Want to read it later?

Send the lesson to your inbox

Lesson 5 transcript

Once you understand the level of risk that’s right for you, you can determine the types of investments or asset classes to choose for your investment portfolio.

Two crucial factors to help you decide your risk tolerance are:

- Your investment timeline: The longer you have before you need to access your money, generally the more risk you can take on

- Risk appetite: How comfortable are you with risk? If your investments fall, would you panic and sell, or would you be comfortable holding on?

If you’re starting earlier in life, you may prefer to invest more in higher risk/higher return assets – growth assets, such as shares, also known as equities.

If you’re investing later in life, you may prefer to invest more in lower risk/lower return assets – fixed income or bonds, known as defensive assets. With these types of investment your aim may be to earn an income from investments during retirement when you stop receiving a regular income from working.

Risk profiles

While there are ‘standard’ asset allocation splits based on these broad profiles, every investor is different, and you may need to adjust weightings from the below.

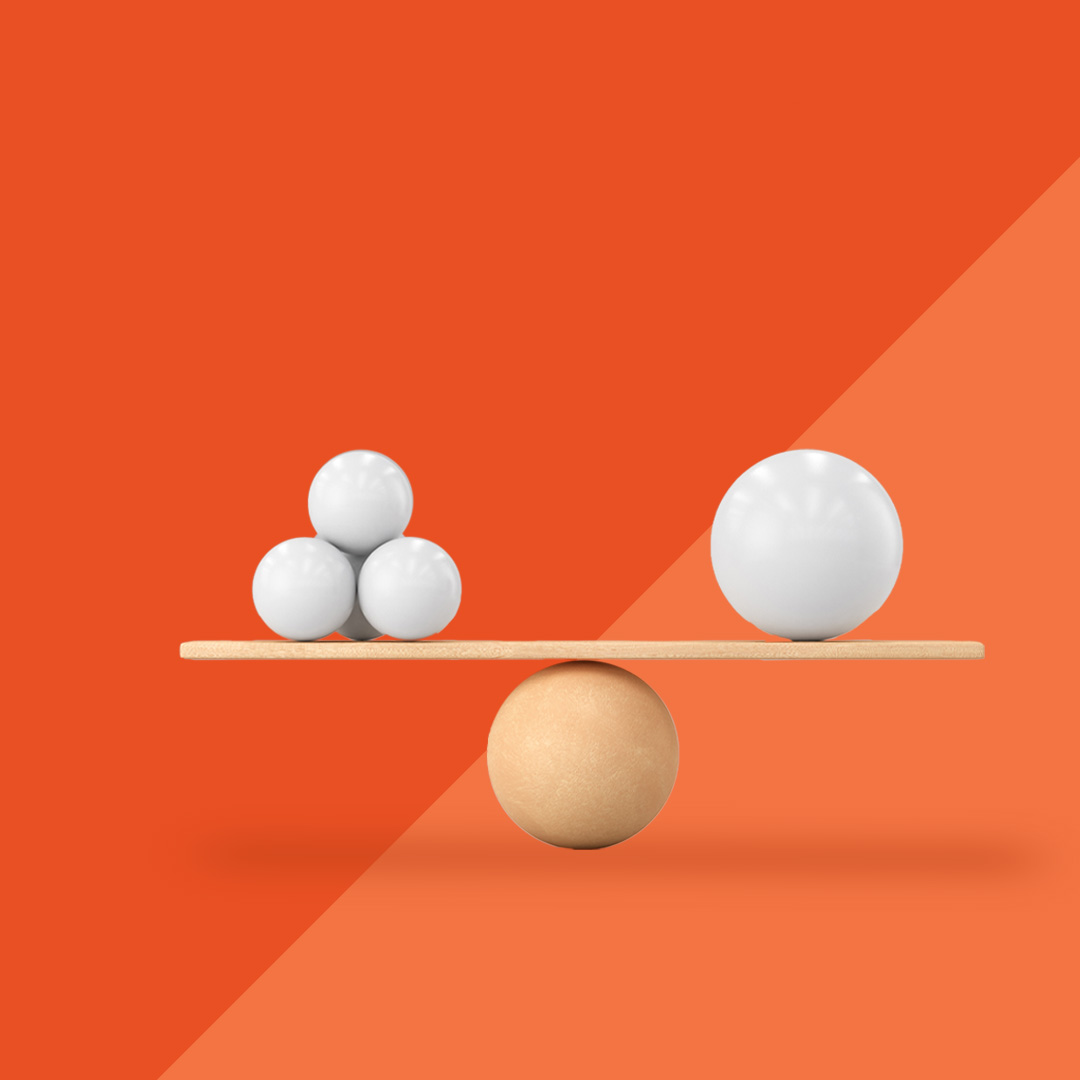

Conservative risk profile

A conservative investment portfolio typically is made up of around 80% defensive assets and 20% growth assets, and a timeframe of around 3 to 5 years.

If you’re a conservative investor, you typically are seeking to protect your capital and are comfortable with moderate returns, rather than taking on higher risk for potentially higher reward.

Balanced risk profile

A balanced investment portfolio typically is made up of around 50% defensive assets and 50% growth assets, with an investment timeframe of around 5 to 7 years.

If you’re a balanced investor, you are more willing to accept some volatility in the value of your investments, as a trade-off for increased potential returns.

High growth risk profile

A high growth investment portfolio typically is made up of 90-100% growth assets, with an investment timeframe of around 7 years or more.

If you’re an investor seeking growth, you are willing to accept a high level of variability in investment returns, with the higher risks associated with investments that have the potential to produce higher returns.