7 minutes reading time

President Trump announced a major tax cut bill last week in a bid to boost the US economy and fulfil his 2024 election campaign promises.

If approved by the Senate, the One Big Beautiful Bill is expected to add ~$3 trillion to the US budget deficit over the next decade. Currently at ~6.5% of GDP, a growing US debt burden will place pressure on tax-paying citizens, future economic growth, and continue to challenge the nation’s creditworthiness.

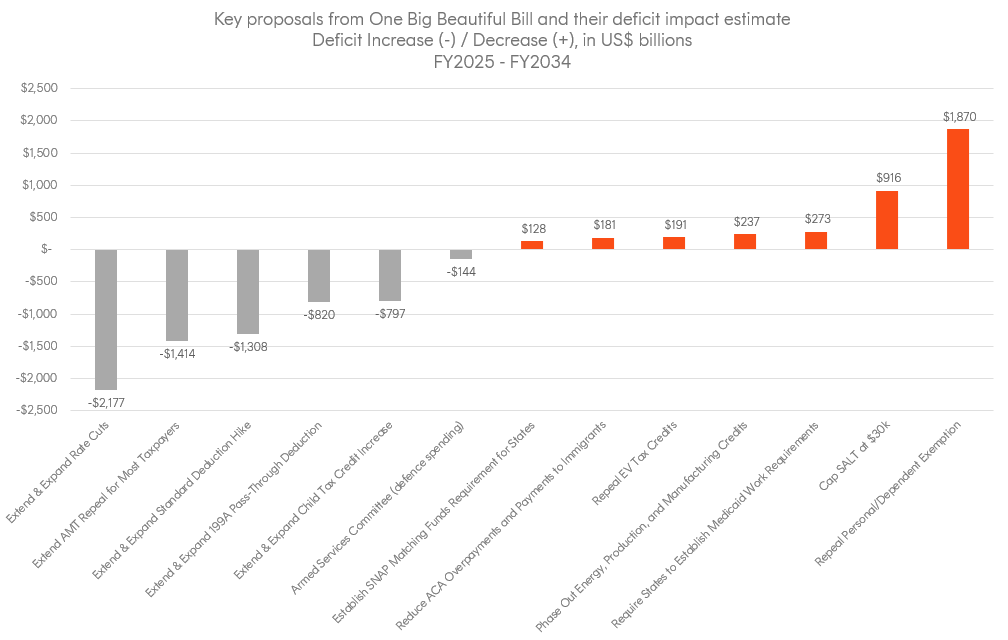

The following chart provides a comprehensive overview of some of the key provisions that make up the One Big Beautiful Bill Act of 2025 (OBBBA), along with a deficit impact estimate over the following decade from the Congressional Budget Office.

Source: Committee for a Responsible Federal Budget

Notably, the extension of the 2017 Tax Cuts and Jobs Act (TCJA) is estimated to substantially increase the deficit by over US$2 trillion which sent yields on US 30-year Treasury bonds above 5%. However, in order to fund these measures, cuts would be made to Medicaid and the Supplemental Nutrition Assistance Program (SNAP) which provide health insurance programs and food to low-income households respectively. Getting the bill approved unanimously by Senate Republicans won’t come without its obstacles.

