trend down, while Materials and Industrials are trending up against the S&P/ASX 200.

Source: Bloomberg

Momentum in action

MTUM’s evolving portfolio reflects the core strength of momentum investing: its ability to dynamically adapt to changing market conditions. By systematically identifying and allocating to stocks and sectors exhibiting strong relative performance, MTUM seeks to capture emerging leadership while avoiding areas of deteriorating momentum.

Key benefits of momentum investing include:

• Portfolio relevance: Momentum strategies like MTUM don’t rely on static allocations. Instead, they dynamically adjust portfolio weights in response to shifting market trends, allowing investors to capture upside as capital flows toward new investment themes and evolving market leadership, this helps keep the exposure relevant and responsive to new opportunities.

• Diversified excess returns: By systematically rotating across companies, sectors and market cap sizes, momentum investing taps into multiple sources of returns beyond buy and hold strategies.

• Efficient capital allocation: Momentum strategies often reduce exposure to underperforming stocks and sectors, reallocating capital towards areas showing persistent strength. This disciplined process aims to boost returns and avoid the continued drag of underperformers.

• Behavioural bias mitigation: Systematic momentum investing removes emotion from decision-making. By relying on objective data and rules, it helps investors avoid common behavioural traps such as holding onto “losers” too long or chasing “winners” too late.

• Evidence-based approach: Decades of academic and empirical research support momentum as a persistent and exploitable market anomaly.

As market leadership continues to evolve – from large caps to mid-caps, and from Financials to Materials and Industrials – MTUM offers investors a disciplined way to harness the power of momentum investing in Australian equities. To find out more about MTUM and how it could fit into your portfolio, check out the fund page here.

There are risks associated with an investment in MTUM, including market risk, index methodology risk, portfolio turnover risk and concentration risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.