ETF distributions: frequently asked questions

4 minutes reading time

A wrap up of the charts catching our eye over the past month

Stock and bond volatility surged in October as markets approached the highly anticipated US election. Gold rallies further amidst geopolitical tensions escalating in the Middle East, and Trump’s reelection as the president-elect may put upward pressure on inflation due to tariff and immigration policies.

1 – America First

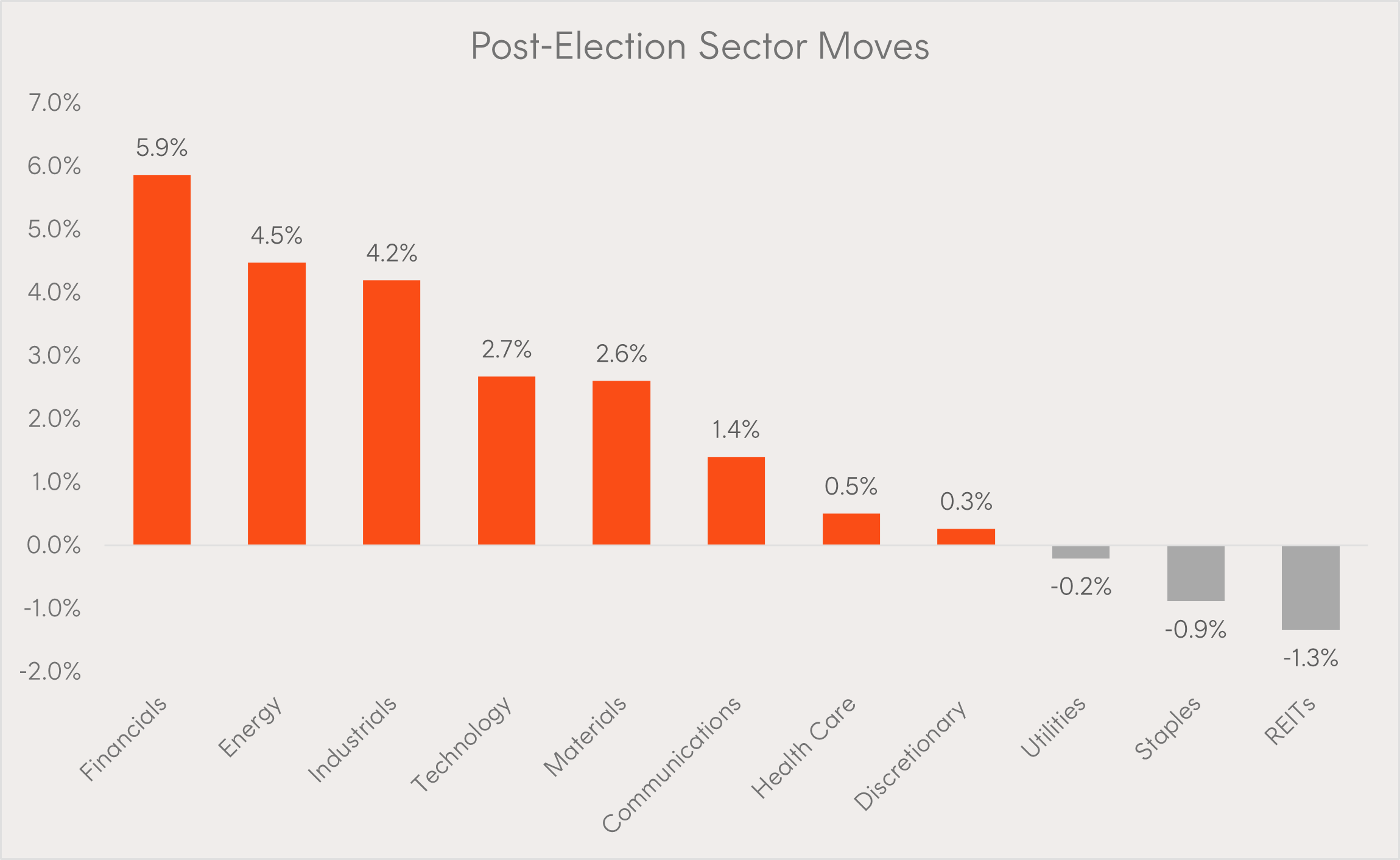

Financials, Energy and Industrials were the best performing sectors following Trump’s election victory as markets shifted towards the prospect of deregulation, tax cuts and a more business friendly backdrop.

However, interest-rate sensitive sectors such as Utilities, Staples and REITs were the worst performing sectors as the yield on US 10 year Treasury bonds breached 4.40%.

