4 minutes reading time

Global markets

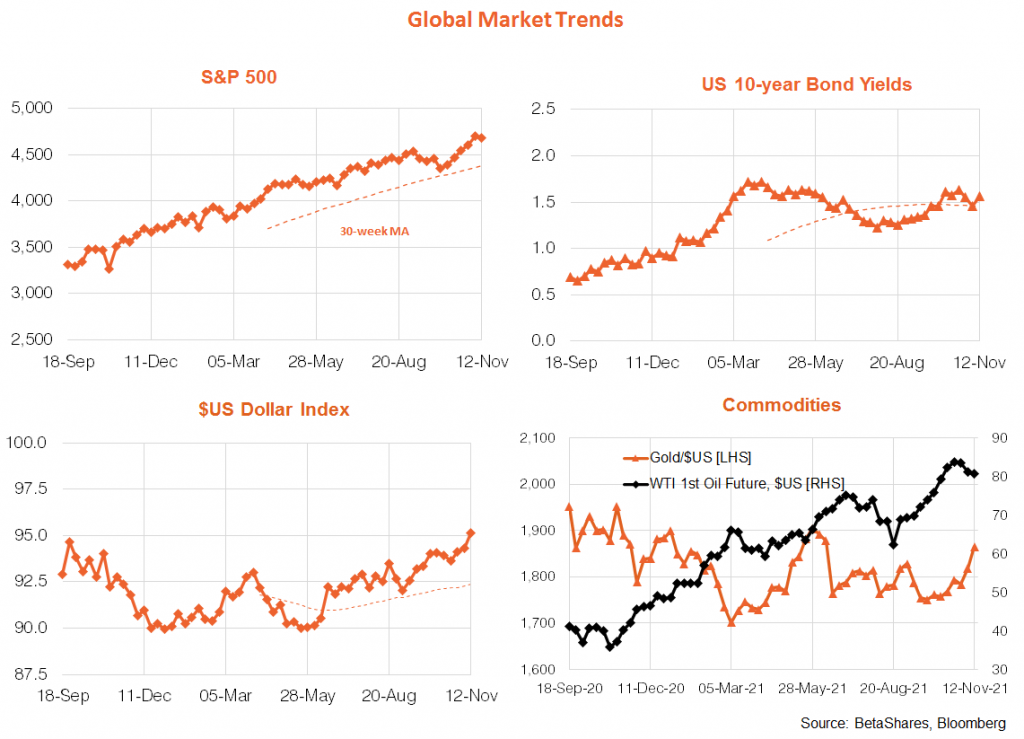

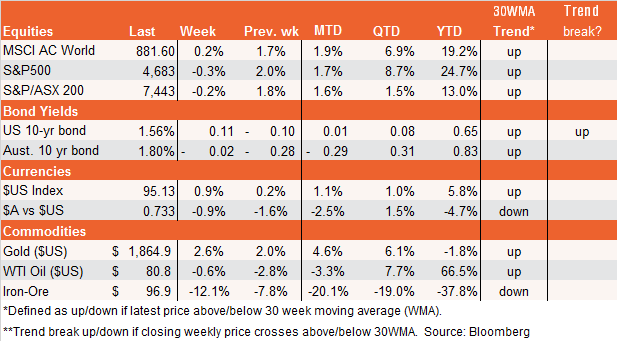

Global equities buckled last week following a higher than expected U.S. consumer inflation report, which also pushed up bond yields and the $US. The U.S. market is now convinced (according to futures pricing) that the Fed will have to raise rates by August next year – or almost immediately after it concludes the tapering in bond purchases by mid-2022. All that said, it’s fair to say equities so far at least remain fairly resilient to the unrelenting run of hot inflation numbers and market pricing of central bank tightening within a year. Indeed, after the initial post-CPI market slump, equities rallied over the rest of the week.

