What is the ‘Innovation Exemption’ and why does it matter?

6 minutes reading time

- Digital assets

This new monthly industry report summarises fund flows and assets under management in crypto-related exchange traded products (ETPs) around the world. It comprises general market information only and is not a recommendation to invest in any crypto asset or financial product or adopt any investment strategy.

Crypto markets staged a choppy rally in July after suffering significant declines year-to-date (YTD), which accelerated in June. Bitcoin was up 27.9% in July, while Ethereum returned 71.5% in anticipation of the much-awaited merge – now expected in September.

Crypto equities – listed companies operating in the crypto economy – returned 42.3% in July, as measured by the Bitwise Crypto Innovators Index (which BetaShares Crypto Innovators ETF (ASX code: CRYP) aims to track).

Crypto market sentiment (as measured by the Crypto Fear and Greed Index) improved from ‘extreme fear’ at the end of June, to ‘fear’ at the end of July, and currently sits at ‘neutral’.

Note: Performance information is expressed in US dollars and does not take into account USD/AUD currency movements. Past performance is not indicative of future performance.

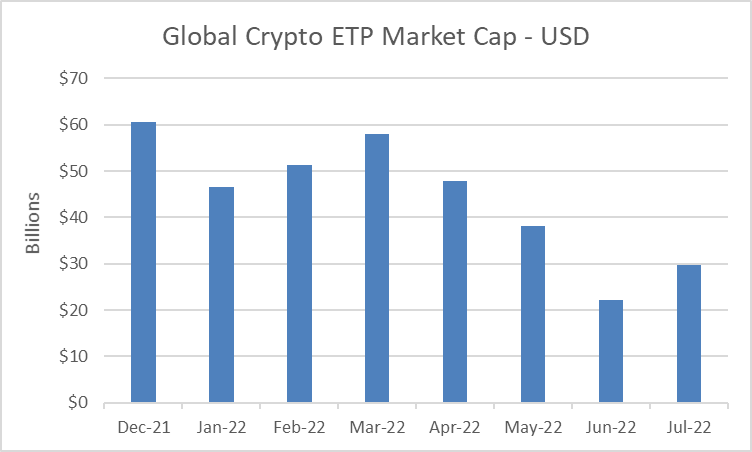

Market cap

- The overall Crypto ETP industry funds under management rose 34.5% to US$29.8B, an increase of US$7.6B from US$22.2B at the end of June. The increase was largely a result of market movement.

- YTD market cap has declined by -50.8% from US$60.6B at the start of the year.

Source: Bloomberg, BetaShares.

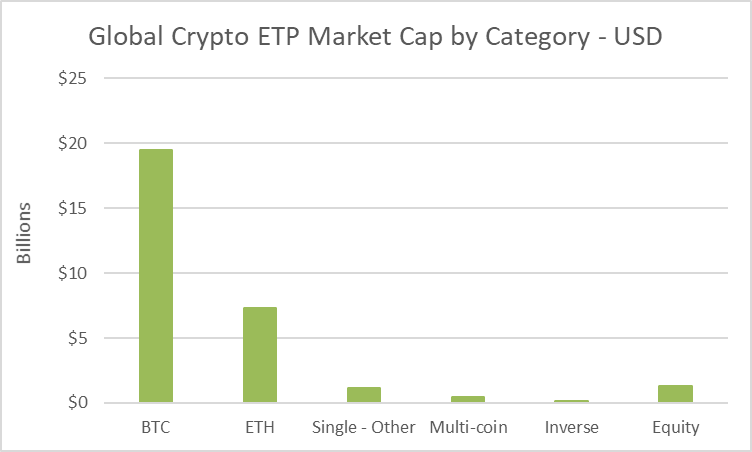

- Bitcoin ETP exposures remain the leader by category, making up 65.3% of the current market cap. Ethereum ETP exposures account for 24.5%, while Equity exposures are in distant 3rd place with 4.4%.

Source: Bloomberg, BetaShares.

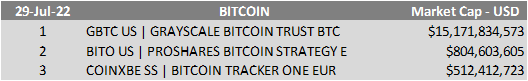

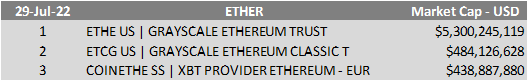

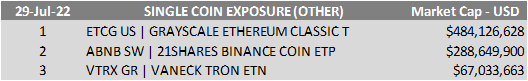

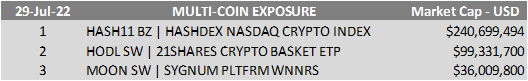

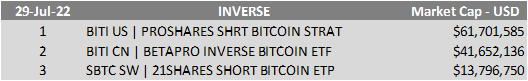

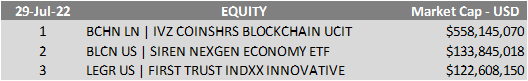

- Within categories, the leaders are Grayscale Bitcoin Trust at US$15.1B (Bitcoin), Grayscale Ethereum Trust US$5.3B (Ethereum), Grayscale Ethereum Classic Trust US$484.1m (Single – Other), Hashdex Nasdaq Crypto ETF US$240.7m (Multi-Coin), Proshares Short Bitcoin Strategy ETF US$61.7m (Inverse), and The Invesco CoinShares Global Blockchain ETF US$558.1m (Equity).

