11 minutes reading time

This information is for the use of licensed financial advisers and other wholesale clients only.

Quarterly commentary from the Betashares investment strategy team. Providing an overview on global equity market performance, company earnings, valuations and fundamentals, asset class correlations, and asset flows.

Q1 2025

Global Equities

- The first quarter of 2025 saw Chinese and European equities outperform their US counterparts as government policy caused a rotation in global equities. However, the looming threat of large tariff increases toward the back end of the quarter saw most major equity markets end down for the first three months of the year.

- Within the US Donald Trump started his second term with the more market disruptive policies of government spending cuts and tariffs causing market volatility and a broad sell off. The uncertainty of the depth of spending cuts, extent of tariffs, and ultimately how these will impact economic growth caused a de-risking in US markets led by the large technology companies whose valuations had disconnected from the rest of the market. Two days after the quarter end on ‘Liberation Day’ Trump announced the full extent of global tariffs causing further significant market volatility and sell offs.

Source: The White House

- The emergence of DeepSeek, a large language model (LLM) developed in China for a fraction of the cost of US’ LLMs, spurred interest in Chinese technology. The Chinese government signaled the biggest turning point to date in its years long crackdown on big tech with symbolic meetings between Chinese President Xi and a dozen prominent private-sector entrepreneurs, sending a strong signal of government support and removing a major obstacle for tech valuations to rise.

- Defence stocks drove European markets higher as the US mounted significant pressure on EU NATO members to increase their defence spending above and beyond the current 2% of GDP target. Multiple European governments responded with increased defence spending plans with the biggest impact coming from Germany in which legislation was rushed through the outgoing government to allow defence spending to bypass long-standing debt limits ushering the country into a new era of fiscal policy.

Betashares Global Equity Markets Monitor – 31 March 2025

Source: Bloomberg, Betashares. As at 31 March 2025. Denotes index performance. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Australian Equities

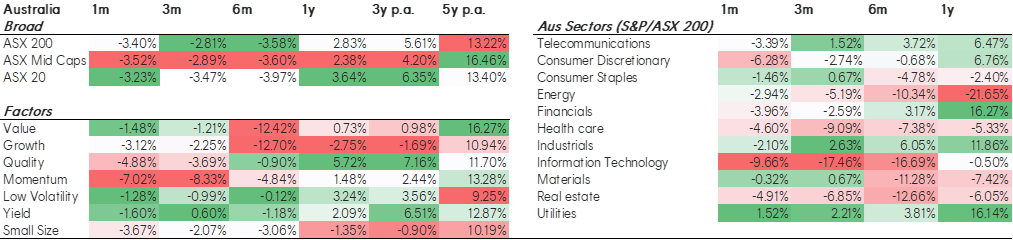

- The ASX 200 followed Wall Street lower in the first quarter of 2025, declining 2.81% as Trump’s tariff policies set the scene for current volatility in markets.

- The worst performers were Information Technology, Health Care and Real Estate whilst Industrials, Utilities and Communication Services were the best performers. We saw a similar rotation in sector performance in the US as investors gravitated towards cheaper, more defensible areas of the market.

- Whilst we noted that Materials underperformed in the last quarter of 2024 in our previous Equity Quarterly Commentary, we saw a rebound in performance with the sector adding +0.67% to returns for Q1 2025. This was driven by favourable movements in gold prices which benefited companies like Regis Resources, Genesis Minerals and Evolution Mining.

- Financials, which posted the highest returns in Q4 2024, detracted -2.57% in the latest quarter as disappointing earnings and high valuations sent the share prices of the ‘Big Four’ banks into the red.

- More recently, we have seen the ASX 200 record its largest loss since 2020 in the first week of April as recession probabilities rise.

Betashares Global Equity Markets Monitor – 31 March 2025

Source: Bloomberg, Betashares. As at 31 March 2025. MSCI World Factor Indices used to represent factor returns. Denotes index performance. You cannot invest directly in an index. Past performance is not an indicator of future performance.

