9 minutes reading time

Just over a year ago, we launched our Wealth Builder ETF range. These ETFs are designed to help investors accelerate long-term wealth creation, through the use of a ‘moderate’ level of gearing at very low institutional interest rates. As a result, the interest cost of gearing into the sharemarket using these ETFs is considerably lower than that typically available to individual investors using a home equity mortgage, for example.

Investors generally appreciate that a geared ETF is expected to outperform in a bull market and underperform in a bear market, but often struggle to understand what return they should expect in a market with multiple cycles. We endeavour to unpack that in his article.

In this note, we look at the recent performance of GHHF Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF . GHHF is designed to provide a geared, all-in-one diversified portfolio of global and Australian equities.

On a single given day, GHHF will provide a return equal to the change in value of the underlying investment portfolio times the gearing multiple shown on GHHF’s fund page on that day.[1]

However, in assessing performance over periods greater than one day, it’s not enough to simply multiply the gearing multiple of the geared ETF by total return of the underlying investment over that time. A geared ETF’s returns over periods longer than one day may differ in amount and possibly direction from the daily target geared return range. The performance of a geared ETF over longer periods is a function of:

- The initial gearing multiple and the return of the underlying investment portfolio

- Interest costs, management fees and other costs; and

- Any rebalancing impacts over the period.

Betashares Wealth Builder ETFs have been designed with the aim of minimising the impacts of points 2 and 3 above, and this has been a key advantage in terms of delivering performance in the choppy markets we have seen over the last 14 months.

Before we get into the detail, it’s important to remember that gearing magnifies gains and losses and may not be a suitable strategy for all investors. Investors in geared strategies should be willing to accept higher levels of investment volatility and potentially large moves (both up and down) in the value of their investment. Geared investments involve higher risk than non-geared investments