Source: Bloomberg, BetaShares.

Net flows

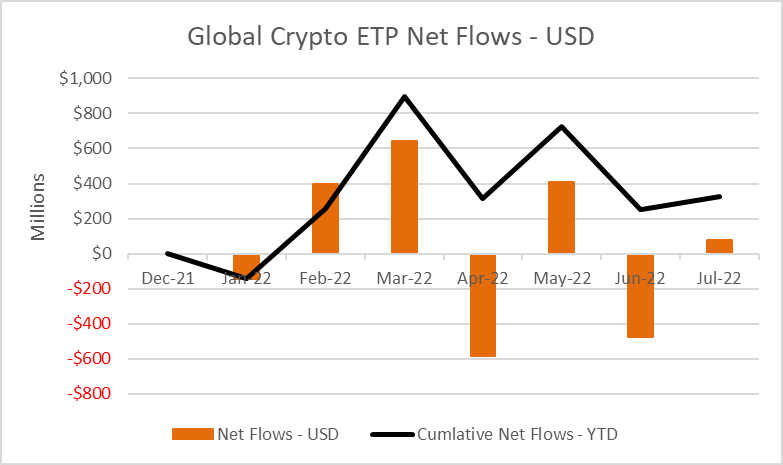

- Net flows in July were positive US$77.3m after suffering one of the worst months in history in June of -US$473m. YTD net flows sit at US$327m.

Source: Bloomberg, BetaShares.

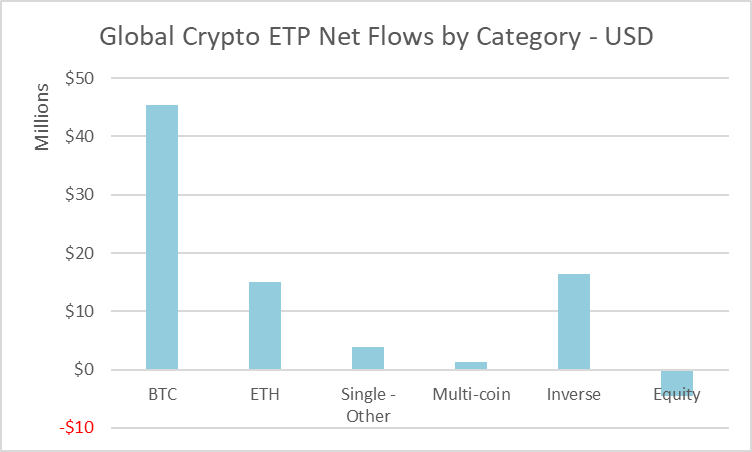

- The lion’s share of net flows in July came from Bitcoin ETP exposures (59%) followed by Inverse ETPs (21%) and Ethereum ETPs (19%), while Equity ETP exposures received net outflows of -US$4.4m.

Source: Bloomberg, BetaShares.

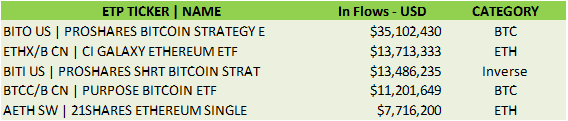

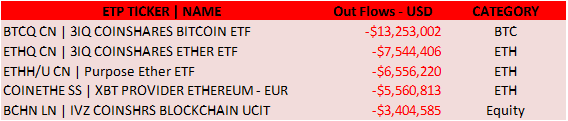

- By product, ProShares Bitcoin Strategy ETF received US$35.1m, while 3IQ CoinShare Bitcoin ETF saw -US$13.2m in outflows.

Source: Bloomberg, BetaShares.

I hope you enjoyed this new report. Please let us know what you think in the comments.

Important Note: This global report includes references to ETPs domiciled and regulated in overseas markets. No representation is being made that such ETPs are available to investors in Australia or are subject to Australian regulatory requirements.

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

IMPORTANT INFORMATION

BetaShares Capital Limited (ABN 78 139 566 868, AFSL 341181) (“BetaShares”) is the issuer of this information. This information is general only, is not personal financial advice, and is not a recommendation to buy, hold or sell any investment or adopt any particular investment strategy. It does not take into account any person’s financial objectives, situation or needs. No representation is made regarding the accuracy or completeness of information in this report.To the extent permitted by law BetaShares accepts no liability for any loss from reliance on this information.Future results are impossible to predict and involve risks and uncertainties outside the control of BetaShares. This information may include views, opinions, estimates and projections (“forward looking statements”) which are, by their very nature, subject to various risks and uncertainties. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in such statements. Readers must not place undue reliance on such statements. BetaShares does not undertake any obligation to update forward looking statements to reflect events or circumstances after the date such statements are made or to reflect the occurrence of unanticipated events.