6 minutes reading time

- Active

Following APRA’s confirmation that AT1 capital (hybrids) would be phased out as eligible bank capital commencing 1 January 2027, Australia’s banks will begin to roll-off their existing hybrids this month.

While it is theoretically possible that the banks could partially replace their upcoming maturities to maintain or more gradually reduce their AT1 capital outstanding, we think this is unlikely because:

- Most banks will remain above their Tier 1 capital requirements even after the repayment of these hybrids.

- APRA has set a clear timeline for the phasing in of the new framework, based on the run-off profile of the existing hybrids outstanding and expected to be completed in 2032, when the last bank hybrid is due to be called.

- It is unlikely APRA will accept adding to this roll-off task or accept the issuance of a new AT1 instrument, given their clearly stated desire to phase them out.

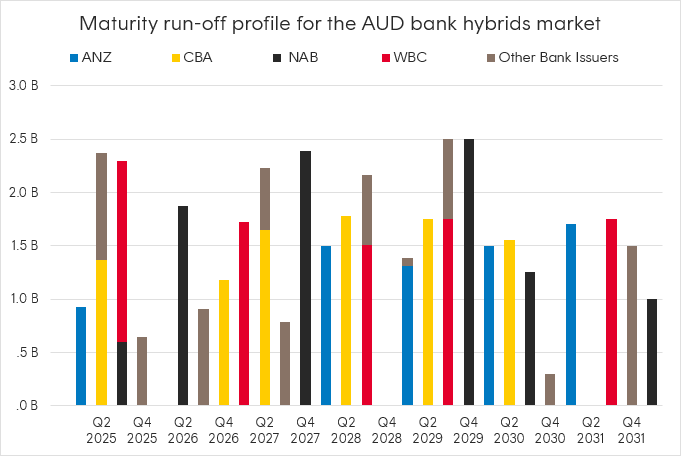

With the expectation that the banks will not issue new hybrids into their call dates, over the next 7 years, $42 billion dollars of capital will be returned to investors on the relevant hybrid call dates as follows:

Source: Bloomberg. As at 10 February 2025.

Betashares exposures to Australian bank hybrids

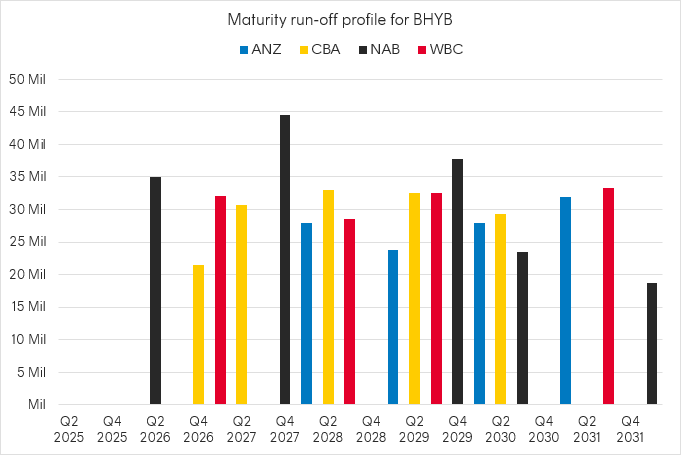

BHYB Australian Major Bank Hybrids Index ETF provides exposure to a portfolio of Australian ‘Big 4’ banks hybrids. BHYB will continue to operate as usual and will continue to provide exposure to the major bank listed hybrid market.

Given the lengthy run-off period, with the next first call date not until June 2026 and approximately 50% of the portfolio due to be called between 2029 and 2032, we see little need to make any immediate product or index changes. Any changes to the product will be communicated to the market with appropriate notice.

BHYB has net assets of $549m (as at 26 February 2025) with the following roll-off schedule for hybrids currently in the index (noting that BHYB’s index will roll out of hybrids on each quarterly rebalance if its first call date is less than 12 months):

Source: Betashares. As at 12 February 2025.

