9 minutes reading time

What just happened

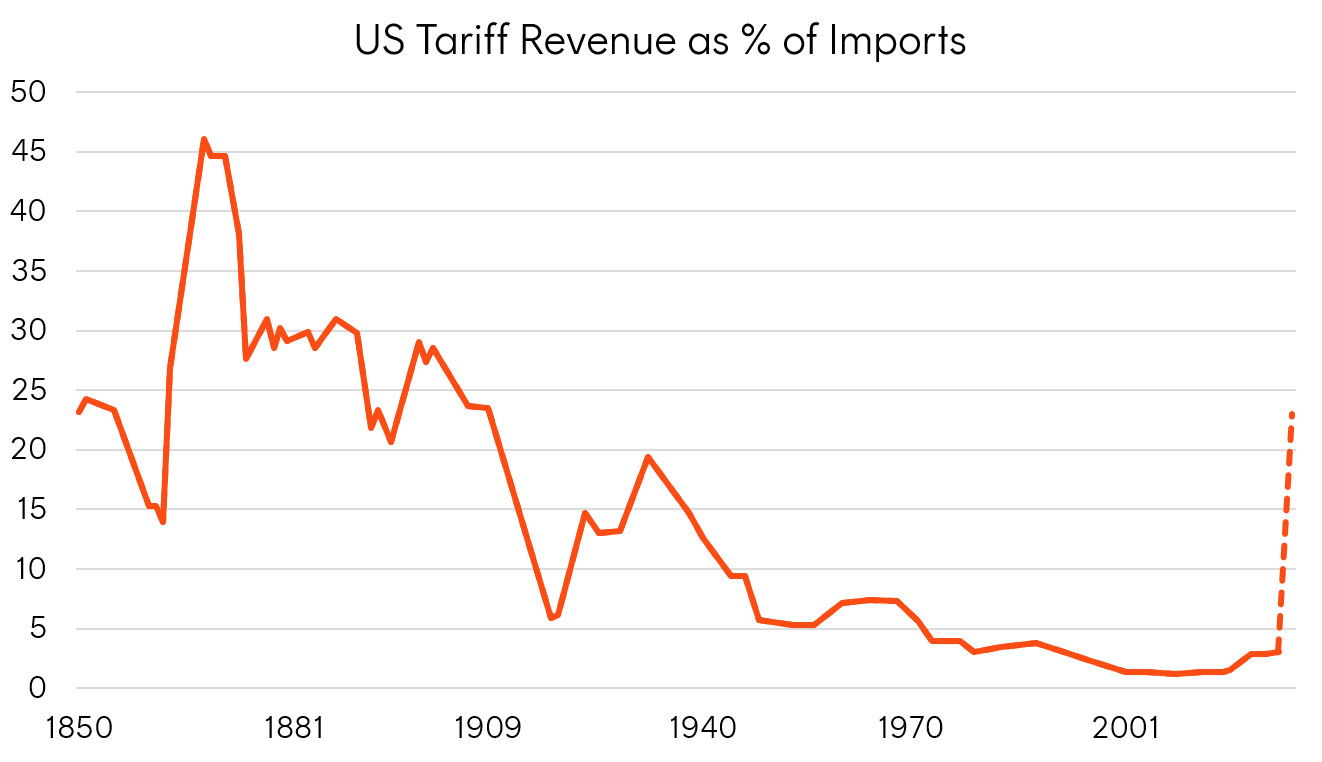

The “reciprocal tariffs” announced by US President Trump last week were generally higher than what the market anticipated. All up, they effectively amount to an increase in the average US tariff of around 20%, compared to a 1.5% increase in Trump’s first term in office.

Source: US Bureau of Economic Analysis

The market surprise partly stems from the fact these “reciprocal tariffs” are much larger than if the tariff rates were based on actual tariffs charged by foreign countries. For example, while China and the EU have average tariffs on US imports of around 3%, the White House determined that their average trade barriers were 67% and 39%, respectively. Allowing for Trump’s 50% discount factor (because the US is “kind”), the US has then imposed reciprocal tariffs on China and the EU of 34% and 20%, respectively.

