Want to read it later?

Send the lesson to your inbox

Lesson 10 transcript

One golden rule of investing is putting your money to work as soon as possible. An investment needs time to grow, so the longer your money is in the market, the more chance you have of reaching your goals.

Investing small sums of money regularly is one of the best ways to keep you on track, assisting you to reach your goal faster.

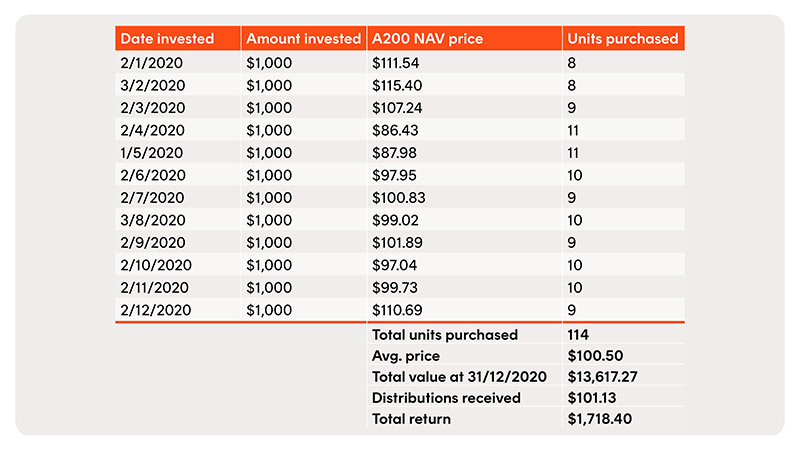

Dollar cost averaging in action

Let’s look at a simple example.*

* Example does not account for any transaction costs, such as brokerage. Past performance is not an indicator of future performance.

Take a low cost, index tracking fund, like the A200 Australia 200 ETF .

Let’s pretend it’s the beginning of 2020, and at the end of 2019, you made a New Year’s resolution to start investing in the sharemarket.

You check your bank account, and you have $12,000 to invest. Looking back over the year you notice the Australian market was up over 23% and has been trending higher for the last few years.

You’re worried that as markets approach all-time highs, you might be getting in at the top.

Rather than trying to pick ‘the best time to invest’, let’s assume you started dollar cost averaging from the first investible day of the year and made the same, equal investment, each month after that.

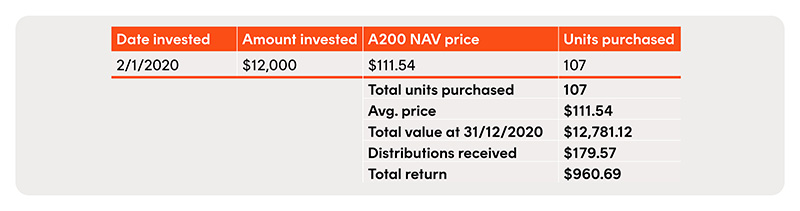

Contrast that with the result you would have achieved had you invested the entire $12,000 in A200 at the start of the year.

In this situation, a dollar cost averaging strategy would have produced a better result, with more units purchased, at a lower average cost. More importantly, it avoided the risk of putting all your eggs in one basket in terms of timing.

Why you should reinvest your dividends (or distributions if you invest in ETFs)

Another strategy automatically topping up your investment is opting into a distribution reinvestment plan, (or DRP for short) if you invest in ETFs. Dividends are payments a company makes to share their profits with its investors.

With a DRP, you can increase your investment in a company or fund over time by automatically reinvesting your dividends/distributions. Rather than taking your dividends/distributions in cash, you’ll be using them to buy more shares in the company, or units in the fund.

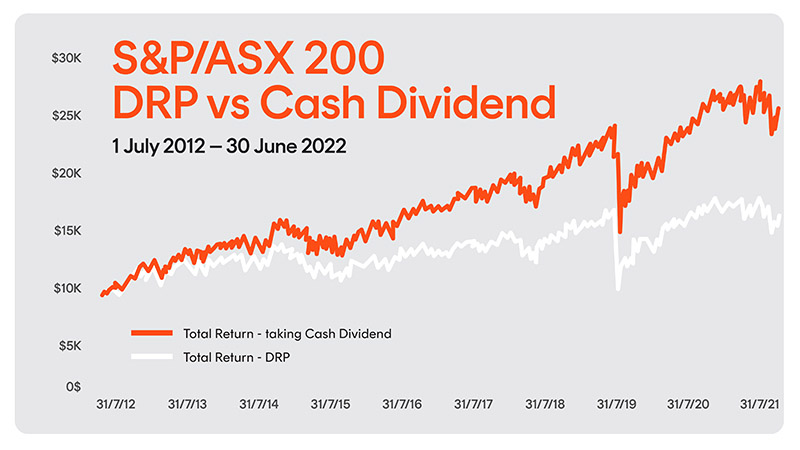

Remember the concept of compound interest? This chart illustrates the powerful compounding effect that reinvesting dividends can achieve.

It assumes an investment in a portfolio made up of the S&P/ASX 200 Index constituents (the largest 200 companies in the Australian sharemarket) and shows the returns over the ten years to 30 June 2021, for:

- an investor who participates fully in a DRP, and

- an investor who takes their dividends in cash

The investor who participated fully in the DRP would have achieved a return of ~246% over the relevant period on their investment, compared to a ~163% return for the investor who took their dividends in cash.

To put it in dollar terms, a $10,000 investment made at the start of the relevant period would have been worth $24,625 as at 30 June 2022 with DRP, compared to $16,268 with cash dividends, which is attributed to $3,384 cash dividends and $2,884 capital appreciation, in addition to the $10,000 initial capital outlay.

The compounding effect is exponential, the impact of which would be exacerbated over a longer period of time.

Source: Bloomberg. Hypothetical example provided for illustrative purposes only. Past performance is not indicative of future performance. You cannot invest directly in an index. Not a recommendation to make any investment or adopt any investment strategy.