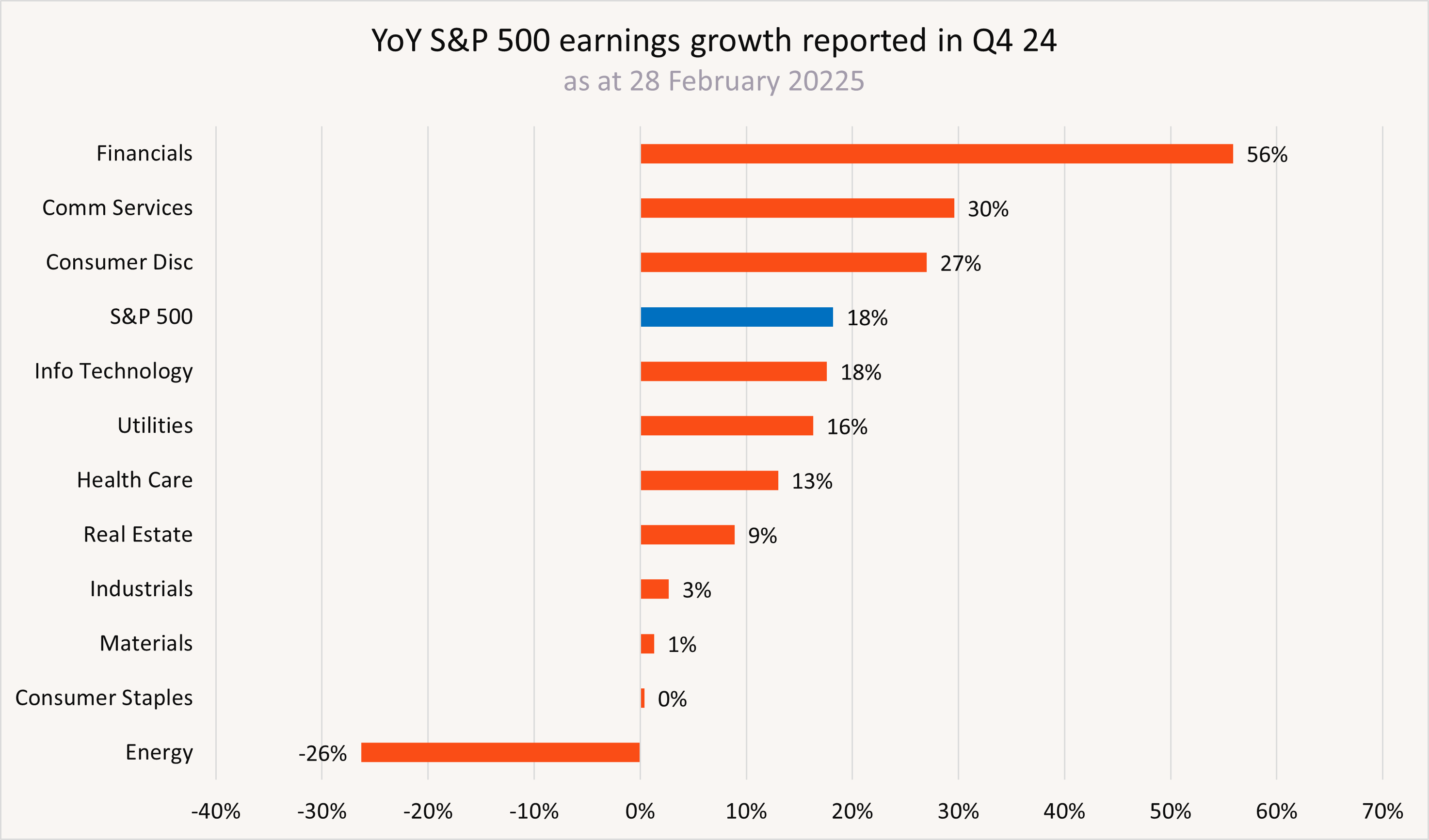

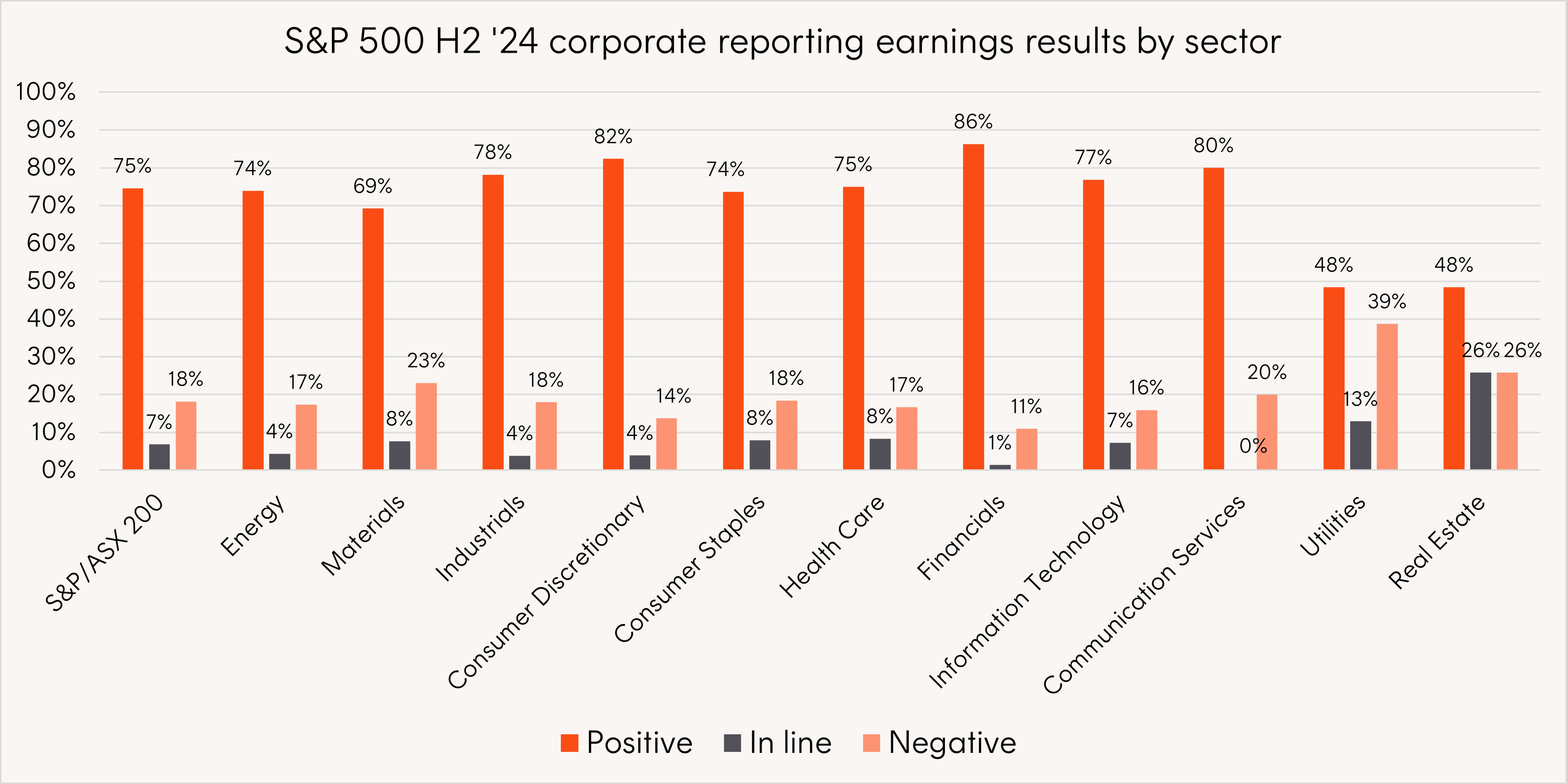

Corporate Earnings – US Q4 24’

- Q4 reporting in the US showed a broadening in earnings growth. The year-on-year (YoY) earnings growth rate for the S&P 500 was 18.2%. This marks the 6th consecutive quarter of YoY growth and is the highest earnings growth rate in 3 years.

Source: FactSet. As at 28 February 2025.

