5 minutes reading time

If you prefer, you can listen to this week’s Bass Bites here:

Global week in review

Global stocks bounced back last week due to a Middle East ceasefire and lingering hopes of US rate cuts later this year. Most notably, the S&P 500 touched a new record high, fully unwinding the tariff-related slump earlier this year.

Iran’s limited response

The key highlight last week was Iran’s relatively limited response to US strikes on its nuclear facilities. It struck one US base in neighbouring Qatar, and seemed to give the US and Israel ample warning to limit any damage.

Trump called it a “weak response” and markets agreed that Iran seemed to want to end hostilities quickly rather than escalate them. Former Prime Minister Paul Keating might have likened it to being hit with a wet lettuce.

Either way, there’s now a shaky ceasefire holding between all parties with some talks set to begin. Oil prices dropped 12% last week as a result. Nothing to see here: let’s move on.

Powell testifies to Congress

Another highlight was US Fed Chair Jerome Powell’s testimony before Congress. As expected, Powell played a straight bat – suggesting the Fed would wait to see the impact of tariffs on inflation before contemplating a rate cut. With economic activity still holding up and core inflation still above 2%, that’s fair enough, despite Trump’s protestations! That would seem to rule out a July rate cut, although keeps September in play.

In terms of economic data, a downward revision to Q1 US GDP (the economy is contracting at a -0.5% annualised rate versus the previous read of -0.2%) perversely boosted stocks on the view it increased the chance of Fed rate cuts. Markets also weren’t fazed on Friday by a slightly higher than expected 0.2% gain in the May core consumption price deflator, which lifted the annual rate to 2.7% from 2.6%.

On the policy front, the US agreed to remove extra taxes on G7 companies operating stateside (under section 899 of the Big Beautiful Bill) in exchange for US firms being exempted from the minimum global tax previously agreed by developed countries. Seems fair right?

Trump also cut off trade talks with Canada, complaining about the latter’s plans to impose a revenue tax on digital companies.

All up, the trade/tariff saga continues to simmer in the background. Markets are drawing hope from Treasury Secretary Scott Bessent’s regular calming announcements and, ultimately, a view that “Trump always chickens out“.

Global week ahead

There’s a smattering of key US data this week, with the highlight being US payrolls on Friday. All are expected to show that the US labour force has downshifted a little but is still holding up reasonably well.

Employment is expected to rise by a firm 120k, with the unemployment rate lifting to 4.3% from 4.2%. There are also job openings data and manufacturing and service sector surveys to come.

