Wet lettuce

6 minutes reading time

Late last year we highlighted a potential investment opportunity in China as COVID restrictions began to ease. Since then, Chinese policy announcements have been decidedly market-friendly with the ending of a two-year ban on Australian coal imports, easing up on tech giants and dialling back the stringent “three red lines” that exacerbated a property meltdown.

In response, Hong Kong and Chinese mainland equity indices have been among the best performing markets since November last year.

The question now is whether this clear shift in policy is likely to fuel a sustained recovery, or should investors remain cautious about conditions in China?

Outbreak following end of zero-COVID policy

In December, China put an end to its controversial zero-COVID policy. This meant people could isolate at home rather than being forced into quarantine camps, and travel restrictions were eased.1

However, this resulted in a large increase in cases and deaths, with official reports of nearly 13,000 COVID deaths reported in the week to 19 January, on top of nearly 60,000 in the prior month. But with officials suggesting that 80% of the population has now been infected, there does not appear to be too much concern about a second wave. Nevertheless, as millions of migrant workers returned to rural areas for Lunar New Year, the risk of spreading COVID in the country remains on officials’ radars.

For better or worse though, mobility is surging. On Lunar New Year eve, travel via rail, highway, ship, and plane was up over 50% on last year – though still just half pre-pandemic levels.2

Crackdown on tech companies easing

Chinese regulators have been investigating and “guiding” 14 large tech platforms for over two years now. Among those targeted were Alibaba, Didi, Baidu and Tencent. According to the Global Times, a government-owned newspaper, the regulators have been carrying out “rectification on prominent issues associated with their financial businesses, such as operating without a license, regulatory arbitrage, blind expansion, and infringing on consumers’ rights.” On 7 January, this rectification was declared “basically completed” by the party secretary of the People’s Bank of China.

This could set the stage for an IPO of Alibaba-owned Ant Group, albeit at lower valuation than its abandoned 2020 IPO, although the company is downplaying this suggestion for the time being.3

In another sign of a more accommodating approach to regulation, the video game regulator appears to be increasingly willing to grant licenses for new online games by Tencent and NetEase. The two industry leaders were denied the ability to publish new games for a 15-month period as part of the government’s crackdown on online gaming.

Ban on Australian coal lifted and a resumption of China-Australia relations

After more than two years of an ‘unofficial’ ban on Australian coal imports to China, the rules are finally being eased, allowing some imports to resume. Rather than being for energy security or economic reasons though, suggestions are that this move was more about repairing diplomatic relations between the two countries.4

Growth expectations rising

With lockdowns ending and restrictions easing, Chinese economic activity rebounded strongly in December. The non-manufacturing PMI, which is a measure of activity in both the services and construction sectors, beat expectations to hit 54.4, up from 41.6 previously.5

China’s 2023 growth outlook is improving, and stands in stark contrast to pessimistic growth expectations in developed markets. Morgan Stanley, Goldman Sachs, Bloomberg and the IMF have all increased their 2023 Chinese GDP growth forecasts to between 5.2-5.8%. Common factors cited include release of excess savings, stronger and resilient consumption, a recovery in jobs and income and better economic coordination with the easing of restrictions.

What are the risks?

While structural headwinds stemming from a likely prolonged housing market downturn, the ageing population, US-China tensions, and geopolitical overhangs remain a threat, they don’t disqualify our view that China looks well positioned across the growth, policy, and inflation cycles in a global context in 2023.

President Xi Jinping has made efforts to consolidate power in recent years. In 2018, he removed term limits, allowing him to remain president for life.6 Last year, he promoted several loyalists while sidelining moderates.7

With a command-economy like China’s, the government always has the option of taking control (as we’ve seen in recent years). As a positive, this does allow for a more coordinated government response in an economic crisis, whereas the US faces political gridlock again this year over their debt ceiling. But, we must acknowledge the higher risk of government intervention individual companies face in China, so all else equal, a higher equity risk premium (i.e. lower valuation multiples) should be expected.

China still looks relatively attractive on both valuation and diversification grounds

Even after the re-rating of the last four months, Chinese equities trade at a significant valuation discount relative to their US counterparts. As certainty increases, the size of this gap is likely to narrow, pointing to the potential for Chinese equity outperformance.

Western economies face headwinds of inflation, synchronised central bank hiking, weak or negative growth, and the post-COVID re-opening bump is well and truly in the rear-view mirror. In contrast, China is enjoying benign inflation, supportive fiscal and monetary policy, rising consumption and a strong growth outlook. This complete decoupling of the Chinese economic cycle from the West means Chinese equities offer excellent prospects for diversification.

In particular, the outlook for Chinese tech stocks like Alibaba and Tencent, arguably looks much brighter than US tech, following the regulatory reset. The Chinese ADR-delisting threat has diminished, advertising revenues are recovering and spending on Cloud is expected to more than double as China seeks to catchup with the US in that field. 8