This resilience likely reflects several factors: corporate earnings remains strong, U.S. 10-year bond yields are still fairly contained at under 2%, and the Fed and many market economists (such as myself) still expect inflation to moderate next year, which may see current tightening expectations unwind. Indeed, next year could well be a ‘Goldilocks’ period, with still good growth yet moderating inflation – the key is how quickly labour markets tighten and wage pressures take off, allowing for the likely return to the labour market of many still sidelined workers.

A key global highlight this week will be October U.S. retail sales on Wednesday. After a strong 0.7% gain in September, the market anticipates an equally strong 0.7% gain in October – which in turn could heighten fears about an overly hot economy. Indeed, for equity markets, a strong retail sales result could be a case of “good news is bad news” to the extent it lifts bond yields and places downward pressure on still elevated equity valuations.

The other highlight will be China’s monthly ‘dump’ of data today covering fixed-asset investment, retail sales and industrial production. The big question facing investors is whether China’s notable slowdown this year has continued, or whether it’s showing signs of levelling out. Weaker than expected numbers would only heighten concerns about China’s economic outlook and place further downward pressure on iron-ore prices and the Australian dollar.

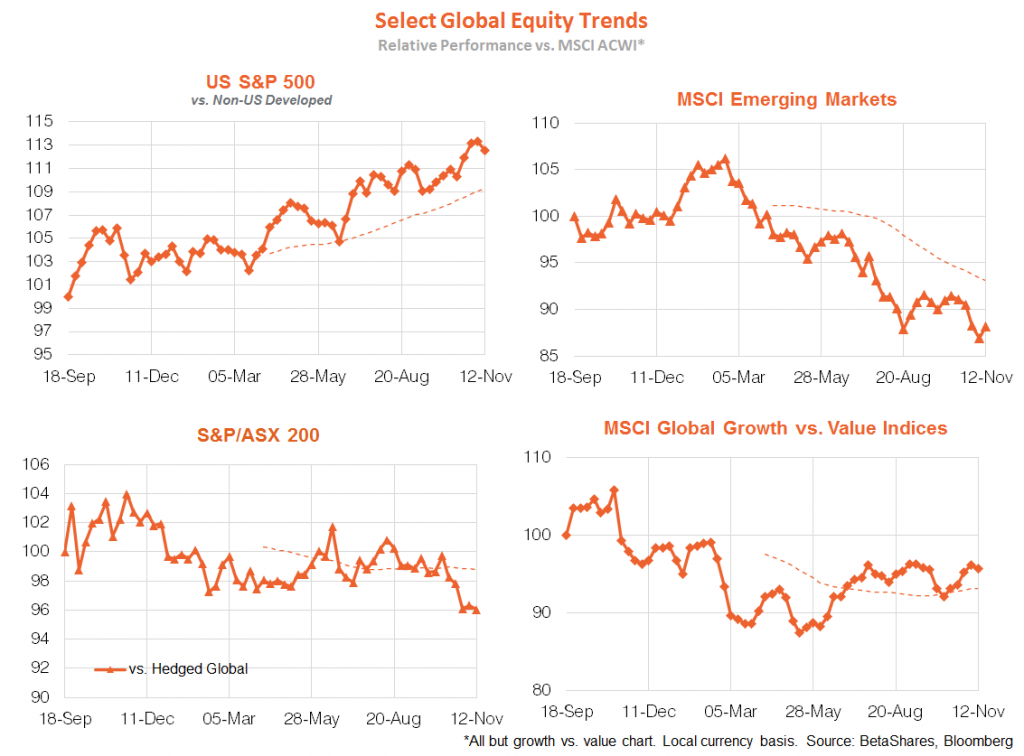

In terms of global equity trends, the U.S. market continues to broadly hold up relative to non-U.S. developed and emerging markets – despite Fed tightening fears. Over recent months, moreover, the growth vs. value tug of war has been fairly even – in line with long-term bond yields also broadly moving sideways. Weakness in iron-ore prices and the resource sector have left the local market still with an underperforming bias versus global markets.

