Contributing to your super

For investors looking to amplify returns, margin loans have long been a go-to strategy. However, traditional investment lending comes with significant risks and drawbacks, including margin calls, high interest rates, and credit assessments.

A smart alternative is emerging in the form of moderately geared ETFs, offering leveraged exposure without requiring investors to take out loans themselves. Instead of borrowing personally, investors gain exposure to gearing through internally managed borrowing within the ETF structure, eliminating the pitfalls of managing debt directly.

While geared ETFs offer advantages over margin loans, they still carry higher risk than non-geared investments and are best suited for investors who are willing to accept higher levels of investment volatility and potentially large moves in the value of their investment.

In this article, we’ll break down how margin loans work, their risks, and why geared ETFs may offer a more efficient and lower-risk approach to leveraged market exposure.

What is a margin loan?

A margin loan is a type of investment loan that allows investors to borrow funds to invest in assets such as shares, ETFs, or managed funds. The idea is simple: by borrowing money to invest, investors can amplify their gains and losses.

Key features of margin loans:

- Loan-to-Value Ratio (LVR): The percentage of an investment portfolio that is financed through borrowings.

- Interest rates: Margin loans usually come with variable interest rates, typically higher than home loans.

- Margin calls: If the value of the investment falls and breaches the LVR threshold, the investor must deposit additional funds or sell assets to maintain the loan balance.

- Risk of liquidation: If an investor can’t meet a margin call, the lender can force the sale of investments to recover the loan amount.

How do margin loans work?

Step-by-step breakdown:

- Investor applies for a margin loan: A lender (e.g. a bank or broker) provides a loan based on the investor’s portfolio.

- Funds are invested: The borrowed capital is used to buy additional investments.

- Portfolio value fluctuates: Gains and losses are amplified due to leverage.

- Margin calls may occur: If the portfolio value drops below the allowable LVR, investors must add funds or sell assets.

- Repayment and interest costs: Interest must be paid as long as the loan is drawn, which can be a substantial cost over time. Loans are often revolving facilities, so repayment of principal can be made at any time, or when the loan is being terminated.

Are there alternatives to margin loans?

Investors looking for leveraged exposure without the risks of margin loans can consider alternatives such as:

- Geared ETFs: Provide leveraged market exposure without margin calls or personal borrowing.

- Listed Investment Companies (LICs) with gearing: Some LICs use internal debt to amplify returns. However, LICs often charge higher fees than ETFs due to active management, with other fees and costs sometimes being charged to the company.

- Derivatives (options & CFDs): While offering leverage, derivatives come with high complexity and risk.

Among these options, geared ETFs stand out as a straightforward, low-cost alternative to margin loans.

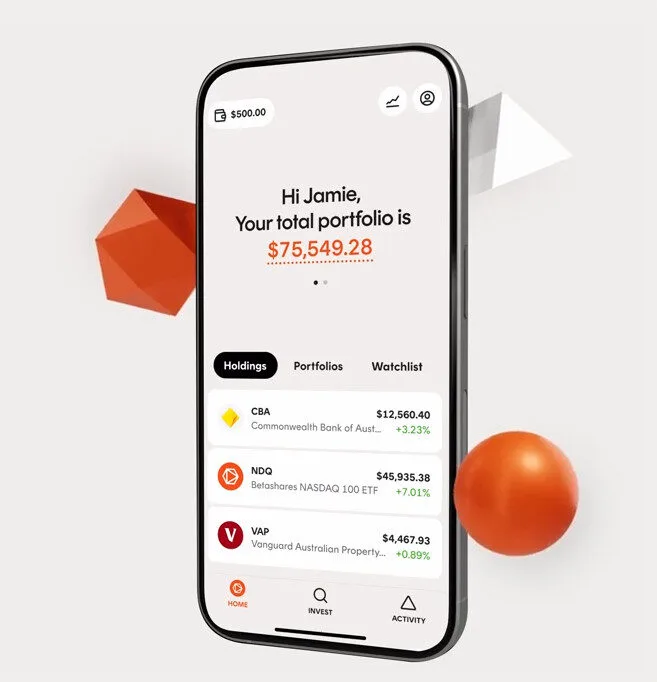

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.

The risks of margin loans

While margin loans offer the potential for higher returns, the potential risks are important to note:

- Margin calls can force unplanned sales: If the market drops suddenly, investors may be forced to sell assets at a loss to meet margin calls.

- High interest costs reduce profitability: Margin loan interest rates tend to attract a higher interest rate than many other ways of borrowing to invest, reducing overall returns.

- Credit assessment and loan rejections: Margin loans require a credit check and approval isn’t guaranteed.

- Emotional stress: The risk of forced liquidation can make margin lending a stressful investment strategy, especially in volatile markets where investors are seeing losses exacerbated by the use of gearing. As such, investors need to monitor their account regularly to ensure it remains in good standing.

- Sudden LVR changes: Lenders control Loan-to-Value Ratios (LVRs) of individual securities and can change them at any time, meaning a previously eligible position may no longer qualify for a margin loan which may have sudden implications for the level of cash investors need to have in their account.

