6 minutes reading time

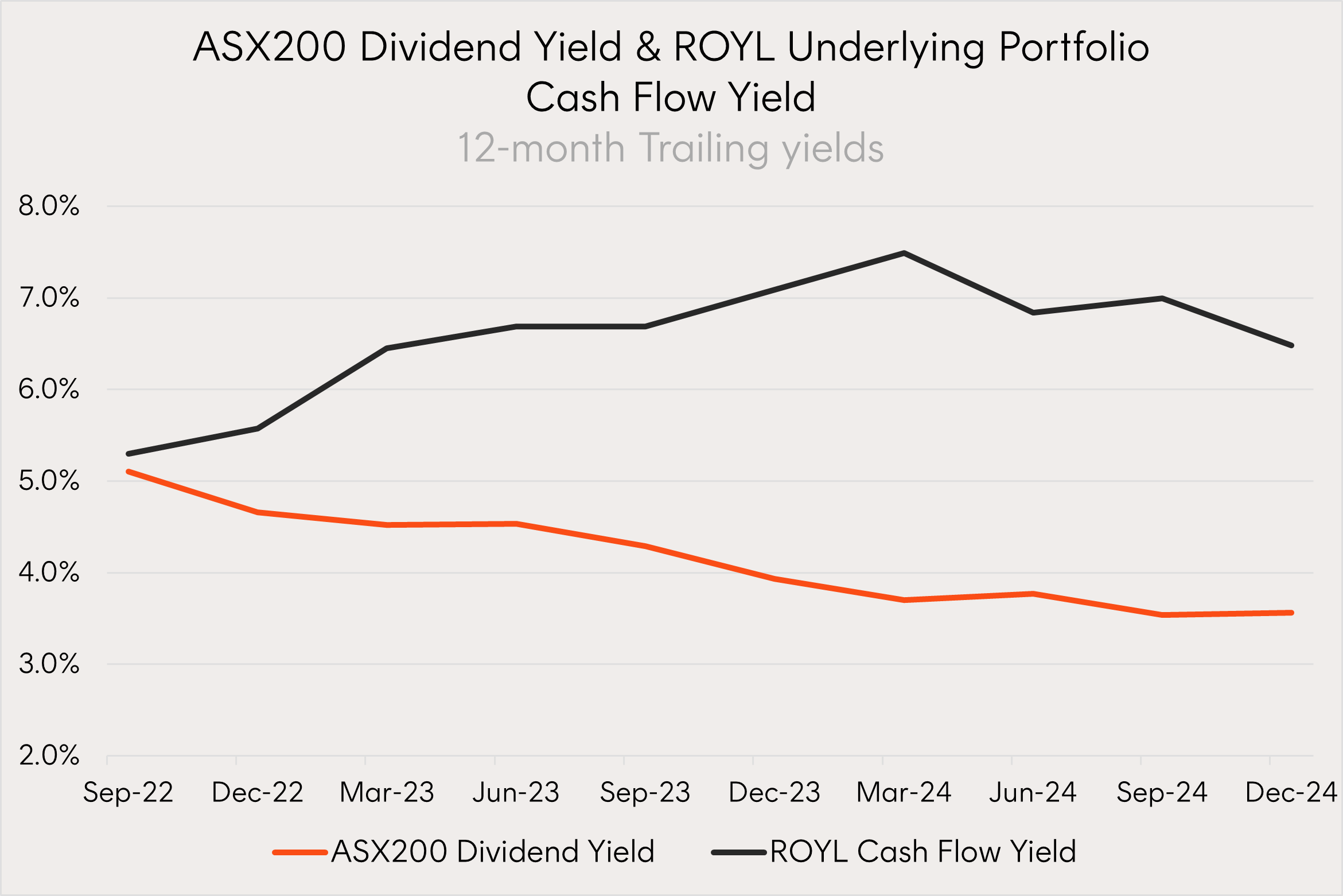

As many investors may have noticed, dividend yields from Australian shares have been on a steady decline since the middle of 2022. Over this period dividend yields from Australian shares have fallen from above 5% to just 3.39% p.a.1 Outside of the brief Covid experience where dividend payments were significantly impacted, yields from shares have not been this low since 2007 before the Global Financial Crisis.

The fall in dividend yields is now coinciding with the RBA entering an interest rate cutting cycle – putting even greater pressure on investors income sources.

While Australian investors have traditionally relied on domestic holdings to generate income from their equity allocations, the ROYL Global Royalties ETF offers a unique opportunity that could help meet investor’s income needs while adding greater diversification to their portfolios.

Jewel in the international income crown

Royalties generate a stream of income payments to the royalty owner for the use of an asset such as:

- Land to extract resources (for example oil and gas),

- non-physical assets or intellectual property (IP), (for example patents for biopharma drug therapies and copyrighted materials), or

- payments which can also involve royalty finance, a funding method used to allow businesses to secure capital in exchange for a portion of future revenues.

The diverse range of companies included in ROYL’s portfolio generally receive recurring and predictable revenues streams in the form of royalties (sometimes referred to as ‘annuity like’ income). The income stream can also grow over time with price inflation and the demand for the underlying assets.

For example, Royalty Pharma2, a market leader in the pharmaceutical royalty market, provides funding options for the late-stage development of therapies, as well as additional funding, in exchange for long-term payment streams.

