Investors should consider bid and offer spreads – also known as buy and sell spreads – when buying and selling exchange traded funds (ETFs).

Here, we explain how bid and offer spreads work.

Summary

- An ETF’s bid and offer or buy and sell spread is the difference between the price at which investors can buy the ETF on the exchange and the (lower) price at which it could be sold on the exchange

- Spreads are often seen as an unavoidable cost of trading and investing, and are not unique to ETFs

- The competitive nature of open exchange markets – as well as the impact of dedicated market makers – helps to ensure ETF bid and offer spreads are as tight as possible

- The narrower the spread the better, as this reduces the trading costs associated with buying and selling ETFs

- Exchange-based spreads, as on the ASX, are set by the competitive tensions between market markers

What are bid and offer spreads, and why should I pay them?

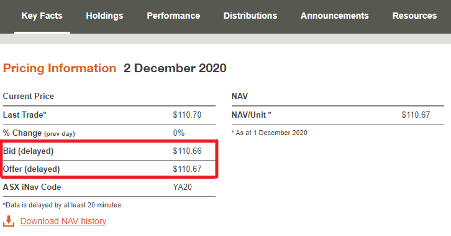

An ETF’s bid and offer spread is the difference between the price at which investors can buy the ETF on the exchange and the (lower) price at which it could be sold on the exchange. This ‘spread’ can be seen when looking at the websites of online brokers and is also displayed by the ASX on the market data pages of its website.

The narrower the spread the better, as this reduces the trading costs associated with buying and selling ETFs. That said, the fact that ETF trading is subject to bid-offer spreads should not be considered a major negative for investors. After all, the issue of bid and offer spreads is not unique to ETFs.

It should be remembered that all securities traded on the ASX are subject to bid and offer spreads, as this is the way the professional trading houses that invest their time and financial risk by standing ready to buy and sell these securities at an investor’s behest – effectively making markets and enhancing liquidity – are compensated.

What’s more, even unlisted investment funds are subject to bid and offer spreads, which can be a combination of entry/exit fees levied by the fund manager and/or an allowance for estimated transaction costs incurred in buying and selling underlying investments.

How are spreads calculated?

Unlike the situation with unlisted funds, the bid and offer spreads for exchange traded securities like ETFs are not set by the product providers (such as BetaShares) or even effectively by the market makers that quote them.

Instead, spreads on the ASX are set by the competitive tensions between market markers. If a market maker’s spreads are too wide, it will lose business to other markers makers that are able to maintain tighter spreads.

In the case of company shares more broadly, the size of bid-offers spreads naturally depends on liquidity factors, such as the frequency and average size of trades involved. For that reason, spreads on larger companies – which are subject to more extensive trading activity – are typically tighter than for smaller companies.

When it comes to ETFs, liquidity and bid-offer spreads depend primarily on the liquidity of the assets the ETF holds. ETFs that invest in liquid underlyings such as large, ‘blue chip’ stocks may be more liquid, and have tighter spreads, than an ETF that invests in less liquid underlying assets such as small companies.

As with most investments, trading costs rise in line with the level of trading activity. The bid and offer cost of buying then selling become a much smaller drag on overall returns when investments are held for the longer-term.

Bid-offer spreads for all BetaShares Funds can be found on the BetaShares website, on the respective product page, as seen below:

When to buy?

To further reduce the impact of bid and offer spreads, investors should also consider the time of the day at which they trade. In the case of ETFs, it is advisable to avoid trading near market open or close, as this is when professional market makers face more risk in pricing ETFs correctly (as they are less sure of the market prices of the underlying securities) and in being able to hedge their risks. For this reason, bid-offer spreads tend to be widest at these times of the day.

Learn about six considerations for buying and selling ETFs and nine key things to know before you make the investment.

Learn more…

To continue learning about ETFs, portfolio construction and investment strategies, visit the Education centre.

Written by

Benjamin Smith

Video and Content Executive

Ben brings a unique blend of financial acumen and creative storytelling to his role. With a solid background as a portfolio analyst, Ben possesses a deep understanding of the financial markets, investment strategies, and how ETFs work.

Read more from Benjamin.