The rise of HCRD - and where Aussie credit goes from here

5 minutes reading time

- Commodities & gold

Gold traditionally has been used as a hedge against inflation. During periods of high inflation, central banks typically increase interest rates. High inflation can make it difficult to value companies as the dollar becomes less valuable, affecting operating costs and profits. This can make markets volatile.

This is where gold and other hedging assets come into play. Hedging refers to taking a position in one asset class or investment to try and offset potential movements in other assets or investments, and therefore reduce the overall impact on a portfolio.

Gold has proven historically to be somewhat negatively correlated to equities during market declines1, making it a widely used hedging asset.

In a high inflation environment, as central banks raise rates, the interest one can earn with excess cash can be expected to increase. In contrast, the opportunity cost of owning gold increases, as gold does not pay an income like investment options such as term deposits or other fixed income investments. In these circumstances, investors could potentially be expected to favour income-generating investments over gold.

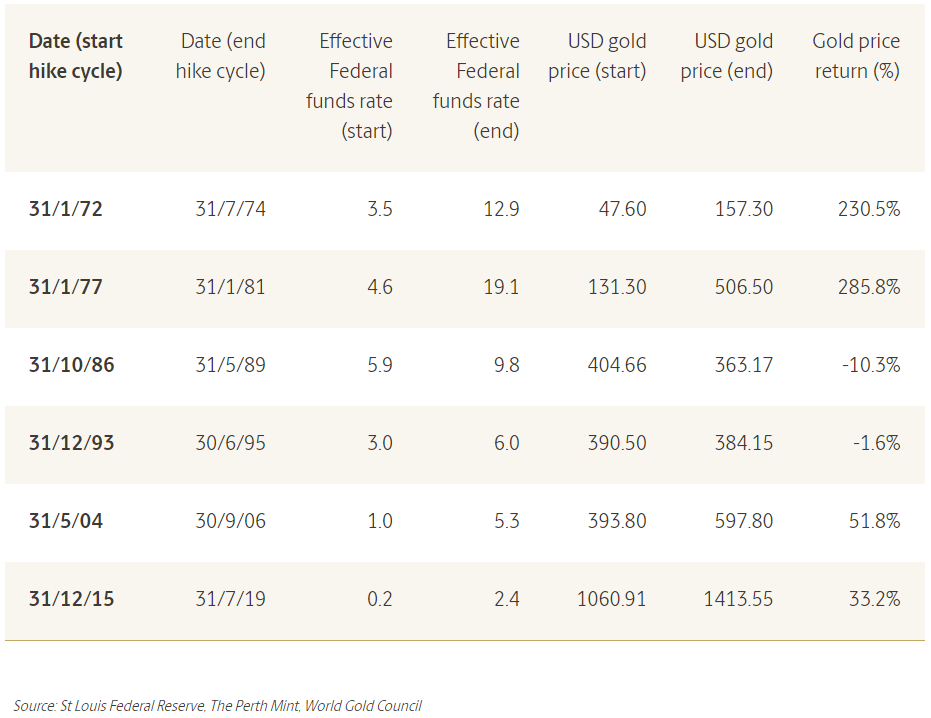

In reality however, gold prices have tended to increase as central banks raise rates, illustrating a somewhat positive correlation with interest rates and gold prices as illustrated in the table below:

Returns shown above do not represent the returns of any BetaShares fund. Information is provided for illustrative purposes only. Past performance is not indicative of future returns.

While we haven’t seen the same performance characteristics from gold so far in this rate hiking cycle, the cycle seems a long way from completion, with the June CPI figure of 9.1%2 compared to target long-term rates for US inflation being around 2%.3 Regardless, gold has still performed significantly better than equities so far in 2022, falling by 1.56%4 compared to the S&P500’s fall of more than 20%5 in the six months to 30th June.

Hedging a hedge?

Investing in gold brings another variable to the equation – foreign currency movements.

Left unhedged, movements in the AUD/USD exchange rate will affect the returns investors see on their holding in gold, as is the case with any investment denominated in USD.

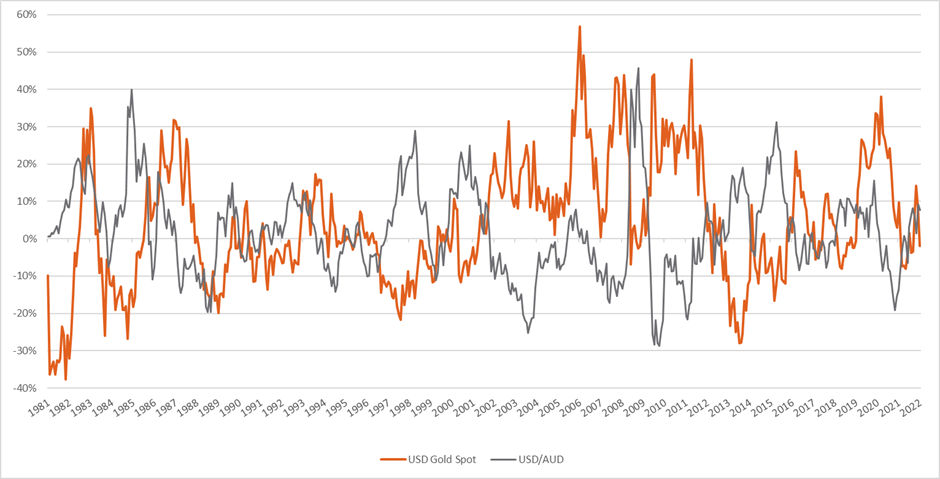

The AUD/USD rate historically has been positively correlated to the USD gold price. Looked at another way, past performance of gold prices suggests an inverse relationship between the USD/AUD exchange rate and the USD gold price. This is shown in the graph below.

