Dollar cost averaging - taking timing out of the investment equation

ETFs started life in the 1990s as a low cost way for traditional investment managers to hold and keep track of the “core” of their portfolios – the stocks they normally seek to hold for the very long term. In the era of paper based share trades – where expensive share custody arrangements were needed to hold and deliver share certificates at settlement of share trades – ETFs became used as a way of reducing custodial costs.

In an era gone by, share certificates were once issued and delivered for settlement.

The role of ‘authorised participants’

The ETF industry began when investment managers transferred parts of their portfolio – comprising stocks within major indices like the S&P 500 – into funds which promised to keep track of the index over time. In return, the funds issued units which moved closely in line with the value of the underlying stocks.

The ETF structure means that instead of having to hold the share certificates for a large number (and sometimes hundreds) of stocks, ETFs allows such institutional investors to hold just one asset (ie units in the fund) – reducing the fees charged by service providers for holding assets on behalf of investors (or ‘custody fees’).

ETFs have, of course, since evolved from these beginnings to become cost-effective, accessible and simple to use vehicles for a broad range of investors. However, the same essential structure described above still underpins the vast majority of equity ETFs globally.

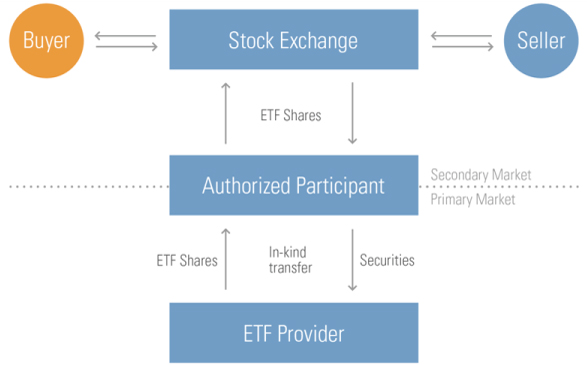

This process of creation of ETF units is known as an “in specie” contribution of stocks – shares themselves are physically transferred to the ETF issuer, who then creates units of equivalent value and transfers them to the vendor.

To streamline the process, and to minimise transaction costs, these “in specie” transfers and creation of units are only available to wholesale investment houses, known as “Authorised Participants”. In ETF-speak, this interaction is known as “primary market” activity.

Once created, ETF units are quoted on a stock exchange (in Australia this is the ASX). Buying and selling on the exchange (which, of course, is the majority of the activity undertaken), is known as ‘secondary market’ activity.

How ETFs are structured and the role of the Authorised Participant

Why is ETF creation and redemption so important?

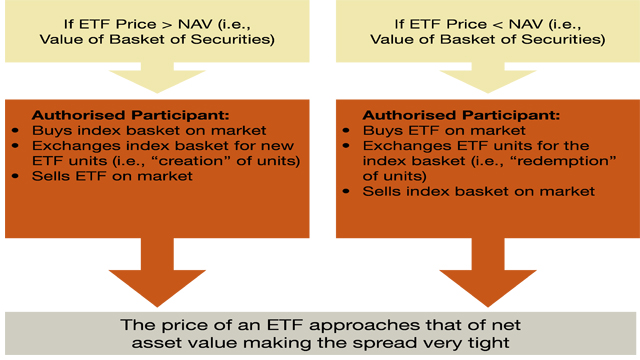

ETF units can be created and redeemed by the Authorised Participant at any time, and this means that liquidity can be increased or decreased to match market demand. For example, if there is more demand for the ETF units, the Authorised Participants is able to simply create extra units and then sell them on-market to meet the demand. Should excess supply occur, units can be ‘redeemed’ at will. Therefore this process of “creation” and “redemption” is a primary contributor to overall ETF liquidity.

The process described above also has an important role to play in seeking to ensure ETFs are continuously priced on the exchange at ‘fair value’ for investors. If the ETF unit price on the exchange diverges from the value that Authorised Participants believe to be the net asset value (NAV) per ETF unit, an Authorised Participant may generally be expected to take advantage of the arbitrage opportunity. For example, if an ETF unit price on the exchange is higher than the expected NAV per unit, an Authorised Participant will create units at their NAV per unit and then sell them on the exchange at the market price. This selling (which increases the supply of ETF units) will tend to drive the ETF price on the exchange back towards NAV per unit. If an ETF unit price on the exchange is less than the expected NAV per unit, the converse would apply.

ETF Arbitrage Mechanism (Source: Betashares)