Chart 1: US Sector Performance as at 6 November 2024

Source: Goldman Sachs, Betashares as at 6 November 2024. Past performance is not indicative of future returns.

2 – Trump tariffs a threat to Asian exporters

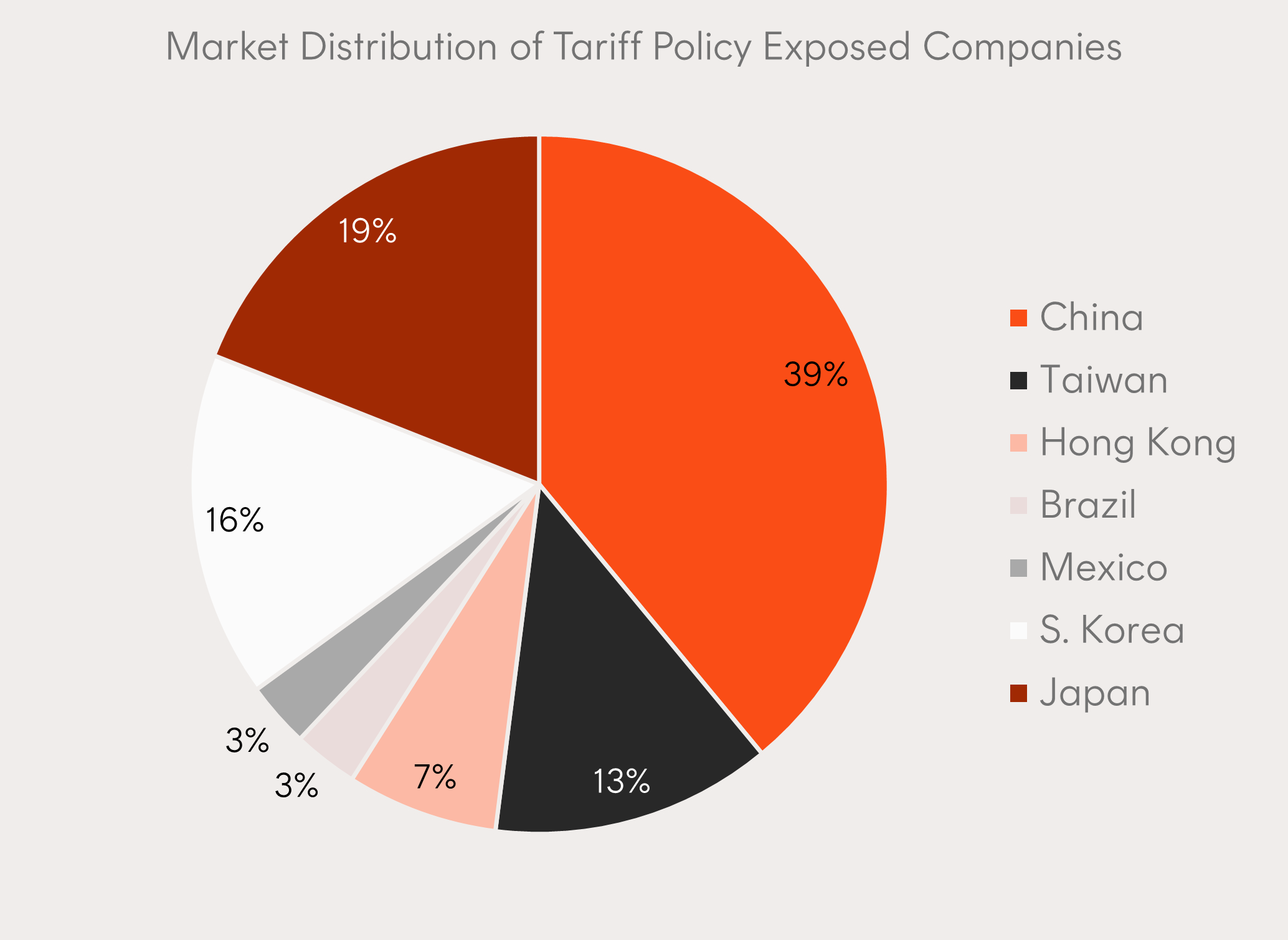

Trump’s tariff proposals present headwinds for many Asian and emerging market countries where exports are a key driver of GDP growth, particularly for China.

A proposed 60% tariff on US imports of Chinese goods under a second Trump administration is likely to pose major growth risks for the world’s second largest economy and increases the possibility of undershooting their 5% annual growth target.

