Want to read it later?

Send the lesson to your inbox

Lesson 9 transcript

By this stage, you should have a grasp of the following:

- Saving vs investing

- An emergency fund and a handle on debt

- Your approach – investing (long-term) or trading (short-term)

- Your risk tolerance

- Your investment goals, such as growth or income

- The types of investments/asset classes to consider based on your risk tolerance and goals

- An understanding of investing fees

All of the above are key ingredients to mix together to build your portfolio. So how do you go about this?

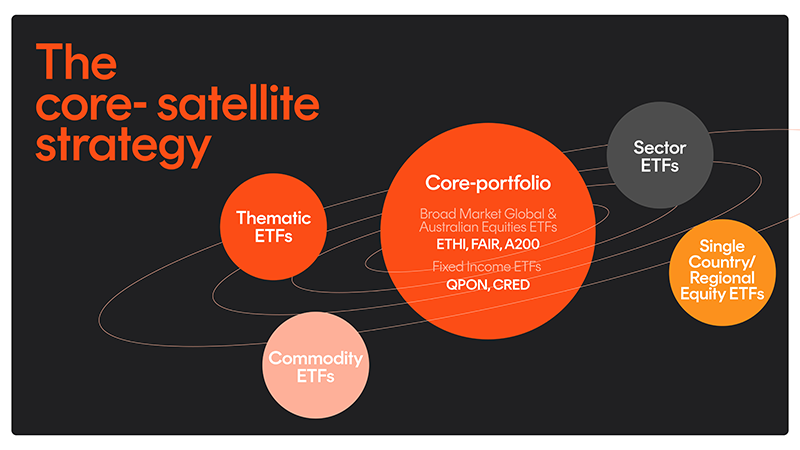

One popular approach is the ‘core/satellite’ strategy.

A core/satellite portfolio means investing the majority of your money in stable, lower-risk investments – the core – and investing less of your money in smaller, higher risk (and potentially higher reward) investments to complement these holdings – the satellites.

You can think of the diagram above like the solar system. Your core is the sun and all the planets are your satellites.

The goal of the core/satellite portfolio is that none of the investments in the satellites are big enough that, if things go badly with any of them, they will greatly impact the overall value of your portfolio.

What could your core include?

- Australian equities

- International equities

- Fixed income

- Cash

Most commonly, for the core, you could buy several broad exposure ETFs. ETFs are a great way to build a core/satellite portfolio because they typically offer diversified exposure at low cost. For example, the A200 Australia 200 ETF provides exposure to the 200 largest companies on the ASX.

Your core could also include for example a diversified fund that provides exposure to a particular country or region, such as the S&P 500.

What could your satellites include?

- Sector-specific or thematic ETFs are popular, with options including technology, healthcare, climate change innovation, cybersecurity, esports, e-commerce

- Individual stocks. These could be small or mid-cap companies, if you have many of the large-cap companies already covered in your core

Remember to choose your investments based on your goals and risk tolerance. We cover this in Lesson 4 – Types of investments and risk vs return.

It’s also worth noting that many people build an entire portfolio of ETFs, without selecting any individual stocks.