Why the difference? The White House’s calculations used a crude formula based on the size of the bilateral trade imbalance the US has with each trading partner. The result of this approach is that countries that export much more than they import from the US, such as Vietnam and many others in emerging markets, have been hit especially hard with tariff increases. This outcome is irrespective of a country’s own level of trade protection against the US and whether the US could viably replace these imports with local production (think exotic fruits or labour-intensive apparel manufacturing). Subsequently Trump signalled he was open to negotiation on tariffs in return for ‘phenomenal’ deals. Instead, China countered with a 34% tariff on all US imports starting April 10.

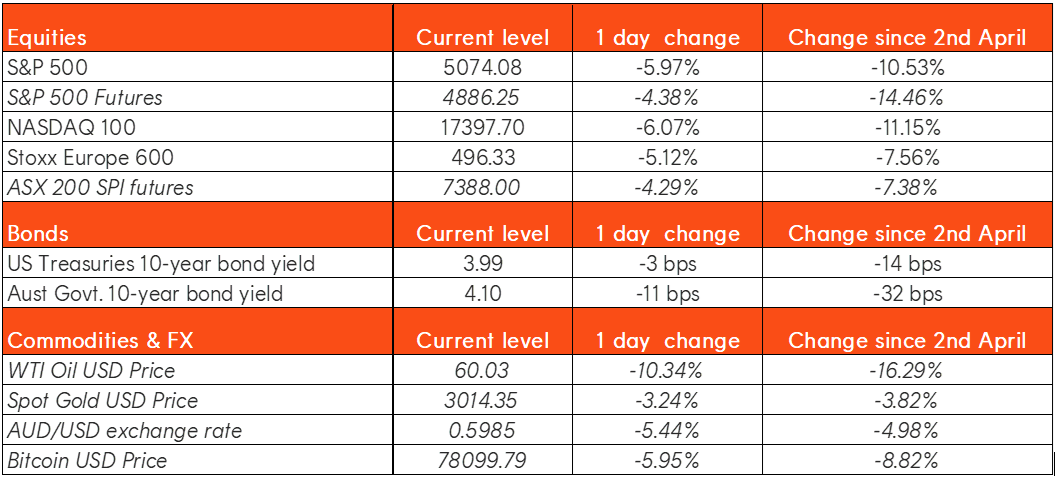

Market moves since Liberation Day

Source: Bloomberg, as at 7 April 2025. Prices shown in italics are based on markets that trade outside of normal share market hours, “1 day change” for these prices is the change as at date of time of writing since Friday close. You cannot invest directly in an index. Past performance is not an indicator of future performance.

What comes next

While the tariff announcement answered some questions, continued market volatility should be expected as the financial markets and real economy come to grips with the full impact and the potential for trade war escalation remains.

The real economy and a Fed or Trump Put

Judged on backward-looking data, the US economy looks to be in good shape. Unemployment is very low, and even the March 2025 payroll jobs growth surprised strongly to the upside.

However, the reported 216,000 DOGE government job cuts aren’t yet showing up in the payrolls report, and consumer and business confidence are falling. Arguably the bigger risk is not layoffs but rather new job creation, as uncertainty causes firms to delay or scrap expansion plans they may have had. Any boost to US business activity or investment that may result from higher tariffs on foreign imports will take years to flow through, whereas US household real incomes will be hit with higher prices as soon as the tariffs take effect.

Indeed, most economic studies of Trump’s tariff increases in his first administration conclude that the tariffs were fully borne by either US households via increased consumer prices or corporate profits. Estimates suggest that these new tariff increases could raise consumer prices by up to 2% (as 10% of US consumption is imported goods) and lower economic growth by 0.5 to 1%. The overall hit to US economic growth increases the chance of a recession, although it’s not inevitable – avoiding one may depend on the speed with which either Trump and/or the Fed respond to deteriorating economic conditions.

The Fed could cut rates to support the economy, which would also help stocks. But given the risk to inflation caused by tariffs it won’t want to, unless unemployment starts to rise.

Talk of a Trump Put, where he would moderate policy which is disruptive to the stock market, has been invalidated by his actions to date. But perhaps if stock market losses, a weakening economy, and inflation get bad enough to hurt the Republicans in the polls there may well be a course correction.