However, a $1.4 trillion debt package to help local governments’ financing strains has cushioned some of the impact on Chinese equities with the CSI 300 relatively flat since the election outcome.

Chart 2: Market distribution of tariff policy exposed companies

Source: Morgan Stanley, Betashares.

3 – Safety in Gold

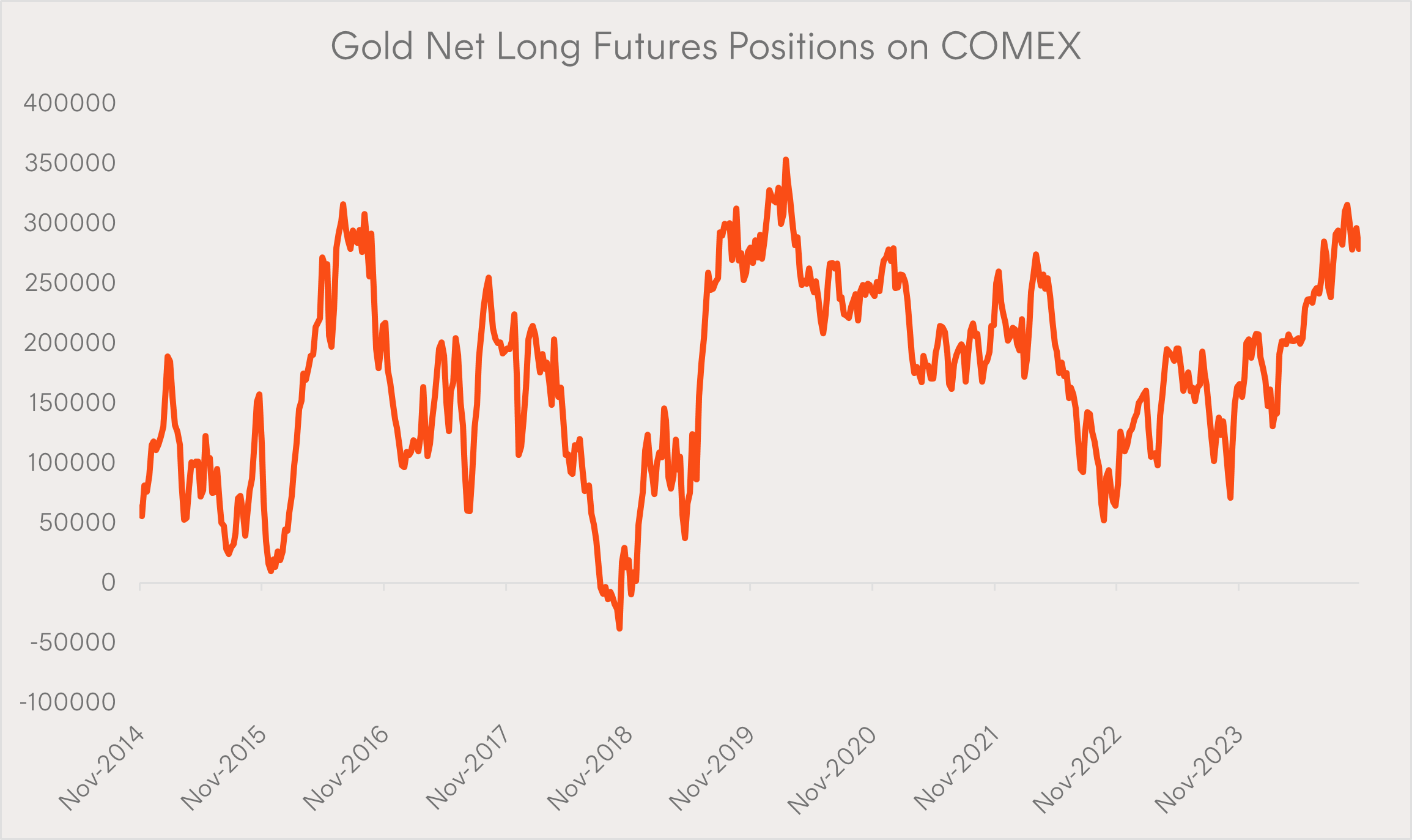

Gold positioning has risen to very high levels with net long futures position on Commodity Exchange (Comex) at the 93rd percentile of the distribution since 2014 according to research from Goldman Sachs.

Geopolitical tensions rose in late October when Israel launched three waves of strikes against 20 locations in Iran, further driving investors to seek safe haven assets like gold.

