What is the ‘Innovation Exemption’ and why does it matter?

6 minutes reading time

- Digital assets

Bitcoin and the rest of the crypto market rallied towards the tail end of last week, to hit a multi-week high. Without a specific catalyst, there is speculation that the rally is being fueled by the possibility that the Federal Reserve will slow its pace of rate hikes in 2023, or the view that the crypto market may be currently undervalued, or that buying was tied to short covering and/or a short squeeze.

At the time of writing, bitcoin is trading at US$21,596. Ethereum outperformed bitcoin, up 13.74% vs bitcoin’s 9.76% for the week.

Bitcoin’s market cap rose to US$413.5B, with the total crypto market up to US$1.06T. Bitcoin’s market dominance sits at 39.18%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $21,596 | $21,760 | $18,702 | 9.76% |

| ETH (in US$) | $1,761 | $1,784 | $1,500 | 13.74% |

Source: CoinMarketCap. As at 11 September 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Crypto assets are no longer seen as niche

A report published recently by the International Monetary Fund (IMF), an agency of the United Nations, calls for a global response to regulating crypto. The fear is that the longer this takes, the more differing regulatory frameworks will exist between national authorities. The IMF recognises that crypto was seen as niche in its early days, but has gained popularity as “speculative investment hedges against currencies, and potential payment instruments”.

The report detailed current challenges in regulating crypto, such as the crypto world evolving rapidly and regulators finding it difficult to attract the talent and learn the skills to keep pace. In addition, data is patchy and there are too many entities not subject to disclosure or reporting requirements. Regulators are also forced to play catch-up considering terminology, products, activities and stakeholders are not globally harmonised. To top things off, on a national level, jurisdictions are at various stages and have taken very different approaches to regulatory policy.

The IMF is hoping that a global response will be coordinated, consistent, and comprehensive. And that a global regulatory framework will “bring order to markets, help instill consumer confidence and provide a safe space for useful innovation to continue”.1

AFP establishes crypto crime unit

A new cryptocurrency unit to target criminals reportedly has been formed by the Australian Federal Police (AFP). The unit will target criminals using digital assets in crimes such as money laundering and other financial crimes. The incidence of these types of crimes has significantly increased since 2018.

Stefan Jerga, manager at the agency said: “The environment was such that we felt a standalone team [was required], rather than a lot of officers picking up some of this skill set as part of their overall role. So we’ve now got a dedicated team that continues to grow.” As crypto has become commonplace in the financial ecosystem and “criminals continue to adapt”, the Deputy Chief Executive of AUSTRAC, John Moss, also supports the launch of the new unit. 2

Binance closes trading on three stablecoins

The world’s largest crypto exchange by volume, Binance, announced that it would close trading for three stablecoins on its platform and convert into their own stablecoin Binance USD (BUSD). The closure is to improve liquidity and efficiency on the exchange, Binance said. The coins that are facing closure are USD Coin (USDC), Pax Dollar (USDP) and trueUSD (TUSD). Although the exchange will halt trading on spot pairs, it will still allow users to withdraw funds in the form of these stablecoins.3

In separate tweets, Jeremy Allaire, CEO of Circle, felt that this would lead to more share of the stablecoin market moving from Tether (USDT) to both USDC and BUSD, and said that “converged dollar books on Binance … is a good thing. USDC utility just increased.”

On-chain metrics

Bitcoin (BTC):

Number of Addresses with Balance ≥ 0.1

The above metric reflects the number of unique addresses holding at least 0.1 coins. The trend of this metric can give us an indication of sentiment from retail investors, and reflects if these wallets continue to accumulate, sell or hold steady.

Looking at data from on-chain analytics company Glassnode, this metric continues to set new all-time highs. The accumulation of satoshis (a satoshi being the smallest denomination of a bitcoin, equivalent to one hundred millionth of a bitcoin) continues, even with the price down -69% from its all-time high in November, and having been range-bound for the last 12 weeks.

Source: Glassnode. Past performance is not indicative of future performance.

