7 minutes reading time

Commentary from the Betashares portfolio management desk by Head of Fixed Income Chamath De Silva, providing an overview of bond markets:

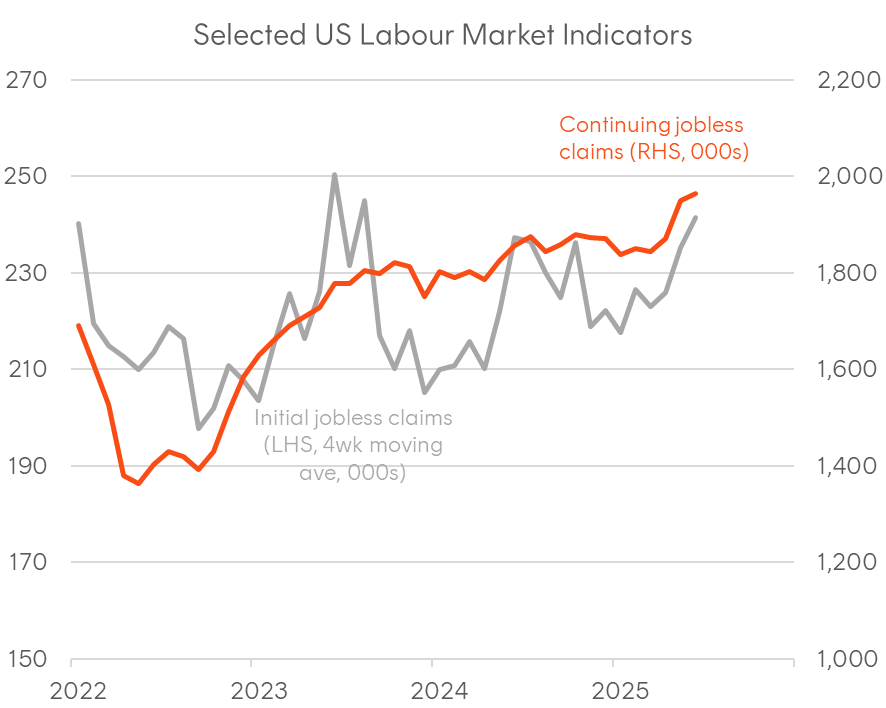

- Despite a torrent of headlines, the main thing to watch remains the US labour market, which continues to soften

- The RBA’s surprise decision to keep the cash rate on hold only delays the inevitable?

- Chinese long-term bond yields retesting the lows presents an ominous picture for global growth

Despite plenty of headlines, from the return of “Tariff Man”, to speculation over Powell’s successor, and the passage of the OBBBA, markets have been placid, with the typical Northern Hemisphere summer lull taking root. Volatility has collapsed, with both the VIX and MOVE index of US yield volatility falling significantly in recent months, while positioning has re-risked, and the broader macro environment remains subdued.

While there’s no shortage of new narratives to chase, it’s mostly noise and we should be instead laser-focused on what really matters for the US economy and yields: the labour market. One of the more bearish houses at present, BCA Research, recently argued that the US economy is vulnerable, with the labour market at a tipping point. Referring to the Beveridge curve, which plots job vacancies against unemployment, they contend that we’re now at the stage where further slack will likely lead to rising unemployment, rather than just moderating wage growth. Looking across the spectrum of labour market indicators, it’s hard to deny there’s a clear softening, particularly in private sector hiring. The recent jobs report may have looked “hot” on the surface, but much of the strength came from a big increase in public sector hiring (at the state level). Private payrolls were tepid at best, with other data, like the ADP series, showing an outright contraction in private sector employment.

