An evolution of high yielding credit income (ECRD)

7 minutes reading time

- Wealth builder

Whether they know it or not, many Australians are already familiar with the idea of gearing. Millions of Australians have built generational wealth through residential property.

If you’ve bought property, either to live in or as an investment, the chances are you funded your purchase partly through a mortgage. Purely from an investment perspective, if the property increases in value over time by more than what you borrowed from the bank, you are better off. Gearing into property allows the equity in your house to increase at a rate potentially much faster than the value of the property itself.

This is the essence of gearing.

What is gearing?

Gearing, sometimes referred to as leverage, involves borrowing money to increase the size of an investment and potentially increase (or ‘amplify’) both gains and losses.

It can be used across most asset classes and takes several forms, from investment loans and structured products, to options, futures and geared funds.

Put simply, gearing lets you invest more than you currently have. If the assets you invest in rise in value by more than the cost of borrowing, your overall return is higher than if you’d just used your own money. But the reverse is also true: if the investment falls, your losses are magnified too. Gearing is like turning up the volume on your investment outcomes – both the good and the bad.

In the context of geared ETFs, this borrowing happens inside the fund itself. You invest your money in the ETF, and the fund manager adds borrowed money to give you greater exposure to the underlying assets, i.e. share portfolio.

Gearing with fewer barriers

For investors comfortable with the risks, geared ETFs offer a way to increase market exposure and potentially accelerate long-term wealth creation, without the costs and complexities of traditional margin lending.

Betashares’ Wealth Builder ETFs provide cost-effective, internally geared exposure to the Australian and global sharemarkets. The funds handle all borrowing on your behalf, meaning you do not need to take out a margin loan. The investor doesn’t have to worry about all the loan applications, credit checks or the risk of margin calls.

Another significant benefit is that Betashares can access funding for the Wealth Builder ETFs at institutional interest rates. These rates are significantly lower than the interest rates typically available to individual investors seeking to borrow on their own account, meaning individual investors have access to a reduced cost of borrowing.

The Betashares Wealth Builder range currently comprises three different funds:

- Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF (ASX: GHHF)

- Betashares Wealth Builder Australia 200 Geared (30-40% LVR) Complex ETF (ASX: G200)

- Betashares Wealth Builder Nasdaq 100 Geared (30-40% LVR) Complex ETF (ASX: GNDQ)

All three Wealth Builder ETFs target loan-to-valuation ratios (LVR) of between 30 to 40%. The LVR is also known as the gearing ratio. These funds are considered “moderately geared” and can be accessed via Betashares Direct.

How do they work?

The amount borrowed is actively managed to keep the fund’s gearing ratio within a target range of 30-40% on a given day. This means that for every $100 you invest, you’ll typically gain exposure to between $143 and $167 worth of assets on a given day. This ratio allows you to amplify your investment potential while keeping gearing at a moderate level.

It’s important to note that over periods longer than a day, each fund’s geared exposure may not necessarily be in this range due to the following reasons:

- Rebalancing activity to stay within the geared exposure range

- The compounding of investment returns over time

- The impact of funding costs, management fees and transaction costs

As a result, investors should review their investment regularly to ensure it continues to align with their goals and risk tolerance.

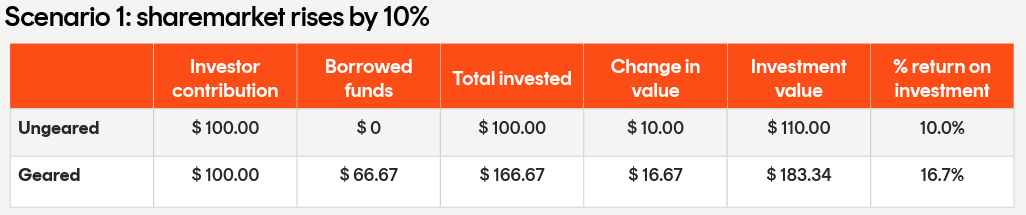

A practical example of how gearing can affect investment performance

When markets are rising or falling, gearing amplifies your returns. Let’s take a look at an example to see how this works.

