Navigating an evolving threat landscape

5 minutes reading time

- Fixed income, cash & hybrids

This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

Investors seeking income and diversification from broad fixed income exposures might have been disappointed last year as the traditionally defensive asset class experienced a sell-off alongside equities. Additionally, the past two years have been marked by significant volatility in both fixed income and equity markets. To reduce risk of capital loss while pursuing attractive income opportunities, turning to fixed income may be the way to go. However, investors may need to take a more targeted approach.

Within the fixed income universe, “credit income funds” offer reduced volatility exposure and attractive income prospects. These funds typically invest in securities like floating rate bonds, which reduce sensitivity to expected interest rate shifts (they often have an interest rate duration of 0-2 years and are benchmarked against the Bloomberg AusBond Bank Bill Index). This enables investors to enjoy potentially enticing income with a high level of capital stability.

Betashares Australian Bank Senior Floating Rate Bond ETF (ASX: QPON) has been one of the best performing credit income funds in Australia since its inception in 2017. QPON invests in some of the largest and most liquid senior floating rate bonds issued by Australian banks, providing a high-quality exposure at the top of the Australian bank capital structure. QPON offers investors the potential for attractive monthly income and a high level of capital stability, as well as lower interest rate sensitivity compared to fixed rate bonds. Historically, accessing floating rate notes directly has been challenging for investors. However, the ETF structure enables exposure through the ASX with T+2 liquidity.

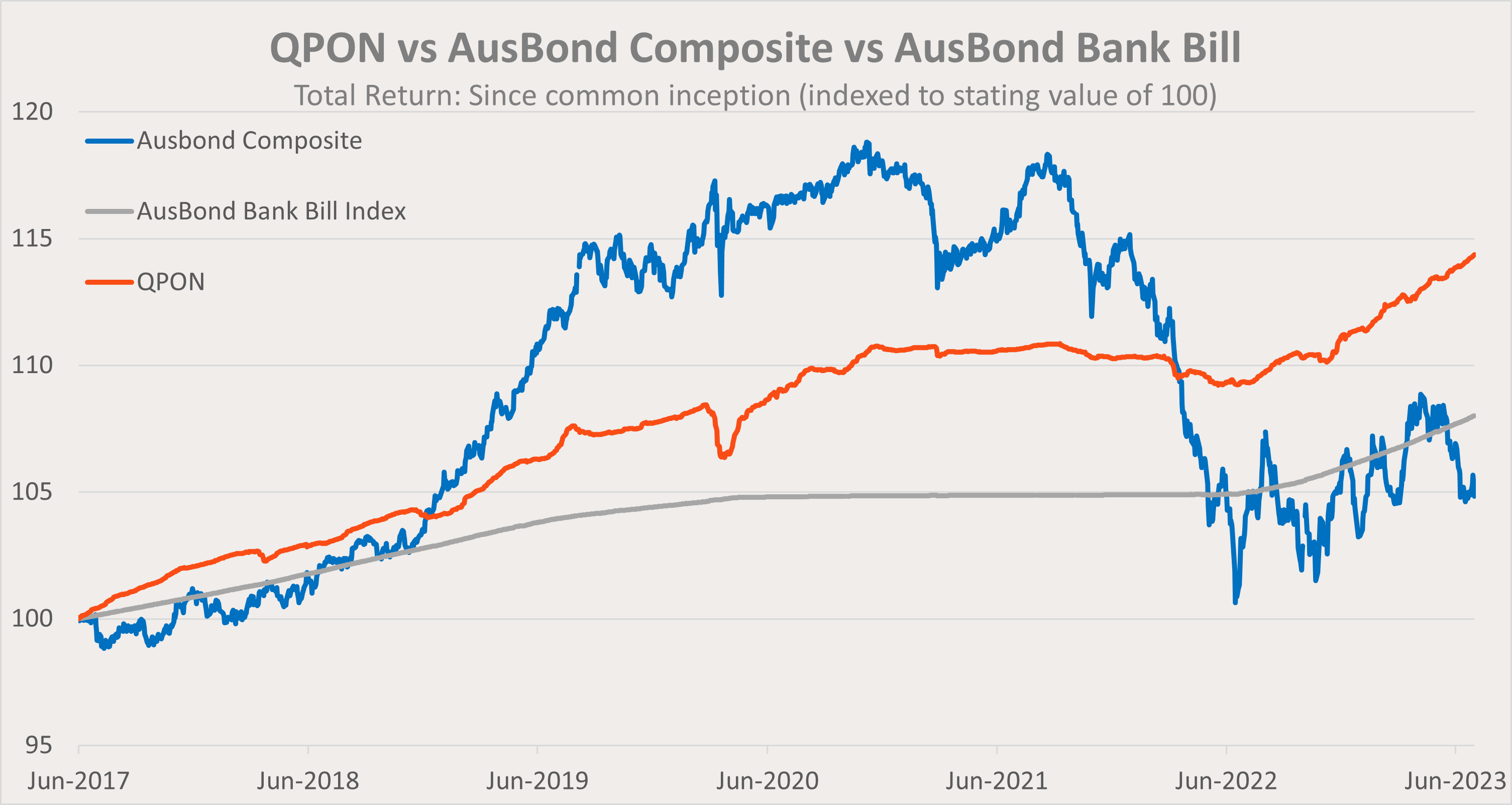

Since its inception in June 2017, QPON has offered attractive returns over cash with significantly less volatility and lower drawdowns than fixed rate bonds. These qualities may make it a suitable choice for both conservative investors and those seeking to enhance returns over cash through their defensive assets.

Source: Bloomberg. As at 31 July 2023. Represented are Betashares Bank Senior Floating Rate Bond ETF (QPON), Bloomberg AusBond Composite 0+ yr Index, and Bloomberg AusBond Bank Bill Index since common inception of 1 June 2017. Past performance is not indicative of future performance of any index or ETF. You cannot invest directly in an index.

