Wet lettuce

4 minutes reading time

- Thematic

Nuclear energy is increasingly being accepted as a safe, reliable, low-carbon energy source and seen as a critical supplementary means of meeting the world’s growing energy demands. As a result, demand for uranium to fuel the nuclear power stations of tomorrow appears on course to grow strongly in the years ahead.

After several years of low prices and low mining activity, however, the prospective lift in uranium demand gives rise to the risk of potential shortages and potential for an associated strong rebound in uranium prices.

Investors can now consider the BetaShares Global Uranium ETF (ASX Code: URNM), which provides exposure to a portfolio of global companies involved in the mining, exploration, development and production of uranium, modern nuclear energy, or companies that hold physical uranium or uranium royalties.

Nuclear power to fuel uranium demand

Demand for uranium is likely to rise significantly as it remains the critical commodity input for nuclear powered energy – which in turn is seen as an increasingly important element in the global quest towards energy transition.

Nuclear power is one of the lowest carbon-emitting power sources available and, critically, can meet the need for consistent ‘base load’ power 24 hours a day. As such, it’s clear that uranium has an important role to play in maintaining the world’s energy security, as well as acting as a bridge and complement to renewable energy solutions.

Average life-cycle CO2 equivalent emissions of electricity options

At present there are around 440 nuclear power plants around the world producing around 400 giga-watts (GW) of energy, or 10% of our electricity needs.

According to the International Energy Agency (IEA), the energy created from nuclear power would ideally need to double by 2050 to 800GW – to be consistent with the net-zero carbon emissions target1. Current projections suggest investment in many more nuclear power plants than currently planned worldwide will be needed to meet this target.

Modern nuclear power plants are also safer to run than those in the past. The safety flaws that led to disasters such as Three Mile Island, Chernobyl, and Fukushima have been addressed in modern reactor designs. Modern reactors are built to be passively safe, meaning that if outside input is lost, the reactor will cool of its own accord.

Higher prices may be required to generate sufficient uranium supply

Although there was a strong uptake in nuclear powered energy from the 1970s to the mid-2000s, its use as an energy source has levelled off in the past decade or so due to community concerns over safety and, perhaps ironically given today’s climate challenges, the environment.