Chart 3: Gold net long futures position on COMEX

Source: Bloomberg, Betashares as at 31 October 2024. Past performance is not indicative of future returns.

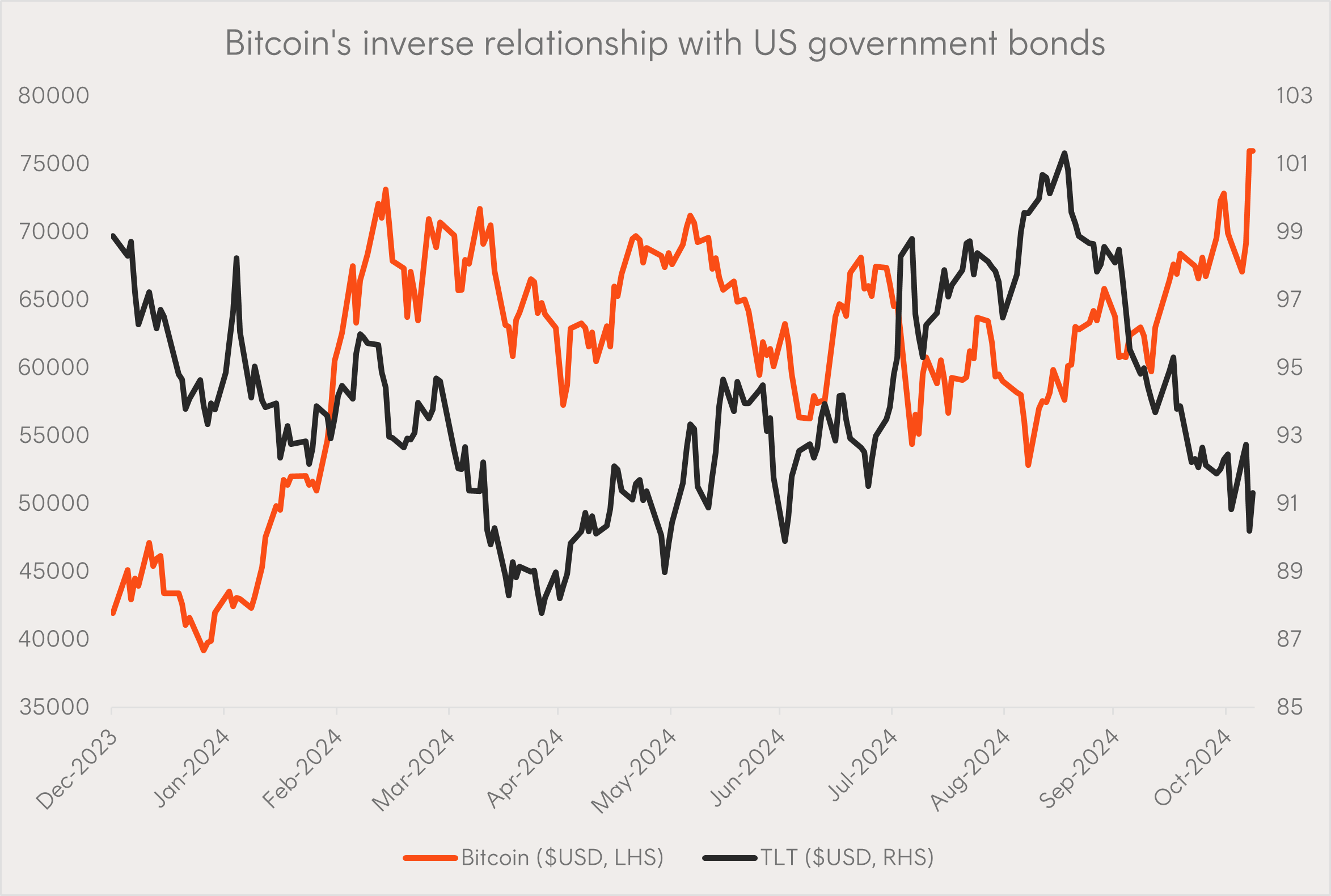

4 – Bitcoin rallies, bonds fall

Bitcoin rose to record highs rising above $US75,000 as sentiment shifted towards digital assets following Trump’s election victory. This follows Trump’s pledge at a keynote bitcoin conference in July to maintain all of the bitcoin the U.S. government currently holds as reserves.

However, fixed-rate bonds suffered as rates on the long end of the yield curve rose significantly throughout the month of October.