Breaking down performance

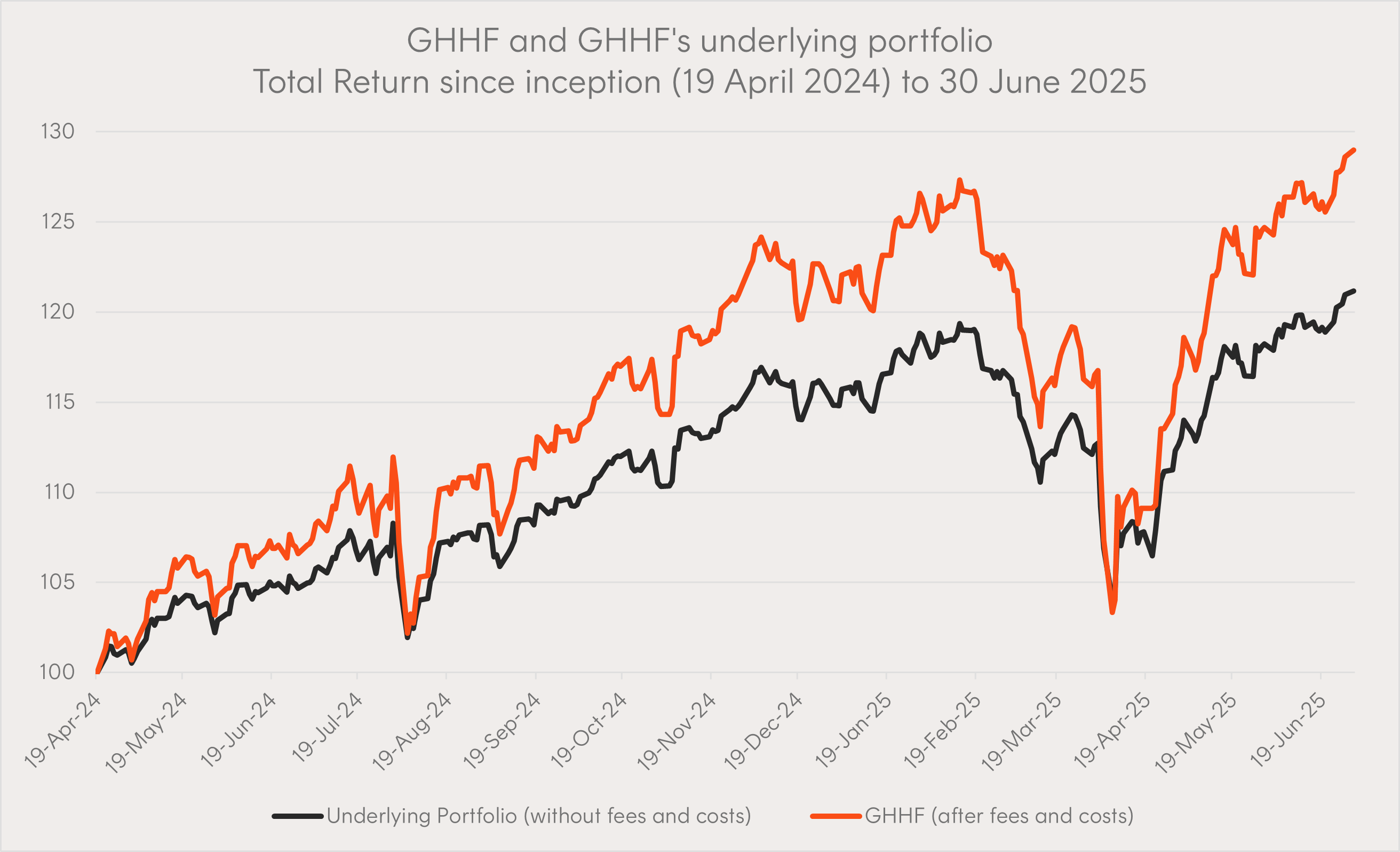

From ETF inception on 19 April 2024 to 30 June 2025, GHHF has generated a total return of 28.99% net of fees and costs (remembering that past performance is not a reliable indicator of future performance and that GHHF has a suggested investment timeframe of 7 years or more). Please note this performance is not necessarily indicative of the fund’s longer-term performance.

Source: Bloomberg, Betashares. As at 30 June 2025. Actual or simulated past performance is not an indicator of future performance of any ETF or strategy. Provided for illustrative purposes only. Actual outcomes may differ materially. GHHF fees and costs are 0.35% p.a. of the fund’s gross asset value. All returns assume reinvestment of distributions. Does not take into account transaction costs.

The chart above shows:

- The actual performance of GHHF; and

- The simulated historical performance of the corresponding ungeared Australian and international equities portfolio which would have returned 21.16% over the same period. This “pre-fee” return is derived from a hypothetical portfolio that holds the same underlying ETFs as GHHF in accordance with the same asset allocation, but on an ungeared basis and not taking into account any fees and costs of GHHF or the underlying ETFs,

In the chart we can observe the sharper drawdowns GHHF displayed in market downturns, such as in July 2024 and the Liberation Day (7 April 2025) selloff. But critically, during the comparison period, GHHF recovered from these drawdowns as quickly as the ungeared portfolio, and outperformed in rising markets.