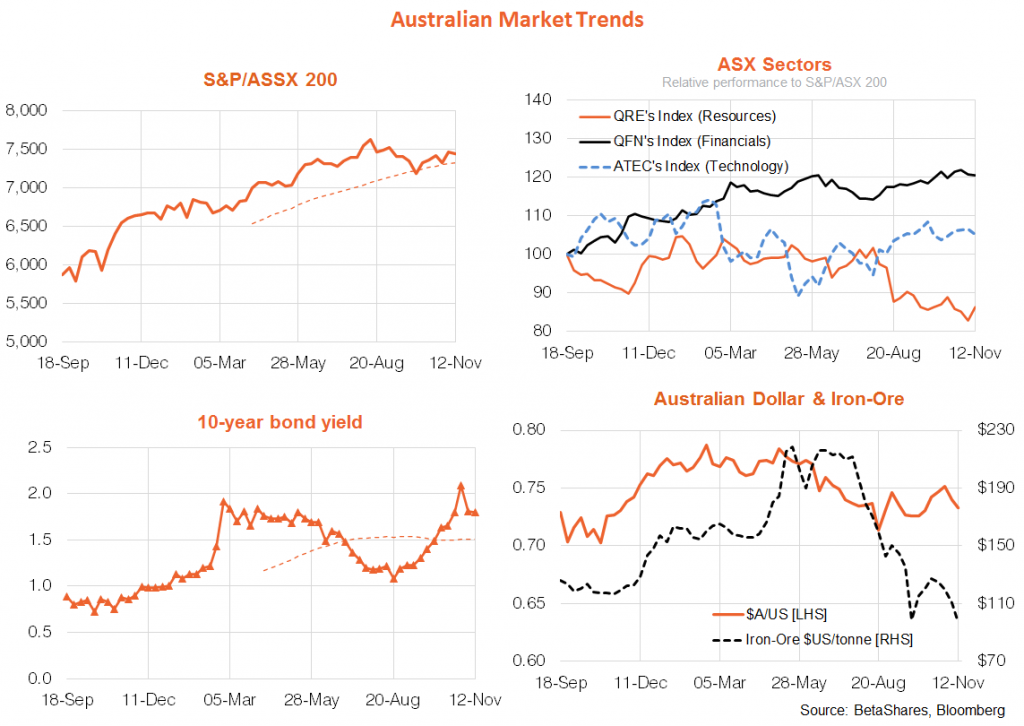

Australian market

Local data last week was generally upbeat, with a solid rebound in the NAB measure of business sentiment and still high consumer confidence as reported by Westpac. Although the official estimate of employment declined by 46k in October, this was ‘old news’ and largely reflected the lingering impact of lockdowns in Victoria. Employment in NSW bounced back nicely, and we should see something similar for Victoria in the November numbers next month. All up, the local economy appears well poised to recover from the mid-year slump caused by the NSW/Victorian lockdowns.

Despite last week’s U.S. inflation scare, local 10-year bond yields eased back last week – unwinding some of the spread widening versus the U.S. market since our own upside CPI surprise. After a moderate rebound in previous weeks, the downtrend in the iron-ore price and the $A resumed last week.

The local highlight this week will be the Wage Cost Index on Thursday, which is expected to show a modest uptick in quarterly growth from 0.4% to 0.6%. That still implies, however, annualised growth of only 2.4%, which is still well short of the RBA’s implicit 3 to 3.5% target level. A 0.6% quarterly gain would nonetheless represent an encouraging lift in annual wage growth from 1.7% to 2.2%, compared to a late-2020 COVID related low of 1.4%. As the economy recovers from COVID, a further tightening in the labour market seems inevitable – but whether this eventually translates into materially higher wage growth remains highly uncertain, especially with State and Federal Governments dead keen to ramp up immigration at the earliest opportunity. The longer wage growth remains subdued, the longer the RBA will remain sidelined, and the longer the economy will be given the chance to grow at a solid above-trend pace.