Chart 4: Bitcoin vs US 20+ Year Treasury Bond ETF (TLT)

Source: Bloomberg, Betashares. As at 7 November 2024. TLT refers to the iShares 20+ Year Treasury Bond ETF (NASDAQ: TLT). Past performance is not indicative of future returns.

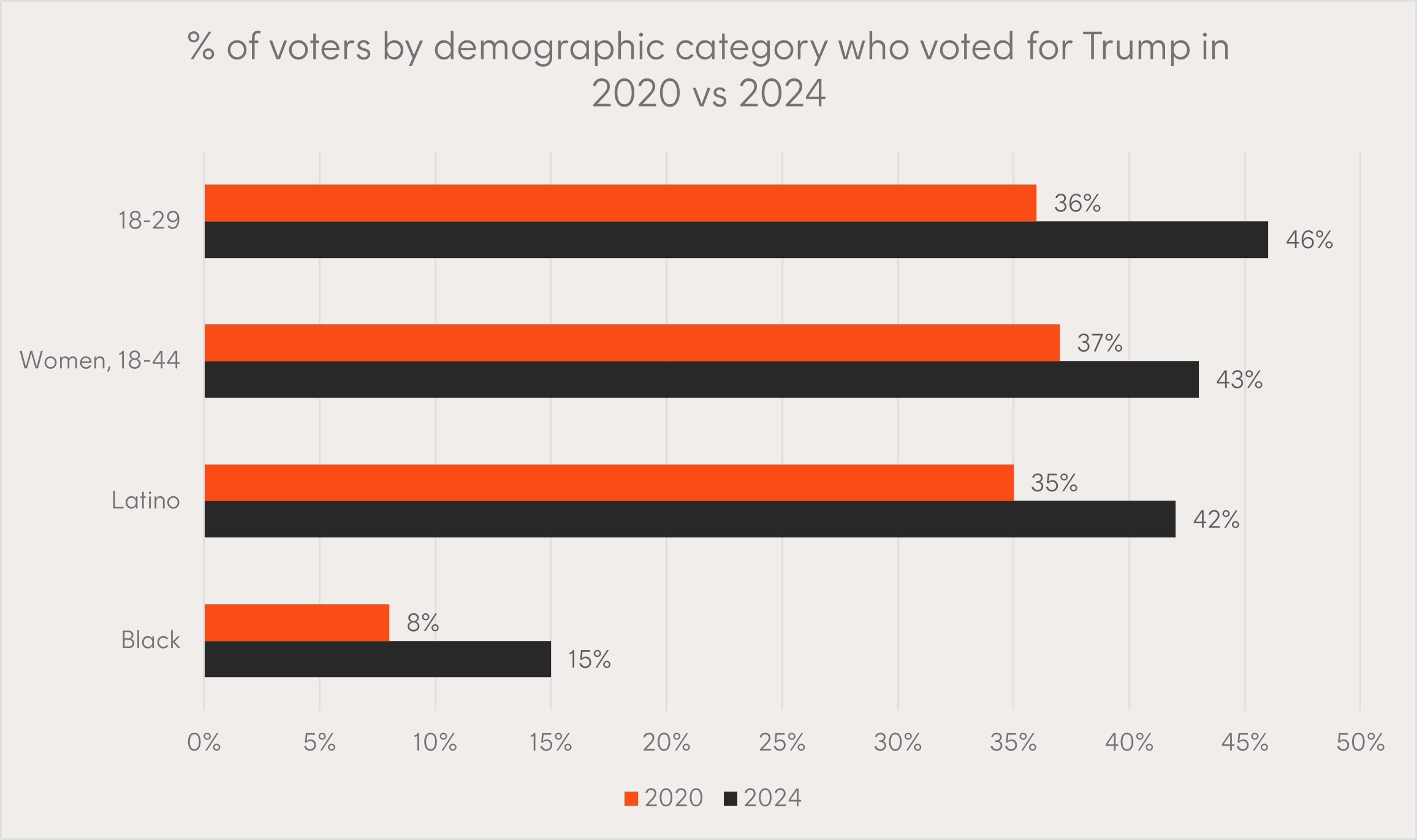

5 – Shifting voter dynamics

This year’s election results show shifting dynamics within Trump’s voter base, with an increased share of young, female, Black and Hispanic voters compared to the 2020 election – traditionally demographic categories aligned with the Democrats.

Chart 5: Percentage of voters by demographic category who voted for Trump in 2020 vs 2024

Source: AP Vote Cast Surveys. As at 8 November 2024.

That’s all for now, but we’ll be back next month with more interesting insights as markets digest what a Trump victory means for 2025.