DEI: Impacts of changes to US law for companies and responsible investors

8 minutes reading time

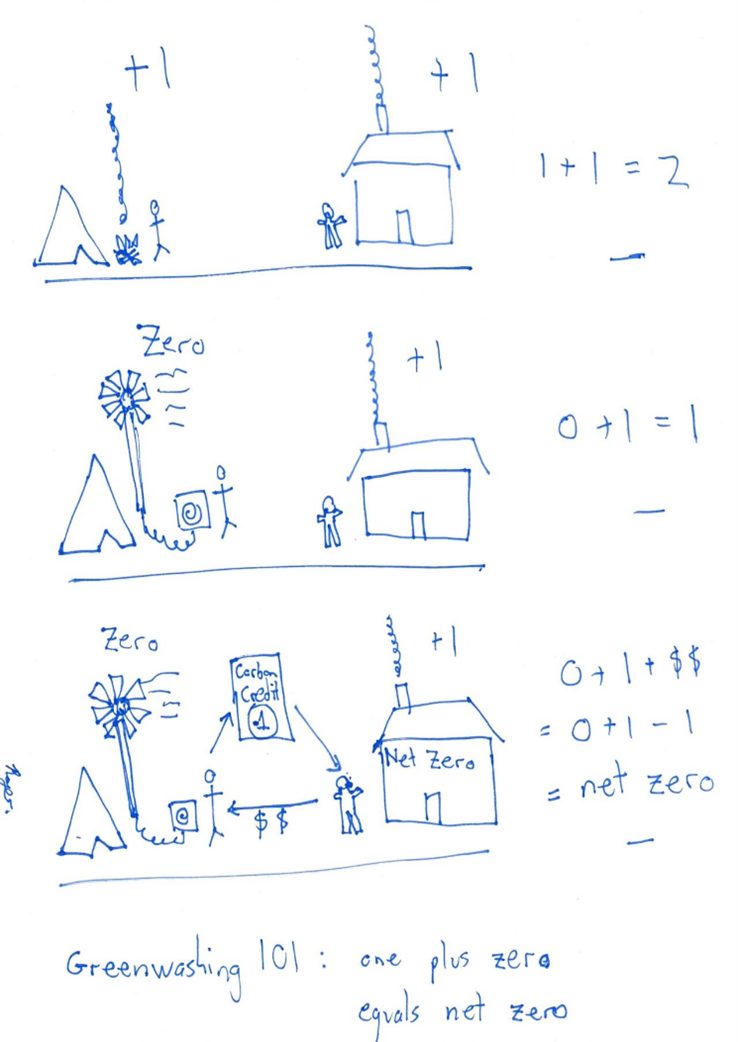

Net-zero has become an unstoppable bandwagon. But in my opinion, net-zero in its current guise is not a credible solution to climate change. The problem is the trade in junk credits on the voluntary carbon market (VCM) has become huge, and no one in that market has an incentive to safeguard its integrity. The hype around net-zero is masking the fact that action on climate change remains inadequate, and offsetting is hastening the march to climate disaster.

Offsets don’t offset

One of the ideas that emerged from the debacle of the 2009 Copenhagen climate change talks was that the goal of climate policy needed to be practical and simple to understand. While Paris adopted a goal of “well below 2 degrees”, the concrete steps to achieve that goal were not well understood. In July 2019, the Secretary General of the United Nations wrote to every head of state that their goal should be ‘net-zero’ by 2050.

At that point in time, ‘net-zero’ and ‘carbon neutral’ were used interchangeable. The idea was that countries would take steps to reduce their emissions by decarbonising their economies and then employ some form of negative emissions to suck carbon dioxide (CO2) out of the atmosphere. Negative emissions come from increasing biomass (e.g. planting trees), and it was hoped new technologies would emerge enabling the direct air capture of CO2.

Most countries and large corporations have adopted a goal of becoming ‘net-zero’. But ‘net-zero’ isn’t carbon neutral. We can achieve ‘net-zero’ and still be a long way from the level of emissions reductions required to limit climate change to well below 2 degrees Celsius. Offsets don’t offset.

There are two types of carbon credits. One represents a tonne of negative emissions and the other represents a tonne of avoided emissions. Let’s focus on the second type first.

Let’s assume a simple economy with one factory emitting a tonne of carbon emissions, an energy company with a coal fired power station, also emitting a tonne of carbon, and a bunch of people who all buy electricity from the energy company and work at the factory. So, our simple economy emits two tonnes of carbon.

Say our energy company closes the power station and replaces it with renewable energy with zero emissions. Carbon emissions decrease from two tonnes to one tonne. The power company has created a carbon credit by reducing its emissions by a tonne and sells that credit to the factory. At this point our simple economy is net-zero. The power company is zero because it has switched from coal to renewable energy and the factory is ‘net-zero’ because it is offsetting its emissions with the carbon credit it has purchased from the energy company.

Our simple economy is net-zero but not carbon neutral.

Figure 1: Greenwashing 101

Source: Roger Cohen C2Zero.

What if we use credits from negative emissions – growing trees?

It’s supposed to work like this: a farmer takes a piece of land that has been previously cleared. He puts a fence around it and plants trees. Those trees suck carbon out of the air and that sequestered carbon backs credits which are sold to polluters. All things being equal those credits have integrity. But all things are rarely equal.

To have integrity, credits need to satisfy three criteria:

-

- They need to be additional

- They need to avoid leakage

- They need permanence.

A study by Finnish NGO Compensate estimates less than 10% of carbon offset projects meet these criteria.