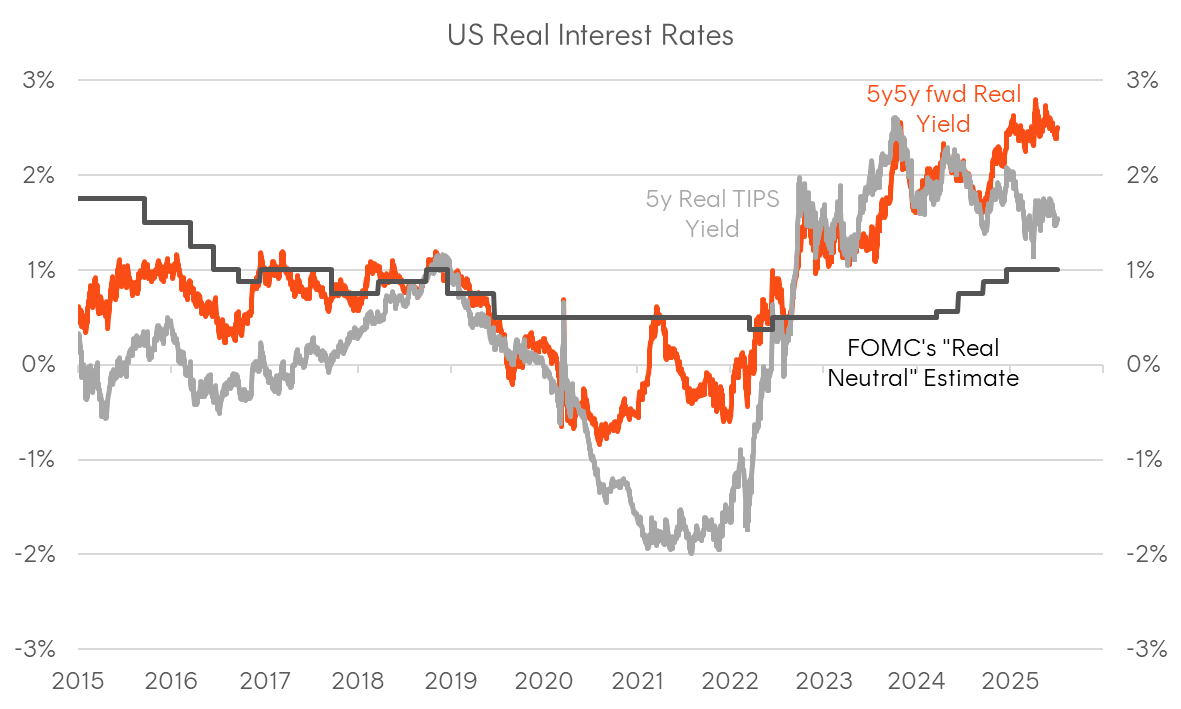

Given this clear softening, it’s interesting that the FOMC is still maintaining a restrictive stance, especially if we compare the “real neutral” Fed Funds projection from the latest dot plot to where medium term and forward real yields on US TIPS are trading. The June FOMC forecasts revisions were arguably stagflationary in nature, showing upward revisions to inflation and downward revisions to activity and employment. However, in a truly stagflationary environment, I’d probably expect real rates to fall. In addition, I don’t think inflation will be a swing factor for the Fed, especially during the remainder of Powell’s term. While tariff pass-through could widen the distribution of headline inflation outcomes, it’s clear Powell is choosing to remain “behind the curve” to preserve optionality, with the uncertainty of tariffs and Trump’s mercurial nature, providing ample pretext. Ultimately, whether the Fed is eventually pushed by continued labour market weakness or fiscal dominance, US real yields are likely to trend lower over the coming years.

Figure 1: Selected US labour market indicators; Sources: ADP, BLS, Department of Labor, Bloomberg

Figure 2: US real interest rates; FOMC real neutral estimated from long-run dot plot estimate less 2% CPI target; Sources: FOMC, Bloomberg

The RBA delays the inevitable?

