What is the ‘Innovation Exemption’ and why does it matter?

6 minutes reading time

- Digital assets

Bitcoin and the rest of the crypto market traded in a tight range and ended up relatively flat over the last seven days.

At the time of writing, bitcoin is trading at US$19,673. Ethereum outperformed bitcoin, up 3.12% vs bitcoin’s -2.07% loss for the week.

Bitcoin’s market cap is US$376.6B, with the total crypto market now at $971B. Bitcoin’s market dominance is the lowest since June 2018 at 38.76%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $19,673 | $20,542 | $19,600 | -2.07% |

| ETH (in US$) | $1,547 | $1,643 | $1,427 | 3.12% |

Source: CoinMarketCap. As at 4 September 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Celsius attempts to return crypto to customers

Bankrupt cryptocurrency platform Celsius Network Ltd has requested permission from a US bankruptcy judge to return about $50 million worth of cryptocurrency to clients. The $50 million is only a small portion of the more than $200 million stuck in custody accounts on the platform.

Many customers deposited crypto with the platform to earn interest thereby losing ownership of their coins, however customers who deposited crypto with the intention of only storing them in custody accounts technically retained title to the coins, according to the company. According to court documents, the market value in ‘earn accounts’ totalled about $4.2 B as of 10 July. A full hearing on the request is set for 6 October, according to court papers.1

CBDC Sandbox Program

The Digital Dollar Project (DDP), a non-profit organisation in the US, is launching a sandbox program to explore central bank digital currency (CBDC) use cases. The program, set to launch in October, will have a focus on cross-border payments. Ripple, Digital Asset, EMTECH, and Knox Networks are four organisations which have been named to help the DPP. The first phase will focus on education to get a better understanding of the technology. A second phase focusing on a pilot will conduct tests to “identify and test specific CBDC use-case hypotheses”.

Jennifer Lassiter, an executive director with DDP, said: “We understand how important it is to include a diverse set of views and expertise as we look to answer key questions about how the technology could work, the problems we hope to solve, and the ultimate business and individual outcomes we want to achieve.”2

Dormant bitcoin make a move

Last week, on-chain data revealed 10,000 BTC from a single wallet, currently worth approximately US$200 million, were moved in two separate transactions. It was the first time that any bitcoin had moved from the wallet in over seven years. The first transaction was for 5000 BTC, followed by another 5000 the following day, according to a post by on-chain analytics provider, CryptoQuant. Analysts agree there isn’t much evidence to draw any solid conclusions as to why the bitcoin may have moved now.3

On-chain metrics

Bitcoin (BTC): New Address Momentum

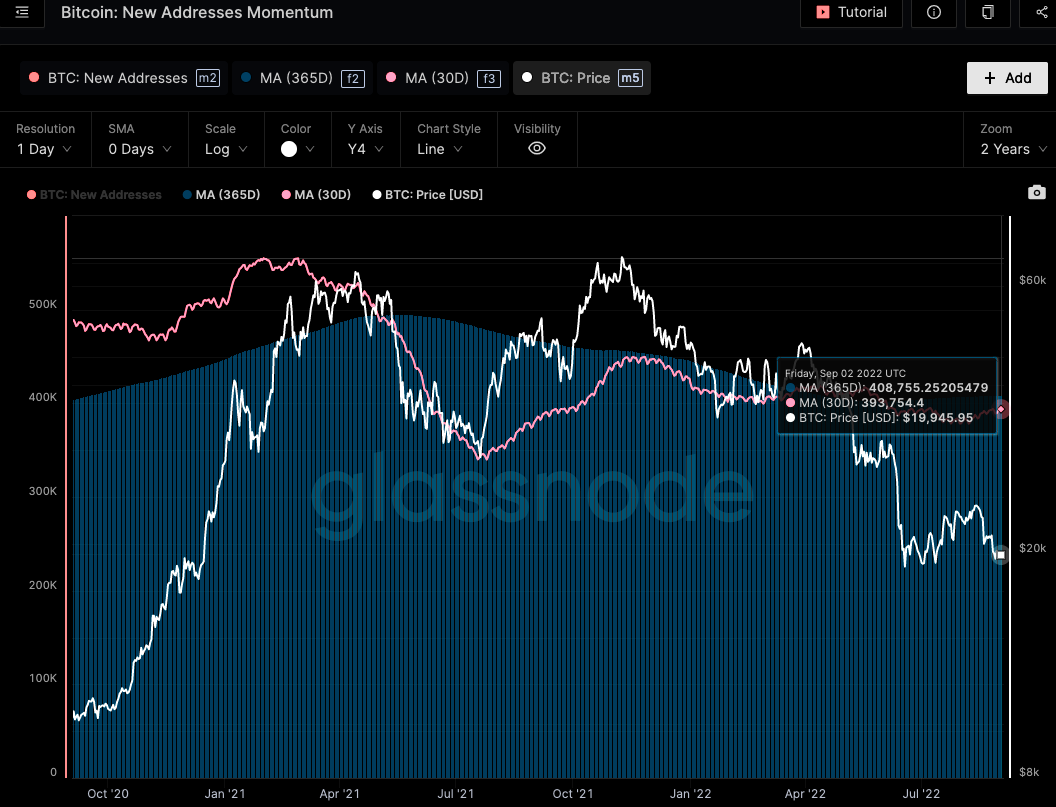

New Address Momentum compares the monthly average of new addresses against the yearly average. Looking at this metric enables us to underline relative shifts in dominant sentiment and help identify the reversal for network activity.

Looking at data from on-chain analytics company Glassnode, the 30 DMA of new addresses fell sharply below the 365 DMA as prices plunged from April to July 2021. In terms of network activity, this could be considered the start of a bear market phase considering that although the price rebounded sharply, the 30 DMA never got back to previous highs.

The monthly average of new addresses is still lower than the yearly average confirming low demand in the market. A turnaround of the 30 DMA above 365 DMA for new addresses historically has signalled new demand entering the market.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Mining Difficulty

According to Glassnode, the Mining Difficulty looks at the current estimated number of hashes required to mine a block, or how computationally difficult it is for Bitcoin miners to mine Bitcoin’s next block.

Looking at the data on Glassnode, the hash rate for Bitcoin is recovering fast. The recent bear market has affected many miners in the industry. BTC mining difficulty has increased by 9.26% after the latest adjustment, the largest since January this year and the third adjustment in a row where the difficulty has risen.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, JPMorgan’s Head of Digital Assets, Umar Farooq, thinks that the sector hasn’t matured enough and that most crypto assets on the market are “junk”. Speaking last week on a panel discussion at the Monetary Authority of Singapore’s Green Shoots Seminar, he stated that regulation is yet to catch up and is holding back traditional financial institutions from getting involved. He also felt that a lot of money currently in the space is for speculative investment.4

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://www.bloomberg.com/news/articles/2022-09-01/bankrupt-celsius-seeks-to-return-50-million-of-locked-crypto?srnd=cryptocurrencies-v2&sref=6EQWk76O

2. https://news.bitcoin.com/ripple-to-participate-in-the-digital-dollar-projects-cbdc-sandbox-program/

3. https://www.coindesk.com/markets/2022/09/02/long-dormant-bitcoin-move-at-low-prices-but-its-probably-nothing/

4. https://cointelegraph.com/news/most-of-crypto-is-still-junk-and-lacks-use-case-jpmorgan-blockchain-head

Off the Chain will be published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.