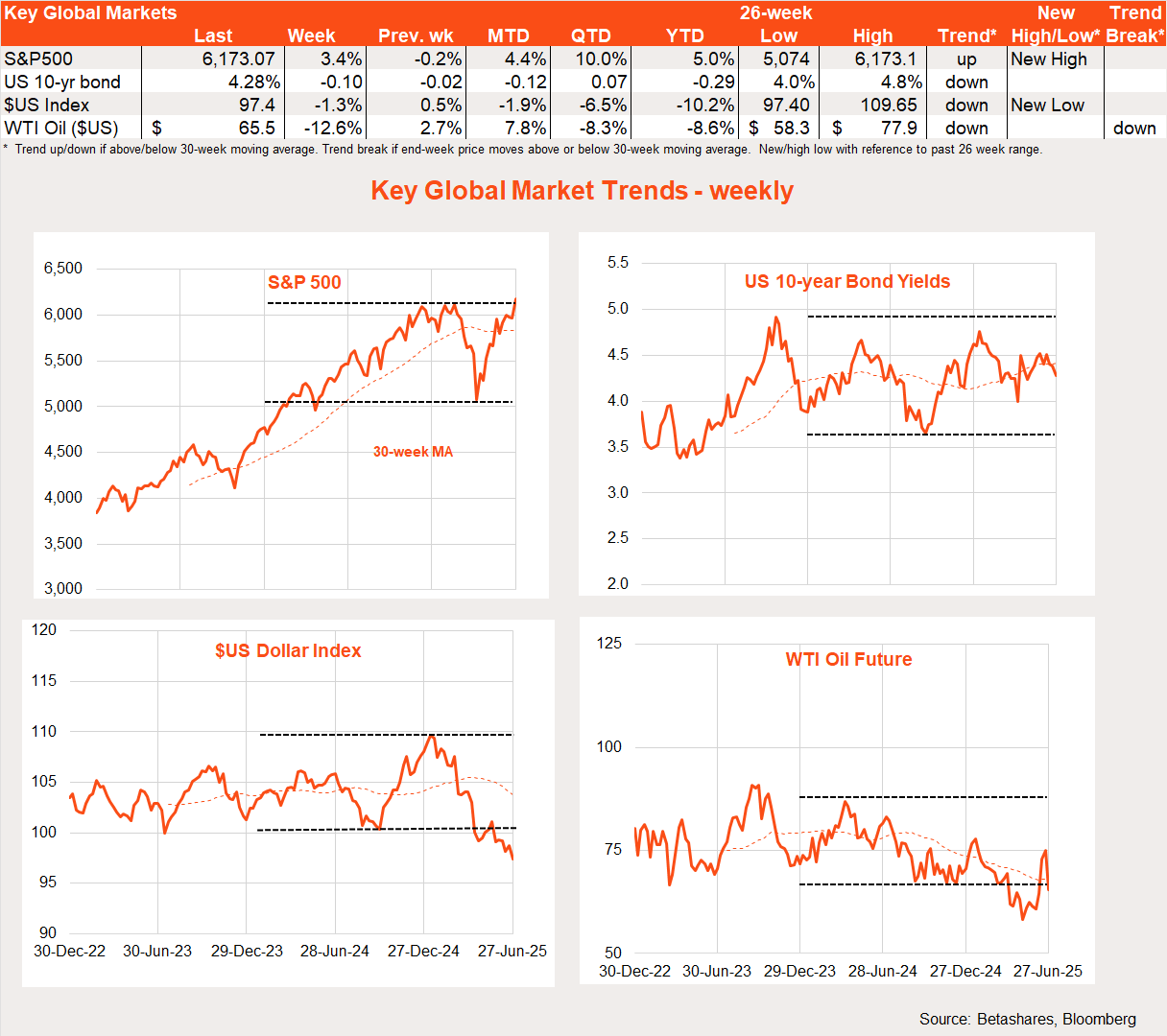

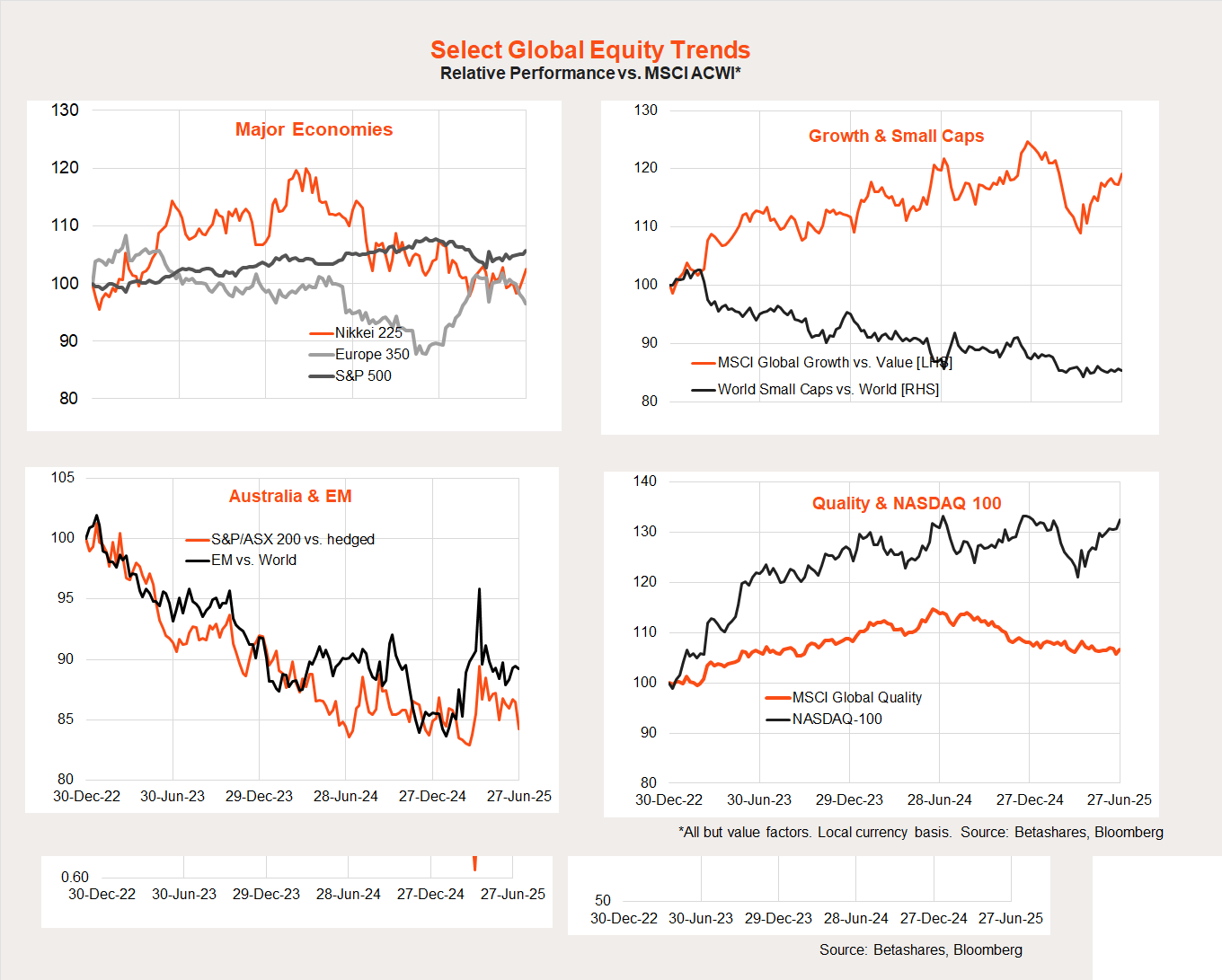

Global market trends

The main trend of note over recent weeks has been the rebound in US/growth/technology relative performance, in line with the market bounce back since early April. Despite the risk-on tone, small caps are still refusing to outperform.

