5 minutes reading time

If you’d like to listen to this week’s Bass Bites, click on the player below:

Global week in review

Global stocks rose further last week, reflecting hopes around US fiscal stimulus and trade talks.

Trade and fiscal hopes

Global stocks are now looking for almost any excuse to rally. Last week, the US Senate’s passing of the ‘Big Beautiful Bill’ was a reason to rally on the back of fiscal stimulus hopes, with concerns of rising US public debt put to one side. Trump signed the bill on Friday. The bond market vigilantes were nowhere to be seen.

Also cause for optimism was the US-Vietnam trade deal, even though it left imports from Vietnam facing a hefty 20% across-the-board tariff. So-called ‘transhipped’ goods – that is, goods exported through Vietnam but mainly made elsewhere (such as China) – will face a 40% tariff.

Resilient economic data and steady Fed

US economic data last week was generally firm, confirming the economy remains impressively resilient in the face of lingering tariff threats. May job openings and June employment growth were both higher than expected, while the key ISM manufacturing and service sector surveys held up close to market expectations.

Given lingering tariff uncertainty and firm economic data, US Fed Chair Jerome Powell again rightly signalled no hurry to cut rates again last week – despite the persistent cajoling of Trump to move quickly.

Tariff deadline looms large this week

There is not a lot of major global economic data due this week, with the focus likely to be on tariff policy.

The 9 July deadline for trade deals to be struck before the US imposes “reciprocal tariffs” on its trading partners takes place mid-week. At this stage it appears Trump is focusing on trying to extract concessions from major players like Europe, India and Canada – and will simply notify the tariffs that most other smaller countries will face. In turn, these major countries seem to have been dragging their heels, perhaps trying to test out if Trump is bluffing or not.

The bottom line is that the tariff saga has not gone away. Emboldened by the share market rebound and economic resilience, there’s a risk this week that Trump might unleash large tariffs again which in turn causes a market backlash – after which he may or may not ‘chicken out’. We simply don’t know at this stage.