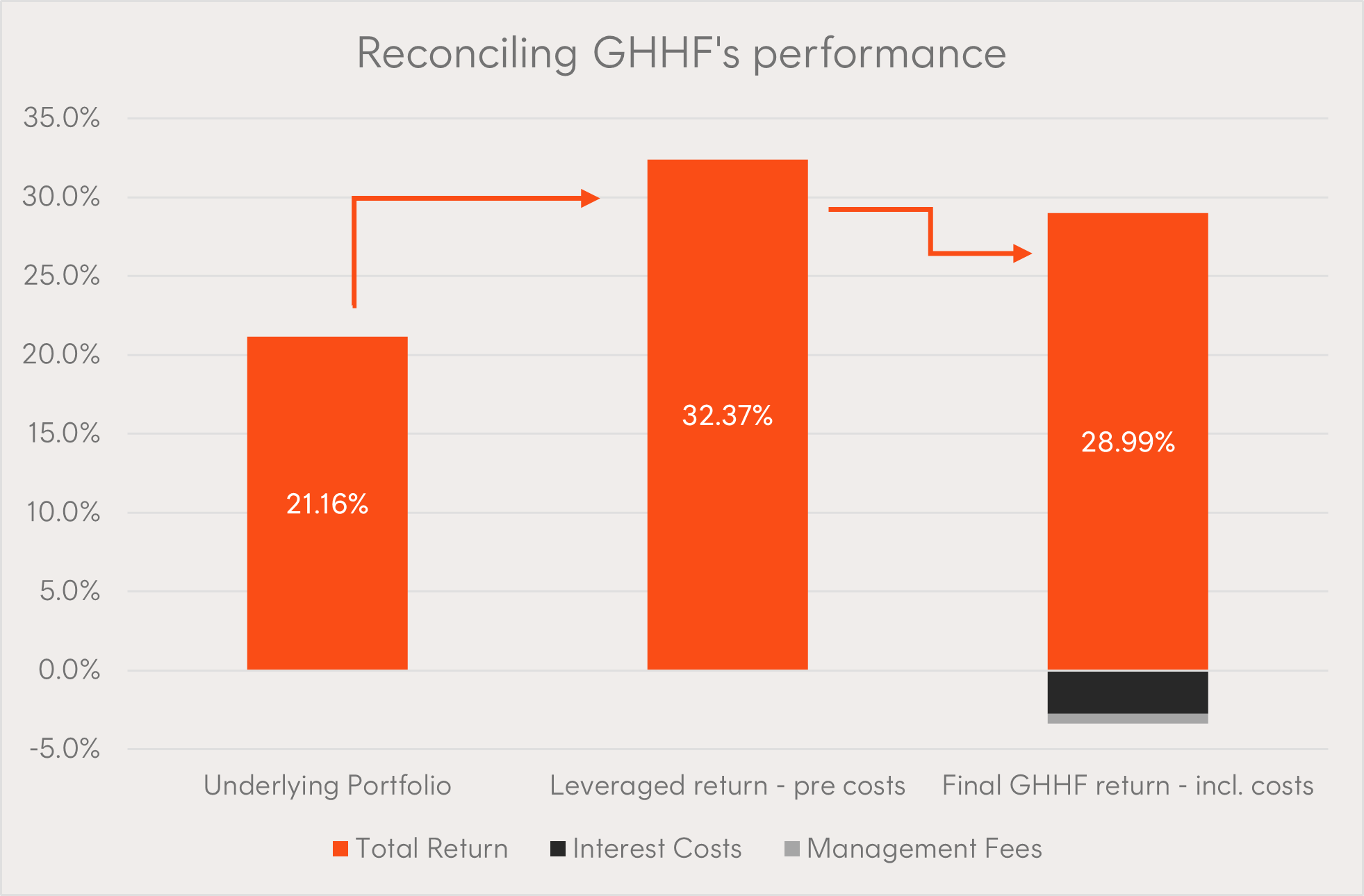

Reconciling GHHF’s performance since inception (to 30 June 2025)

As stated previously, GHHF’s performance is a function of: (1) the initial gearing multiple and the return of the underlying investment portfolio, minus (2) interest costs, management fees and other costs; plus/minus (3) any rebalancing impacts over the period.

- The gearing multiple of GHHF at the start of the day it was launched was 153%. Without the impact of GHHF’s fees and costs, as well as rebalancing, a hypothetical ungeared Australian and international equities portfolio (with the same underlying ETFs and asset allocation as GHHF) would have generated 1.53 x 21.16% (i.e. 32.37%).

- Both the interest costs and management fees for GHHF are incredibly low for a leveraged investment product. In total, the impact of all costs (including interest, management fees and other costs) was -3.38% to performance since inception to 30 June 2025 (made of an annualised interest cost of 2.30% and an annualised management fee of 0.62% as a percentage of net asset value)

- The rebalancing impacts have been zero, as GHHF did not have a single rebalance in the period from inception to 30 June 2025.

