ETF distributions: frequently asked questions

7 minutes reading time

- Fixed income, cash & hybrids

The past 12 months have been devastating for fixed income portfolios of various flavours.

Not only have benchmark government bond yields risen from historic lows to their highest level since 2014, but credit spreads have also widened considerably as economic uncertainty rises and liquidity diminishes. As a result, the capital value of fixed income investments typically has fallen significantly.

In this article, we look at the potential investment opportunity this creates for investors in Australian investment grade corporate bonds.

What drives the return from a fixed income investment?

First, a recap on fixed income returns.

The yield on a fixed income investment primarily reflects two risks:

- interest rate risk, and

- credit risk.

Interest rate risk

Part of a fixed income investment’s return is linked to the current ‘risk-free’ interest rate i.e. what can be earned on a high-grade government bond with a similar maturity. Government bond yields in turn are affected by:

- short term (cash) rates

- expected future cash rates, and

- expectations around economic growth and inflation over the term of the bond.

As the risk-free rate changes, the price of a bond (or bond portfolio) changes. As interest rates increase, the price of a bond will fall. As interest rates fall, the price of the bond will rise.

Credit risk

Credit risk refers to the additional risk of a fixed income investment over and above a risk-free (government) bond. An investment in corporate bonds, for example, involves liquidity risk (the risk that the corporate bond might be harder to liquidate or involve higher transaction costs than a government bond of the same maturity) and, to a lesser extent, the risk that the issuer of the bond will default on its obligations. This risk will be reflected in the ‘credit spread’ – the spread above the risk-free yield to compensate for taking on credit risk.

What has happened to bonds in the last two years?

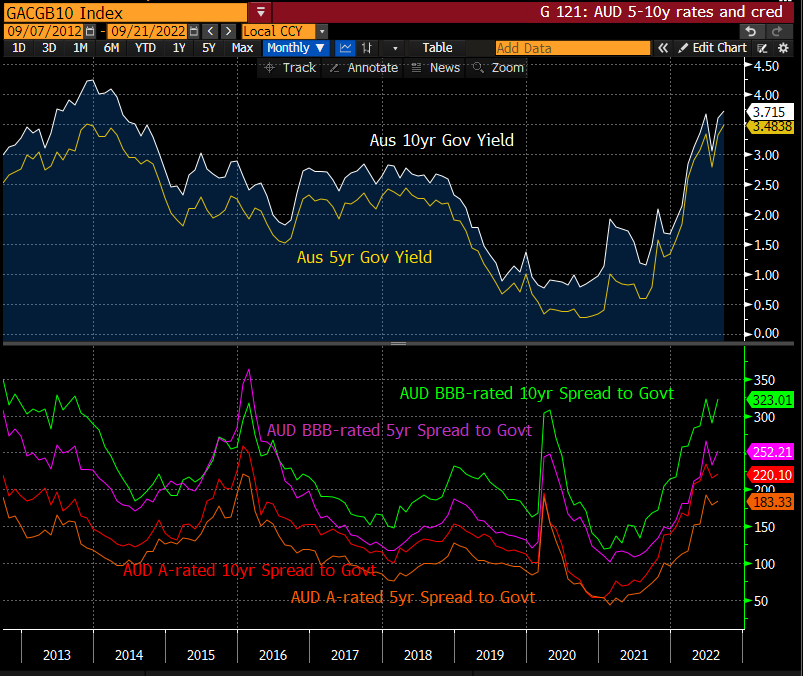

Not only have benchmark government bond yields repriced on the back of a much more aggressive policy rate outlook (with most of this move coming via higher real yields), but credit spreads have also widened considerably as economic uncertainty rises and liquidity diminishes.

Chart 1: AUD 5yr and 10yr benchmark yields (top panel, %) and investment grade credit spreads (lower panel, bps)

Sources: Bloomberg, RBA. Past performance is not indicative of future performance

This has been something of a ‘double whammy’ for Australian investment grade corporate bonds, hitting them from both the rates and credit sides, and resulting in the largest drawdown in recorded history.

Where to from here?

As a result of the above, the forward-looking return environment for fixed rate investment grade credit may be the best we’ve seen in several years based on a number of factors.

Firstly, it’s getting harder for long-end government bonds to keep selling off.