Australian week in review

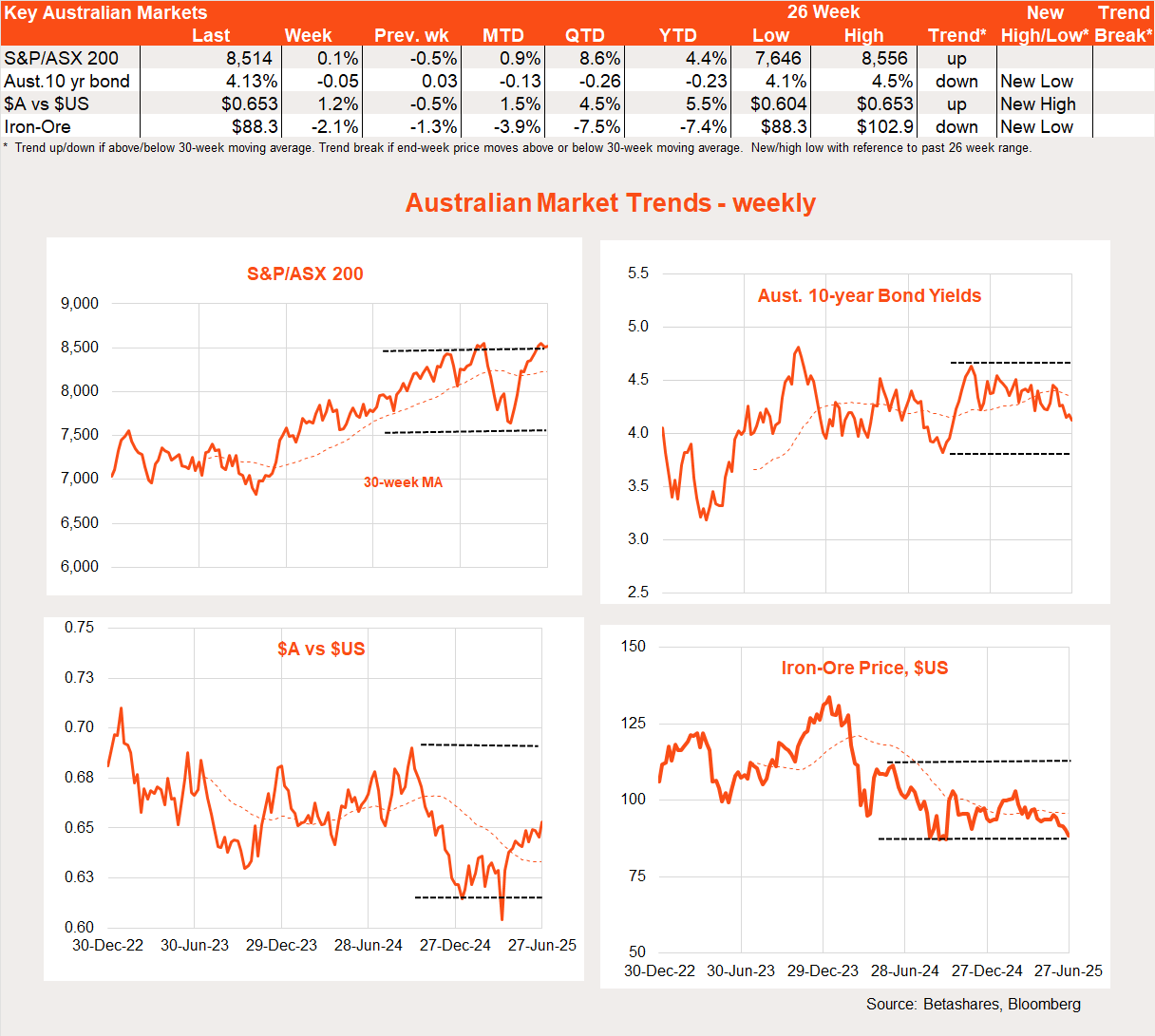

Local stocks only managed a 0.1% gain last week, despite the strength in global markets and good news on the inflation front. Most sectors were down apart from financials, which lifted a further 1.8%.

In line with the US dollar’s decline, the Australian dollar continued to rebound, with bond yields and iron ore prices seemingly in a choppy gradual downtrend.

Of course, the local highlight last week was the May monthly CPI report, which revealed a large drop in trimmed-mean annual inflation from 2.8% to 2.4%. Markets leapt on the result, pricing in a July rate cut with near-certainty.

I’m still not so sure, with recent monthly CPI volatility suggesting we should not place too much weight on one monthly number. With the real economy holding up, I can’t see the hurry to cut rates – and still anticipate the RBA will await confirmation of low inflation in the more reliable quarterly CPI report in late July before cutting rates in August. Further confirmation of a still-solid labour market came with a 2.9% gain in job vacancies in the three months to May.

Indeed, it would be embarrassing for the RBA to cut rates on July 8 only to see monthly and quarterly inflation bounce back big time in the quarterly report a few weeks later. We’ll see!

Local data this week includes house prices and retail spending. Retail spending has so far remained relatively subdued despite RBA rate cuts, while house prices have already started to firm up again.

Have a great week!

1 comment on this

Thanks David