Source: Bloomberg, Betashares. As at 30 June 2025. Actual or simulated past performance is not an indicator of future performance of any ETF or strategy. Provided for illustrative purposes only. Actual outcomes may differ materially. GHHF fees and costs are 0.35% p.a. of the fund’s gross asset value. All returns assume reinvestment of distributions. Does not take into account transaction costs.

These factors help to explain GHHF’s 28.99% total return since its inception on 19 April 2024.

Why is this return outcome so significant?

Many investors understand that geared ETFs amplify both gains and losses. However, some can be surprised when a geared ETF underperforms versus a simple point-to-point return expectation, particularly when markets experience a sharp selloff, followed by a strong rally.

The key issue is the impact of rebalancing, which is required to manage the gearing level of a geared investment strategy as the market moves in one direction or another. In a market that continues to trend in one direction, rebalancing will improve the risk control and returns (buying more into a rising market or closing out positions on the way down).

However, rebalancing can also detract from performance in choppy markets. In these scenarios, maintaining a desired gearing level can cause a geared investment strategy to “buy high and sell low” intra period, even if the total return for the overall period is flat.

The Wealth Builder ETFs, including GHHF, seek to reduce the impact of rebalancing on returns by design:

1. No daily rebalancing

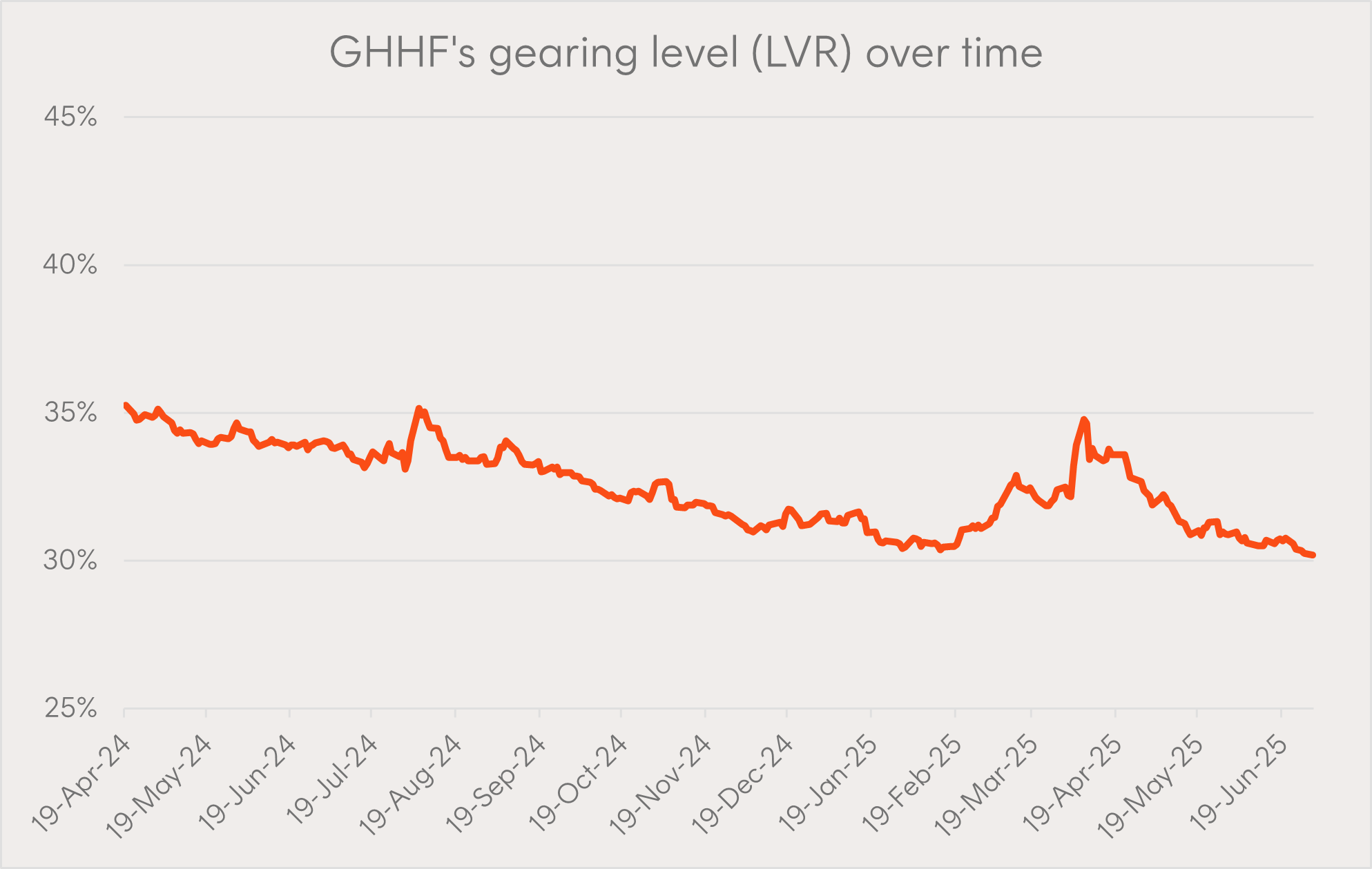

In the US, geared ETFs tend to adopt a daily-resetting strategy, meaning that each day the ETF will be rebalanced back to its starting gearing level. In contrast Betashares’ geared ETFs do not reset their gearing daily, but rather the gearing is managed within a range. For GHHF that gearing ratio (being the total amount borrowed and expressed as a percentage of the total assets of the fund) is between 30–40% on a given day. GHHF only rebalances when its exposure drifts outside this range, which limits unnecessary turnover compared to a daily resetting strategy. This means it does not suffer from the day-to-day compounding drag seen in traditional US geared ETFs.

2. Lower and more sustainable gearing