Not all credit income funds are created equal

QPON’s index was purposefully constructed to allocate only to senior floating rate bonds with amounts outstanding of at least $500 million and a term to maturity between 1 to 5 years. This allocation includes up to 80% of the portfolio being assigned to bonds issued by the ‘big 4’ Australian banks and up to 20% of the portfolio allocated to other major Australian banks. This strategy ensures a high-quality exposure and potential for attractive income.

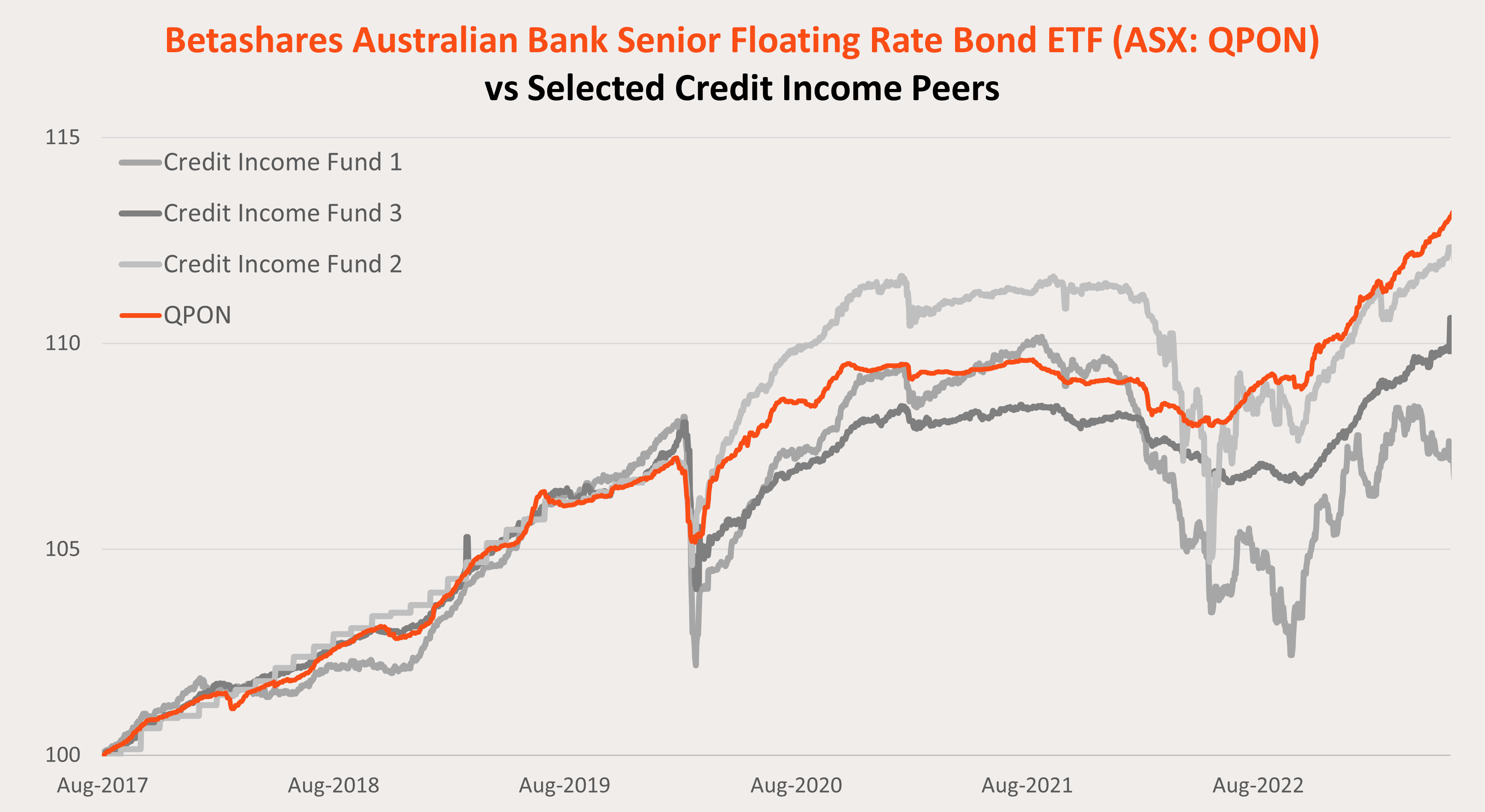

In contrast, active credit income funds generally invest in a wider range of security types, which may include asset-backed securities, emerging market bonds, high yield and hybrid securities, and selectively over and underweight across and within each security type. As a result, their exposure to interest rate and credit spread sensitivity can vary over time, along with their credit ratings. While active managers strive to strategically allocate among these securities to generate alpha, QPON has outperformed the three largest credit income funds in Australia since its inception to 30 June 2023, particularly during periods of market stress . Additionally, QPON has achieved this performance with lower volatility and fewer drawdowns .

Source: Bloomberg. As at 30 June 2023. Comparison is against three largest funds by FUM across the Morningstar Categories “Australia Fund Bonds – Australia”, “Australia Fund Diversified Credit”, “Australia Fund Unconstrained Fixed Income” that are benchmarked in whole or in part to a variable rate index. Performance shown since common inception of 1 June 2017, indexed to a starting value of 100. Performance shown net of QPON management fee and costs (0.22% p.a.). Not a recommendation to invest or adopt any investment strategy. Past performance is not indicative of future performance.

QPON’s current all-in yield is 5.03% p.a. (as at 21 August 2023).1 You can find more information on QPON, including its all-in yield updated daily, on the fund page here.

QPON is rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.