The yield curve is pricing in the most aggressive rate hiking cycle in modern history. The economy is at a key macro inflection point, where a further escalation in monetary tightening in response to stubbornly high inflation pressures will likely just crush longer-term growth and inflation expectations further and simply bring forward the eventual recession. Because the rates market has moved on from pricing in the hiking cycle to pricing in the consequences of the hikes, the probability of long-dated government bonds continuing to sell off is falling.

Secondly, on some measures current credit spreads in the 5 to 10-year sector have now surpassed what was seen during the Covid crisis and are around the levels of the European debt crisis in the early 2010s.

Credit spreads may continue to widen, but at current levels in Australian investment grade bonds, it’s likely that a shallow US recession and a major global growth downturn is already priced in.

A ‘soft landing’ scenario should drive an aggressive compression in credit spreads and would be the ‘Goldilocks’ environment for long-dated investment grade bonds, as it’s likely benchmark rates would also stabilise and possibly trend lower.

In contrast, a ‘hard landing’ scenario, where the US economy would experience a deep and prolonged economic contraction, would probably take credit spreads wider, but given the buffer already provided, something approaching a full-blown global credit crisis to sustain further credit losses over the next 12 months would probably be required. And while a hard landing might see spreads widen, it’s likely that government bonds would stage an aggressive rally as rate hike expectations would probably fall.

In summary, the underlying yield on corporate bonds may make them a compelling opportunity for long-term investors. For investors who are questioning whether to buy now or later, the decision boils down to two main questions:

- Is the rate hiking cycle for Australia fully priced in?

- Is the current credit spread of +230bps over government bonds sufficient compensation for the reduction in global liquidity and elevated US recession risk?

How can Australian investors get exposure to Australian investment grade corporate bonds?

The BetaShares Australian Investment Grade Corporate Bond ETF (CRED) focuses on the A and BBB-rated segment of corporate bonds in the 5–10-year maturity range, and as at 5 September 2022 offered an underlying yield to worst of 5.8%*, with an additional .

CRED provides investors with a convenient way to capture the relatively high yield on Australian government bonds and the generous risk premium on Australian investment grade credit.

Table 1: CRED’s Yield to Worst, as at 5-Sep-2022

| Latest | 12-month Change | |

| Yield to Worst* | 5.87% | +3.51% |

| Credit Spread Component** | 2.30% | +0.93% |

| Benchmark Yield Component*** | 3.57% | +2.58% |

*The annualised total expected return of a portfolio if underlying bonds are held to maturity or are called, do not default, and the coupons are reinvested. Yield to Worst is the lower of either yield to Maturity or Yield to Call. Assumes no change in interest rates. Subject to change over time. Yields do not take into account fund fees and costs.**Credit spread component of the Solactive Australian Investment Grade Corporate Bond Select TR***Yield component of Solactive Australian Investment Grade Corporate Bond Select TR

Chart 2: CRED’s since-inception yield

Source: Solactive. Past performance is not indicative of future performance. Yields do not take into account fund fees and costs.

| There are risks associated with an investment in the Fund, including interest rate risk, credit risk, market risk and index tracking risk. The value of an investment and income distributions can go down as well as up. For more information on risks and other features of the Fund, consider the relevant Product Disclosure Statement and Target Market Determination (TMD) (available at www.betashares.com.au) and your particular circumstances, including your tolerance for risk, and obtain financial advice. |

BetaShares Capital Ltd (ABN 78 139 566 868 AFS Licence 341181) is the issuer of the BetaShares Funds. Read the Target Market Determination and PDS at www.betashares.com.au and consider with your financial adviser whether the product is appropriate for your circumstances.

Future results are impossible to predict. This information may include opinions, views, estimates, projections, assumptions and other forward-looking statements which are, by their very nature, subject to various risks and uncertainties. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in such forward-looking statements. Forward-looking statements are based on certain assumptions which may not be correct. You should therefore not place undue reliance on such statements. BetaShares does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date such statements are made or to reflect the occurrence of unanticipated events.

The Fund is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Index at any time or in any other respect. The Index is calculated and published by Solactive AG. Neither publication of the Index by Solactive AG nor the licensing of the Index or Index trade mark for the purpose of use in connection with the Fund constitutes a recommendation by Solactive AG to invest capital in the Fund nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in the Fund.