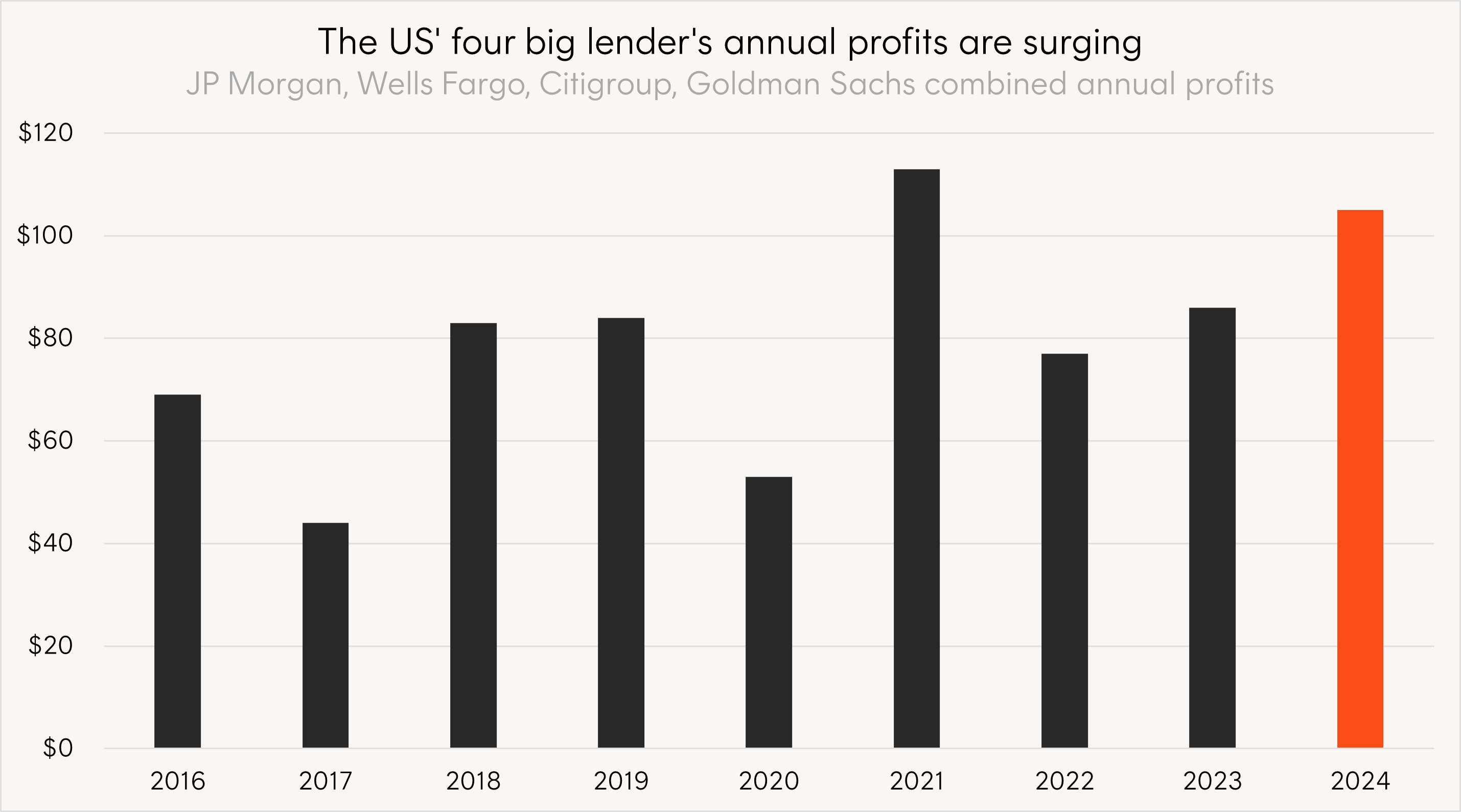

- At the sector level, the Financials sector reported the highest YoY earnings growth driven by large-cap banks with strong capital markets presence. A strong rebound in investment banking fees, seeing an aggregate 32% increase from 2023, and M&A activity bouncing off three-decade lows. This is not a US-centric story, with a global ex-Aus banks profit surge playing out.

Source: Company filings. As at 16 January 2025.

- Industrials saw some of the largest upward earnings surprises during reporting, leading the sector to modest earnings growth. Stronger-than-expected growth in traditional corners of the economy, like airlines (with Southwestern posting record revenues and Delta reporting its most profitable Q4 in company history), and defence (with US poster child Palantir Technologies experiencing a 45% increase in US government revenue and a 64% increase in US revenue), drove these positive surprises.

- Meanwhile, Industrial Services—the companies related to construction, transportation, and logistics—experienced stronger growth as rates started to fall. Any of Trump’s ‘America First’ policies that are enacted, such as protectionism through tariffs and the re-shoring of US manufacturing, should only support this trend. The US January Manufacturing PMI, an economic indicator of manufacturing health, returned to an expansionary level this month. The Industrial sector is expected to grow earnings by 14% in 2025.

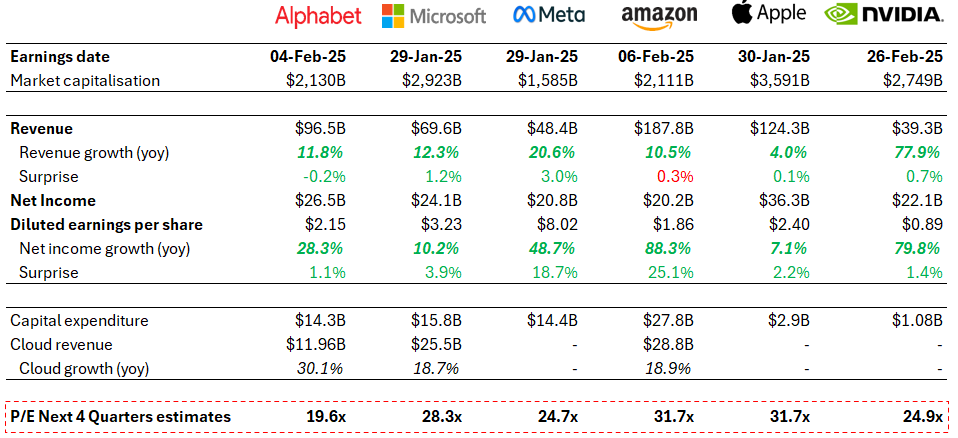

- Finally, the Magnificent 7 continued to show very strong revenue and earnings growth as a cohort, having a significant impact on their respective sectors’ results: Information Technology (Apple, Microsoft, Nvidia), Communication Services (Meta, Alphabet), and Consumer Discretionary (Amazon, Tesla). See here for a comprehensive summary of their earnings. The main concern for these companies will remain valuations, particularly in the face of broadening earnings strength from the rest of the market, and monetisation of significant AI capex.

Source: Bloomberg, Betashares.

- Looking ahead, every sector in the S&P 500 is expected to deliver positive earnings growth for 2025. This hasn’t happened since 2018. However, investors will have to keep a keen eye on any earnings revisions throughout the year which could be significant due to disruptive policies.

Source: Bloomberg, Betashares. Earnings of S&P 500 companies.