Wealth Builder ETFs: A smart margin loan alternative

Unlike margin loans, where investors borrow personally, Betashares Wealth Builder ETFs use internal borrowing within the fund. This means:

- Investors don’t need to take on personal debt.

- No credit checks or loan applications are required.

- No margin calls – investors are never forced to deposit extra capital.

LVR and market exposure in Wealth Builder ETFs

Betashares Wealth Builder ETFs typically maintain an LVR of 30-40%, meaning they provide market exposure of ~143% to 167% of the fund’s Net Asset Value (NAV).

This controlled leverage ensures enhanced returns while reducing the likelihood of severe losses compared to margin loans, which often have a higher LVR.

Why Wealth Builder ETFs are an attractive alternative to margin loans

- No personal borrowing or credit risk: Unlike margin loans, investors don’t take on debt themselves – the ETF issuer handles borrowing within the fund.

- No margin calls: Because the borrowing happens internally, investors are never forced to sell assets to cover loan requirements.

- Cost-effective leverage: Instead of paying interest directly for a margin loan, the cost of leverage is embedded in the ETF’s structure, potentially resulting in lower interest as a fund issuer can use its scale to negotiate better rates with lenders.

- Simple and accessible: No complex applications, loan agreements, or paperwork – just buy and sell the ETF like any other investment.

- Diversified and professionally managed: The leverage on Betashares Wealth Builder ETFs is monitored to ensure gearing levels stay within acceptable limits, and the funds are invested in a diversified manner.

Risks of Investing in Wealth Builder ETFs

While Wealth Builder Geared ETFs offer a structured and simplified way to access leveraged market exposure, they also come with inherent risks that investors should carefully consider. These risks include (but are not limited to):

- Amplified market volatility: Since these ETFs use internally managed borrowing, their value can fluctuate more than traditional ETFs. In rising markets, this leverage can enhance gains, but in declining markets, losses are also magnified.

- Interest costs and borrowing risks: The fund’s internal borrowing incurs interest costs, which are reflected in the ETF’s performance. If market conditions lead to higher borrowing costs, returns could be affected.

- Potential for underperformance in flat or down markets: If the underlying assets don’t perform strongly, the cost of leverage may lead to lower net returns compared to an unleveraged ETF. In prolonged market downturns, compounded losses can be greater than those of traditional ETFs.

Who should consider geared ETFs?

Betashares Wealth Builder ETFs may be suitable for:

- Growth investors seeking amplified returns.

- Investors looking to avoid personal debt or margin calls.

- Investors with very high risk tolerance.

- Long-term investors who want leveraged exposure without active loan management.

- Investors looking for diversification through a structured ETF vehicle.

How to get started with geared ETFs

- Research Betashares Wealth Builder ETFs: Understand their strategy, LVR, and risk profile.

- Choose a platform: Buy the ETF through a brokerage account or investing platform such as Betashares Direct.

- Monitor your investment: Track your portfolio to ensure you stay within your desired asset allocation ranges, but focus on the long term and avoid panic during volatility.

- Consider Dollar-Cost Averaging (DCA): Spread risk by investing gradually over time.

Margin Loans vs. Wealth Builder ETFs: A Comparison

| Feature | Margin loans | Wealth Builder ETFs |

|---|---|---|

| Leverage mechanism | Investor borrows funds directly from a lender (bank/broker). | ETF issuer borrows funds internally within the ETF structure. |

| Loan-to-Value Ratio (LVR) | Typically 50-70%. | Typically 30-40%. |

| Market exposure | Up to 200% of NAV, depending on LVR. | ~143%-167% of NAV, based on internal gearing. |

| Margin calls | Yes – Investor must add funds or sell assets if LVR threshold is breached. | No – Investors are not responsible for maintaining collateral levels. |

| Credit checks & loan approvals | Yes – Requires credit assessment, and approval is not guaranteed. | No – Anyone can buy and sell the ETF on the ASX. |

| Interest costs | 7-10% p.a. (variable and often high). | Relatively lower, embedded within ETF structure (varies based on borrowing costs). |

| Complexity | Requires application, loan management, and monitoring margin calls. | Simple – Buy and sell like a regular ETF, no loan management required. |

| Risk of forced liquidation | High – Investors may be forced to sell assets during a market downturn. | Lower – Gearing is managed internally to avoid margin calls. |

| Investment accessibility | Requires a margin lending account with a lender. | Available on standard brokerage and investing platforms like CommSec and Betashares Direct. |

| May be suitable for | Experienced investors comfortable managing leverage and debt. | Investors looking for leveraged exposure without the complexity of margin loans. |

Let ETFs do the work for you

For investors seeking leveraged returns without the pitfalls of margin lending, Betashares Wealth Builder ETFs offer a simple and cost-effective solution. With no personal borrowing, no margin calls, and built-in leverage, these ETFs provide an efficient pathway to enhanced investment returns.

If you’re considering margin lending, ask yourself: why take on the risks of margin calls and personal loans when an ETF can do the work for you?

Betashares Wealth Builder range:

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.