2 minutes reading time

Likely under massive pressure due to the implosion in both US equity and bond markets, US President Trump “blinked” overnight, agreeing to a pause in the reciprocal tariff imposts of more than 10%. That said, he has increased tariffs on China further, which is only likely to spark more retaliation as early as today.

Despite Trump’s concession, the global economy – and particularly the US economy – faces enormous risk in the weeks and month ahead. While equity markets bounced overnight, this may well be but one of likely several cruel bear market rallies in what had become a very oversold market in the short-term. We’re not out of the woods just yet.

Risks to the global outlook remains for several reasons. Indeed, the good ship USA has still been hit by an iceberg and is taking on water. All that’s happened is Captain Trump has told the crew to stop the engines.

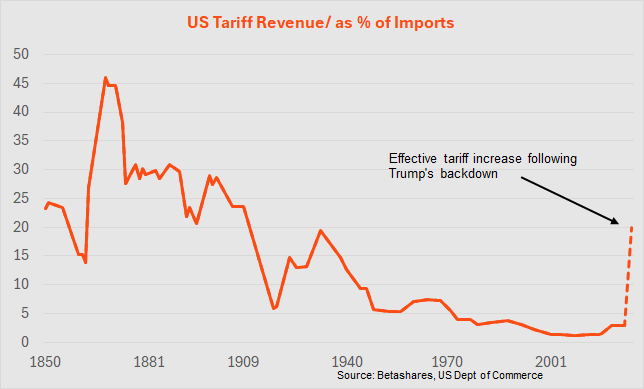

For starters, even with the overnight concessions, the US still faces a significant increase in the average effective tariff rate to around 20%, instead of only 30%. That still represents a significant hit to US inflation and economic activity sufficient to likely cause a US recession in their own right – unless Trump quickly backs down further.

What’s more, even the pause in tariffs leaves the global business community facing significant uncertainty in terms of the cost pressures that will face in the months ahead – which will lead to a curtailment in both investment and hiring plans. It’s the uncertainty with regard to eventual tariff levels that is likely even worse for economic growth than the actual tariffs the US imposes.

Source: Betashares, US Department of Commerce

As regards the Reserve Bank, nothing overnight lessens the need for a rate cut in May, and by hopefully more than 0.25% (my view is the RBA should cut by 0.35%). There is now also a strong case for the RBA to act earlier – given the large decline in consumer sentiment reported for April and the fact the next scheduled RBA policy meeting is over five weeks away. The RBA could cut now and then cut again at the scheduled May meeting.