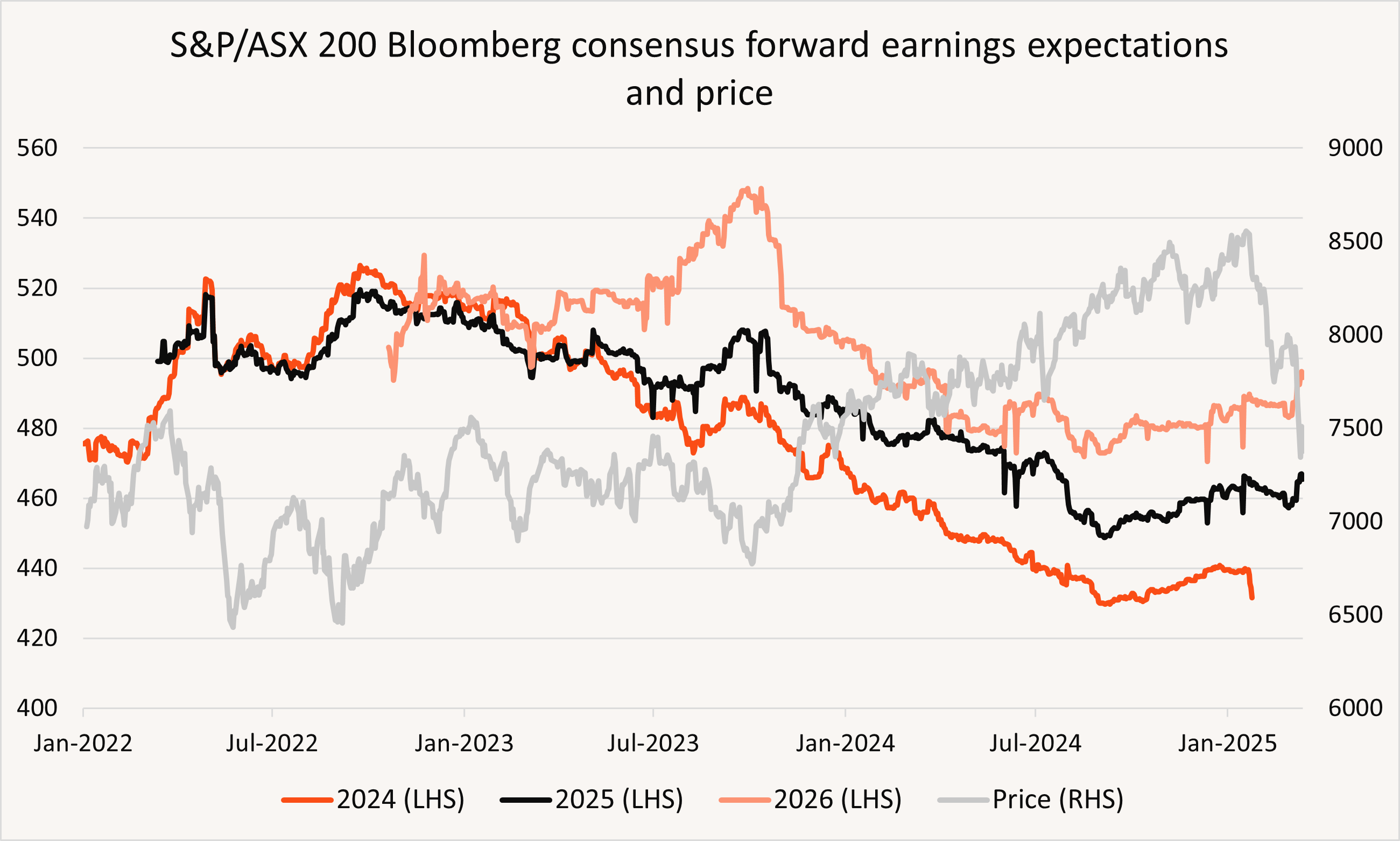

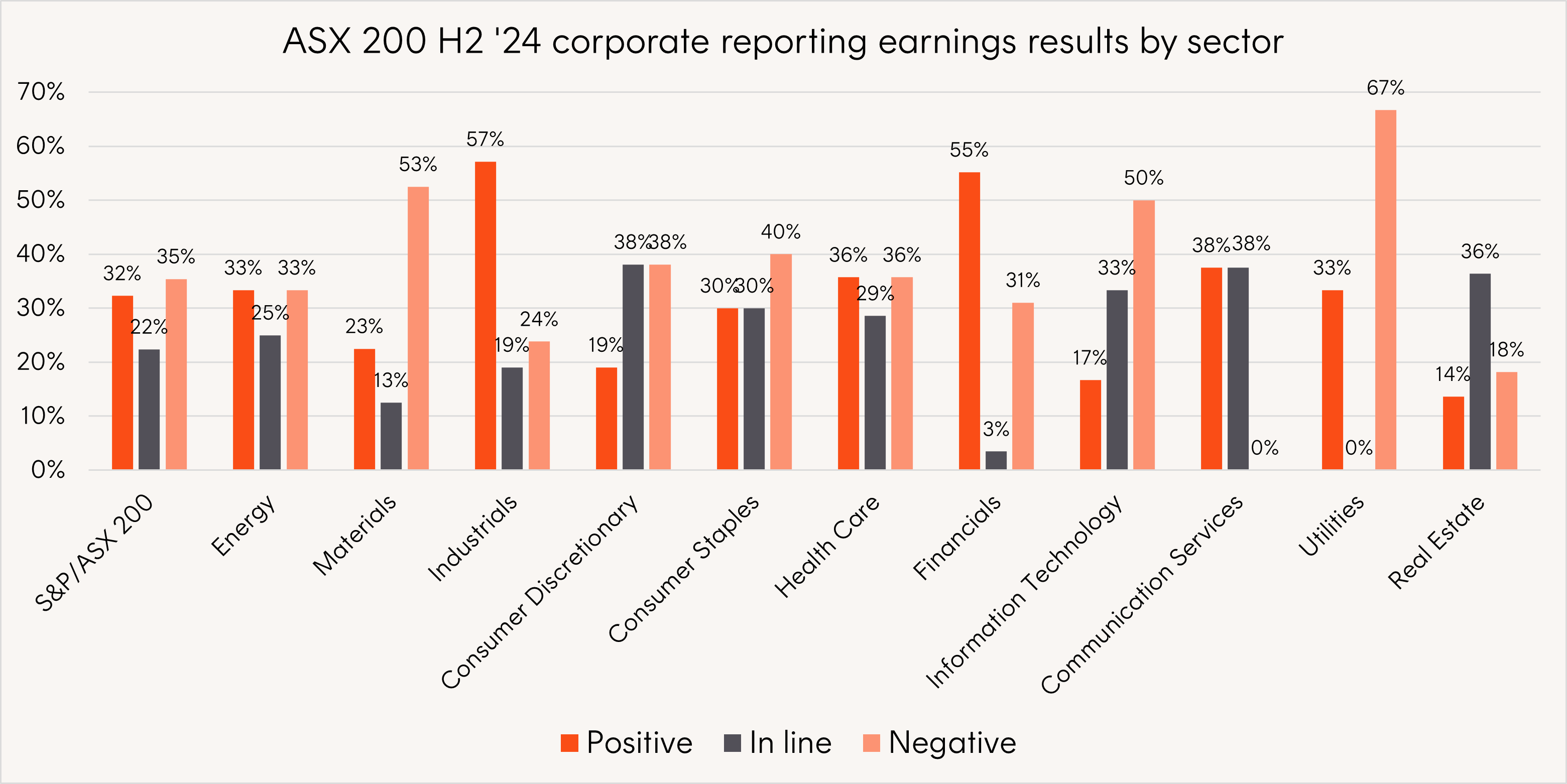

Corporate Earnings – Australia H2 24’

- February saw risk off moves in Australian equities in what has been the most volatile earnings season on record, with 20% of stocks moving +/-10% on their result. Results in aggregate were largely in-line, but expensive companies which posted no or little cuts to consensus forecasts still saw heavy downward valuation re-ratings, such as JB Hi-Fi in the Consumer Discretionary sector.

- CBA’s result was initially well received, but a fall in the net interest margins in BEN’s half year result and WBC and NAB’s quarterly trading updates saw the bank shares slide.

- Most sectors within the ASX 200 sold off with the exception of defensive sectors like Consumer Staples, Communications and Utilities with the latter posting sales growth of 11.65% in the half-year period ending 15 February 2025.

- Communication services saw positive returns largely assisted by Telstra’s earnings update and buy-back announcement and Nine Entertainment, following the CoStar proposal to buy Domain Holdings. Whilst many sectors across the ASX reported earnings lower than consensus expectations, Communication services ‘surprised’ by +27.1%.

- Information Technology was the fastest growing sector across the ASX from a sales and earnings perspective, however that alone wasn’t enough to beat expectations with the sector down during the month of February.

Source: Bloomberg. As at 9 April 2025. Bloomberg consensus earnings estimates for 2024, 2025, and 2026 since 31 January 2022. Actual results may differ materially from estimates.

Source: Bloomberg, Betashares. Earnings of S&P/ASX 200 companies. Totals may not add to 100% as not all companies report earnings during the period.

