ETF distributions: frequently asked questions

7 minutes reading time

Pick axes and gold pans might be things of the past, but are we experiencing a modern gold rush?

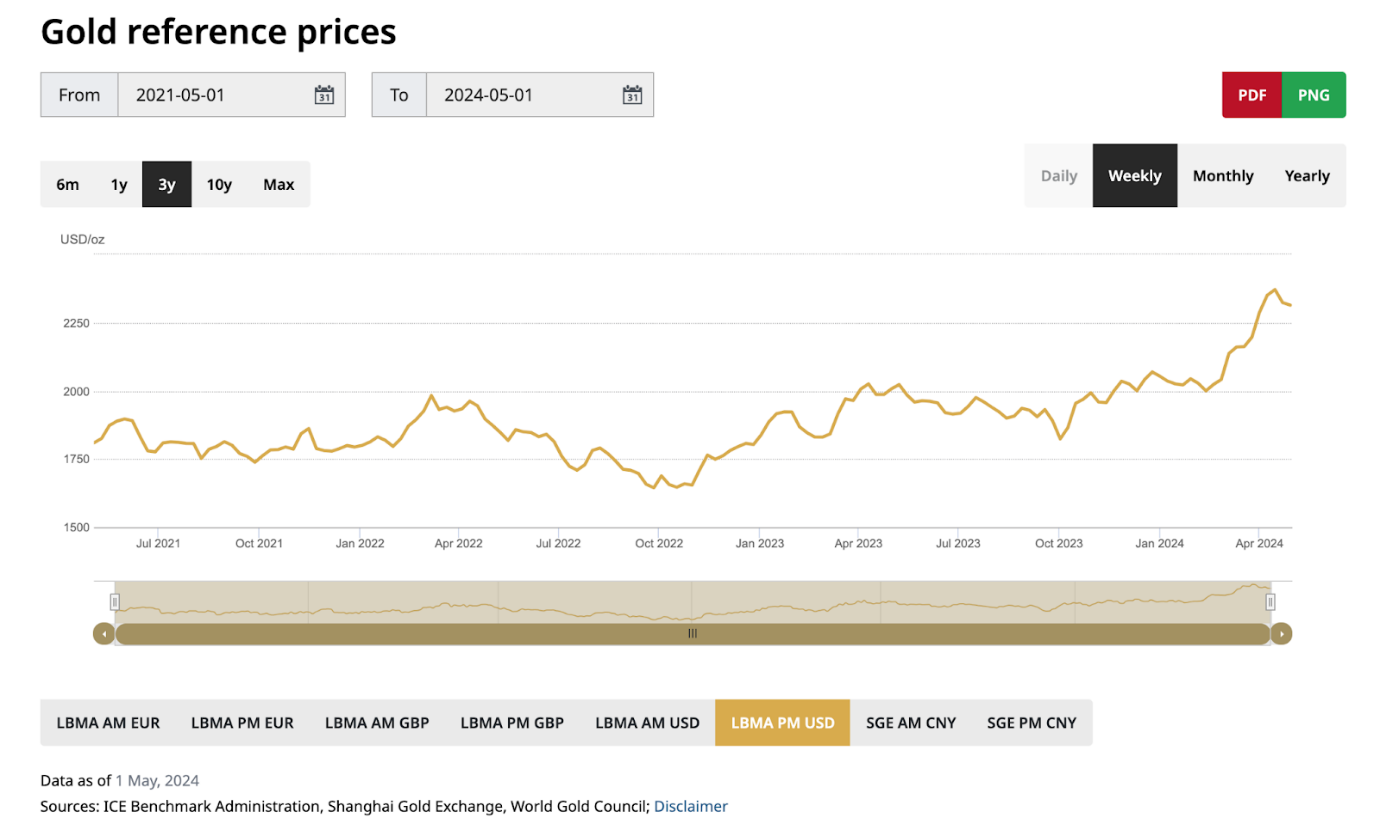

Gold hasn’t been an especially newsworthy asset for years, making its recent momentum and new all-time highs all the more interesting to investors. The price of gold is up roughly 40% from its 2022 lows, reaching US$2,304.70 at the end of April.