GHHF targets a ‘moderate’ level gearing exposure (between ~143% and 167% on a given day). While this means GHHF has higher volatility than an equivalent ungeared investment, it is not at levels that would generally create the need for frequent rebalance activity. The moderate level of gearing combined with a gearing range significantly reduces the frequency which with the ETF needs to be rebalanced compared to other ‘traditional’ leveraged products that may have a higher gearing level and/or a daily resetting strategy, as well as reducing the amount of the portfolio that needs to be bought or sold if a rebalance is triggered.

As at 30 June 2025. Gearing level is subject to change over time for the reasons discussed in this article. Past performance is not indicative of future performance.

Throughout the approximately 14-month period since its inception, GHHF has not required a single rebalance, as shown in the chart above. The ETF’s gearing remained within its target range (30-40%), and by not trading in response to every market movement, GHHF avoided the negative consequences that rebalancing can have on performance in traditional leveraged products.

This approach aligns more closely with long-term wealth-building goals, particularly for investors who are not seeking to take short-term tactical positions.

Falling interest rates – something to look forward to

GHHF is an “internally geared” ETF, meaning gearing is managed within the ETF by Betashares. Importantly Betashares has access to institutional interest rates, which are typically considerably lower than margin loans or those available to individual investors seeking to borrow in their own capacity.

As at the time of writing the variable interest rate applied to GHHF’s leverage is well below 5% p.a. Furthermore, any RBA rate cuts will mechanically lower the GHHF’s “breakeven” – what the underlying portfolio needs to return to offset the cost of borrowing and management fees.

With its cost-effective approach to gearing, that mitigates the typical drawbacks of more traditional leveraged strategies, GHHF offers investors a powerful tool to accelerate wealth creation over the cycle.

Footnotes:

1. The current gearing multiple is available and updated every day on GHHFs’ fund page. The gearing multiple is anticipated to vary within a 143% to 167% range. The figure published is as at start of the relevant date and can be expected to vary throughout the day. ↑

2 comments on this

Hi, I’m wondering if the gearing is reset daily for other Betashares ETF’s ( GEAR and GGUS)?

Hi Justin, thanks for your question. No, our GEAR and GGUS do not automatically reset daily. They are managed to a target gearing range of between 50-65%. The leverage is monitored daily, but a reset only occurs on a day when the market declines (or rises) such that the fund’s effective leverage has either moved above 65% or fallen below 50%.”