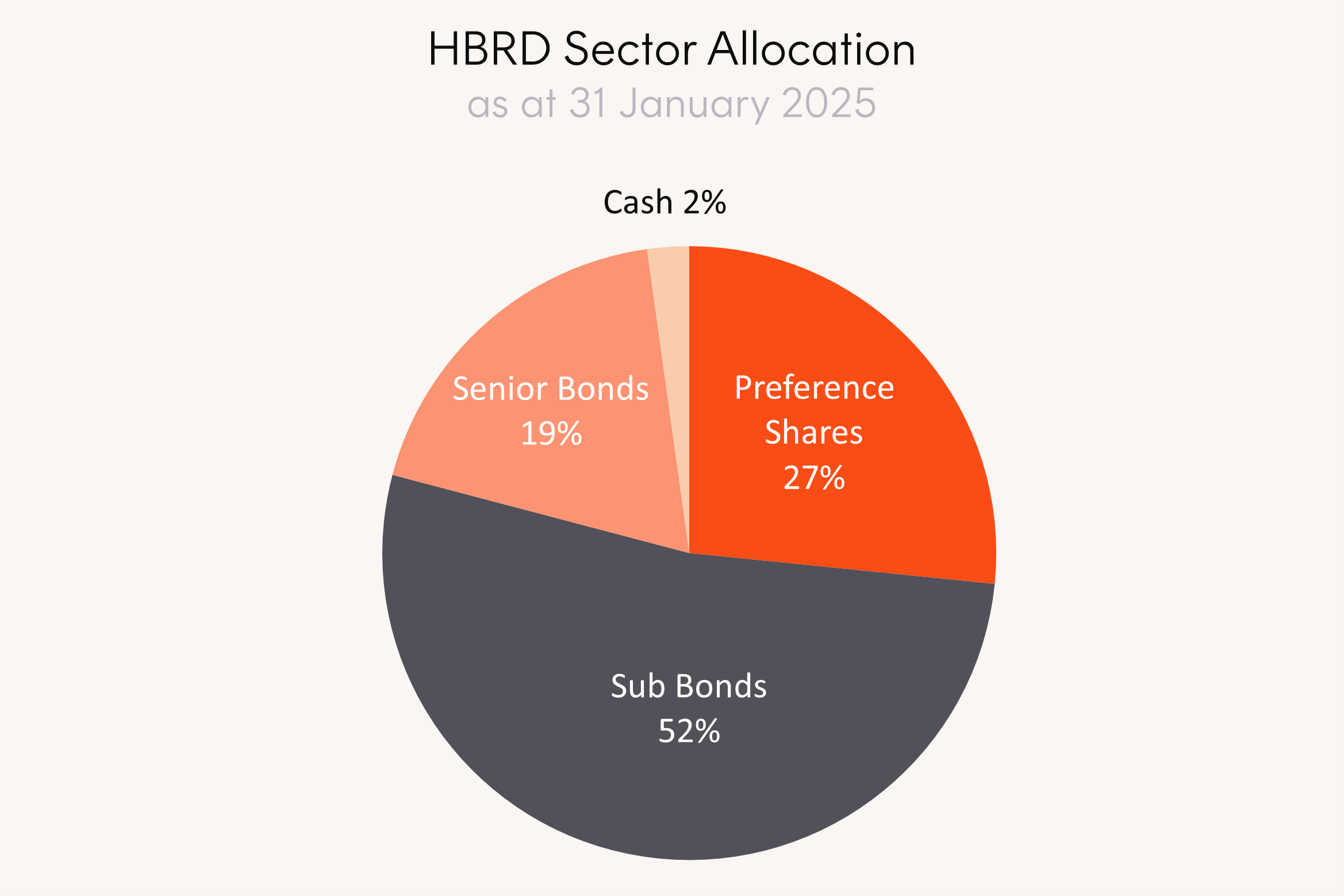

HBRD Australian Hybrids Active ETF is an actively managed fund with the flexibility to invest across the whole bank capital structure (not just hybrids), as well as in corporate bonds (and hedge interest rate risk), offshore Australian bank credit (with foreign currency exposure hedged back to Australian dollars), and the market for corporate and insurer-issued hybrids that are not affected by APRA’s changes.

Given HBRD’s mandate, the fund is under no threat from APRA’s recent announcement and will continue to operate as a full capital structure solution.

HBRD has net assets of $2.3b (as at 26 February 2025) with a current allocation of ~27%, or $621m, to bank hybrids. The current allocation reflects the manager’s (Coolabah Capital) view of the relative value of bank hybrids and the other investment opportunities available to them.

Source: Betashares. As at 31 January 2025.

Investors who are still making a decision of where to allocate their bank hybrid capital once called could consider BHYB or HBRD to maintain exposure to Australian bank hybrids in the interim. Both funds pay monthly distributions and pass on the full benefits of any franking credits.

Beyond bank hybrids

Beyond these funds, Australian investors who have relied on hybrids in the past should turn their attention to traditional investment grade fixed income markets that have historically been the domain of institutions.

ETFs have revolutionised access to a broader range of fixed income securities that only exist in the over-the-counter market, helping to overcome the barriers that most investors face in trying to access it directly. Fixed income ETFs offer a similar “user experience” to traditional listed investments, while also allowing investors to easily diversify their portfolios and generate regular income in a cost-effective way.

The most comparable exposures to Australian bank hybrids from a risk and return perspective within Betashares fixed income ETF suite include:

HCRD Interest Rate Hedged Australian Investment Grade Corporate Bond ETF offers investors exposure to income from high-quality Australian corporate bonds, while hedging out the interest rate risk inherent in its underlying portfolio by shorting Australian government bond futures. In doing so, HCRD substantially reduces the greatest source of corporate fixed rate bond volatility (interest rate risk) and maintains the most consistent source of return (credit risk). HCRD has a current yield to worst of 5.34%1 and has returned 9.28% over the past year and 9.85% p.a. since inception on 14 November 2022 (as at 31 January 2024).

BSUB Australian Major Bank Subordinated Debt ETF offers investors exposure to income from subordinated bonds which rank one spot above bank hybrids in the capital structure. Following APRA’s announcement, Tier 2 issuance will increase as banks seek to replace hybrids to meet regulatory capital requirements. BSUB’s current all in yield is 5.18%2 and has returned 5.88% since its inception on 6 May 2024 (as at 31 January 2024).

QPON Australian Bank Senior Floating Rate Bond ETF offers investors exposure to income from floating rate bonds issued by Australian banks. Senior floating rate bonds rank at the top of a bank’s capital structure offering higher yields than traditional bank deposits in addition to capital protection in rising interest rate environments. QPON’s current all in yield is 4.87%3 p.a. and has returned 5.97% over the past year and 2.94% over the past 5 years (as at 31 January 2025).

Each of these ETFs pay smoothed monthly distributions to investors. More details can be found on the relevant fund’s page.

There are risks associated with investing in Betashares Funds including market risk, industry sector risk, currency risk and index tracking risk. Investment value can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1. As at 27 February 2025 ↑

2. As at 27 February 2025 ↑

3. As at 27 February 2025 ↑