Sources: ICE Benchmark Administration, Shanghai Gold Exchange, World Gold Council; Disclaimer (Data as of 1 May, 2024)

In this blog, we’ll dive into the factors driving the surging price of gold and discuss considerations for investing in this asset. We’ll also provide an ETF idea for investors looking to diversify their portfolio to include gold.

How is gold different from other investments?

Before diving into contemporary contributors to the climbing gold price, it’s helpful to understand how gold differs from other common investments. Its unique characteristics help to explain its performance during different geopolitical and economic environments.

Many other investments, such as shares and bonds, are purchased for their ability to generate cash flow through dividends and interest or for their potential appreciation when the underlying companies or assets produce profits. Gold doesn’t share these characteristics but is typically viewed as a reliable way to store value.

The metal has been prized for millennia, imbuing it with a degree of perceived safety compared to other assets.

That trendy new tech company surging today could conceivably go to zero in the future, but we have thousands of years of data and knowledge of its cultural significance to suggest gold will continue to be seen as valuable—even if it isn’t likely to surge in quite the same way as top-performing shares.

Factors driving higher gold prices

In recent months, multiple forces have converged to drive up demand for gold. Since gold doesn’t generate other cash flows, supply and demand dynamics are key to understanding its escalating price.

Flight to safety during geopolitical uncertainty

Conflicts can disrupt supply chains and cause volatility in equity markets. Amid geopolitical turmoil like the war in the Middle East and the ongoing Russia-Ukraine tensions, investors tend to flock to gold as a safe haven.

This flight to safety spikes demand for the precious metal, driving its price upward. The chart below represents the Geopolitical Risk Index (GPR), and measures both actual and perceived geopolitical tension. When there’s major trouble in the world, the index spikes.

Source: Matteo Iacoviello, World Gold Council

During the Gulf War, gold prices rose 23%, 37% and a whopping 126% in 1977, 1978 and 1979, respectively1. On the first trading day after 9/11, markets experienced heavy sell-offs, while gold rallied nearly 6%2.

Increased global demand

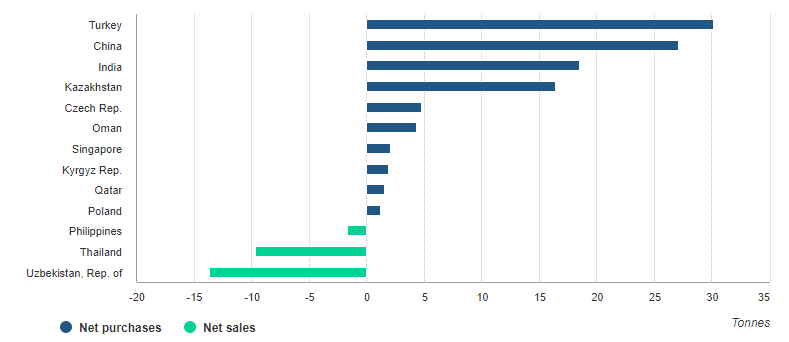

Central banks worldwide are bolstering their gold reserves, possibly to protect themselves from potential US influence in their region. China leads the charge globally, with Turkey, India, and Kazakhstan also boosting their gold holdings. Globally, net purchases of gold by central banks far exceeded net sales in the first three months of 2024, as shown in the chart below.

Robust consumer demand for gold jewellery amidst a growing middle class in gold-loving regions like India, where it plays a key role in weddings3, further intensifies demand.

Sources: IMF IFS, Respective central banks, World Gold Council; (Data as at 31 March, 2024)

Inflation, interest rates, and opportunity cost factors

Gold’s reputation as a hedge against inflation helps us understand its rising price in the face of post-COVID inflationary pressures. However, interest rates tend to correlate negatively with gold prices: as interest rates increase, the opportunity cost of holding a non-yielding asset like gold is higher, and some investors prefer income-producing assets like equities or bonds.

In a bid to bring post-COVID inflation under control, banks around the world—including in the US and Australia—have maintained high interest rates. Despite this, gold prices have continued to rise.

This may be explained by the strength of other factors impacting the price of gold, such as geopolitical turmoil and demand from consumers and central banks. It may also indicate that despite higher interest rates over the past year, the narrative holding court among investors is that interest rates are likely to come down.

