ETF distributions: frequently asked questions

6 minutes reading time

In recent years, Emerging Markets have generally not been a happy hunting ground for investors. The MSCI Emerging Markets Index (AUD) returned -0.73% p.a. over the 3 years to 29 Feb 2024, while MSCI World Index (AUD) delivered 15.10% p.a.

To sum up what went wrong – in a word, China. The silver lining is that there are excellent investment opportunities with strong tailwinds and reasonable valuations in Emerging Markets – you just have to know where to look.

China’s economic woes

China’s economy grew 5.2% in 2023, a long way off the double digit growth rates it achieved throughout the 2000s from rapid urbanization. The previous growth model fueled by real estate and infrastructure spending has lost steam as the CCP’s deleveraging campaign and “Common Prosperity” agenda have seen property developers like Evergrande unable to pay back debtholders. It has become difficult for properties to be constructed and sold to aspiring homeowners, negatively impacting consumer confidence given 60-70% of household wealth is tied up to real estate in China. Stress in the property sector has had second order effects on consumer confidence, domestic consumption and deflation.

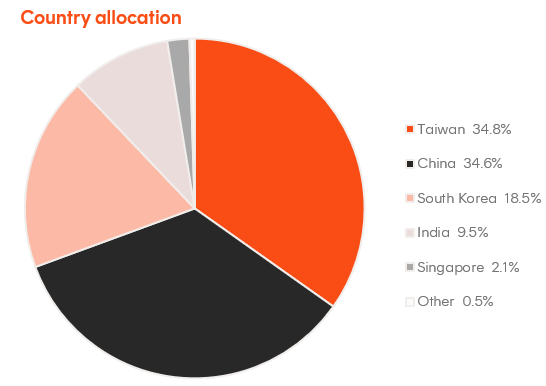

As the largest country weight in the MSCI Emerging Markets Index, the de-rating of Chinese equities hit the broader index hard, but EM arguably now presents a compelling investment opportunity.

Look for companies with strong fundamental growth

The good news is that Emerging Market companies now trade off much cheaper valuations than their Western counterparts. And coupled with that, there is one area in particular that is seeing very strong growth prospects. Technology-related sectors such as Consumer Discretionary and Information Technology are expected to grow earnings at 26% and 22% respectively, far higher than other Emerging Market sectors. Below we look at what some of the leading EM tech companies have to offer.

Taiwan – TSMC

Taiwan Semiconductor (TSMC) is arguably one of the most important companies in the world. It is the largest manufacturer of advanced semiconductor chips which are required for building and developing artificial intelligence (AI) applications. For example, Nvidia’s new AI chip – Blackwell B200, will use TSMC’s 4NP manufacturing capabilities to scale production. Notably, TSMC also manufactures chips for other large tech companies including Microsoft, Meta, and Amazon which have all invested heavily in AI research & development.

TSMC is currently trading at a 1 year forward PE ratio of 19.8, lower than Nvidia and Intel at 36.5 and 32.6 respectively1. Whilst this may be due to left tail geopolitical risks from China invading Taiwan, TSMC’s dominance as the world’s go-to manufacturer of advanced semi chips should somewhat demand a higher premium to its current valuation. The company is also expanding their manufacturing footprint beyond Taiwan with fabrication plants in Arizona, Germany and Japan2.

South Korea – Samsung and SK Hynix

AI applications require both a logic chip (to perform calculations) and a memory chip (to store data) – just like a human requires a brain and memory to access information quickly.

South Korea is home to 2 of the largest memory chip manufacturers, Samsung and SK Hynix. These two companies combined account for almost 70% of dynamic random access memory (DRAM) production3. Revenue and earnings for these companies should increase on the back of increased memory chip demand from ‘Magnificent 7’ AI investment. In fact, earnings per share (EPS) for SK Hynix is estimated to grow to $4.24 by the end of 2024 after reporting negative EPS of $1.50 a year earlier according to Bloomberg estimates.

India – Infosys

India is quickly becoming the ‘market darling’ of the world, experiencing rapid rates of growth whereas most other countries are slowing down. The country grew 8.4% in the final three months of 20234, driven by favourable demographics and a growing tech-savvy population. As businesses digitize and automate their processes, the demand for IT consulting services has never been greater in the 21st century.

Infosys is a global leader in technology business consulting and global outsourcing services. Its share price has more than doubled over the last 5 years, driven by structural spending on IT services. Enterprises are embracing new and emerging technologies such as cloud and AI to deliver cost savings and increase productivity, benefiting companies like Infosys which provide specialised services in these areas.

China – Tencent and Alibaba

Whilst investors are particularly wary of the Property and Financials sectors in China, the country still has strong growth opportunities within the Consumer Discretionary/IT sector.

Alibaba is the largest e-commerce player in China, with 40% market share in terms of net gross merchandise value (GMV) in 20235. While Alibaba did come under regulatory pressure in 2020/21, its underlying business remains very strong, with expected EPS growth of 18% in the next year. The balance of downside and upside risk appears quite attractive as the stock trades at a forward PE ratio of only 8.2x.

Tencent is also trading at its lower range of 14.1x forward PE, despite their leadership in online gaming (with over 50% market share6), online advertising and digital payments.

Supporting these companies and the economy more broadly is recent fiscal and monetary stimulus from the Chinese government which should act as a backdrop to a deterioration in GDP growth numbers and large equity market drawdowns.

How to get access to leading EM tech companies

ASIA Asia Technology Tigers ETF provides exposure to the 50 largest technology companies from Emerging Market Asia, including all of the names listed in this article.7

The criticality of some of ASIA’s companies to the global semiconductor supply chain cannot be understated. If Nvidia is indeed the most important company in the world, then its worth knowing that last year 54% of their cost of goods sold came from the companies in ASIA.8 Yet despite this ASIA is currently trading at a 1 year forward PE ratio of 14.8. ASIA also provides exposure to the structural growth of India and the leading tech platforms of China, that may be posed for a turnaround. There is a lot to like about ASIA as a compelling investment opportunity within Emerging Markets.

There are risks associated with an investment in ASIA, including information technology risk, concentration risk, emerging markets risk and currency risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

1.Bloomberg estimates as of 21 March 2024 ↑

2,https://www.reuters.com/technology/tsmc-build-second-japan-chip-factory-raising-investment-20-bln-2024-02-06/ ↑

3.https://www.chosun.com/english/industry-en/2024/02/29/SGS2LHTAAJAIHBDRMMJLBHGSFA/#:~:text=Samsung%20Electronics%20and%20SK%20Hynix%20account%20for%20almost%2070%25%20of,the%20matter%20on%20Feb.%2029 ↑

4.https://www.bloomberg.com/news/articles/2024-02-29/india-s-economic-growth-unexpectedly-accelerates-to-above-8 ↑

5.https://www.dbs.com.hk/treasures/aics/stock-coverage/templatedata/article/equity/data/en/DBSV/012014/9988_HK.xml ↑

6.https://www.statista.com/statistics/868870/market-share-of-leading-online-gaming-operators-china/#:~:text=Leading%20online%20gaming%20companies%20market%20share%20China%20Q1%202019&text=In%20the%20first%20quarter%20of,51.5%20percent%20of%20market%20share. ↑

7.As at 25 March 2024. No guarantees these companies will remain the ASIA’s index going forward ↑

8.Bloomberg, as at 21 March 2024. ↑