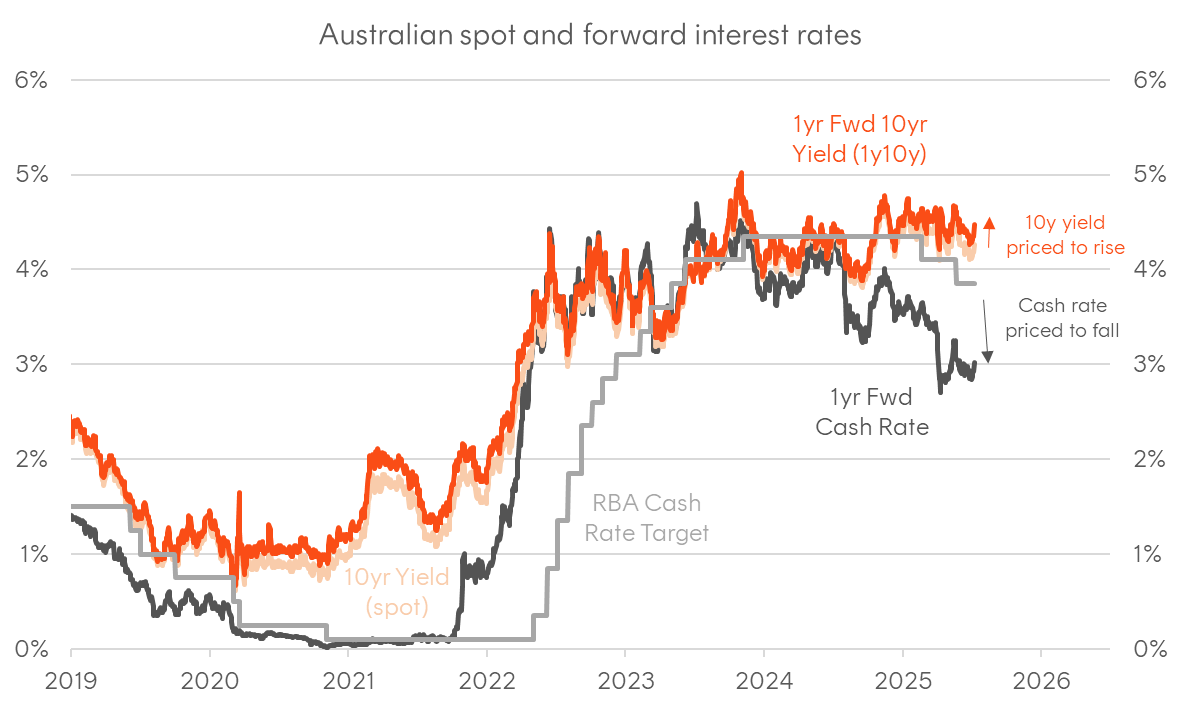

Closer to home, the RBA’s “shock” decision to hold the cash rate steady dominated headlines. Market pricing of a cut was above 90%, and most economists surveyed expected one, making this arguably one of the biggest policy surprises in recent years. That said, it’s worth pointing out that our very own David Bassanese called it correctly, arguing that the Bank would opt to stay data-dependent, particularly with recent employment data suggesting the economy isn’t faring quite as badly as some believed.

Still, data dependence doesn’t preclude a rate cut at the next meeting and it likely comes down to the Q2 CPI print (due 30 July) confirming the recent trend of trimmed mean inflation approaching the midpoint of the RBA’s target band. If so, “close enough” may be “good enough”, giving the Bank the green light to bring policy closer to neutral, which in our view entails a cash rate of around 3% over the next 12 months, with the risks skewed to the downside amid global growth uncertainties.

For Australian bonds, the back-up in yields following the decision presents a compelling dip-buying opportunity in duration, especially given how steep the curve is and how attractive the term premium has become. Ultimately, duration typically performs well during an easing cycle, especially when there is a steep curve to add a buffer (and an additional source of return via rolldown).

For those taking a tactical view, or simply trying to decide between fixed vs floating, it’s worth looking at what’s priced in as a starting point. Even after the shock of the recent rate decision, market pricing still expects around 90 basis points of rate cuts over the next 12 months, yet the Commonwealth yield curve is pricing in the 10-year yield to rise by 20 basis points. There are many ways of capturing the term premium, but a 125-basis point spread between what’s priced in for the 10-year yield and the cash rate in 12 months makes fixed-rate appear more attractive than floating to me.

Figure 3: Australian spot and forward interest rates; Sources: RBA, Bloomberg

What’s happening in China?