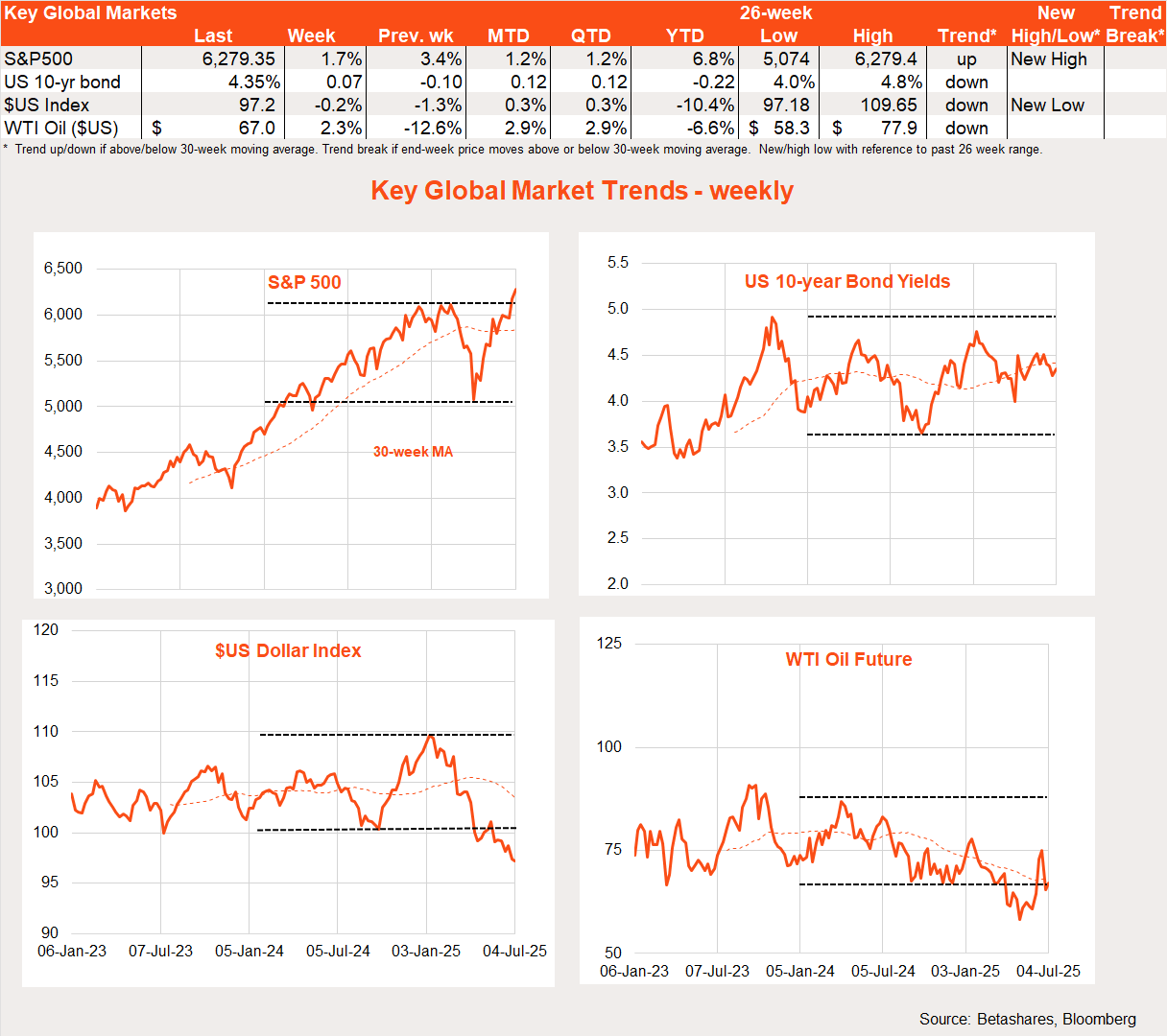

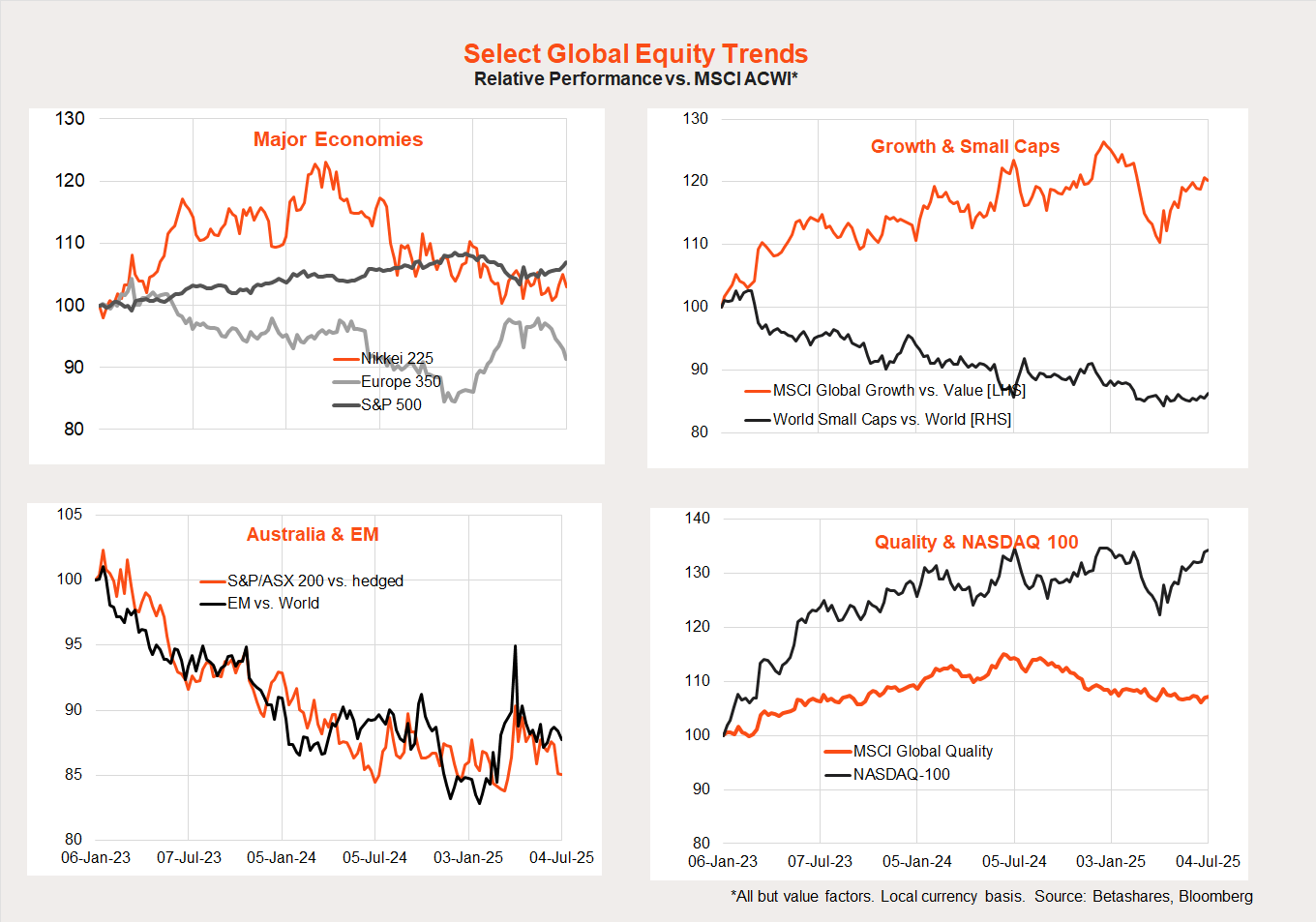

Global market trends

The main trend of note over recent weeks has been the rebound in US/growth/technology relative performance, in line with the market bounce back since early April. Despite the risk-on tone, small caps are still refusing to outperform.

