Dollar cost averaging - taking timing out of the investment equation

The crypto economy has been growing strongly, aided by the performance of Bitcoin, Ethereum and other digital assets over the past ten years. This growth is anticipated to continue, naturally attracting the interest of investors. However, the radical technological innovation of digital ledger technology, and the investment opportunity it represents, may not be as easily understood as an investment in traditional asset classes such as equities and fixed income.

This guide is intended to help investors who may be considering an investment in the cryptocurrency sector, but who are unsure where to start.

In this guide, we will:

- provide a brief explanation of blockchain, and cryptocurrency

- set out the opportunity that crypto presents to investors, and

- discuss where an exposure to crypto can fit in an investment portfolio.

| Investing in the crypto space involves very high risk of rapid loss. It should only be considered by investors who understand the nature of the investment, who have very high tolerance for risk, and as a small component of an overall portfolio. |

Brief guide to blockchain & crypto

What is a blockchain?

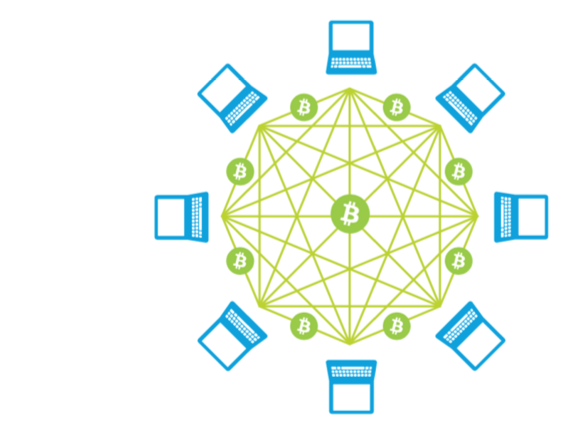

A blockchain is a digital, publicly accessible ledger or register. The ledger contains data, such as a list of transactions, and is replicated across all the computers in the network, rather than being centralised. A blockchain is a type of distributed ledger.

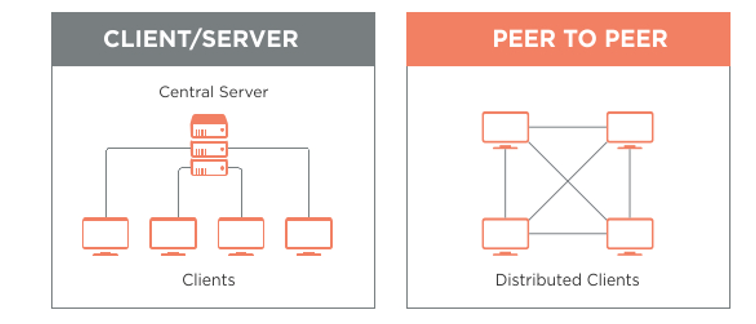

In network terms, the blockchain utilises the peer-to-peer model, in which there is no centralised database. In the traditional client/server model, by contrast, a centralised database holds 100% of the data, and clients trust that the data held on the server is definitive.

What is DLT and blockchain?

The terms distributed ledger technology (DLT) and blockchain are sometimes used interchangeably.

They are not the same, however. Blockchain is a type of DLT, but not all distributed ledgers use blockchain technology. Blockchain is the type of DLT used by Bitcoin.

How is the blockchain built?

Parties with access to the network enter into transactions, for example transferring digital currency to another party.

Transactions are verified by other computers in the network, and grouped into a block, which is then added to the chain. Once a block is added to the chain, the new version of the blockchain is broadcast to all the nodes (computers) in the blockchain network. As a result, each computer in the network has its own copy of the ‘source of truth’, rather than having to refer to a central version.

What is cryptocurrency?

A cryptocurrency is a type of digital token that makes use of cryptography to secure transactions and to control the creation of new units in the currency. Transactions of most cryptocurrencies utilise blockchain technology.

What is Bitcoin?

Bitcoin is the most prominent example of a cryptocurrency. It was released as open-source software in 2009 by a programmer (or group of programmers) using the pseudonym Satoshi Nakamoto.

What is bitcoin mining?

Mining involves performing a set of mathematical computations to win the right to add a new block to the chain. Miners compete for this right, because the reward for being the node that adds the block to the chain is newly-minted bitcoin (as of July 2021, 6.25 BTC per block).

The Investment Opportunity

Crypto presents investors with two broad opportunities, which can be seen either as standalone, or as opportunities that complement each other:

- The opportunity in Bitcoin and other cryptocurrencies

- The opportunity offered by the companies driving the crypto economy.

There are currently over 5700 cryptocurrencies1. Of these, Bitcoin is the oldest, the largest in terms of market cap, the most liquid, and the most popular. Let’s take a closer look.

Bitcoin – the future of money?

Top cryptocurrency companies driving the industry

The second crypto investment opportunity lies in the innovative companies providing core infrastructure for the crypto economy, including:

- Crypto mining and mining equipment firms – Mining is the process by which new Bitcoin or other cryptocurrencies are entered into circulation, and is also a critical component of the maintenance and development of the blockchain ledger.

