What is the ‘Innovation Exemption’ and why does it matter?

6 minutes reading time

- Digital assets

Bitcoin fell below US$20,000 again, losing most of last week’s gains. Q2 2022 has turned out to be the worst quarter in about a decade for Bitcoin. The crypto market has lost US$100B in value over the past week as contagion fears stemming from the collapse of Three Arrows Capital, as well as broader market issues, continued to dominate the industry.

At the time of writing, bitcoin is at US$19,061.

Ethereum also struggled, returning -14.8% vs bitcoin’s -11% for the week.

Bitcoin’s market cap fell to US$363.8B, while the total crypto market sits at US$863.4B. Bitcoin’s market dominance decreased to 42.1%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $19,061 | $21,783 | $18,729 | -11% |

| ETH (in US$) | $1,056 | $1,272 | $1,009 | -14.8% |

Source: CoinMarketCap. As at 26 June 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

News we’re watching

From bad to worse for Three Arrows Capital (3AC)

What started as a liquidity scare has ended in bankruptcy and now even accusations of fraud. Things have gone from bad to worse for 3AC.

3AC is seeking protection from creditors in the United States under Chapter 15 of the US Bankruptcy Code after being court-ordered to liquidate their assets. Chapter 15 allows foreign debtors to shield US assets in the wake of bankruptcy. This comes after 3AC defaulted on a $655 million loan from Voyager Digital as well as unknown sums from numerous other counterparties.

3AC is not just another crypto firm struggling with the recent market capitulation. In a note published by FSInsight on Friday, 3AC has been accused of running an “old-fashioned Madoff-style Ponzi scheme wrapped in a trade that was similar to the positions that sunk Long Term Capital Management (LTCM)”. FSInsight did not mince words in the report, stating 3AC were “using borrowed funds to repay interest on loans issued by lenders, while ‘cooking their books’ to show massive returns on capital.”1

It’s likely more information will come to light over the coming weeks.

FTX inks another deal with BlockFi

Sam Bankman-Fried has inked another deal with BlockFi, but this time with an embedded option to purchase the struggling platform. BlockFi CEO, Zac Prince, tweeted they’d signed definitive agreements with FTX for;

- A $400M revolving credit facility which is subordinate to all client funds, and

- An option to acquire BlockFi at a variable price of up to $240M based on performance triggers.

The agreements are still subject to shareholder approval. At the peak valuation, BlockFi had a price tag close to US$5B, so it’s unlikely shareholders will be overly pleased. Prince quoted volatility and market events related to Celsius and 3AC as primary reasons for the decision.

3AC’s bankruptcy has led to approximately US$80M in losses for BlockFi. When discussing the matter, Prince stated “as a matter of principle, we fundamentally believe in protecting client funds. Not only because it’s absolutely the right thing to do, but this also benefits the ongoing health and adoption of crypto financial services worldwide.”2

Voyager Digital halts withdrawals

Five days after securing a revolving line of credit from Almeda, Voyager Digital announced to the market it was “temporarily suspending trading, deposits, withdrawals and loyalty rewards” for its users. Voyager was one of many lenders to the now bankrupt 3AC and is owed approximately US$655M in bitcoin and the stablecoin USDC. It’s the second platform in as many weeks to suspend trading in the wake of 3AC’s collapse, the full impact of which remains unknown.

Voyager’s share price at Friday’s close was just north of US$0.30, which represents a ~99% decline in price since its April 2021 high of US$27.39 per share.

Voyager’s announcement also discussed “[3AC’s] court-ordered liquidation process in the British Virgin Islands” as the crypto firm said that it was “actively pursuing all available remedies for recovery from 3AC.”3

