ETF distributions: frequently asked questions

4 minutes reading time

Global Markets

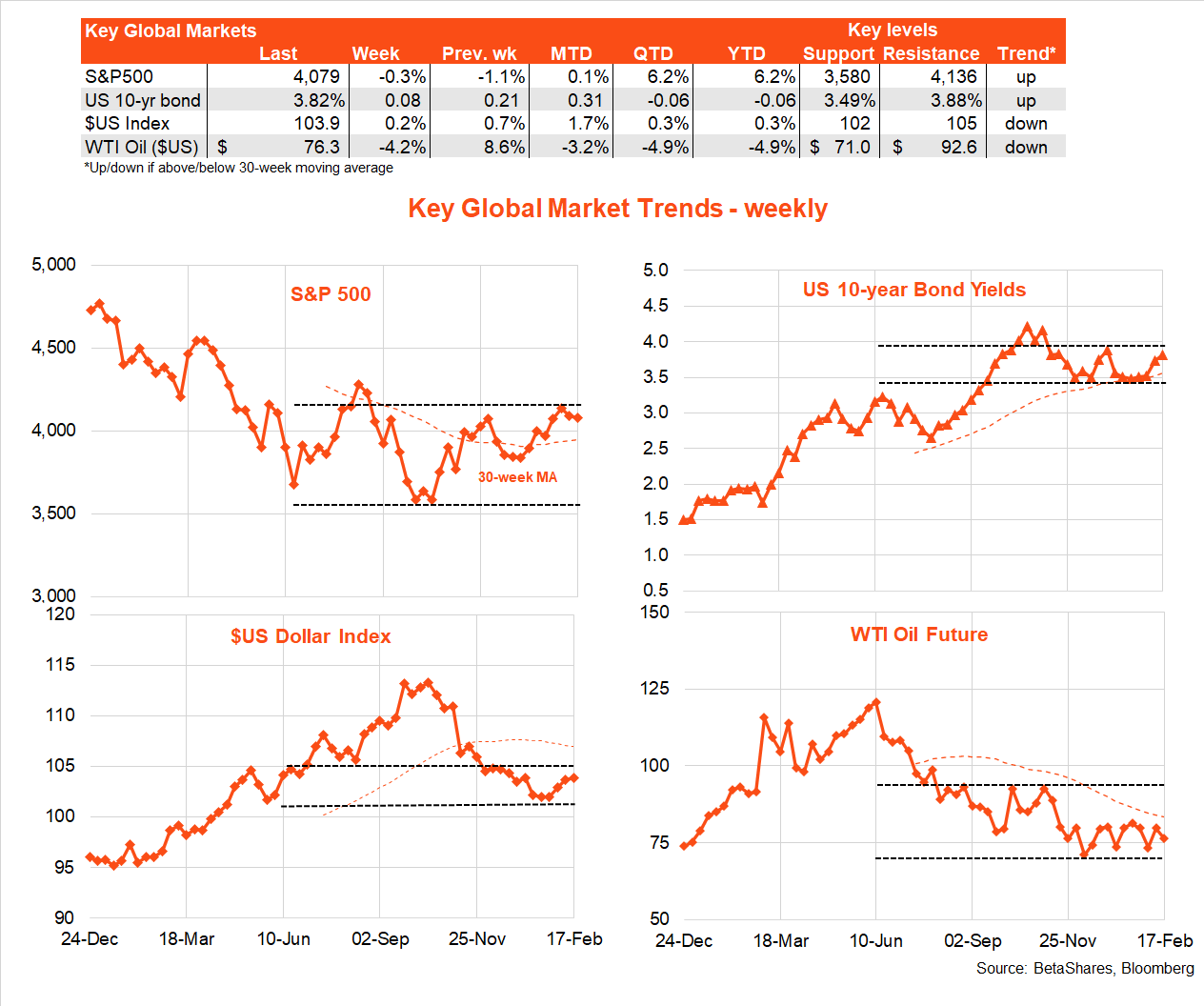

Global equities nervously retreated further last week as bond yields edged higher amid concerns that stubbornly persistent US economic growth and inflation could see the Federal Reserve lift rates more than expected. The US$ also held up while oil prices remained range bound.

The key global highlights last week were US consumer and producer price reports which suggested that while inflation continued to ease an a year-on-year basis, pricing pressure remained uncomfortably firm. Adding to the angst, US retail sales in January were blisteringly strong, up a lazy 3%.

Along with the strong January payrolls report, this either suggests the US economy amazingly lifted a gear in early 2023, or is benefiting from a milder than usual winter. Either way, reports over the past week add to the risk of a “no landing” US scenario, which could hurt both bonds and equities if the Fed decides to ramp up policy tightening.

Turning to the week ahead, the key highlight will be another US inflation report on Friday, the private consumer deflator for January. Excluding food and energy, core prices are expected to lift 0.4% – slightly up on the 0.3% December result. Annual core inflation will slow only modestly, from 4.4% to 4.3%. All up, the inflation report seems likely to add to the simmering concern that US inflation is not falling fast enough.

Minutes to the last Fed meeting will be released on Wednesday and there’s a range of major retailers that will present their Q4 earnings results. Of interest in the Fed minutes will be the degree of apparent consensus among voting members for further rate hikes. While retailer earnings are likely to be OK (reflecting solid consumer spending), their outlook statements may well be cautious – which risks making Wall Street even more nervous.