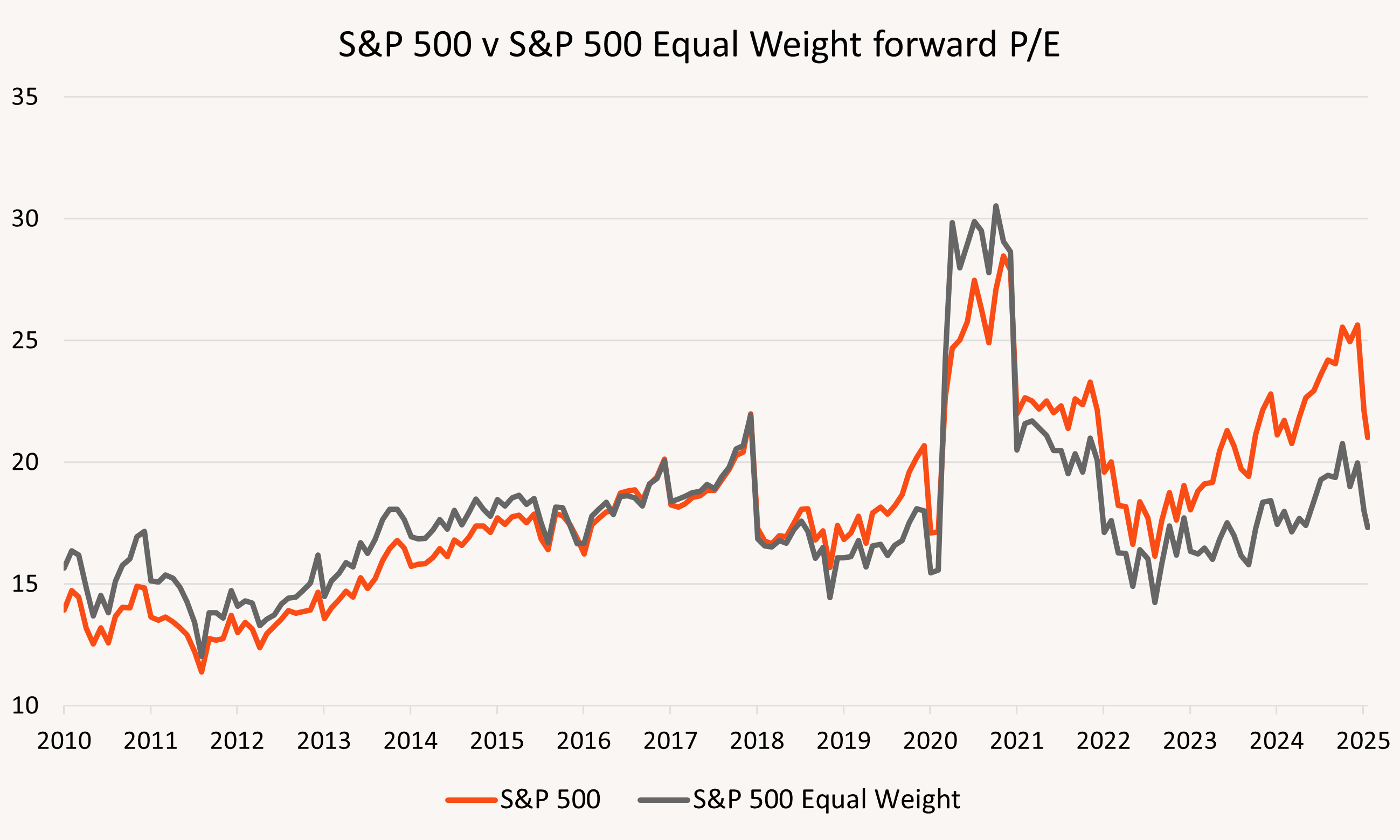

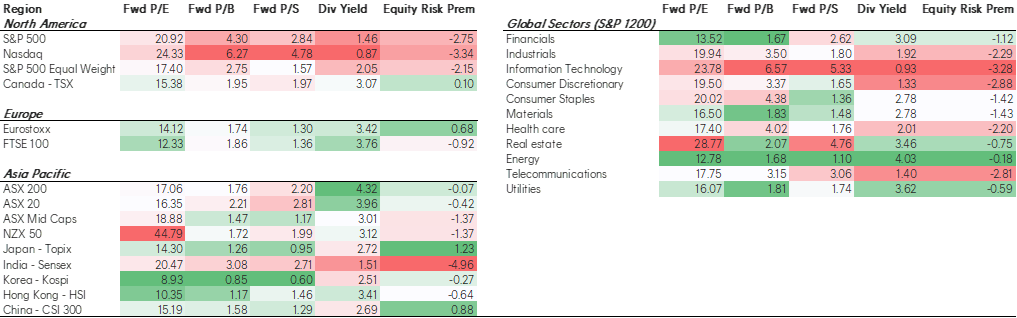

Valuations and fundamentals

- The S&P 500 reached all-time highs midway through the quarter with valuations for the index pushing above 27 times forward earnings, the second highest level since the dot com bubble with the Covid aberration being the other. This left plenty of room down for the market sell off that began during the quarter and while the forward p/e ratio had fallen to 21x by 31 March this level is still above the 30-year average leaving further room for valuations to fall yet.

- On the other side of the equation, earnings have only seen modest revisions lower and do not yet reflect any more severe economic impacts from Trump’s proposed tariffs. This poses a further risk to markets as downward earnings revisions could add fuel to the market sell off.

- While Chinese and European equities saw strong returns for the quarter, there remains a significant valuation discount for these regions versus the US. The outperformance of US equities has been a decades long trend supported by corporate earnings, business investment, and dollar strength. While it is too early to call an end to the US’ dominance, some cracks begun to show in US exceptionalism this quarter and the valuation gap between the US and the rest would be a factor favouring ex-US equities in any rotation.

Source: Bloomberg. February 2010 to March 2025. You cannot invest directly in an index. Past performance is not indicative of future performance of any index or fund.

Betashares Global Equity Markets Monitor – 31 March 2025

Source: Bloomberg, Betashares. As at 31 March 2025. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Asset Class Correlations

- Correlations between broad stock and bond indices were close to zero over the quarter as markets slowly began pricing in the threat of a growth slowdown over further inflationary pressures. More often than not, bonds have provided investors diversification in time of equity market stress. However, tariffs pose a complication in that they are likely to cause both a slowdown in growth and higher inflation sending mixed signals for the path of interest rates.