On-chain metrics

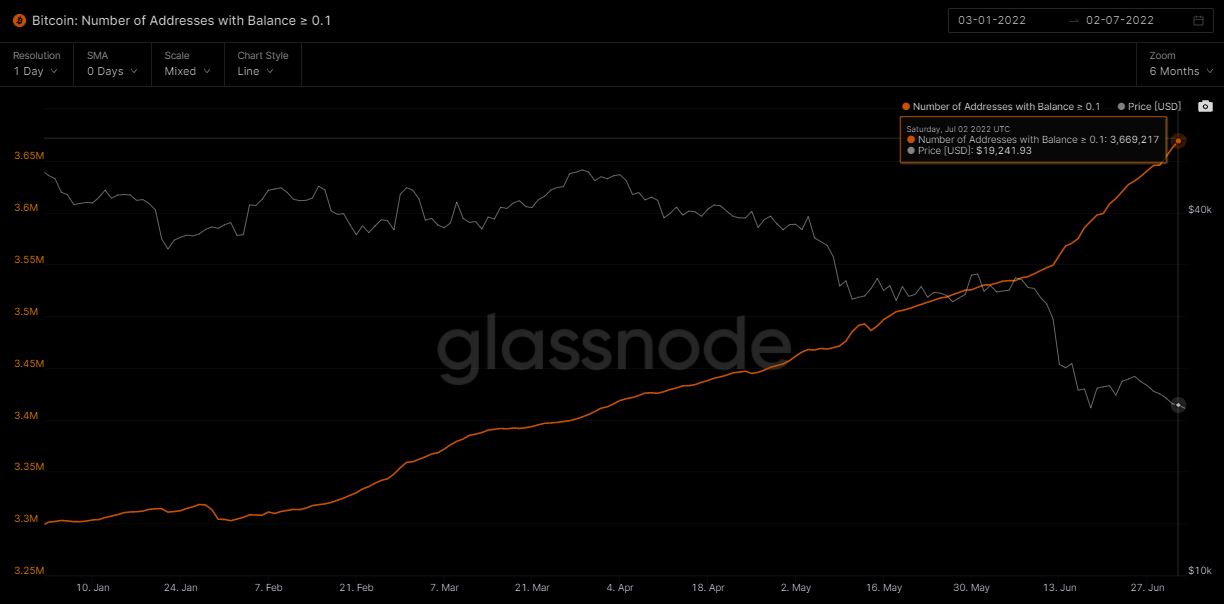

Bitcoin (BTC): Number of Addresses with Balance ≥ 0.1

This metric looks at the number of unique addresses holding at least 0.1 coins. This metric is considered a good indicator of bitcoin’s adoption and retail sentiment.

Looking at data from on-chain analytics company Glassnode, the number of unique addresses holding at least 0.1 coins currently sits at 3.66 million. There has been sharp growth over the last 6 months, and more notably over the past month, which may indicate $20,000 as a price level retail investors are comfortable investing at.

Source: Glassnode. Past performance is not indicative of future performance.

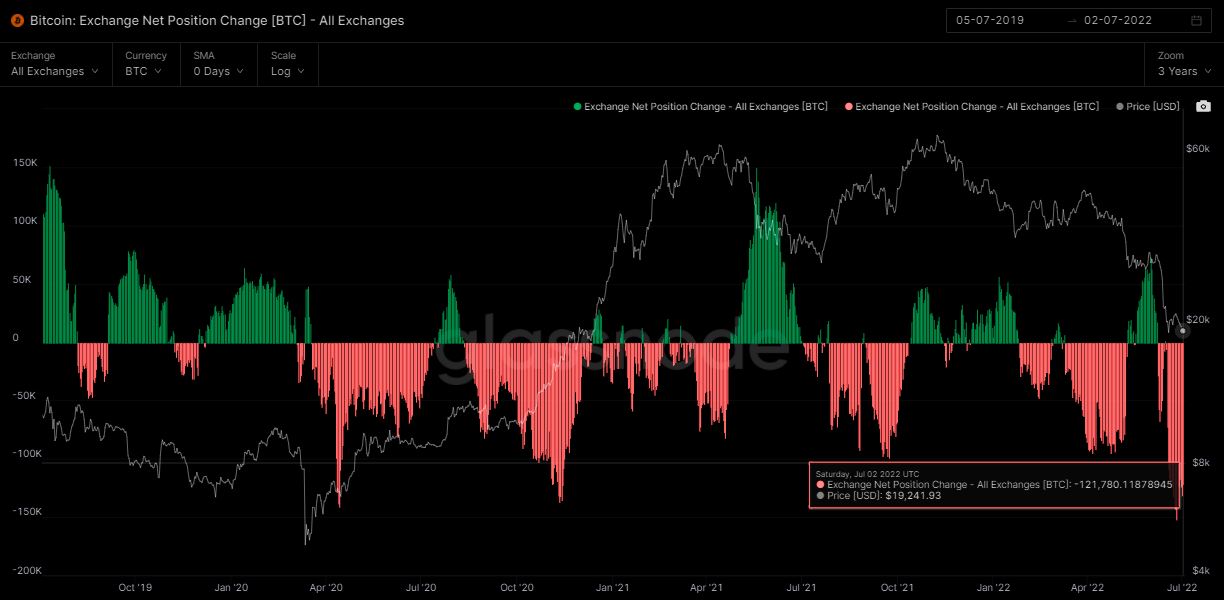

Bitcoin (BTC): Exchange Net Position Change

Exchange Net Position Change is an indicator that measures the net amount of bitcoin that’s entering or exiting the wallets of all exchanges. When the value of this metric is positive, it means exchanges are currently observing more inflows than outflows. Such a trend can be bearish as investors usually deposit their BTC for selling purposes.

Looking at the Exchange Net Position Change data for BTC, June saw one of the largest months of net outflows for exchanges – potentially a bullish sign for bitcoin.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Many will recall when the once-stable coin TerraUSD (UST) lost its USD peg in May, falling 99.5% from peak to trough. Amazingly, the coin’s price has jumped 472.4% in the past week alone, but crypto pundits warn this may be short-lived. UST’s trading volume has regularly reached US$500m per day over the past week, but according to CoinMarketCap, 45% of the volume originates from a single entity in KuCoin, who are a centralised exchange platform reportedly operating from Seychelles. Financial analytics firm InvestmentU have made it clear in a recent report that it could once again decline massively as according to InvestmentU “the tech behind it is dead.”4

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://fortune.com/2022/06/28/crypto-hedge-fund-three-arrows-capital-old-fashioned-madoff-style-ponzi-scheme-research-firm-fsinsight/

2. https://www.cnbc.com/2022/07/01/ftx-signs-a-deal-giving-it-the-option-to-buy-crypto-lender-blockfi-.html

3. https://www.bloomberg.com/news/articles/2022-07-01/crypto-broker-voyager-digital-suspends-trading-withdrawals

4. https://cointelegraph.com/news/double-bubble-terra-s-defunct-unstablecoin-suddenly-climbs-800-in-one-week

Off the Chain will be published every Tuesday, and provide the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.