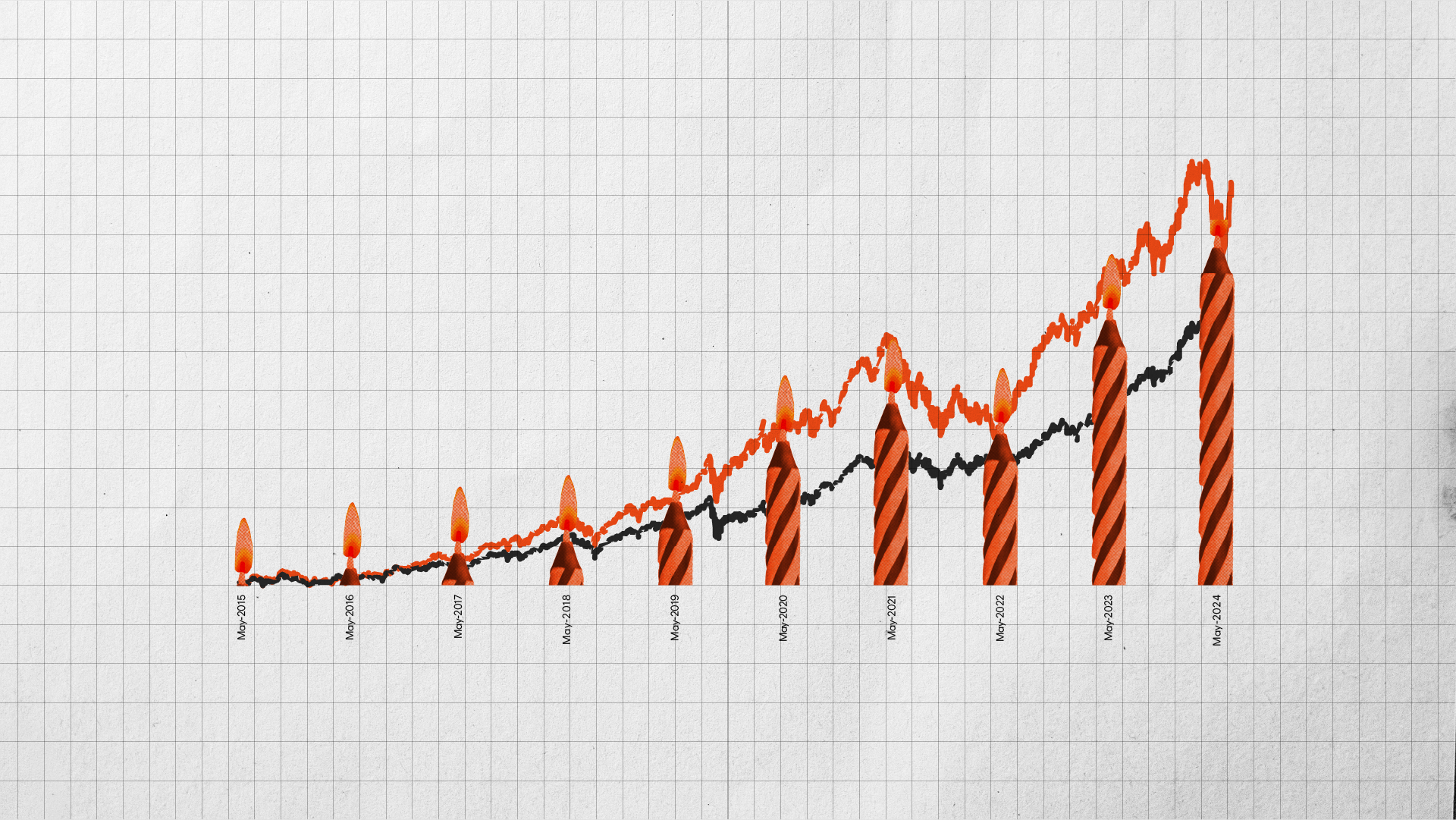

This shift in views resulted in a slowing in demand for uranium, and an associated decline in uranium prices and mining activity. After reaching as high as US$173 a pound in 2007, the spot price of uranium sank to around US$20 a pound by 2016.

In more recent years, however, uranium prices and interest in the sector have begun to recover, in line with a re-appraisal of nuclear power in light of the pressing need to transition away from traditional energy sources. More recently, Russia’s invasion of Ukraine has also exposed the lingering reliance of some countries – notably Germany – on potentially unreliable and morally questionable Russian oil and gas exports.

According to Australia’s official commodity forecasting department “after years of deferrals of uranium projects, there is a growing prospect that supply shortfalls could emerge as existing mines gradually deplete [later this decade]”2.

In its base case scenario, the Department estimates spot uranium prices to rise from just over US$40 a pound earlier this year to over US$50 in coming years, with contract prices moving above US$60. It also concedes that due to the long lead times in developing mining deposits, “the [uranium] shortfall could lead to prices spiking significantly above forecast levels”.

It’s also worth noting the price of uranium per se is a relatively small component of the overall cost of producing nuclear energy. As a result, uranium prices could spike significantly if shortages emerge before there was much curtailment in demand.

The BetaShares Global Uranium ETF (ASX Code: URNM)

To tap into the growth potential of this sector, the BetaShares Global Uranium ETF (ASX Code: URNM) is designed to provide exposure to a portfolio of global companies involved in the mining, exploration, development and production of uranium, modern nuclear energy, or companies that hold physical uranium or uranium royalties.

URNM aims to reduce stock specific and geographic risk compared to investing in individual uranium companies – an important consideration given the risks associated with individual projects in the uranium industry.

The index of companies which URNM aims to track includes some of the largest uranium producers and developers in the world, including Cameco Corp, NexGen Energy and Paladin Energy.

There are risks associated with investment in the URNM, including market risk, sector concentration risk, international investment risk and regulatory risk. The Fund’s returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure, given its more concentrated exposure. The Fund should only be considered as a component of a diversified portfolio. For more information on risks and other features of the Fund, please see the Target Market Determination (TMD) and Product Disclosure Statement, available at www.betashares.com.au.

1. Nuclear Power Not on Track, IEA, November 2021.

2. Department of Industry, Science, Energy and Resource. Resources & Energy Quarterly March 2022.