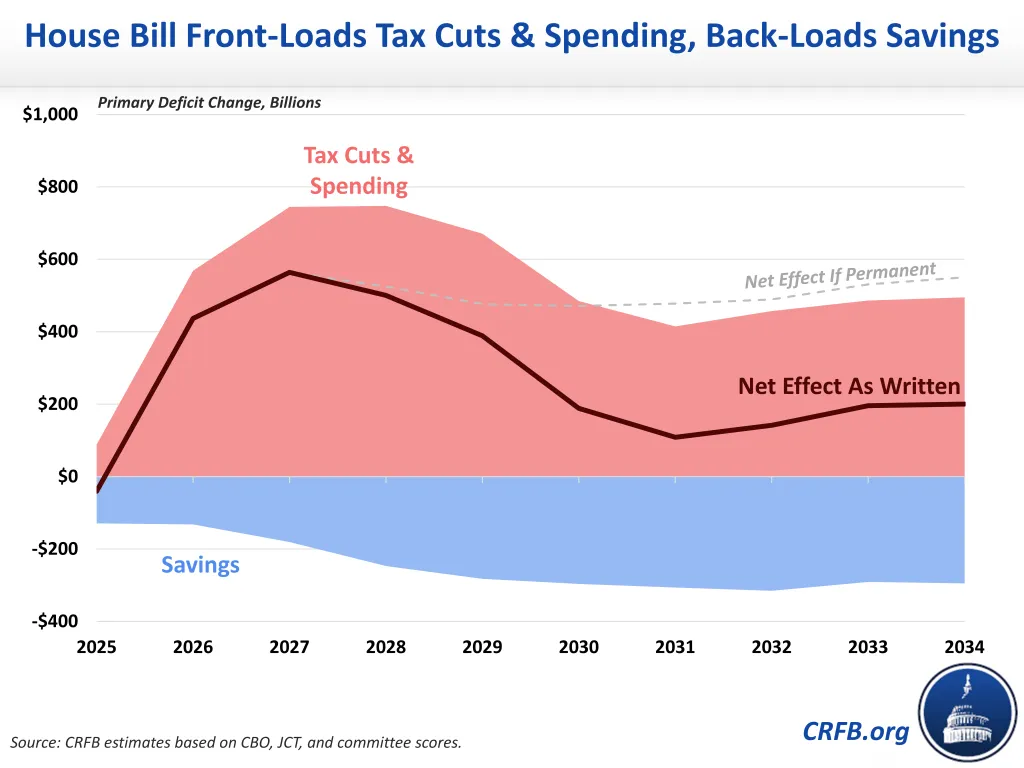

Another point worth highlighting is that these proposals and their impact on the deficit will vary over time given the mismatch on timeframes between savings and tax cuts with the former being back-loaded, and the latter quite front-loaded.

That means more of the gross deficit increases are likely to take place earlier in the budget window whilst savings would accumulate more gradually over that period. The result is a projected fiscal deficit that is expected to balloon to significant levels by 2028 as shown in the chart below, putting pressure on any future tax cut extensions.

Source: CRFB estimates based on CBO, JCT and committee scores.

Whilst the near-term outlook for the deficit appears dire, the tax bill does not include the impact of tariffs which are expected to increase US federal tax revenue by $2.1 trillion over the next decade according to the Tax Foundation.

This would help US Treasury Secretary Scott Bessent reduce the trade deficit towards his goal of 3% of GDP, however achieving this relies on an assumption that nominal growth can outgrow the current debt load. Tariffs can be an effective revenue generating tool but can also reduce domestic GDP growth through lower corporate margins and/or consumer spending.

Controversially, the Bill introduces section 899 which also gives the White House the power to impose a new tax of up to 20% on certain income earned by non-U.S. persons from U.S. sources. Australian investors should watch this development closely. At this stage, it appears that section 899 is intended to be used as a bargaining tool to force countries to change their tax policies towards US corporations, rather than to collect revenue. The section can be invoked by the US Treasury by adding a country to their list. The US has made it clear that they are not happy with certain Australian taxes. Importantly, proposed section 899 does not appear to capture capital gains, which for many Australian investors is the primary reason for investing in US equities.

The OBBBA will continue to be a focal point for markets over the next few weeks as Trump seeks to get the bill approved in earnest by July 4th.

What are the asset class implications if the One Big Beautiful Bill is approved?

|

Asset Class |

Potential Implications |

Betashares Implementation Ideas |

|

Equities |

|

QUS S&P 500 Equal Weight ETF / HQUS S&P 500 Equal Weight Currency Hedged ETF

|

|

Fixed Income |

|

UTIP

Inflation-Protected U.S. Treasury Bond Currency Hedged ETF

|

|

Foreign exchange |

|

You can explore the entire range of Betashares Currency Hedged ETFs here Some of our currency hedged US equities ETFs include: HQUS S&P 500 Equal Weight Currency Hedged ETF

|

|

Commodities |

|

QAU

Gold Bullion Currency Hedged ETF

|

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in each Betashares fund should only be considered as part of a broader portfolio, taking into account an investor’s particular circumstances, including their tolerance for risk. For more information on the risks and other features of each fund, please see the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD), available at www.betashares.com.au. Any Betashares fund that seeks to track the performance of a particular financial index is not sponsored, endorsed, issued, sold or promoted by the index provider. No index provider makes any representations in relation to the Betashares funds or bears any liability in relation to the Betashares funds.

Betashares Capital Ltd (ABN 78 139 566 868 AFSL 341181) is the issuer of each Betashares fund. Investors should read the relevant PDS and TMD (available at www.betashares.com.au) and consider whether the product is right for them.