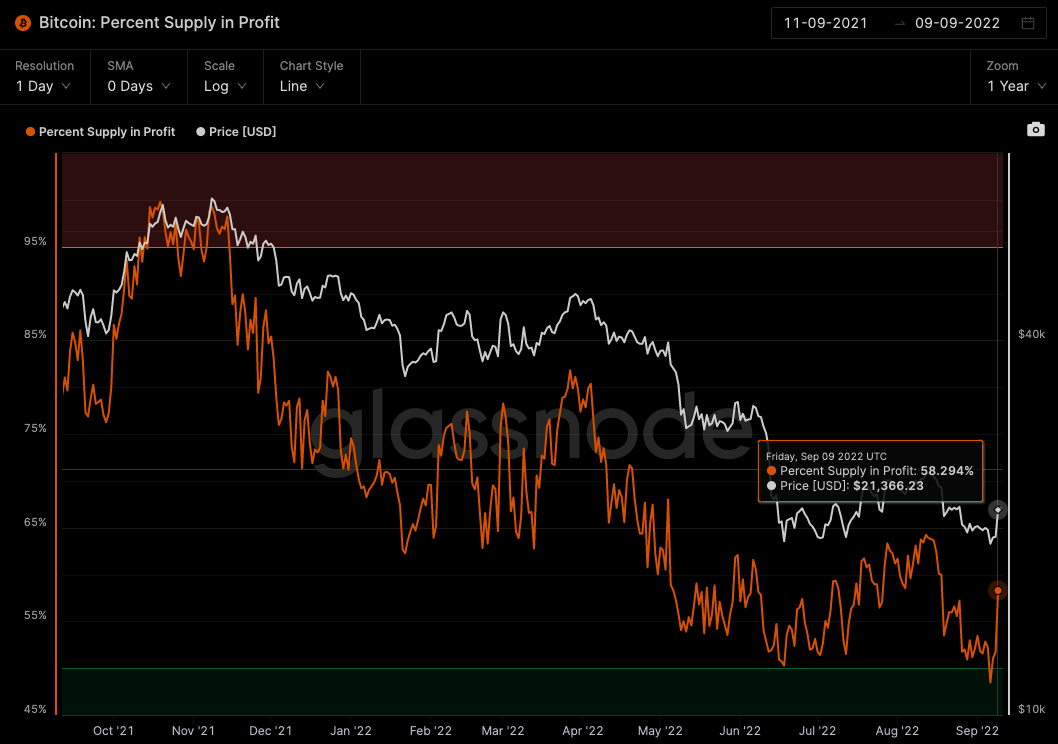

Bitcoin (BTC): Percent Supply in Profit

The percentage of circulating supply in profit looks at the percentage of existing coins whose price at the time they last moved was lower than the current price. Looking at this metric helps us understand the current state of the bitcoin market. Historically, a level of above 95% has tended to indicate market tops, while a level below 50% has typically indicated market bottoms.

According to Glassnode, the percentage of circulating supply in profit has risen by almost 10% with the current price increase from $18,849 to $21,366 in just four days. The large percentage increase shows that approximately 1.8 million or about 10% of the circulating supply last transacted within that price range.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, although all eyes are focused on Ethereum’s merge, the Cardano blockchain has an upcoming hard fork of its own, called ‘Vasil’, later this month. This upgrade should bring greater capacity to the Cardano network, along with reducing the cost of transactions. The release was confirmed by Input-Output Hong Kong (IOHK), the blockchain development firm behind Cardano. According to IOHK, most cryptocurrency exchanges will support the upgrade and have already started upgrading their nodes.4

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://www.imf.org/en/Publications/fandd/issues/2022/09/Regulating-crypto-Narain-Moretti

2. https://cryptopotato.com/australian-federal-police-established-a-crypto-unit-to-target-criminals-report/

3. https://www.coindesk.com/markets/2022/09/06/binance-ditched-a-bunch-of-stablecoins-even-a-newly-banished-issuer-was-ok-with-it/

4. https://cryptopotato.com/cardano-most-ambitious-upgrade-has-confirmed-launch-date/

Off the Chain will be published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.