Additionality – Additionality means the reduction in carbon emissions needs to be in addition to any reductions that would have occurred without the financial gain from selling the offsets. The Compensate study estimated that half the wind turbine projects in India that generate offsets would have occurred anyway1.

A major criticism of the Australian Emissions Reduction Fund is that it purchased credits from projects such as waste to energy that were profitable on a stand-alone basis, and already had approval2.

An issue related to additionality is that of baselining and overestimation. A good example of this is the Hawke Mountain Sanctuary project in Philadelphia, USA. JP Morgan, the world’s largest lender to the fossil fuel industry3, says that it offsets the carbon emissions from staff travel using credits including those from the Hawke Mountain Sanctuary project. The Hawke Mountain project is run by The Nature Conservancy (TNC), a not-for-profit which operates in Australia, with billions of dollars in assets and close ties with some of the world’s largest polluters4. In baselining Hawke Mountain, TNC used a scenario that assumed the area would be aggressively commercially logged. The project generated hundreds of thousands of credits based on this alleged avoided deforestation. But Hawke Mountain was a sanctuary. It had not been logged in 85 years and there were no plans or permissions for commercial logging.

All over the world, including Australia, thousands of carbon offset projects generate millions of credits from not cutting down trees that were never going to be cut down in the first place.

Figure 2: Hawke Mountain Sanctuary

Source: Zeete – Wikimedia Commons.

Leakage – In a promotional video for the Australian Emission Reduction Fund, a grazier talks about the benefits of carbon farming and the additional revenue he derives from an avoided deforestation program established with the assistance of Greencollar, which describes itself as ‘Australian largest environmental markets investor and project developer’. What is not mentioned in the video is that the grazier reportedly used the proceeds from carbon farming to buy a neighbouring property, which he then cleared5.

Leakage occurs when the carbon captured by a project leads to increased emissions outside the project framework. Forestry projects in developing countries are particularly prone to leakage where illegal and unregulated logging is enabled by the revenue from carbon credit projects.

Figure 3: Illegal Forestry in Peru

Source: WWF.

Permanence –The 2014 Football World Cup in Brazil was promoted as net-zero with offsets generated by the Surui Forest Carbon Project under which an area of 248,000 hectares of rainforest needed to be protected for 100 years. But diamonds and gold were discovered, leading to illegal mining and deforestation. By September 2018, the Surui was substantially destroyed, the trees that needed to be protected for 100 years were gone in four.

Figure 4: Illegal diamond mine in the Surui Forest Brazil

Source: Ibama.

The problems with credits from deforestation or reforestation activities are so serious they are prohibited under the mandated carbon reporting framework in the European Union. Yet they are the most traded credits in the VCM, and in Australia the majority of our claimed 20% reduction in emissions since 2005 has come from land use, land-use change and forestry.

Why does ‘net-zero’ make things worse?

According to Kohlberg’s Theory of Moral Development, humans will act to avoid feelings of guilt. If we believe flying in planes is bad for the environment, we will take less flights. By paying a small fee to offset the carbon from our flight, we assuage that feeling of guilt. We take more flights than we would if the offset was unavailable. If the carbon credit purchased by the airline is not actually backed by an actual tonne of CO2, then the process leads to an increase in emissions.

The problem with ‘net-zero’ is it leads to corporations and individuals doing more of activities that would be reduced if the offsets were not available. Rather than focus on rapid and substantive decreases in CO2 emissions, the focus becomes where to purchase the cheapest offsets. Carbon credit projects with low additionality are the cheapest.

Not enough trees in the world

In a paper published in May 2020, researchers attempted to estimate how much carbon could be sequestered in the world’s forests and soils6. It found that if we absolutely maximised the amount of vegetation all land on Earth could hold, we’d sequester about 70 gigatonnes, enough to offset ten years of CO2emissions. After that, there could be no further sequestration, and atmospheric concentrations would continue to increase.

The ability of the natural environment to absorb carbon is finite. A trillion trees will not save us from climate change disaster.

Conclusions

In 2021, VCM activity surpassed US$1 billion. None of the players in the market – not the big accounting firms who all offer ‘net-zero’ services, not the specialist consultants, not the project managers like TNC or Greencollar, not the brokers or traders and especially not high emitting corporations that purchase cheap offsets – have an incentive to improve the integrity of the VCM. There is simply too much money to be made from a debased system.

Investors concerned about climate change need to be aware that most claims of ‘net-zero’ are exercises in virtue signalling and woke capitalism. Any analysis of a company’s environmental performance should overwhelmingly focus on the impacts of its business-as-usual activities, and largely ignore claims of ‘net-zero’. Where credits are relevant, care should be taken to critically assess their integrity against criteria of additionality, leakage, and permanence.

1. Source: https://www.compensate.com/avoid-greenwashing-corporate-climate-claims-whitepaper

2. Source: https://www.climatechangeauthority.gov.au/sites/default/files/2020-09/3%20-%20ERF%20Review%20Submissions%20-%20Australian%20Conservation%20Foundation.pdf

3. Source: https://www.ran.org/wp-content/uploads/2021/03/Banking-on-Climate-Chaos-2021.pdf

4. Source: https://www.sourcewatch.org/index.php/The_Nature_Conservancy

5. Source: https://www.abc.net.au/news/2022-04-02/carbon-credit-conflicts-of-interest-in-clean-energy-regulator/100952758

6. Source: https://www.frontiersin.org/articles/10.3389/ffgc.2020.00058/full and https://onlinelibrary.wiley.com/doi/abs/10.1046/j.1365-2486.2002.00536.x