Wet lettuce

5 minutes reading time

- Global shares

Global markets

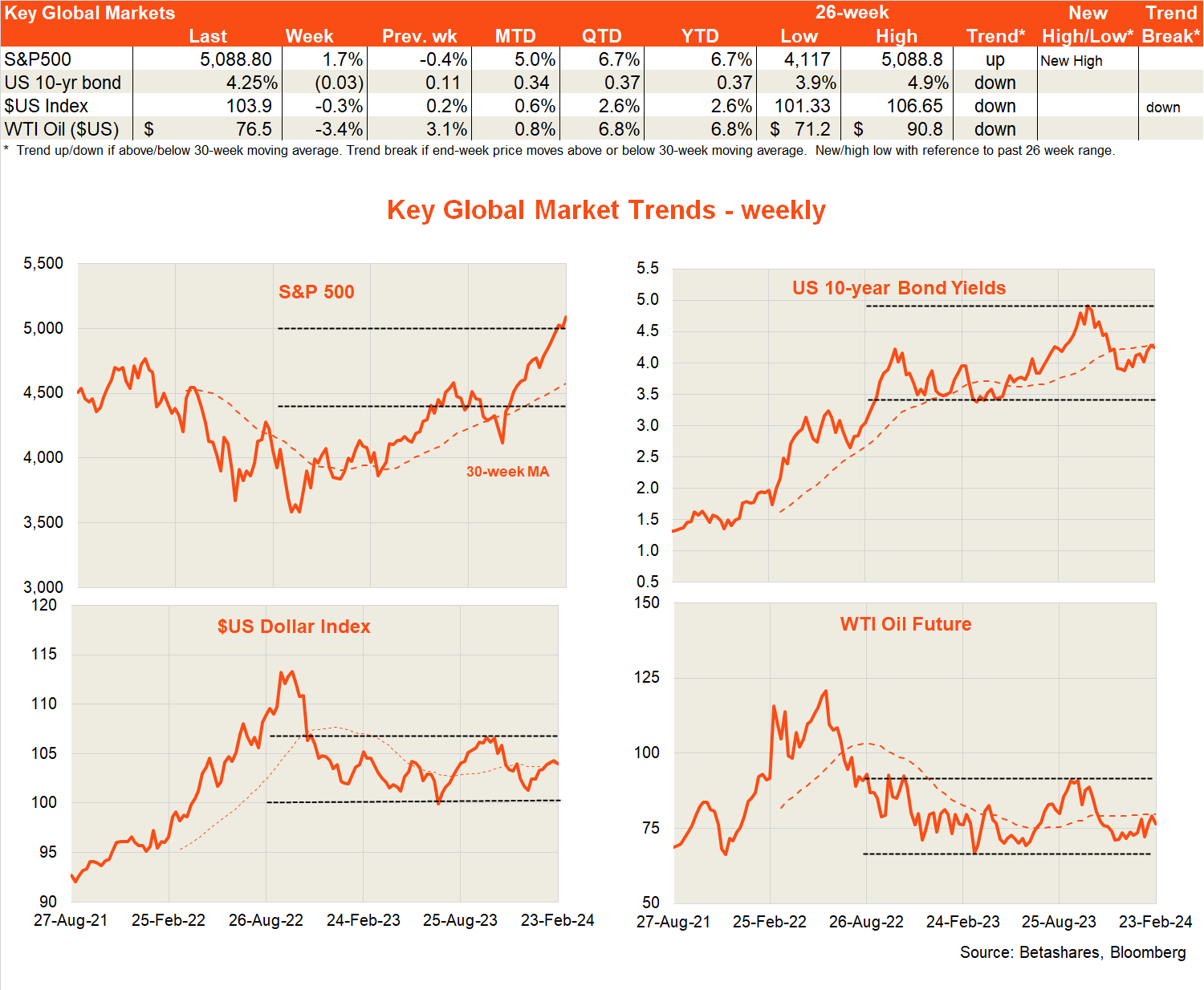

US stocks bounced back last week after a small inflation related dip the previous week, with the S&P 500 gaining 1.7%. Bond yields and the US dollar were broadly steady.