- Asset management – Institutional adoption of crypto assets accelerated in 2020. Until then, investment in crypto assets was mostly retail-driven, but asset managers are increasingly

selling and marketing crypto as another asset class. - Crypto exchanges and custody – As more investors and institutions become involved, the trading volumes and custodial requirements of crypto will continue to grow. Coinbase, one of the largest and longest-operating cryptocurrency exchanges in the world, made over $1 billion in revenue in the first quarter of 2021 alone5.

- Service providers – Providers of financial infrastructure solutions and services to participants in the digital currency industry will likely have an increasing role to play.

Where does crypto fit in an investment portfolio?

A challenge to investors in the emergence of a new asset class is figuring out ‘where it fits’ in the portfolio? In determining their asset allocation, investors typically consider their financial

circumstances and goals, timeframe, risk tolerance, and the principles of traditional asset allocation.

Digital assets typically are volatile, and have a low correlation to traditional assets, and a shorter history than other asset classes. Their potential and use case is still developing.

Direct cryptocurrency exposure

The three main attributes of a direct investment in cryptocurrency are:

- the potential for high returns

- high volatility/risk

- low correlation with traditional assets

Following are four possible ways investors can view a direct investment in cryptocurrency:

- Store of value – To be eligible for consideration as a store of value, an investment typically should have scarcity value, and low correlation with traditional assets. Its value should not be easily eroded over time due to inflation.

- Early-stage investment opportunity – Even after 13 years, Bitcoin is considered to still be in its infancy. As a technology and a network, the potential remains largely untapped.

- Trading vehicle – The volatility of cryptocurrencies makes them attractive to many short term traders.

- Speculative investment – some investors speculate with a small portion of their portfolio. In taking this approach, investors should recognise that the potential for significant gain is invariably accompanied by a high level of risk.

Investing in the companies behind the crypto economy

Investing in individual companies in the crypto eco-system is a high-risk exercise. Stock picking is a challenge in any sector – but particularly so in a sector still in its infancy, and characterised by as much volatility as crypto and crypto-related companies.

We believe that an ETF that provides exposure to a portfolio of companies driving the crypto economy is a more prudent way of gaining exposure. Of course, exposure to this sector remains high risk.

A crypto ETF can be considered a thematic exposure, offering access to a theme that has the potential for strong growth over the long term. Crypto is shaping up to be a technology that disrupts many industries and become a global megatrend. An exposure to the innovators of the digital assets industry could be compared to thematic exposures such as robotics and artificial intelligence, cloud computing, and climate change innovators.

Exposure to crypto-equities is not the same as investing directly in crypto-currencies. The performance of such companies should not be expected to track price movements of any cryptocurrencies.

Cryptocurrency risks

The risks of an investment in digital assets, or in shares of companies servicing crypto-asset markets, include:

- Volatility risk – Cryptocurrencies are subject to extreme volatility, as are companies operating in the crypto-economy

- Early-stage investment risk – Just because something is first, does not make it the best, and there is no guarantee that the first players in the crypto space will remain dominant. Remember that MySpace preceded Facebook!

- Regulatory risk – Regulation in crypto assets is still evolving and varies from jurisdiction to jurisdiction. Investors should expect the evolution and variation to continue. The taxation

treatment of digital assets also continues to evolve. - Custody risks – Traditional investment vehicles will make investing in Bitcoin easier and lower the risk of fraud, cyber-attacks and lost keys. These risks remain for direct crypto investments.

Crypto-assets are highly speculative in nature and companies with significant exposure to crypto-asset markets can be expected to have a very high level of return volatility.

Summary

Digital assets such as Bitcoin have generated strong investor interest and returns over the past ten years, and the crypto economy is anticipated to continue to grow strongly. The investment opportunity presented by crypto can be accessed by investing directly in cryptocurrencies, or by investing in the companies driving the crypto economy, or by a combination of both. Given the very high volatility of the sector, investors should consider carefully whether such an investment is appropriate for their circumstances.

1https://coinmarketcap.com/

2https://www.researchgate.net/publication/333298459_The_Role_of_Bitcoin_in_the_Monetary_System_Its_Development_and_the_Possible_Future

3https://techstartups.com/2021/05/22/40-us-dollars-existence-printed-last-12-months-america-repeating-mistake-1921-weimar-germany/

4https://www.fidelitydigitalassets.com/articles/corporate-treasurer-bitcoin

5https://www.nasdaq.com/articles/coinbase-ipo-exceeds-all-expectations-showing-more-promise-for-bitcoin-2021-04-19

Investing in crypto assets or crypto focused companies should be considered very high risk. Exposure to crypto assets and companies involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto asset markets.

Investing in crypto assets and companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of the investment.

Any investment in crypto assets and companies should only be considered as a very small component of an investor’s overall portfolio.