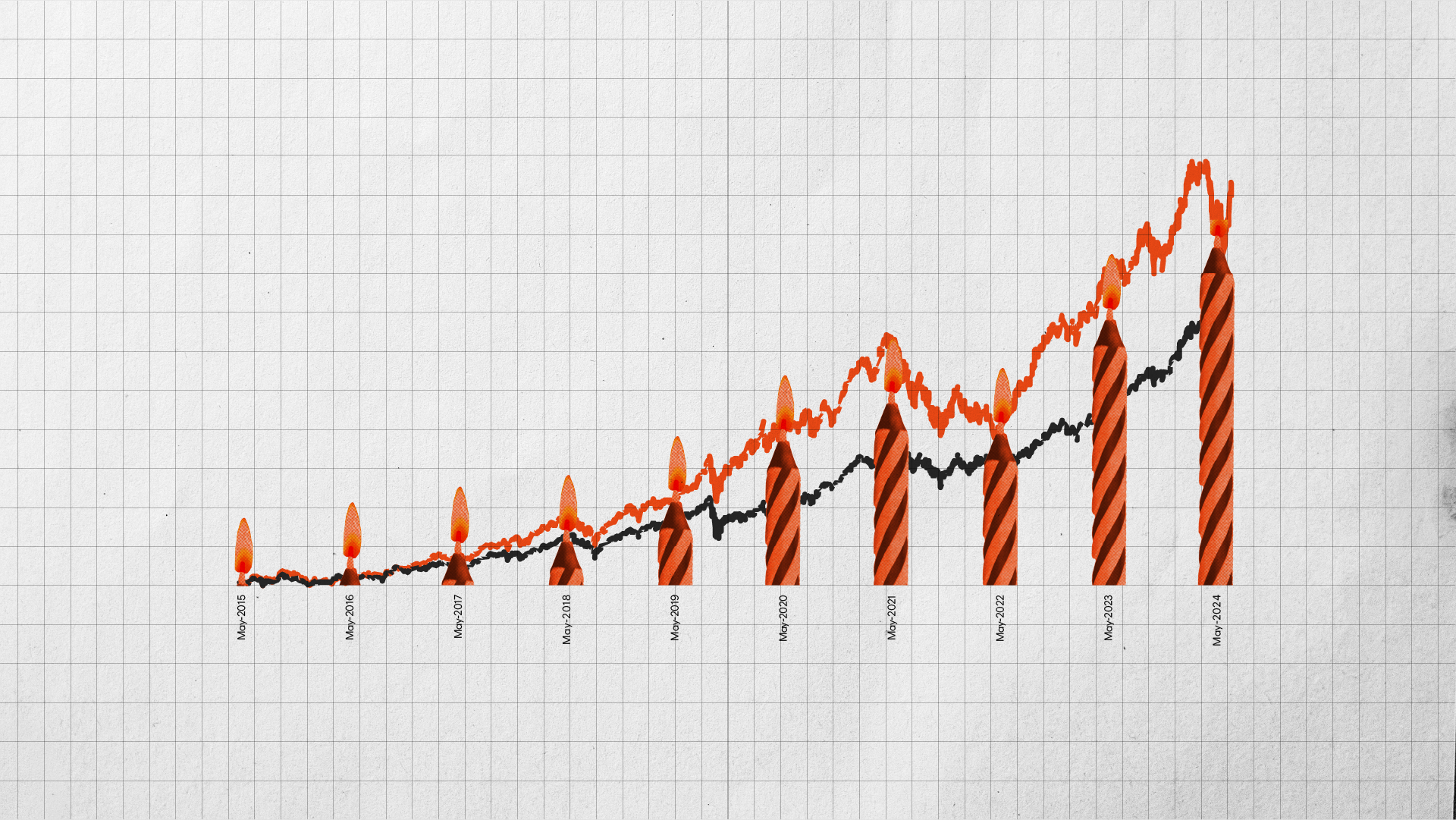

Betashares Asia Technology Tigers ETF (ASX Code: ASIA) provides exposure to Asia’s 50 largest technology companies (ex-Japan), and has China country weight of approximately 50%.9

ASIA has been a volatile exposure over the last three years, but as a result it is now trading at pre-COVID levels, but with a significantly lower P/E ratio.

ASIA P/E and unit price on select dates over 31/12/2019 to 31/01/2023

| Date | Event | 12-month Trailing P/E | Unit price |

| 31/12/2019 | EOY 2019 | 26 | $7.13 |

| 14/02/2020 | Pre-Covid High | 32 | $7.89 |

| 20/03/2020 | Covid Low | 28 | $6.99 |

| 12/02/2021 | Post-Covid High | 43 | $13.81 |

| 28/10/2022 | Post-Covid Low | 14 | $5.58 |

| 31/01/2023 | Current | 16 | $7.53 |

For context, the Betashares Nasdaq 100 ETF, which aims to track the performance of the Nasdaq-100 index before fees and expenses, has a 12-month trailing P/E of 26 (as at 31/01/23). In addition, ASIA also has a correlation of only 0.19 to the S&P/ASX 200 Index.10

For investors seeking a growth opportunity with current tailwinds, reasonable valuations, and that improves overall portfolio diversification, ASIA is worthy of consideration.

There are risks associated with an investment in ASIA, including information technology risk, concentration risk, emerging markets risk and currency risk. The Fund’s returns can be expected to be more volatile (ie vary up and down) than the broader market given its more concentrated exposure. An investment in ASIA should only be considered as a component of a broader portfolio. For more information on risks and other features of the Fund, please see the Product Disclosure Statement.

References:

1. https://www.bbc.com/news/world-asia-china-63855508

2. https://www.reuters.com/world/china/china-reports-almost-13000-new-covid-related-deaths-jan-13-19-2023-01-22/

3. https://www.forbes.com/sites/brendanahern/2023/01/09/alibabas-ant-could-be-marching-toward-an-ipo-cnys-remarkable-ghost-rally/

4. https://thediplomat.com/2023/01/whats-behind-chinas-resumed-imports-of-australian-coal/

5. A figure above 50 represents an expansion.

6. https://www.bbc.com/news/world-asia-china-43361276

7. https://www.afr.com/world/asia/china-s-xi-jinping-confirmed-as-leader-for-life-elevates-loyalists-20221023-p5bs53

8. https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/cloud-in-china-the-outlook-for-2025

9. As at 31 December 2022.

10. Source: Bloomberg, Betashares. As at 31 January 2023. Correlation figure based on monthly returns for the last three years.