In 2014, Royalty Pharma provided Vertex Pharmaceuticals with US$3.3 billion in funding in exchange for perpetual royalties from Vertex’s cystic fibrosis franchise. This was followed by an additional investment of US$575 million in 2020 to acquire further interest. In 2024, Royalty Pharma received US$857 million in royalty receipts from this deal, with the reported revenue received since 2018 totaling US$4.2 billion (Royalty Pharma did not disclose revenue specific to this deal prior to 2018)3.

Royalty Pharma has a portfolio linked to the commercial sale of more than 35 FDA approved drugs4.

Source: Royalty Pharma company filings, Betashares. Past performance is not indicative of future performance.

Given the appeal of the strong annuity-like cash flows royalty companies tend to generate from their operations, ROYL seeks to allow investors to experience similar strong levels of cash flows.

ROYL has commenced monthly distributions that aim to reflect the historical cash flow yield of the underlying portfolio. The prior 12-month cash flow yield of ROYL’s portfolio was 6.5% as of 31 December 20245.

Source: Bloomberg. Since ROYL’s inception. 30 September 2022 to 31 December 2024. Past performance is not indicative of future performance.

Income and diversification opportunity for Australian investors

In June 2024 we wrote an article about why you should consider adding royalty companies to a portfolio and the several unique advantages many of these companies enjoy, including high margins, inflation linked revenue streams and low operational business risks.

Companies like ARM Holdings6, for example, create and license IP technology used in semiconductor chips which many of the world’s leading companies including Samsung, Apple, Nvidia and Microsoft, use. Rather than manufacture and sell its own chips, ARM can scale without incurring the operational risk and capital requirements of manufacturing and the associated input costs.

However, what is of particular potential benefit is the lower correlation that royalty companies have historically displayed to the broader Australian market. ROYL’s Index vs. the ASX200 Index experienced a correlation of just 0.21 between Nov 2018 to Jan 20257.

To illustrate the dynamics of adding a royalty companies portfolio to an Australian shares portfolio, we can consider a hypothetical scenario of adding a 20% allocation to royalty companies (represented by ROYL’s index net of ROYL’s management fees and costs) alongside a 80% allocation to Australian equities8.

Using the period since ROYL’s index inception on 7 November 2018 through to 31 January 2025 demonstrates:

- total returns would have improved from 10.2% p.a. to 11.2% p.a.,

- volatility would have reduced from 16.5% to 14.6%, and

- the current forward 12 month expected income yield would have increased from 3.4% to 3.9%.

|

Returns to 31 Jan 2025 (p.a.) |

ROYL’s Index (net fees) |

Broad Market Australian Equities (net fees) |

Blend (20/80, net fees) |

|

1 Year |

37.11% |

15.10% |

19.33% |

|

2 Years |

14.78% |

11.06% |

11.91% |

|

3 Years |

17.65% |

11.53% |

12.89% |

|

5 Years |

14.72% |

8.15% |

9.67% |

|

7-Nov-18 |

13.90% |

10.37% |

11.29% |

|

Fwd 12m Income Yield est. p.a. (as at 31 Jan 2025)9 |

5.90% |

3.41% |

3.91% |

|

Volatility |

19.28% |

16.47% |

14.56% |

|

Sharpe Ratio |

0.59 |

0.48 |

0.60 |

Source: Bloomberg. Past performance is not indicative of future returns. ROYL’s inception date was 9 September 2022. ROYL’s Index (net of fees) shows index performance after ROYL’s management fees of 0.67% p.a. ROYL’s index is the Solactive Global Royalties Index. You cannot invest directly in an index. For the Sharpe Ratios an average risk-free rate of 2.5% was used. The Blend (20/80, net of fees) is a hypothetical example provided for illustrative purposes only. A200’s Index, the Solactive Australia 200 Index, is used as the proxy for “Broad market Australian Equities“. Portfolio returns assumes quarterly rebalancing to the allocations shown above. Total returns shown are index returns less ETF management fees and costs. Not a recommendation to invest or adopt any investment strategy. Actual outcomes may differ materially.

Hence, considering the royalty streams and other unique benefits of these global businesses, ROYL not only has the potential to add more diversification to a portfolio of Australian shares, but may also yield more targeted outcomes for those investors looking to both enhance the level and the frequency of their income payments from shares.

You can find more about ROYL on its fund page here.

There are risks associated with an investment in ROYL, including market risk, international investment risk, sector risk, royalties related risks and concentration risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Footnotes:

1. Represented by the 12-month trailing dividend yield on the S&P/ASX200 as at 31 January 2025. ↑

2. No assurance is given that this company will remain in ROYL’s portfolio or will be a profitable investment. ↑

3. Source: Royalty Pharma company filings. ↑

4. Royalty Pharma reports Q4 and full year 2024 results. ↑

5. Past performance is not indicative of future performance. ↑

6. No assurance is given that this company will remain in ROYL’s portfolio or will be a profitable investment. ↑

7. Source: Bloomberg ↑

8. This illustration assumes an equities allocation as part of a broader portfolio consistent with ROYL’s intended product use of up to a 10% allocation per the TMD. See ROYL’s TMD here. ↑

9. ROYL’s index yield represented by the trailing 12-month cash flow yield of ROYL’s Index constituents. Australian Equities yield represented by the expected forward 12-month dividend yield on the Solactive Australia 200 Index. ↑