Australian week in review

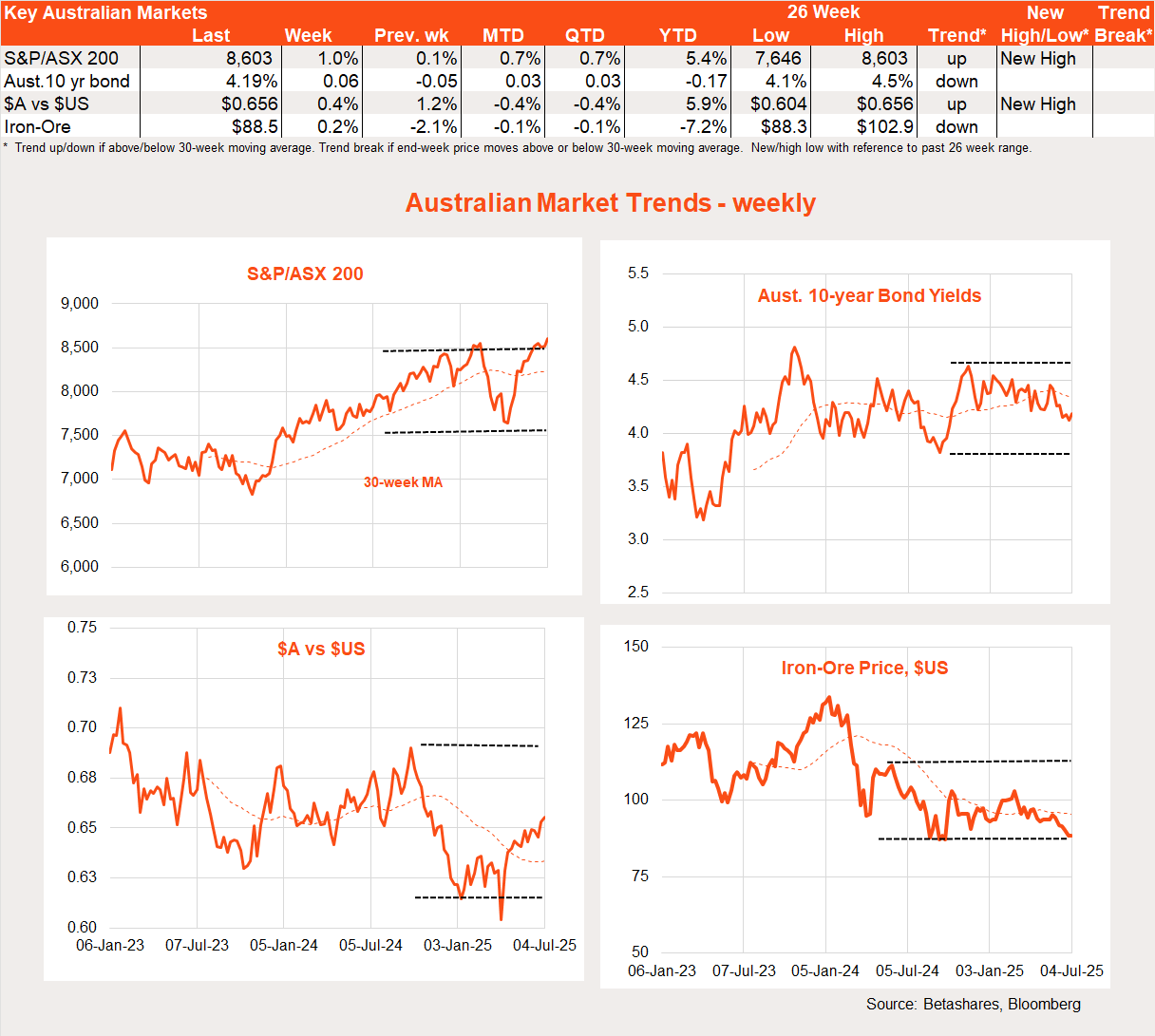

Local stocks rose in line with global markets last week, helped by rising excitement around a potential RBA rate cut this week.

Last week’s economic data was mixed, with retail spending continuing to remain subdued (at least according to the official survey) while house prices showed signs of growing momentum.

Retail sales limped ahead 0.2% in May to be up 3.3% over the year (barely in line with inflation). That said, the newly established ‘Monthly Household Spending Indicator’ – which looks set to replace the retail sales report completely in coming months – tells a stronger story, with 0.9% growth in May and 4.2% growth over the year.

National house prices, meanwhile, rose 0.6% in June to be up 2.7% over the year. Weekend reports noted strong auction clearance rates ahead of a widely expected rate cut this week.

RBA: What’s the hurry?

The key local highlight this week will be tomorrow’s RBA meeting. I’ve long been bewildered by the near-certain probability that markets have attached to a rate cut this week, despite a still firm labour market and volatility in the monthly CPI reports. Only two months ago, monthly trimmed mean inflation was 2.8%!

I would have thought the RBA could easily wait for confirmation of lower underlying inflation in the quarterly CPI report later this month before cutting rates again in August. It might also help to hold off the impending house price boom for at least another month. It would also give themselves a bit more time to assess what Trump does with tariffs as the 9 July deadline passes.

Of course, it could be that the RBA has been disappointed with the apparent persistent weakness in consumer spending and the lacklustre Q1 GDP growth of 0.2%. It might conclude it can afford to give the economy a bit more stimulus and that there’s no need to wait. I’m less convinced it needs to hurry.

Also not surprising, most market economists have now jumped on the rate cut bandwagon – which I attribute to an absence of any “well sourced” media reports seeking to hose down market expectations by playing down the prospect of a rate cut. In my experience, that suggests a rate cut may well be coming – however dubious I personally find the case.

For the record, however, I will retain my call that the RBA will see sense at the 11th hour and hold off cutting rates this week.

2 comments on this

Rate cut – i hope you are right. There is a large number of people who rely on fixed income which are always overlooked in the rate cut hysteria

Rate Cut indicates serious economic conditions ahead; more fuel on the property bonfire. Anyone under the age of 50 has never lived through major falls in house, land and equity prices all at the same moment.