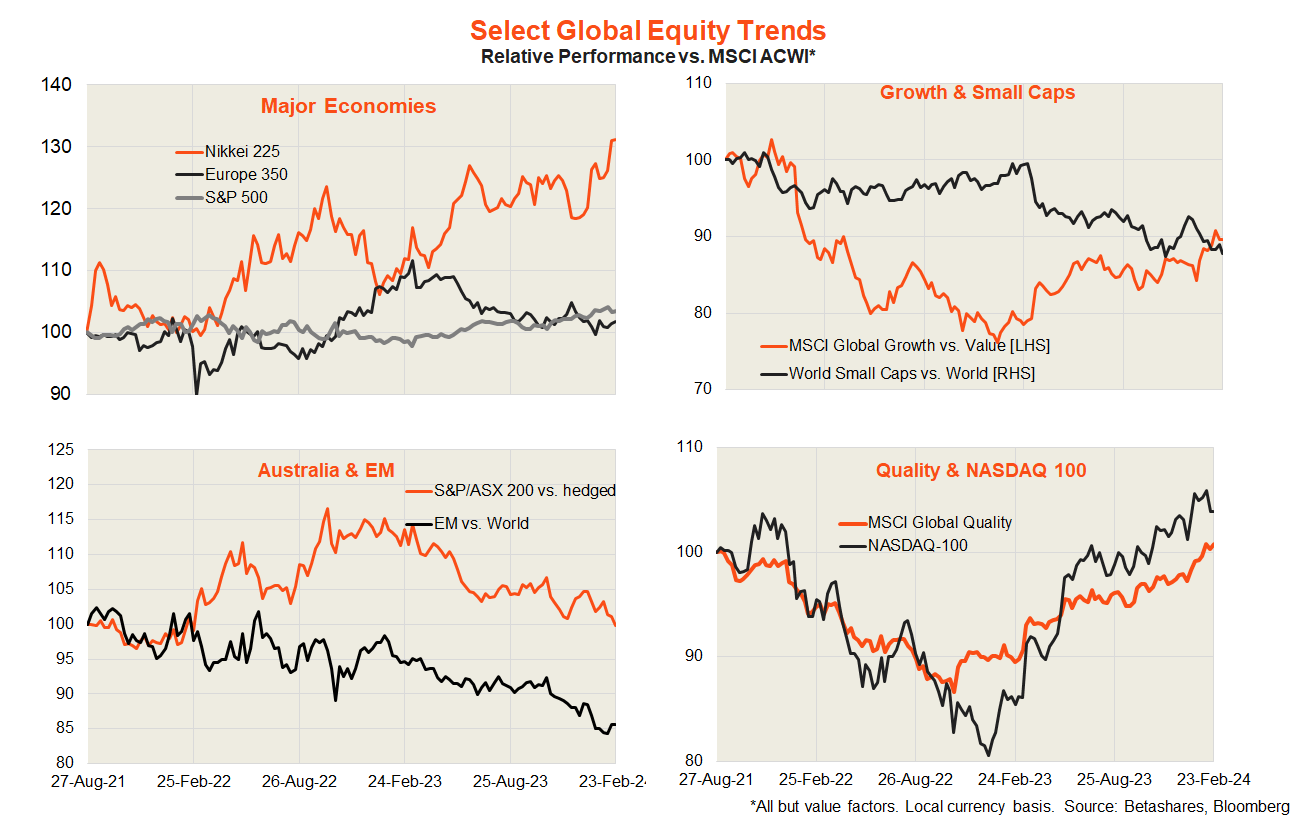

Of course, the big news last week was the blowout earnings result from Nvidia, which pushed its stock price up another lazy 16% on the following day, with the Nasdaq 100 up 3%. Nvidia reported Q3 adjusted earnings per share of $5.16, or 12% better than market expectations. Thanks to demand for its chips to drive the AI boom, revenues were up 260% over the past 12 months, while net income was up 770% – now that’s a growth stock! Many other tech stocks rose also, basking in the glow from Nvidia’s red-hot result.

In less bullish, but not too surprising news, minutes from the January Fed meeting indicated it thought interest rates had now likely peaked, though a rate cut was not likely until there was “greater confidence” that disinflation remained on track. That still seems some months away, with markets now pinning there hopes on a June rate cut.

To that end the previous week’s higher-than-expected January CPI result will not have helped, with firming pricing pressure also likely to be reflected in Thursday’s (US time) private consumption expenditure (PCE) price deflator – the Fed’s preferred measure of inflation. Markets are already anticipating a firm 0.4% monthly gain in the core PCE, which which still see an easing in annual inflation from 2.9% to 2.8%.

What really matters now is not so much Thursday’s result – though an upward shock will be problematic – but rather whether the pricing pressure reassuringly drops back in February, suggesting the January result was due to seasonal distortions.

Other notable global news last week was a 0.25% rate cut from the Central Bank of China – a sign that officials are getting a little more serious about supporting economic growth. Of course the problem in China is not overly high interest rates – but rather a simple unwillingness to borrow (especially for off-the-plan apartments!) given economic uncertainty and concerns over the ongoing viability of developers. Economists called this a “liquidity trap”. If its truly concerned and serious, China’s government will eventually need to flick the switch to major fiscal stimulus – which would put a rocket under the deeply unloved equity market.

Apart from US tech stocks, it’s also worth noting the ongoing impressive performance of the Japanese stock market – with the Nikkei 225 hitting a new record high last week. Cheap valuations and solid corporate earnings – due to an improved focus on shareholder returns – is helping Japanese stocks rise again.