In any case, it appears that things would have to get worse before either a Fed or Trump Put kicks in. One silver lining of market moves has been the 16% fall in the oil price which signifies weaker growth expectations but may reduce inflationary pressures.

Apart from the direct hit to the US, other countries will also be negatively affected by the potential reduction in US demand for their exports – though this will likely not be as great as the hit to the US economy itself. In the case of both China and the EU, for example, exports to the US account for around 3% of GDP. That said, the biggest concern is the lingering economic uncertainty and disruption to established supply chains that this tariff shock represents. Uncertainty persists as to the risk of both further trade escalation and even latter tariff reductions through negotiation. The immediate impact may well be a slowing in business investment and hiring plans, which would further dampen economic activity around the world.

It is worth noting that the US’ tariffs targeted goods imports. The trade war expanding to include services would open a new front.

Potential for trade negotiations

We do think there’s a possibility that negotiation will lower some of these tariffs. However, successful negotiation will not arrive quickly, as it’s not yet clear what the US would deem sufficient concessions from its trading partners. And even if tariff reductions succeed, it’s still likely that tariff levels will be meaningfully higher than previously anticipated. We are of the view that Trump primarily views tariffs as a tool for reshoring manufacturing and raising revenue, rather than as a negotiating tactic.

Potential for tax cuts

The announced tariffs are much higher than was generally anticipated. From a revenue raising perspective some have estimated these tariffs will be close to matching Trump’s goal of bringing in US$500 billion. If he is successful in this, it opens the door for one of Trump’s more market friendly policies – tax cuts. Over the weekend, the US Senate passed a budget resolution which, if approved by the House of Representatives, may allow the fast tracking of Trump’s plan to extend existing tax cuts that were due to expire later this year. Also on Trump’s agenda are corporate tax cuts, that would boost US equity market earnings, lending support to stock prices. They could also help Republicans hold onto their slim majorities in the Congressional mid-terms.

Implications across Asset Classes

Bonds

In the market meltdown of last week, fixed rate government bonds were one of the few assets to rally. The protectionism and tariffs which are bad for global growth also push down long term bond yields. The risk of recession increases the attractiveness of fixed rate bonds as a safe haven and their role in diversifying equity risk in a portfolio.

The implications for Australian fixed rate bonds are unambiguously strong. Unlike the US, Australia does not face the same inflation shock from tariffs and inflation expectations are on a downward trend, clearing the way for RBA rate cuts. This environment supports the case for Australian fixed rate bonds as a defensive investment.

Gold

Even before Trump was elected, gold was enjoying strong structural demand in a world of heightened geopolitical tension. After the invasion of Ukraine, central banks from emerging market countries stepped up their buying of gold in lieu of US government bonds and US dollars.

Now gold is providing a very valuable hedge and source of liquidity against the fallout from an escalating trade war. Gold’s fall on Friday was most likely as a result of hedge funds selling all assets (including gold) to meet margin calls caused by the severe equity market sell off. Gold also serves as an inflation hedge, which is particularly relevant given the potential for increased inflation from tariffs.

As pressure mounts on the US exceptionalism narrative, and by extension the US dollar, gold can certainly continue to grind higher from here.

Global equities

There are few equity market winners from a trade war. Global stock markets fell sharply for a second consecutive day on Friday, with the S&P 500 and STOXX Europe 600 Indices both down more than 5% after China’s tariff counterpunch.

At a sector level there has been a notable rotation, with traditional defensives outperforming cyclicals. Consumer staples and other less cyclical areas have held up relatively well, while companies with high supply chain exposure to Asia have been hit hard.

