Want to read it later?

Send the lesson to your inbox

Lesson 4 transcript

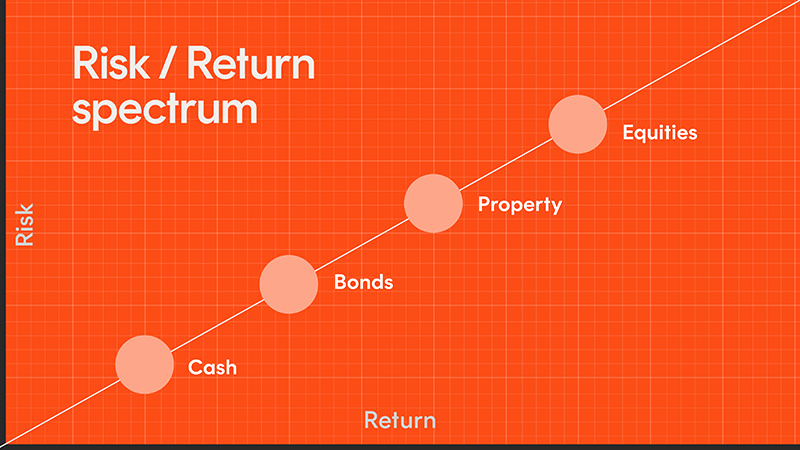

When it comes to investing, greater risk means greater opportunity for price growth, but also greater chance of loss.

You may have heard the term ‘asset classes’. Different types of investments or ‘asset classes’ have varying levels of risk and therefore return.

Asset Classes

- Equities (also known as shares)

- Commodities (e.g. gold or oil)

- Property

- Hybrids (a combination of bonds and equities)

- Fixed income or fixed interest (also known as bonds)

- Cash

- Cryptocurrency (also known as digital assets)

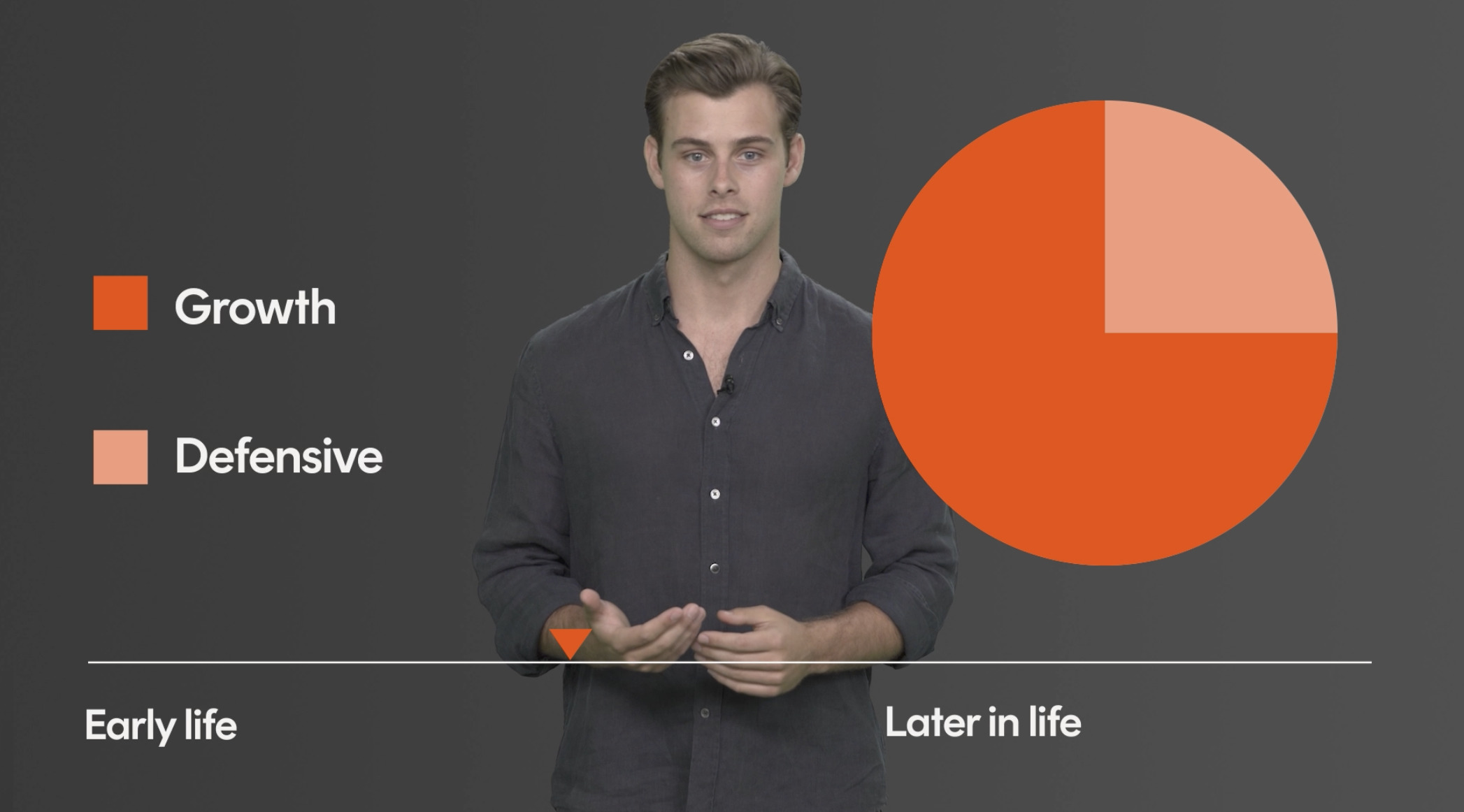

How do investors decide between growth and defensive assets?

The balance between growth investments and defensive investments is likely to change as you grow older and your financial circumstances change.

Investors looking for capital gains are likely to invest more of their portfolio in companies that tend to use their profits to grow their business, rather than paying those profits out in dividends.

Technology companies, for example, typically retain most of their profits to reinvest in their business, and their returns tend to be more in the form of capital gains than income.

Investors seeking income traditionally have turned to fixed income, such as bonds and hybrids, and also to high-yielding equities. Banking stocks, for example, are often favoured by income investors for the high dividends they historically have paid.

The risk/return spectrum

Source: Betashares. Provided for illustrative purposes only. Not a recommendation to make any investment or adopt any investment strategy.

Risk and return characteristics also differ within asset classes. For example, within the equities asset class, different sectors have different risk/return characteristics.

Technology companies, for example, are typically more volatile than companies selling consumer staples, and a speculative mining stock will have higher risk than a stock in one of the big four banks.

ETFs are a cost-effective and convenient way to tap into all asset classes – across the full risk and reward spectrum – offering you exposure not only to equities, but also to cash, bonds, hybrids and even commodities in one trade.

Diversification - don’t put all your eggs in one basket

Diversifying your investments – across country, region, industry and size – helps spread the risk. Whilst some investments may fall in value, others may rise and therefore somewhat balance out the fall overall across your investment portfolio.

Sharemarkets are fast paced, and so it can be difficult to stay updated on market movements and make decisions on the best performing individual investments at any particular point in time.

This is one of the reasons for choosing ETFs over individual shares – there is instant diversification. When you buy an ETF that tracks a market index, it gives you exposure to all the companies in that index in a single trade. You don’t need to pick individual shares.