- Gold’s strong run in the face of market weakness saw the commodity provide strong diversification benefits to portfolios with negatively correlated returns to equities.

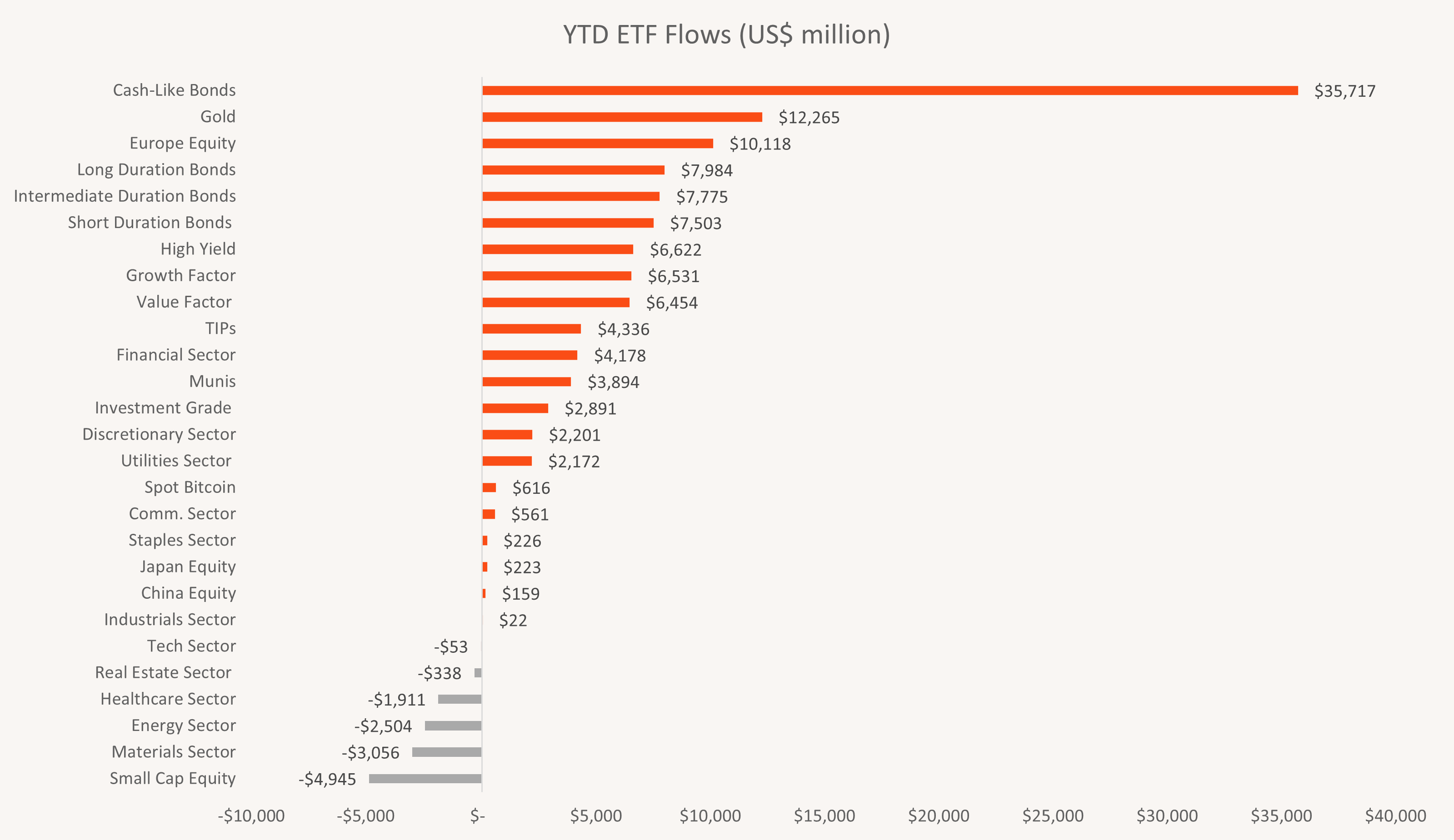

Flows

- Consistent with equity markets coming under pressure, we saw significant inflows into cash, gold and bond ETFs in the US as investors sought safe haven assets during times of uncertainty.

- Investors preferred European equities while there were large outflows from small-cap, Materials and Energy exposed ETFs. Technology ETFs also saw net outflows in the first quarter of 2025 as record high valuations, and US policy uncertainty weigh on the sector’s future outlook.

Source: Strategas, Bloomberg. As at 31 March 2025.

Betashares Capital Limited (ACN 139 566 868 / AFS Licence 341181) (“Betashares”) is the issuer of this information. It is general in nature, does not take into account the particular circumstances of any investor, and is not a recommendation or offer to make any investment or to adopt any particular investment strategy. Future results are impossible to predict. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in any opinions, projections, assumptions or other forward-looking statements. Opinions and other forward-looking statements are subject to change without notice. Investing involves risk.

To the extent permitted by law Betashares accepts no liability for any errors or omissions or loss from reliance on the information herein.