Chart 1: Rolling 12m returns of USD Gold Spot vs USD/AUD since May 1981

Source: Bloomberg, BetaShares. Monthly rolling 12m returns from 29 May 1981 to 31 May 2022. USD Gold spot price is based on the LBMA Gold Price AM USD Index. Returns shown above do not represent the returns of any BetaShares fund. Information is provided for illustrative purposes only. Past performance is not indicative of future returns.

A positive correlation between the AUD/USD rate and the USD gold price suggests that as gold increases in value, the AUD has historically gone up as well. The result is that gold price returns denominated in AUD have been cut short by the changing exchange rate in previous cycles.

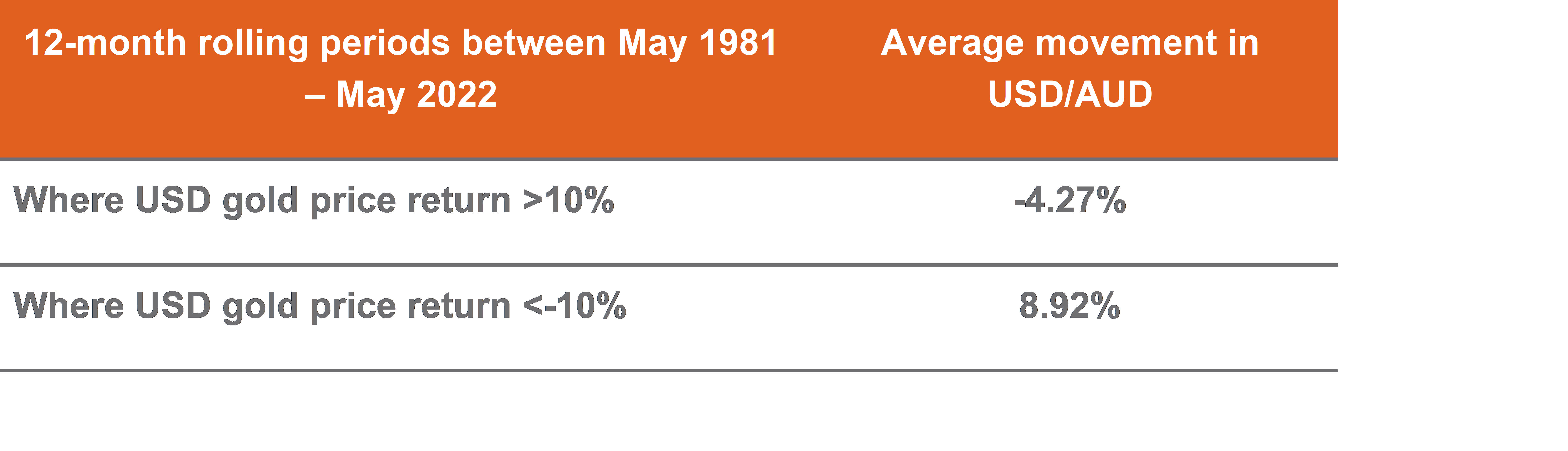

The below table shows the average USD/AUD movement when the USD gold price return over a 12 month period is greater than, or less than 10%. Source: Bloomberg, BetaShares. Monthly rolling 12month returns from 29 May 1981 to 31 May 2022. USD

Source: Bloomberg, BetaShares. Monthly rolling 12month returns from 29 May 1981 to 31 May 2022. USD

Gold spot price is based on the LBMA Gold Price AM USD Index. Returns shown above do not represent the returns of any BetaShares fund. Information is provided for illustrative purposes only.Past performance is not indicative of future returns.

How can Australian investors minimise the impact of currency movements on their gold investment?

Australian investors seeking to gain a ‘pure’ exposure to gold, and minimise the influence of currency fluctuations, have the option to hedge against currency movements.

The BetaShares Gold Bullion ETF – Currency Hedged (QAU) is backed by physical gold bullion and aims to track the performance of the price of gold, hedged for currency movements in the AUD/USD exchange rate (before fees and expenses).

|

There are risks associated with an investment in QAU including market risk, gold price risk and currency hedging risk. QAU should only be considered as a component of a broader portfolio. For more information on risks and other features of QAU, please see the Product Disclosure Statement (PDS) and the Target Market Determination (TMD), available at www.betashares.com.au. A Target Market Determination is also available at www.betashares.com.au/target-market-determinations. BetaShares Capital Ltd (ABN 78 139 566 868 AFSL 341181) is the issuer of the BetaShares Funds. The information in this article is general only, it is not personal advice, and is not a recommendation to buy units or adopt a particular strategy. It does not take into account any person’s financial objectives, situation or needs. Any person wishing to invest should read the relevant PDS and TMD from www.betashares.com.au and obtain financial advice in light of their individual circumstances. |

1. https://goldsilver.com/blog/if-stock-market-crashes-what-happens-to-gold-and-silver/

2. https://www.statista.com/statistics/273418/unadjusted-monthly-inflation-rate-in-the-us/

3. https://www.federalreserve.gov/faqs/economy_14400.htm

4. https://au.investing.com/commodities/gold-historical-data

5. https://au.investing.com/indices/us-spx-500-historical-data