The rise of HCRD - and where Aussie credit goes from here

5 minutes reading time

- Diversified

All too often I see individuals getting caught up in complex investment strategies, most of which require a mathematician to decipher. But in the long run, they generally end up with market-like returns. Like Bruce Lee said “simplicity is the key to brilliance” – and there couldn’t be a truer phrase related to the world of investing.

In my opinion, the BetaShares Diversified All Growth ETF (ASX: DHHF) may be one of the most overlooked and under-utilised funds that we have brought to market. There are a variety of ways it can be implemented across nearly any portfolio at any stage in life – all while ticking four key boxes: liquidity, transparency, price and diversification.

In order to best frame how versatile this fund is, here are a few different scenarios in which DHHF could be utilised and the benefits it can provide.

The asset allocator

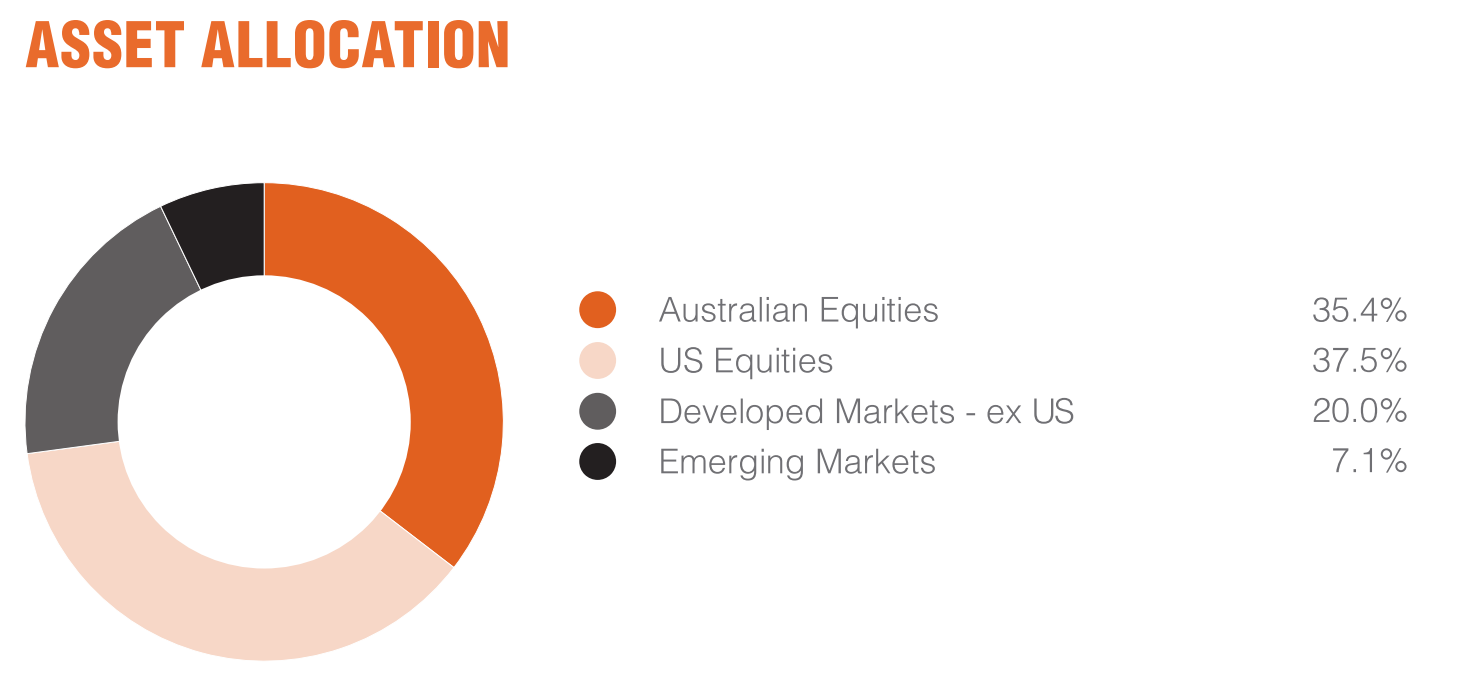

DHHF offers flexibility to those who wish to manage their own portfolios at the asset class level. It can be used as a tactical way for investors to implement the core equity component of their portfolio in a single trade. Satellite exposures can then be added as you see fit, or to achieve your preferred risk profile.