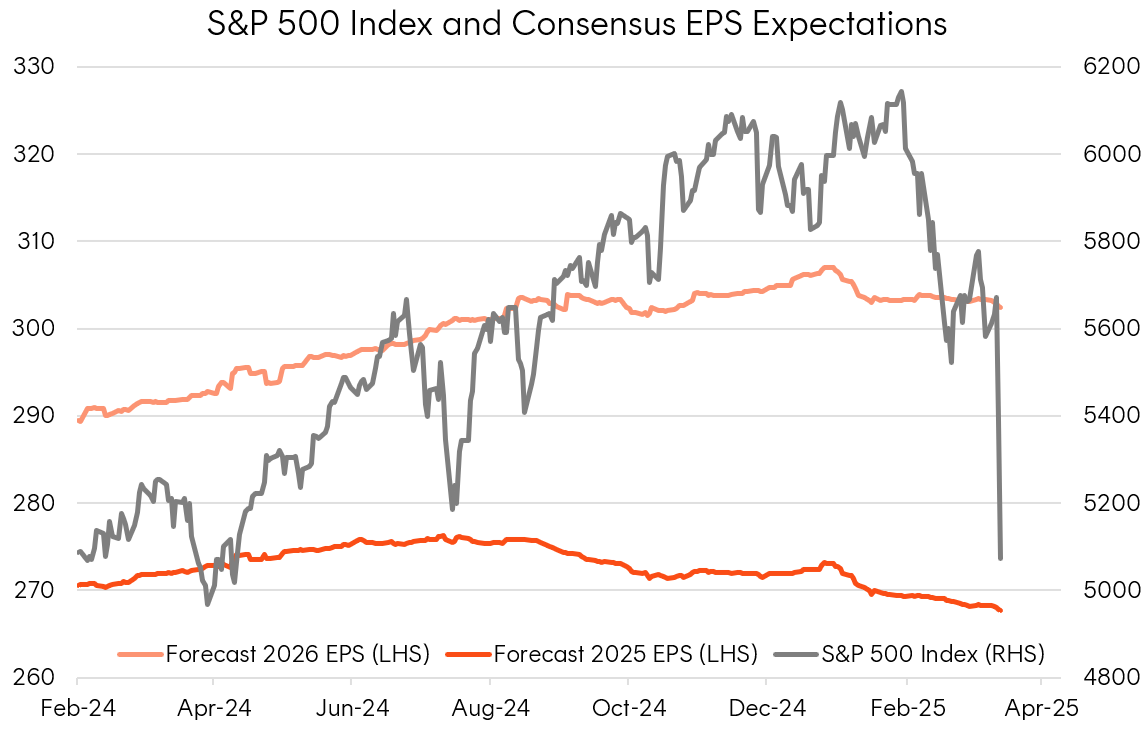

At an index level US equity market valuations had been sustained by high consensus forecast earnings growth until this sell off. The risk is that as the market assess the potential impacts of these tariffs, those earnings forecasts may be revised lower which could lead to further downward pressure on share prices.

Source: Bloomberg. As at 7 April 2025. Bloomberg consensus earnings expectations. Actual results may differ materially from forecasts.

Another risk is that, if the US goes into recession, years of foreign investor net flows into US equities start to unwind. However, there aren’t a lot of better alternatives under a trade war scenario, a US recession hurts all global equity markets.

Australian Equities

The Australian dollar sold off heavily on Friday, and Monday saw large declines on the ASX. Yet, Australian equities may ultimately be relatively well-placed compared to other global markets over the intermediate to longer term.

Firstly, the announced tariff rate for Australia was ‘only’ 10% and secondly, Australia’s economic ties with China could provide a backstop for the Australian market.

After striking back at the US on Friday, China will probably focus on supporting its domestic economy before attempting to negotiate with Trump. Xi Jinping will need to unleash significant stimulus to offset the expected 1 to 2% hit to Chinese growth from the tariffs. At least some of the stimulus will spill over into fixed asset investment creating demand for Australia’s commodities.

What to look out for

It is difficult to forecast the outlook with any level of conviction, given the potential impacts of global trade touching every country in the world as well as Trump’s unpredictability.

We are looking out for any further announcements of escalation or olive branches. In terms of economic data, US jobs and unemployment data is key. In terms of financial markets, watch US equity earnings growth forecasts for any signs of a downward revision.

The extent of the current global changes, whether it be geopolitical or financial market volatility, creates challenges for all investors. In this period of uncertainty, it is as important as ever to remain disciplined in one’s investment approach which should include the benefits of diversification.