Considerations for Australian investors

While no one can predict if the price of gold will continue upward with certainty, there’s plenty of evidence to suggest gold can play an important role in a well-diversified portfolio, acting as a hedge against market volatility.

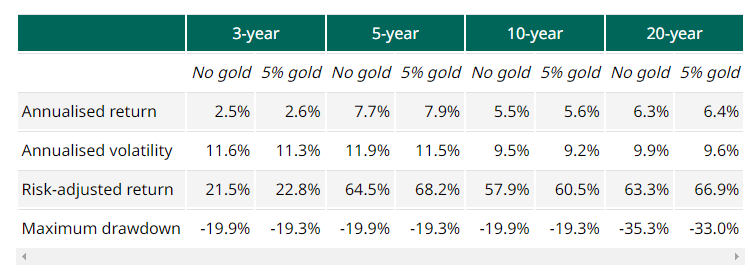

For illustrative purposes, the chart below shows that even a 5% allocation to a balanced portfolio comprising assets including global shares, bonds, and real estate investment trusts improved returns, lowered volatility and made performance more resilient during major market swings.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council (as at 31 December 2023). Not a recommendation to make any investment or adopt any particular investment strategy.

Australians should consider the impact of the AUD/USD exchange rate on their gold investments. Since gold is traded in US dollars, a weaker AUD makes the metal more expensive for Australians. However, a weak USD can drive up global demand for alternative assets like gold, boosting its price.

To mitigate the impact of currency movements, Australians might consider protecting themselves through currency hedging. Some gold bullion and gold miner ETFs, for example, allow for currency-hedged exposure to gold.

Investing in gold

The traditional way to invest in gold is by purchasing coins, bars, or jewellery, but today there are other ways to add gold to your portfolio without physically holding the asset, such as gold bullion ETFs like QAU Gold Bullion Currency Hedged ETF .

As a gold bullion ETF, QAU’s holdings comprise of physical gold bullion bars held in a vault at JP Morgan Chase in London.

Since the ETF is hedged for currency movements, it offers Australian investors exposure to gold while seeking to minimise the impact of major fluctuations in the AUD/USD exchange rate.

With gold coins or bars, it’s important to consider storage and insurance prices. QAU offers a way to easily invest in an asset 100% backed by physical gold while avoiding the need to physically purchase it and incur the costs of storage and insurance.

Conclusion

The price of gold has been on the move, reminding us that during market volatility and geopolitical strife, this time-tested investment can shine.

Distinct from other investments like shares and bonds thanks to its perception as a safe haven and store of value, gold can function as a hedge against losses in other parts of your portfolio. High inflation and increased global demand—both from consumers and central banks—have further bolstered the metal’s price performance.

With the factors contributing to gold’s rise in price persisting, allocating a portion of your portfolio to gold through a 100% gold bullion-backed ETF can mitigate the impact of volatility and may even grow in value.

Disclaimer

There are risks associated with an investment in QAU, including market risk, gold price risk and currency hedging risk. Investment value can go up and down. QAU should only be considered as a component of a broader portfolio. For more information on risks and other features of QAU, please see the Product Disclosure Statement (PDS) and the Target Market Determination (TMD) available on this website.

Sources:

1. Yahoo Finance – How the Threat of War Affects Gold Prices

2. Investopedia – How September 11 Affected the U.S. Stock Market

3. CNN – No big fat Indian wedding is complete without lots of gold

2 comments on this

If you had $500K invested in Gold before covid, you would now have $1 Million in net worth. Everything economists have tried to convince investor relating to inflation and interest rates coming down has failed. Equities have already slid downwards. Gold will run, especially when the FED releases more data that NO relief is in sight. I sold my gold etf and all my betashares and invested in PMGOLD, my returns have outperformed your ETF and their mgt fee is considerably less and it’s not hedged. Sadly, after huge profits with Betashares ETF, I bailed at the right time and invested in gold prior to the jump. That’s investing.

Really good article. I’ve held QAU for 5+ years and it’s been a good hedge in my portfolio. I don’t agree with Silvio though – where/when have equities really slid downwards – COVID and the tech crash of 22 now look like blips on a chart. Good on you for timing your trades well though, but I don’t think investing in gold should come at the cost of not investing in equities/cash. You *NEED* income and gold doesn’t provide that.