In this instance, DHHF is being implemented as a tool and not as an all-in-one investment decision like a model portfolio. Its main purpose is to provide access to a diversified basket of equities. This allows flexibility to implement your own tactical or defensive allocations within your portfolio.

Having a pure growth allocation allows investors to customise their exposure with defensive assets that best suit their risk profile and income needs. For example, an investor in their 40’s may wish to allocate 20% of their portfolio in 12-month term deposits and a further 10% in a composite bond style exposure like the BetaShares Australian Composite Bond ETF (OZBD). This would result in what we call a “growth” or 70/30 portfolio.

The youthful investor

DHHF can be an investment solution for someone who is just starting out on their investment voyage. In most cases, younger investors will be focused on allocating to predominantly growth assets (such as equities) due to their longer time horizon.

DHHF gives investors access to a portfolio of over 8000 different stocks from all over the world, across more than 60 global exchanges. It delivers investors with exposure to companies with large, medium and small market capitalisation from both developed and emerging markets.

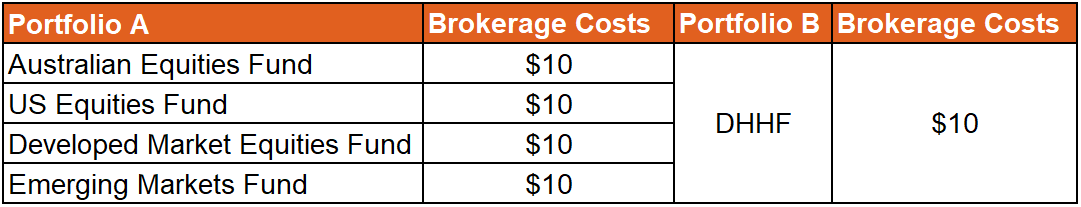

Despite being such a widely diversified ETF, investors can get access to this portfolio through one simple trade on their brokerage platform. One trade means one transaction, so you’re saving on brokerage costs. Brokerage costs can really stack up when you’re first starting out!

Brokerage costs example (common HIN based brokerage platform)

The below example illustrates how significantly brokerage costs can impact the overall cost of implementation. Despite being effectively the same portfolio, investing into the individual funds separately could increase transaction costs by up to four times compared to the one investment in DHHF – that’s $40 every time you want to top up your portfolio vs $10 for DHHF (assuming brokerage of $10 per transaction).

Example provided for illustrative purposes only. Not a recommendation to invest or adopt any investment strategy.

Another key benefit for investors is the fact the fund is rebalanced on a quarterly basis to ensure it remains consistent with target allocations. This means that investors can spend less time chopping and changing their equities holdings in accordance with their desired risk profiles and avoid creating additional tax events and incurring brokerage costs along the way.

Investing for your children

Finally, one for the thoughtful folks out there who are considering investing on behalf of their children. A little while ago I wrote about the concept of compounding returns and the role that time plays in generating higher returns. Getting started when your children are still young is a huge advantage and will have a much larger impact on the end pool when they finally make you proud enough to hand it over.

There are a few different structures that parents can use in order to invest for their children, such as a trust structure, which allows parents (as trustee) to buy and sell investment on behalf of their children. I recommend doing your own research on what suits your situation best.

Where does DHHF come in?

Over the long run, fees are just as important as returns and with management costs at 0.19% p.a., DHHF is the lowest fee all-in-one diversified ETF currently on the ASX – so you can be sure excessive fees won’t be unnecessarily eating into the value of the fund.

Be sure to consider the benefits of the distribution reinvestment plan, which will reinvest the distributions in more units of the fund at no additional brokerage. This ensures that the income genhttps://www.betashares.com.au/education/strategies-portfolio-construction/drp-the-ultimate-short-term-pain-long-term-gain-trade-off/erated within the portfolio is put to good work – adding to your compounding returns over time.

There are risks associated with investment in DHHF, including asset allocation risk, market risk, currency risk, underlying ETFs risk and index-tracking risk. For more information on risks and other features of DHHF, please see the relevant Target Market Determination and Product Disclosure Statement, available at www.betashares.com.au.