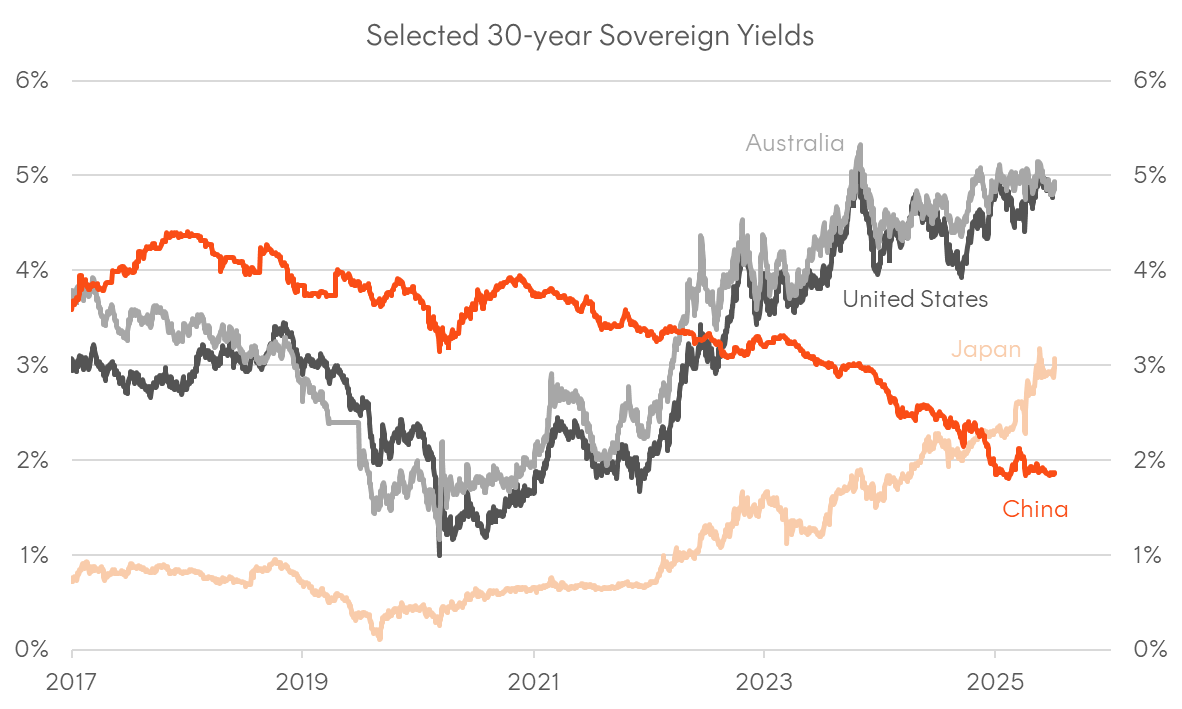

One of the most significant developments in global bonds in the post-pandemic period has been the decoupling of Chinese government yields from the rest of the world. As yields surged in the US, Europe, and Japan between 2021 and 2024, Chinese yields staged a major decline as the Chinese economy grappled with a deflationary malaise. Chinese long-term yields also recently had the dubious distinction of trading below equivalent JGB yields – quite the irony given China’s ongoing battle to fight off “Japanification”.

Given all this, there was no shortage of fanfare around the Q1 fiscal stimulus package in China, which briefly triggered a sharp rise in long-end CGB yields. But this proved short-lived. The economy remains plagued by overcapacity and weak domestic demand, prompting the authorities to publicly denounce “price wars” in various industries. Chinese yields have since fully retraced the Q1 spike and now sit barely above their all-time lows. In addition to this, China has also defied the global steepening trend, with the CGB curve bull-flattening in recent months, reminiscent of the Japanese experience in the mid-2010s.

The reason this all matters for the local fixed income market is that the US and China are still the two primary engines of global growth, and the steadily weakening US labour market combined with China’s deflationary funk isn’t a great signal for global growth accelerating. It’s always worth remembering that Australia, being a medium-sized open economy, doesn’t operate in a purely domestic vacuum. A tepid global growth backdrop combined with generous risk premiums for Australian bonds make a compelling case to buy any duration dips.

Figure 4: Selected 30-year sovereign yields; Source: Bloomberg

Figure 5: Chinese CPI; Sources: National Bureau of Statistics of China; Bloomberg