Australian markets

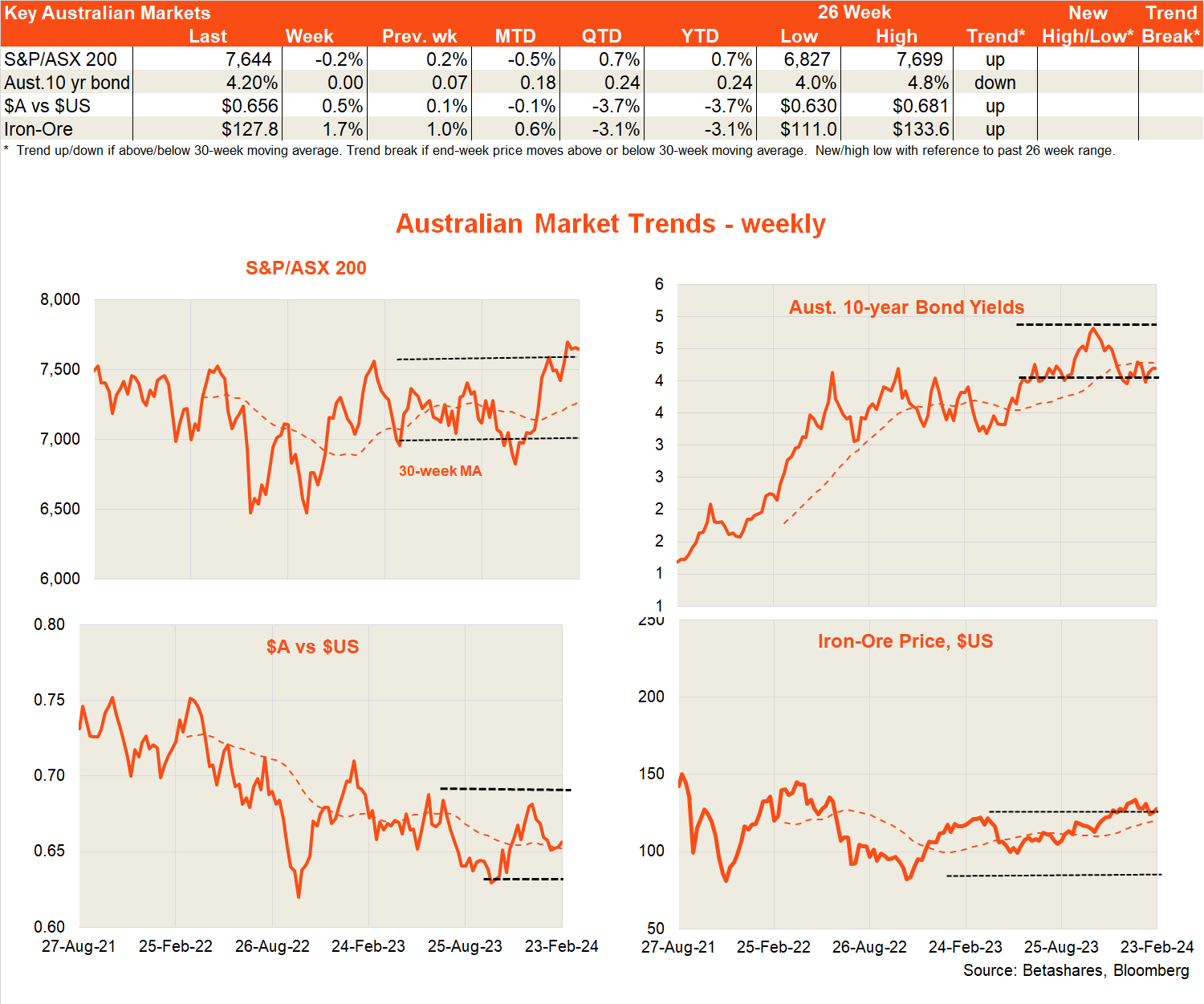

The S&P/ASX 200 was fairly steady again over the past week, slipping a mere 0.2% – with futures suggesting a flat start this morning. The two major local highlights last week were the RBA minutes and the Q4 wage price index.

With regard to the minutes, the main interest was the fact the RBA still considered it’s two most likely options either steady rates or a rate hike. That’s a reminder that the RBA still retains a tightening bias – although likely mild – rather than an easing bias at this stage. Going forward there will likely be much market excitement when the RBA switches to formally considering either steady rates or a rate cut – which assuming continued progress on inflation should be later this year.

In that regard last week’s Q4 wages outcome was fairly neutral – with a gain of 0.9% in line with expectations, for annual growth of 4.2%, up slightly from the 4.1% in Q3. That said, delving into the details, some slowing in privately negotiated wage gains is evident – consistent with a gradual easing in labour market tightness.