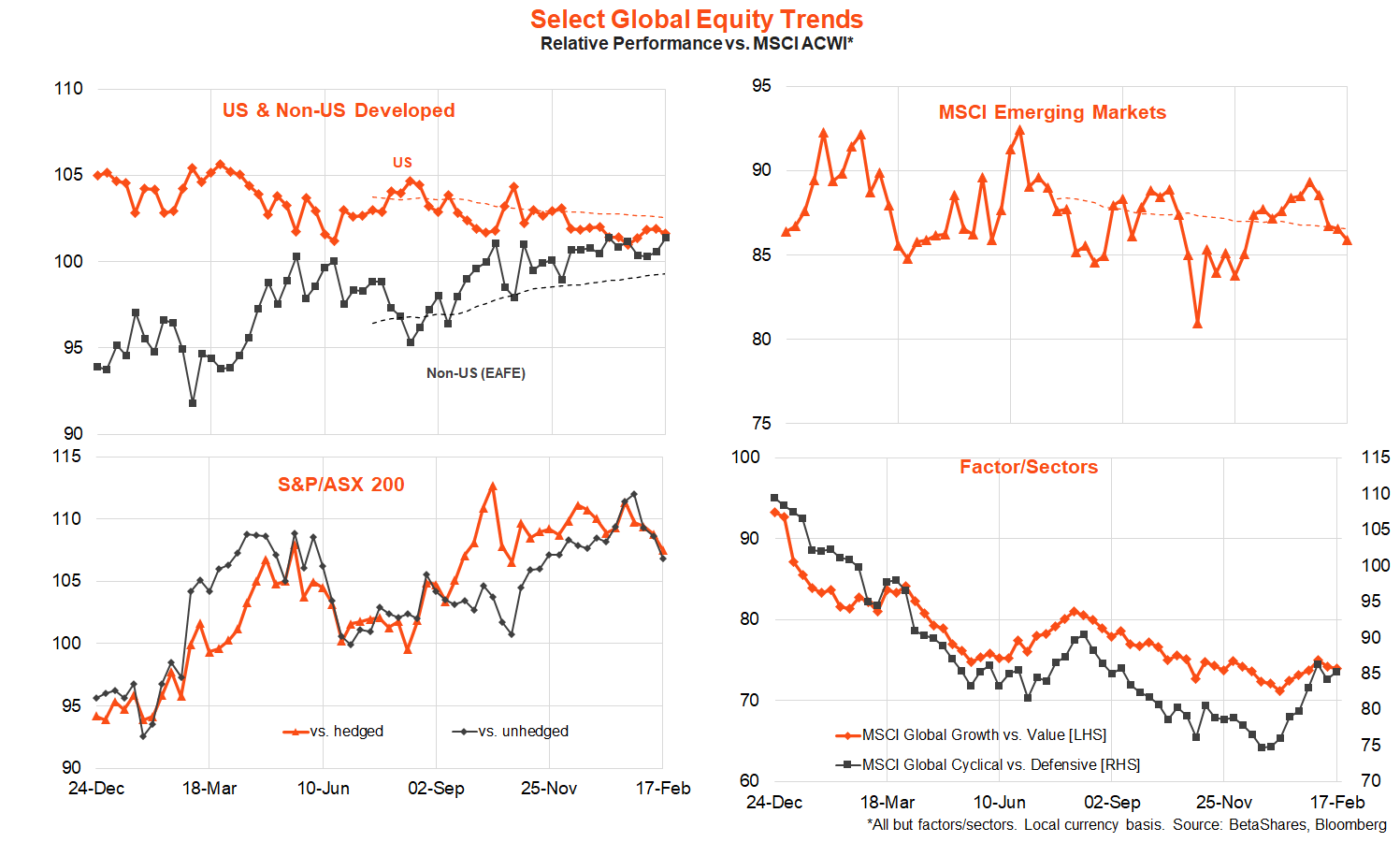

In terms of market themes, the increase in market nervousness in recent weeks has seen emerging markets and Australia give back some recent outperformance. Additionally, the outperformance of cyclicals over defensives and growth over value has levelled out.

Australian Market

Local stocks retreated for the second week in a row after failing to break through resistance at 7,500 two weeks ago. Although global stocks were down, another hindrance was local economic data hinting that higher interest rates are beginning to take their toll.

The biggest highlight was the surprise 12,000 drop in employment in January, with the unemployment rate lifting to 3.7% (from 3.5%). While there may well be seasonal quirks behind the outcome, it was the second successive monthly decline in employment. Also, consumer confidence in January slumped 7%, taking sentiment back to COVID and GFC lows. By contrast, the NAB survey of business sentiment remained upbeat – though this may change if we see greater evidence of household spending beginning to buckle.

Although minutes to the latest RBA meeting will be released on Tuesday and we get important Q4 GDP building blocks (construction activity and private capital spending), this week’s highlight will be the Q4 Wage Price Index (WPI) on Wednesday.

The market anticipates a quarterly 1.0% WPI increase, which would lift annual wage inflation from 3.1% to 3.5% – some of which still likely reflects flow though of the Fair Work Commission minimum wage increase. Such a result would be consistent with the view that a tight labour market is gradually lifting wage growth, althrough still remains fairly benign, especially by global standards. Of course, a hotter than expected wage result could hurt both equity and bond markets as it would add to the risk of even more aggressive RBA tightening this year.