What is the ‘Innovation Exemption’ and why does it matter?

5 minutes reading time

- Digital assets

- Thematic

Have you ever wished you could have invested in the internet when the World Wide Web first took off? While still an early stage technology, the Metaverse has the potential to be one of the biggest secular growth trends of the coming decades.

The BetaShares Metaverse ETF (ASX Code: MTAV) has been designed to provide investors with exposure to some of the world’s leading companies in this emerging sector.

What is the Metaverse?

Neal Stephenson first coined the term ‘Metaverse’ in his 1992 science fiction novel, Snow Crash – but there still is no industry-wide agreed definition of what the Metaverse is.

Mark Zuckerberg, Chairman and CEO of Meta Platforms (previously known as Facebook), said:

You can think about the Metaverse as an embodied internet, where instead of just viewing content, you are in it. And you feel present with other people as if you were in other places, having different experiences that you couldn’t necessarily do on a 2D app or webpage.

Currently, probably the most common way the Metaverse is conceptualised is the idea of the video gamer wearing a virtual reality (VR) headset.

Video gaming is certainly a part/exemplar of the possibilities of the Metaverse, but it is not the same as the Metaverse.

The Metaverse can be thought of as a shared virtual space where megatrends converge. These include online games, social networks, and live entertainment. The user experience can be augmented with the help of technology, for example using digital avatars.

What does the Metaverse incorporate?

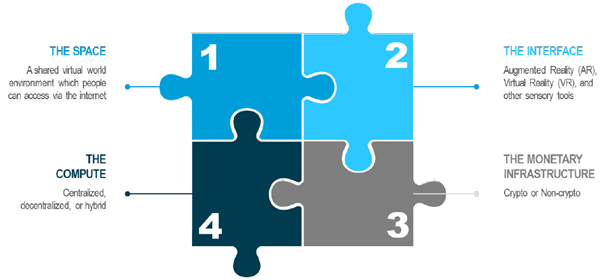

Citi Global Insights offers the following conceptualisation of the Metaverse ecosystem:

Requires persistent, real-time connections, high bandwidth networks, and exchange centres, among other items, that create an immersive digital experience.

The Interface

This is the hardware that enables access to the Metaverse, and includes Virtual Reality (VR) and Augmented Reality (AR) headsets, mobile devices, smart glasses, and other sensory tools.

The monetary infrastructure

Critical to the Metaverse will be the ability for users to buy and sell digital assets. This will require infrastructure to support digital payment processes.

The compute

The evolution of the Metaverse will make unprecedented demands of computing power, including the software that brings objects into 3D and allows users to interact with them.

How big is the Metaverse market?

Estimates of the size of the ‘Metaverse opportunity’ vary as widely as definitions of the Metaverse itself.

According to Citi Global Insights, if a narrow definition of the Metaverse as purely a ‘Virtual Reality’ world is adopted, by 2030 there may be around 1 billion users, and a total addressable market (TAM) of $1-$2 trillion.

If a broad definition of a ‘persistent and immersive combination of the physical and digital world’ is used, the Metaverse expands to a potential 5 billion unique users with a TAM of $8 – $13 trillion.

According to Bloomberg Intelligence, the market opportunity for ‘bringing the metaverse to life’ could potentially approach $800 billion in annual revenue by 2024.1

What will drive the growth of the Metaverse?

As the Metaverse evolves, consumers are expected to spend more and more time in virtual worlds. To stay connected with those customers, brands will have to invest considerable resources towards their Metaverse strategy. Businesses will have to establish and maintain a 3D, digital presence inside virtual worlds.

Younger generations in particular are likely to be demanding in their expectations of the interactive experience of the Metaverse, meaning businesses will have to devote resources to constantly managing and refreshing their content.

Who are the key players in the Metaverse?

As at the end of June 2022, there were 32 companies in the index MTAV aims to track. These include large and profitable technology and entertainment companies, as well as more specialised companies with a focus on the core technologies that will enable the Metaverse.

Here are a few examples:

Roblox

In 2020, over half of American children under 16 played Roblox2. Roblox is perhaps one of the best examples today that illustrate where the Metaverse could go. Roblox is a platform where users can socialise, interact, and play games created by other users3. As of May 2022, there are over 40 million games available to play on Roblox4.

NVIDIA

NVIDIA is most famous for its ‘GeForce’ graphics processing units (GPUs)5, which are critical for gamers and cryptocurrency mining6. GPUs will also be important for powering the graphic interface of the Metaverse7.

Meta Platforms

Meta Platforms is changing the focus of its business. Mark Zuckerberg has said “in our DNA we are a company that builds technology to connect people, and the Metaverse is the next frontier just like social networking was when we got started.”8

How to get exposure

The BetaShares Metaverse ETF (ASX Code: MTAV) aims to track the performance of an index (before fees and expenses) that provides exposure to a portfolio of leading global companies involved in building, developing and operating the Metaverse.

As the future of the internet looks increasingly three dimensional, the hardware, software, digital currencies, and licences that power this ecosystem will become more and more valuable. An exposure to MTAV gives growth-seeking investors the opportunity to participate in the potential upside.

| There are risks associated with investment in the Fund, including market risk, sector risk, Metaverse theme risk and concentration risk. The Fund’s returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure, given its more concentrated exposure. The Fund should only be considered as a component of a diversified portfolio. For more information on risks and other features of the Fund, please see the Target Market Determination (TMD) and Product Disclosure Statement, available at www.betashares.com.au. |

1. Source: Bloomberg Intelligence, December 2021. Actual outcomes may differ materially from estimates. https://www.bloomberg.com/professional/blog/metaverse-may-be-800-billion-market-next-tech-platform/

2. https://www.theverge.com/2020/7/21/21333431/roblox-over-half-of-us-kids-playing-virtual-parties-fortnite

3. https://www.theguardian.com/games/2019/sep/28/roblox-guide-children-gaming-platform-developer-minecraft-fortnite

4. https://www.vg247.com/best-roblox-games

5. https://www.investopedia.com/how-nvidia-makes-money-4799532

6. https://www.nvidia.com/en-us/cmp/

7. https://blog.imaginationtech.com/the-role-of-the-gpu-in-experiencing-the-metaverse/

8. https://www.cnbc.com/2021/10/28/facebook-changes-company-name-to-meta.html