We get two key Q4 GDP “building blocks” this week with construction and business investment. Construction work likely remained solid in Q4, helped by public infrastructure and private non-residential construction projects – though with continued subdued home building. Business investment (plant and equipment) should flatten off further meanwhile, following the end of tax incentives in mid-2023.

Other likely more important local highlights will be January retail sales on Wednesday and the January monthly CPI tomorrow. Retail sales has been highly volatile of late due to shifting seasonal patterns, with a solid bounce back expected in January after December’s slump (which followed a strong November!).

The monthly CPI is expected to gain a firmer 0.4% seasonally adjusted, which would edge up the annual rate from 3.4% to 3.5%. Note this can be a volatile series, with only partial data each month and dodgy seasonal adjustment.

Have a great week!

2 comments on this

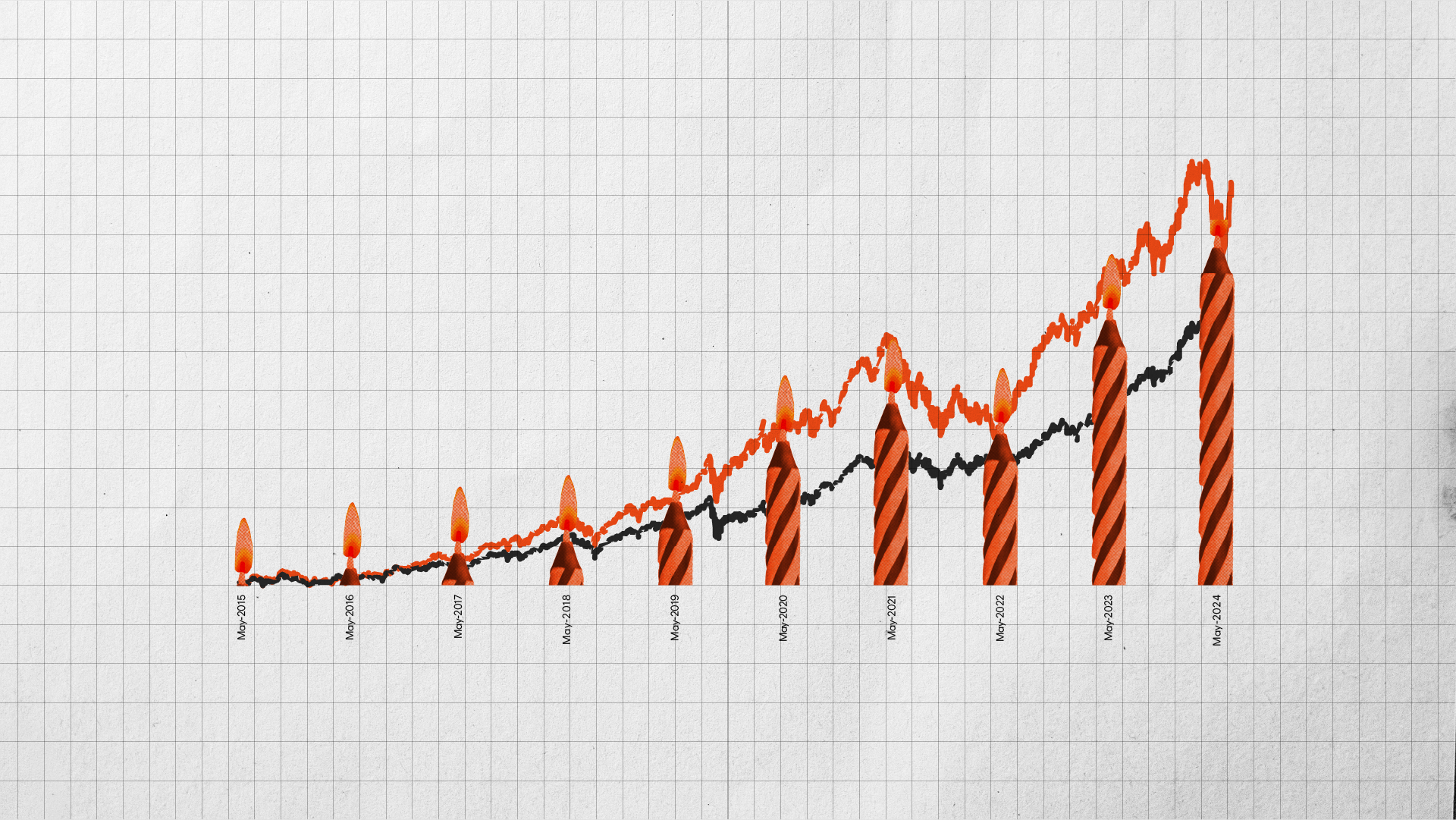

The 30 week MA charts are back! *insert celebration emoji* As always, an informative read. Thanks David.

Glad we could help!