Two illustrative examples are shown below, both assuming an LVR of 40%, meaning 40% of the total money invested is borrowed money. In this simple example, neither borrowing costs nor any income from the investments are taken into account. It’s also important to note that this example does not reflect actual fund performance and that actual results may differ materially.

In Scenario 1, where the sharemarket has risen by 10%, gearing has resulted in a 16.7% return on the investor’s initial contribution.

However, in Scenario 2 where the sharemarket has fallen by 10%, the effects of gearing have resulted in a 16.7% loss.

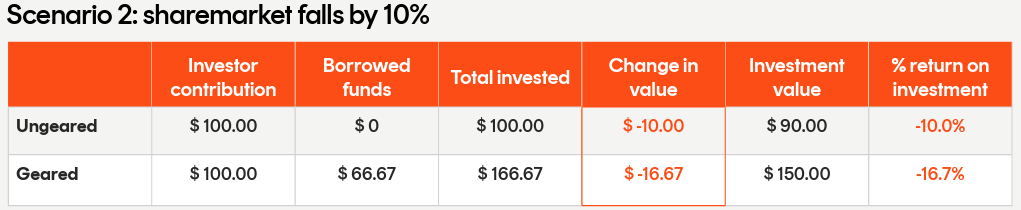

In the chart below, we use simulated historical performance to compare the performance of a moderately geared portfolio of Australian equities to a corresponding ungeared strategy over the period from September 2010 to June 2025 (almost 15 years).

Source: Bloomberg. Betashares. This information is provided for illustrative purposes only and is not representative of actual fund performance. Actual outcomes may differ materially. The information is not a recommendation or offer to make any investment or to adopt any particular investment strategy. Simulated past performance is not indicative of future performance of any fund or strategy.

This chart is for illustrative purposes only and is based on assumptions set out in the ‘Important information’ section at the end of this article. It does not represent actual fund performance.

What are the risks?

Gearing magnifies both gains and losses and carries higher risk than non-geared investments. In a rising market, you may outperform an equivalent ungeared investment; in a falling market, the reverse is true. Investing in geared ETFs also comes with greater volatility.

For these reasons gearing may not be a suitable strategy for all investors.

Geared ETFs also tend to be more expensive compared with their ungeared counterparts. This may be important for cost-conscious investors.

In the right hands, gearing can be investing’s best kept secret

For the investor with a long-term outlook, geared ETFs can be a powerful tool, offering a way to potentially accelerate wealth creation.

Geared ETFs should always be used as part of a broader, well-considered strategy. For those investors who can tolerate the risks, gearing could be a valuable step toward reaching your financial goals.

Important information – simulated historical strategy performance illustration

The simulated historical strategy performance illustration included in this artcile shows simulated historical performance of a geared strategy for a broad market Australian equities portfolio (as measured by the Solactive Australia 200 Index) compared to an ungeared strategy over the same portfolio for the period from September 2010 to June 2025. All simulated performance information is provided for illustrative purposes only and is not representative of actual fund performance. Actual outcomes may differ materially. You cannot invest directly in an index. The information provided is not a recommendation or offer to make any investment or to adopt any particular investment strategy.

Simulated past performance is not indicative of future performance or any fund or strategy.

Key assumptions

- Simulated strategy performance is shown net of management fee and costs, being 0.04% p.a. of net asset value (for the ungeared strategy, being the management cost for Betashares Australia 200 ETF (ASX: A200)), being the fund into which G200 invests) and 0.35% p.a. of gross asset value (for the geared strategy).

- For the geared strategy, a gearing ratio of 30-40% is applied, with the ratio brought back to the midpoint (35%) at end of day if the ratio moves outside of this range.

- Borrowing costs are based on the rates/margins agreed with the prime broker for G200.

- All returns assume reinvestment of distributions. Does not take into account transaction costs.

Key risks

There are risks associated with an investment in each Fund, including market risk, underlying ETF risk, gearing risk, rebalancing and compounding risk and lender risk, as well as (for GHHF) asset allocation risk and currency risk. Investment value can go up and down. An investment in each Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Fund, please see the applicable Product Disclosure Statement and Target Market Determination at www.betashares.com.au.

1 comment on this

[email protected]